Progressive Car Insurance Rates

When it comes to car insurance, drivers are always on the lookout for the best rates to ensure they get the coverage they need without breaking the bank. One of the leading names in the industry, Progressive, has gained a reputation for its innovative approach to insurance and its commitment to offering competitive rates. In this comprehensive guide, we'll delve into the world of Progressive car insurance rates, exploring the factors that influence them, the unique features that set Progressive apart, and the strategies you can employ to secure the most advantageous rates for your specific circumstances.

Understanding Progressive’s Approach to Car Insurance Rates

Progressive Insurance, with its headquarters in Mayfield Village, Ohio, has been a prominent player in the insurance industry since its founding in 1937. The company’s innovative spirit and customer-centric approach have contributed to its success and popularity among drivers across the United States. Progressive’s approach to car insurance rates is centered on offering personalized coverage plans that cater to the unique needs of each driver, while also providing tools and resources to help drivers make informed decisions about their insurance.

One of the key strengths of Progressive is its ability to offer a wide range of coverage options, ensuring that drivers can find a plan that aligns with their specific needs and budget. Whether you're a cautious driver with an impeccable record or someone who's had a few accidents in the past, Progressive aims to provide tailored coverage that offers the right balance of protection and affordability.

Factors Influencing Progressive Car Insurance Rates

Like any insurance provider, Progressive takes into account a multitude of factors when calculating car insurance rates. These factors help Progressive assess the level of risk associated with insuring a particular driver and, consequently, determine the premium they will charge. Here’s a closer look at some of the key factors that influence Progressive car insurance rates:

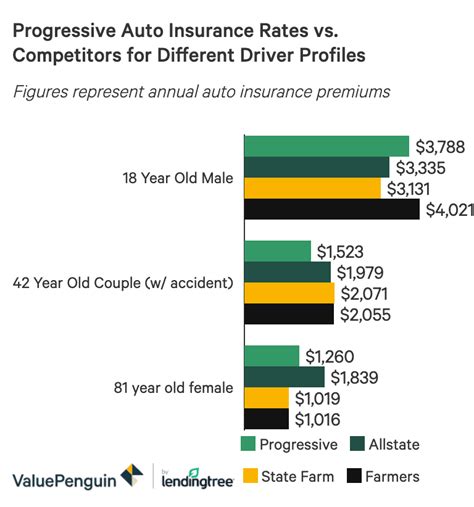

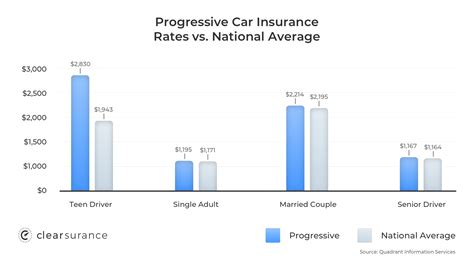

- Driver's Profile: Your age, gender, driving history, and the number of years you've held a valid driver's license all play a role in determining your insurance rate. Progressive carefully considers these factors to assess your level of driving experience and the potential risks you pose.

- Vehicle Information: The make, model, and year of your vehicle are significant considerations. Progressive evaluates the safety features, repair costs, and overall risk associated with your vehicle type to determine the appropriate coverage and rate.

- Coverage Level: The level of coverage you choose directly impacts your insurance rate. Progressive offers a range of coverage options, including liability-only, full coverage, and specialized add-ons like rental car coverage or gap insurance. The more comprehensive your coverage, the higher your premium is likely to be.

- Location and Usage: Where you live and how you use your vehicle also affect your insurance rate. Progressive takes into account factors such as the crime rate, traffic congestion, and weather conditions in your area. Additionally, if you use your vehicle for business purposes or commute long distances, your insurance rate may be higher.

- Claims History: Your claims history is a crucial factor in determining your insurance rate. Progressive considers the frequency and severity of any previous claims you've made. A history of frequent or costly claims may result in a higher premium.

- Discounts and Bundling: Progressive offers a variety of discounts to help drivers save on their insurance premiums. These discounts can be based on factors such as safe driving habits, vehicle safety features, or even your profession. Additionally, bundling your car insurance with other policies, such as home or life insurance, can often lead to significant savings.

Progressive’s Unique Features and Benefits

Progressive is known for its innovative approach to insurance, and this is reflected in the unique features and benefits it offers to its customers. Here’s a closer look at some of the standout aspects of Progressive’s car insurance offerings:

Snapshot Program

One of Progressive’s most notable features is its Snapshot program. This innovative program allows drivers to voluntarily share their driving data with Progressive in exchange for personalized rate adjustments. By installing a small device in your vehicle or using a smartphone app, Snapshot tracks your driving habits, including miles driven, time of day, and sudden braking or acceleration. Based on this data, Progressive can offer discounts to drivers who exhibit safe and responsible driving behaviors.

The Snapshot program is a game-changer for many drivers, as it provides an opportunity to lower their insurance rates by simply practicing safe driving. This program is particularly beneficial for drivers who may have had accidents or traffic violations in the past, as it allows them to demonstrate their improved driving habits and potentially qualify for significant discounts.

Name Your Price Tool

Progressive’s Name Your Price tool is a unique feature that empowers drivers to take control of their insurance coverage and costs. With this tool, drivers can input their desired monthly premium amount, and Progressive will provide coverage options that align with that budget. This feature is especially useful for those on a tight budget or for individuals who want to prioritize their insurance spending.

The Name Your Price tool is a testament to Progressive's commitment to customer-centricity. By allowing drivers to define their budget and then tailoring coverage options to meet those needs, Progressive ensures that drivers can find affordable insurance without compromising on the level of protection they desire.

Customizable Coverage Options

Progressive understands that every driver has unique needs and preferences when it comes to insurance coverage. That’s why the company offers a wide array of customizable coverage options to ensure that drivers can create a plan that suits their specific circumstances. From liability-only coverage for budget-conscious drivers to comprehensive plans with add-ons like roadside assistance and rental car coverage, Progressive provides the flexibility to choose the coverage that aligns with your needs and budget.

Digital Convenience and Customer Service

Progressive recognizes the importance of digital convenience and customer service in today’s fast-paced world. The company’s website and mobile app offer a seamless experience, allowing customers to manage their policies, make payments, and file claims with just a few clicks. Additionally, Progressive’s customer service team is renowned for its responsiveness and expertise, ensuring that customers receive timely assistance whenever they need it.

Strategies to Secure the Best Progressive Car Insurance Rates

While Progressive already offers competitive rates and innovative features, there are several strategies you can employ to further optimize your insurance costs. Here are some tips to help you secure the best Progressive car insurance rates:

Shop Around and Compare

Before committing to a Progressive policy, it’s essential to shop around and compare rates from multiple insurance providers. Progressive may offer competitive rates, but other insurers might have different pricing structures or promotional offers that could make them more cost-effective for your specific situation. Use online comparison tools or seek quotes from various insurers to ensure you’re getting the best deal.

Take Advantage of Discounts

Progressive offers a wide range of discounts to help drivers save on their insurance premiums. From safe driver discounts to multi-policy discounts, there are numerous opportunities to reduce your costs. Make sure to inquire about all the available discounts and fulfill the requirements to qualify for them. The more discounts you can stack, the more significant your savings are likely to be.

Bundle Your Policies

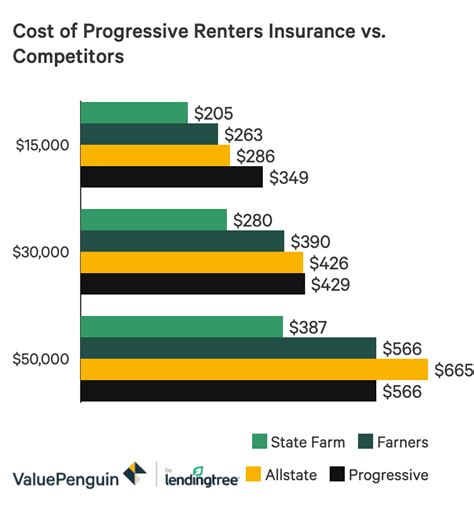

If you have multiple insurance needs, such as home, renters, or life insurance, consider bundling your policies with Progressive. Bundling your policies can lead to substantial savings, as insurers often offer discounts when you combine multiple policies under one provider. By bundling, you not only save money but also streamline your insurance management, making it more convenient and efficient.

Maintain a Clean Driving Record

Your driving record is a significant factor in determining your insurance rate. To keep your rates as low as possible, it’s crucial to maintain a clean driving record. Avoid traffic violations, practice defensive driving, and always follow the rules of the road. A clean driving record not only helps you secure the best insurance rates but also ensures your safety and the safety of others on the road.

Consider Higher Deductibles

One way to potentially lower your insurance premium is by opting for a higher deductible. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you’re essentially assuming more financial responsibility in the event of a claim, which can lead to reduced insurance costs. However, it’s important to ensure that you can afford the higher deductible in the event of an accident or claim.

Explore Usage-Based Insurance

If you’re a safe and cautious driver, you might want to consider Progressive’s usage-based insurance programs, such as Snapshot. These programs allow you to provide real-time data about your driving habits, and if you consistently demonstrate safe driving behaviors, you could qualify for significant discounts on your insurance premium. Usage-based insurance is a great way to reward responsible drivers and potentially save a considerable amount on their insurance costs.

Maintain a Good Credit Score

In many states, your credit score can be a factor in determining your insurance rate. Insurance companies often view individuals with higher credit scores as more responsible and less likely to file claims. As a result, maintaining a good credit score can potentially lead to lower insurance rates. If you have a low credit score, consider taking steps to improve it, as this can have a positive impact on your insurance costs over time.

Performance Analysis and Customer Satisfaction

Progressive’s commitment to customer satisfaction and delivering competitive insurance rates is evident in its performance and the feedback it receives from customers. The company consistently ranks highly in customer satisfaction surveys and is known for its efficient claims process and responsive customer service.

According to J.D. Power's 2022 U.S. Auto Insurance Study, Progressive earned a score of 856 out of 1,000, surpassing the industry average of 842. This impressive score reflects Progressive's dedication to providing customers with a positive insurance experience, from policy acquisition to claims handling.

Furthermore, Progressive's Snapshot program has received widespread acclaim for its innovative approach to incentivizing safe driving and rewarding customers with personalized rate adjustments. The program has been a game-changer for many drivers, allowing them to take control of their insurance costs and demonstrate their commitment to responsible driving.

Future Implications and Industry Trends

As the insurance industry continues to evolve, Progressive remains at the forefront, embracing technological advancements and innovative practices to enhance its offerings. The company’s focus on data-driven insights and personalized coverage is likely to shape the future of car insurance, offering customers even more tailored and cost-effective solutions.

Progressive's continued investment in usage-based insurance programs, such as Snapshot, is expected to drive further innovation in the industry. As more drivers embrace these programs and demonstrate their safe driving habits, Progressive and other insurers may develop even more sophisticated algorithms and analytics to offer precise and fair insurance rates based on individual driving behaviors.

Additionally, Progressive's commitment to digital convenience and customer-centricity is set to shape the future of insurance interactions. The company's user-friendly digital platforms and responsive customer service are likely to become industry standards, ensuring that customers receive seamless and efficient insurance experiences.

Conclusion

Progressive’s approach to car insurance rates is a testament to its commitment to providing customers with personalized and affordable coverage options. By understanding the factors that influence rates and leveraging Progressive’s unique features and benefits, drivers can secure the best insurance rates for their specific circumstances. With a focus on innovation, customer satisfaction, and data-driven insights, Progressive continues to lead the way in the insurance industry, offering drivers the protection they need at competitive prices.

How does Progressive determine car insurance rates?

+Progressive calculates car insurance rates based on various factors, including driver’s profile, vehicle information, coverage level, location and usage, and claims history. These factors help assess the level of risk associated with insuring a driver, which determines the premium.

What are some of Progressive’s unique features that benefit customers?

+Progressive offers innovative features like the Snapshot program, which tracks driving data to offer personalized rate adjustments, and the Name Your Price tool, allowing customers to define their budget for insurance coverage. These features empower customers to make informed decisions and potentially save on their premiums.

How can I get the best Progressive car insurance rates?

+To secure the best Progressive car insurance rates, shop around and compare quotes, take advantage of available discounts, bundle policies, maintain a clean driving record, consider higher deductibles, explore usage-based insurance programs like Snapshot, and maintain a good credit score.

What sets Progressive apart from other insurance providers?

+Progressive stands out for its customer-centric approach, offering a wide range of customizable coverage options, innovative features like Snapshot and Name Your Price, and a focus on digital convenience and responsive customer service. These aspects make Progressive a top choice for many drivers seeking affordable and personalized insurance.