Comprehensive Auto Insurance Meaning

Comprehensive auto insurance is a type of coverage that goes beyond the basic liability protection and provides a more extensive range of protections for vehicle owners. It is designed to offer financial security and peace of mind by covering a wide array of potential risks and damages that a vehicle might encounter during its lifetime. In this article, we will delve into the intricacies of comprehensive auto insurance, exploring its definitions, coverage, exclusions, benefits, and real-world examples to help you understand why it is considered a crucial component of vehicle ownership.

Understanding Comprehensive Auto Insurance

Comprehensive auto insurance, often referred to as “comp” insurance, is an optional coverage that supplements the mandatory liability insurance required by most states. While liability insurance covers damages caused to other parties in an accident, comprehensive insurance steps in to protect your vehicle from various non-collision-related damages. It is a comprehensive form of protection that addresses a wide spectrum of risks, making it an essential consideration for vehicle owners seeking robust financial coverage.

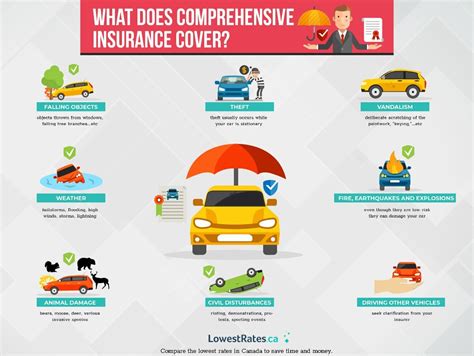

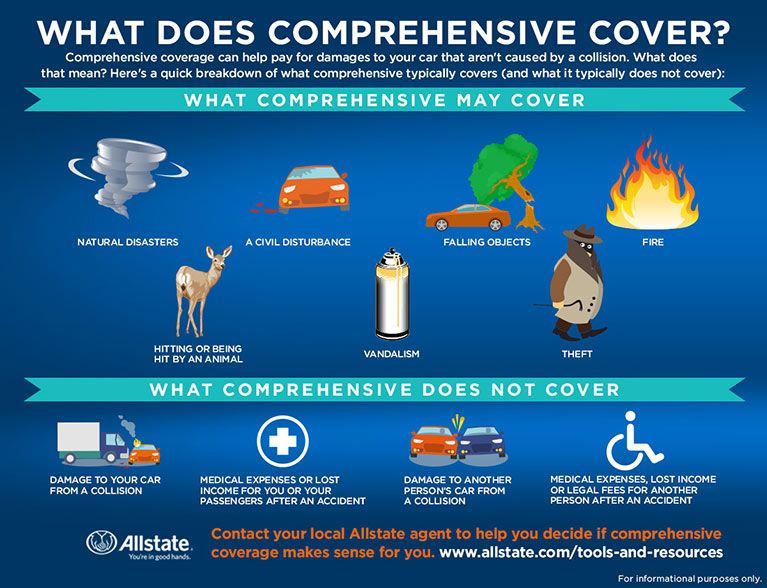

What Does Comprehensive Auto Insurance Cover?

Comprehensive auto insurance provides coverage for a variety of incidents and damages that are typically not covered by standard liability or collision insurance. Here are some of the key perils that comprehensive insurance protects against:

- Vandalism and Theft: Comprehensive insurance covers damage or loss caused by vandalism, such as broken windows, graffiti, or other intentional damage to your vehicle. It also covers theft or attempted theft of your vehicle.

- Natural Disasters: Natural events like hurricanes, floods, earthquakes, and wildfires are covered under comprehensive insurance. This includes damage caused by falling trees, flying debris, or water damage from heavy rains.

- Animal Strikes: If your vehicle collides with an animal, such as a deer or a moose, comprehensive insurance will typically cover the resulting damages.

- Fallen Objects: Damage caused by objects falling on your vehicle, such as a tree branch or a piece of debris from a construction site, is covered by comprehensive insurance.

- Glass Breakage: Comprehensive coverage includes protection for broken windshields and other glass components of your vehicle.

- Weather Damage: Damage caused by severe weather conditions, including hail, heavy storms, or even falling icicles, is covered under comprehensive insurance.

- Fire and Explosion: In the event of a fire, whether it's caused by an accident or an external source, comprehensive insurance will cover the damage to your vehicle.

- Civil Disorders: If your vehicle is damaged during a riot or civil disturbance, comprehensive insurance will provide coverage.

It's important to note that comprehensive insurance typically has a deductible, which is the amount you must pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your insurance premiums, but it also means you'll pay more if you need to file a claim.

Exclusions and Limitations of Comprehensive Coverage

While comprehensive auto insurance provides an extensive range of protections, there are certain situations and damages that are typically excluded from coverage. Understanding these exclusions is crucial to managing your expectations and ensuring you have the appropriate coverage for your needs.

Normal Wear and Tear

Comprehensive insurance does not cover damages resulting from normal wear and tear. This includes issues like fading paint, rust, worn tires, or mechanical failures that occur due to regular use and aging.

Negligence and Poor Maintenance

If damage to your vehicle is caused by your own negligence or failure to maintain the vehicle properly, comprehensive insurance will not cover it. This could include instances where you fail to perform routine maintenance, resulting in engine failure or other mechanical issues.

Mechanical Breakdowns

Comprehensive insurance does not cover mechanical breakdowns that are unrelated to a covered peril. For example, if your engine fails due to a manufacturing defect or normal wear and tear, comprehensive insurance will not provide coverage.

Damages Covered by Other Policies

If another insurance policy, such as a home insurance policy, provides coverage for a specific type of damage, comprehensive auto insurance will not duplicate that coverage. For instance, if your home insurance covers damage to your vehicle caused by a falling tree in your yard, comprehensive insurance would not provide additional coverage for the same incident.

Legal Liability Claims

Comprehensive insurance does not cover claims of legal liability, which means it won’t cover damages you cause to other vehicles or property. These types of claims are typically covered by liability insurance.

Nuclear Hazards

Most comprehensive insurance policies exclude coverage for nuclear hazards, including damage caused by nuclear reactions or radiation.

Benefits of Comprehensive Auto Insurance

Comprehensive auto insurance offers several significant advantages to vehicle owners. Understanding these benefits can help you make informed decisions about your insurance coverage.

Financial Protection

Comprehensive insurance provides financial protection against a wide range of unforeseen events. By covering damages from natural disasters, theft, vandalism, and other perils, it helps vehicle owners avoid potentially devastating financial losses.

Peace of Mind

Knowing that your vehicle is protected against a variety of risks can provide peace of mind. With comprehensive insurance, you can drive with the confidence that you’re prepared for the unexpected, reducing stress and anxiety associated with potential damages.

Resale Value Protection

Comprehensive insurance can help maintain the resale value of your vehicle. By covering damages that could otherwise diminish the value of your car, it ensures that you can sell your vehicle for a fair price in the future.

Customizable Coverage

Comprehensive insurance policies can be customized to fit your specific needs and budget. You can choose the level of coverage you require and select additional options to ensure your policy aligns with your priorities.

Fast Claims Process

In the event of a covered incident, comprehensive insurance typically offers a straightforward and efficient claims process. This allows for quick repairs and gets you back on the road as soon as possible.

Real-World Examples of Comprehensive Coverage

To illustrate the value of comprehensive auto insurance, let’s explore a few real-world scenarios where this coverage would prove invaluable:

Hurricane Damage

Imagine your vehicle is parked outside during a hurricane, and a tree falls on it, causing significant damage. Without comprehensive insurance, you would be responsible for the full cost of repairs. However, with comprehensive coverage, your insurance provider would cover the repairs, helping you get your vehicle back in working condition quickly.

Vandalism and Theft

Suppose you park your vehicle overnight and find it vandalized in the morning, with broken windows and scratches on the paint. Comprehensive insurance would cover the cost of repairs, including replacing the broken glass and repainting the affected areas.

Animal Collision

While driving through a rural area, you collide with a deer, causing extensive damage to the front of your vehicle. Comprehensive insurance would cover the repairs, helping you avoid a large, unexpected expense.

Flooding

If you live in an area prone to flooding, and your vehicle is submerged during a heavy storm, comprehensive insurance would cover the damage, ensuring you can replace or repair your vehicle.

Choosing the Right Comprehensive Auto Insurance

When selecting comprehensive auto insurance, it’s essential to consider your specific needs and circumstances. Here are some key factors to keep in mind:

- Value of Your Vehicle: If your vehicle is older or has a lower resale value, you may want to consider whether the cost of comprehensive insurance is justified.

- Risk Factors: Assess the risks you face in your area. If you live in an area prone to natural disasters or theft, comprehensive insurance becomes even more crucial.

- Deductible Amount: Choose a deductible that aligns with your financial situation. A higher deductible can lower your premiums, but you'll pay more out of pocket if you need to file a claim.

- Additional Coverage: Some insurers offer optional add-ons, such as rental car coverage or roadside assistance, which can provide extra peace of mind.

FAQ

Does comprehensive insurance cover all types of damage?

+No, comprehensive insurance covers a wide range of perils, but there are exclusions. It does not cover normal wear and tear, negligence, or mechanical breakdowns unrelated to a covered peril.

What is the difference between comprehensive and collision insurance?

+Collision insurance covers damage to your vehicle resulting from a collision with another vehicle or object, while comprehensive insurance covers a broader range of non-collision-related damages.

Can I choose my deductible for comprehensive insurance?

+Yes, you can typically select your deductible when purchasing comprehensive insurance. A higher deductible can lower your premiums, but it means you’ll pay more out of pocket if you need to file a claim.

Comprehensive auto insurance is an invaluable tool for protecting your vehicle and your finances from a wide array of potential risks. By understanding the coverage, exclusions, and benefits of comprehensive insurance, you can make informed decisions to ensure your vehicle is adequately protected. Remember, when it comes to auto insurance, it’s always better to be prepared for the unexpected.