Health Insurance In California

California is known for its diverse population and dynamic healthcare landscape, making health insurance a critical aspect of life for millions of residents. The state has taken significant steps to ensure access to quality healthcare, and understanding the nuances of health insurance in California is essential for both residents and those considering a move to the Golden State.

The Landscape of Health Insurance in California

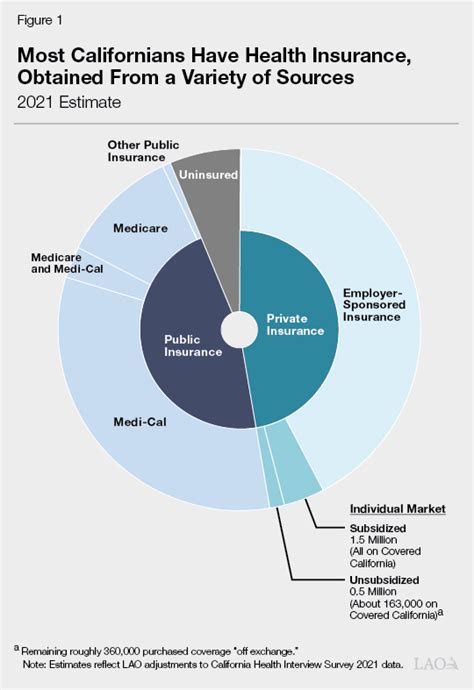

Health insurance in California is a multifaceted system, influenced by federal policies, state regulations, and the unique needs of its population. The state has actively worked to expand healthcare coverage, resulting in a comprehensive network of public and private insurance options.

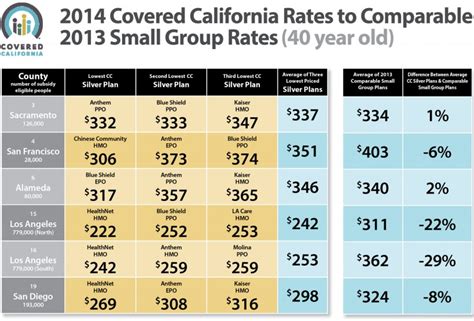

California's commitment to healthcare accessibility is evident in its robust Medicaid program, Medi-Cal, which provides coverage to millions of low-income residents, including children, pregnant women, seniors, and individuals with disabilities. The state has also embraced the Affordable Care Act (ACA), offering health insurance exchanges where individuals and small businesses can purchase qualified health plans. These exchanges, such as Covered California, provide a range of options from various insurance carriers, allowing for personalized coverage choices.

Beyond public programs, California boasts a vibrant private insurance market. Leading national carriers, such as UnitedHealthcare, Blue Cross Blue Shield, and Aetna, offer a wide array of plans tailored to individual needs. These plans encompass a variety of coverage types, including HMO (Health Maintenance Organization), PPO (Preferred Provider Organization), and POS (Point of Service) plans, each with its own network of providers and cost structures.

Furthermore, California's health insurance landscape includes Medicare Advantage plans, which are offered by private insurance companies as an alternative to original Medicare. These plans provide additional benefits beyond Medicare, such as vision, dental, and prescription drug coverage, enhancing the overall healthcare experience for seniors.

Key Metrics and Insights

As of 2022, California has made significant strides in healthcare coverage, with an estimated 95.1% of its population insured. This high rate is largely attributed to the state’s proactive efforts to expand coverage and the availability of a diverse range of insurance options.

| Population Covered | Estimated Percentage |

|---|---|

| Private Insurance | 55.3% |

| Medicaid/Medi-Cal | 33.1% |

| Medicare | 15.7% |

| Uninsured | 4.9% |

Understanding Health Insurance Plans in California

California’s health insurance plans are designed to cater to a diverse range of needs and preferences. From comprehensive coverage to more specialized plans, residents have a variety of options to choose from.

Private Insurance Plans

Private insurance plans in California offer a spectrum of choices, allowing individuals and families to tailor their coverage to their specific healthcare needs. These plans often provide more flexibility in choosing healthcare providers and may offer additional benefits such as vision, dental, and wellness programs.

Key features of private insurance plans in California include:

- Network Flexibility: HMO plans typically have a more limited network of providers, offering cost-effective coverage within a defined network. On the other hand, PPO plans offer more flexibility, allowing enrollees to visit providers outside the network with higher out-of-pocket costs.

- Cost Sharing: Private insurance plans may have various cost-sharing structures, including deductibles, copayments, and coinsurance. These factors can significantly impact the overall cost of healthcare, so it's important to understand these terms when selecting a plan.

- Benefit Packages: Beyond basic medical coverage, private plans often offer additional benefits such as prescription drug coverage, mental health services, and preventive care. Some plans also include wellness programs and incentives to encourage healthy lifestyles.

Public Insurance Programs

California’s public insurance programs, such as Medi-Cal and Medicare, provide essential coverage to vulnerable populations and seniors. These programs often have lower out-of-pocket costs and are designed to ensure access to necessary healthcare services.

Key aspects of public insurance programs include:

- Medi-Cal: This program provides comprehensive healthcare coverage to low-income individuals and families, with a focus on ensuring access to primary and specialty care. Medi-Cal also offers long-term care services for seniors and individuals with disabilities.

- Medicare: This federal program provides healthcare coverage for seniors aged 65 and older, as well as certain younger individuals with disabilities. Medicare offers a range of plans, including original Medicare (Parts A and B) and Medicare Advantage plans (Part C), which may include additional benefits like vision and dental coverage.

Specialized Health Insurance Plans

California’s health insurance market also includes specialized plans tailored to specific populations or healthcare needs. These plans may offer enhanced benefits or coverage for unique circumstances.

- Student Health Plans: Many colleges and universities in California offer student health plans, providing coverage for enrolled students. These plans often have lower premiums and may include benefits such as mental health services and wellness programs.

- Short-Term Health Plans: For individuals between jobs or seeking temporary coverage, short-term health plans offer a more affordable option with limited benefits. These plans typically have shorter durations and may not cover pre-existing conditions.

- High-Deductible Health Plans (HDHP): HDHPs are designed to offer lower premiums with higher deductibles, making them suitable for individuals who anticipate minimal healthcare needs. These plans often pair well with Health Savings Accounts (HSAs), allowing enrollees to save for future medical expenses.

Navigating Health Insurance Costs in California

Health insurance costs can vary significantly based on individual circumstances and the type of plan chosen. Understanding the factors that influence these costs is essential for making informed decisions.

Premium Costs

Premiums are the monthly payments made to maintain health insurance coverage. In California, premium costs can vary based on several factors, including the type of plan, the insurer, and the enrollee’s age and location.

For example, a 30-year-old individual in Los Angeles may pay a different premium for a PPO plan compared to a 50-year-old individual in San Francisco. This variation is due to differences in healthcare costs and provider networks across the state.

Cost-Sharing Structures

Beyond premiums, health insurance plans in California may have different cost-sharing structures. These structures define how enrollees share the cost of healthcare services with their insurer.

Key cost-sharing elements to consider include:

- Deductibles: This is the amount an enrollee must pay out-of-pocket before the insurance plan begins to cover costs. For instance, a plan with a $2,000 deductible means the enrollee pays the first $2,000 of covered services before the insurance kicks in.

- Copayments (Copays): Copays are fixed amounts paid by the enrollee for covered services, such as a $20 copay for a doctor's office visit.

- Coinsurance: This is a percentage of the cost of a covered service that the enrollee pays. For example, a 20% coinsurance means the enrollee pays 20% of the cost of a covered service, while the insurance plan pays the remaining 80%.

- Out-of-Pocket Maximums: This is the maximum amount an enrollee will pay in a year for covered services. Once this limit is reached, the insurance plan pays for all covered costs for the remainder of the year.

Financial Assistance and Subsidies

California offers various financial assistance programs to help individuals and families afford health insurance. These programs are designed to make coverage more accessible, especially for low- and middle-income households.

- Premium Tax Credits: Eligible individuals and families purchasing health insurance through Covered California may qualify for premium tax credits, which lower the monthly cost of their insurance plan.

- Cost-Sharing Reductions: Some enrollees may also qualify for cost-sharing reductions, which lower their out-of-pocket costs for deductibles, copays, and coinsurance.

- Medi-Cal Expansion: California's expansion of Medi-Cal under the ACA has made coverage more accessible to low-income individuals and families. This program provides comprehensive healthcare coverage with little to no out-of-pocket costs.

Choosing the Right Health Insurance in California

With a wide array of health insurance options available in California, selecting the right plan can seem daunting. However, by understanding your specific healthcare needs and considering key factors, you can make an informed decision.

Assessing Your Healthcare Needs

Before choosing a health insurance plan, it’s crucial to evaluate your individual and family healthcare needs. Consider factors such as:

- Chronic Conditions: If you or a family member has a chronic condition, such as diabetes or heart disease, ensure the plan covers the necessary medications, treatments, and specialist visits.

- Prescription Drug Needs: Review the plan's formulary to ensure your essential medications are covered. Some plans may have preferred pharmacies or require prior authorization for certain drugs.

- Specialist Care: If you require frequent visits to specialists, choose a plan with a robust network of providers, including specialists in your area.

- Mental Health Services: Ensure the plan covers mental health services, including therapy and counseling, if needed.

- Wellness Programs: Consider plans that offer incentives or coverage for wellness activities, such as gym memberships or weight loss programs.

Comparing Plan Features

Once you’ve assessed your healthcare needs, compare different plan features to find the best fit. Consider the following aspects:

- Network of Providers: Review the plan's provider network to ensure your preferred doctors and hospitals are included. Check for any out-of-network costs or restrictions.

- Cost-Sharing Structures: Evaluate the plan's deductibles, copays, and coinsurance to understand your potential out-of-pocket costs. Consider your anticipated healthcare needs and choose a plan that aligns with your financial comfort.

- Benefit Packages: Look for plans that offer additional benefits beyond basic medical coverage. This could include dental, vision, or prescription drug coverage, as well as mental health services and wellness programs.

- Premium Costs: While premiums are important, remember that the lowest premium doesn't always equate to the best value. Consider the overall cost of the plan, including deductibles and other out-of-pocket expenses.

Enrolling in a Health Insurance Plan

The enrollment process for health insurance in California varies depending on the type of plan you choose. Here’s a brief overview of the enrollment process for different plan types:

- Private Insurance Plans: You can enroll in private insurance plans through the insurer's website, an insurance broker, or a licensed agent. The enrollment period typically runs from November 1 to December 15, but special enrollment periods may be available if you experience a qualifying life event, such as a job loss or marriage.

- Covered California Plans: If you're purchasing a plan through Covered California, you can enroll during the annual open enrollment period, which typically runs from November 1 to January 15. You may also qualify for a special enrollment period if you experience a qualifying life event.

- Medi-Cal: Enrollment in Medi-Cal is available year-round. You can apply online, by mail, or in person at a local county office. Eligibility is determined based on income and certain other factors.

- Medicare: If you're eligible for Medicare, you can enroll during the Initial Enrollment Period, which begins three months before your 65th birthday and ends three months after. Special enrollment periods may be available if you miss the initial enrollment period due to extenuating circumstances.

The Future of Health Insurance in California

California’s healthcare landscape is continually evolving, with ongoing efforts to improve accessibility and quality of care. The state’s proactive approach to healthcare reform has positioned it as a leader in expanding coverage and advocating for patient rights.

Ongoing Reforms and Initiatives

California continues to implement reforms and initiatives to enhance healthcare accessibility and quality. Some key areas of focus include:

- Healthcare Cost Transparency: The state is working towards increasing transparency in healthcare pricing, allowing consumers to better understand the costs associated with different procedures and services.

- Telehealth Expansion: With the COVID-19 pandemic, telehealth services have become an essential part of healthcare delivery. California is exploring ways to expand telehealth access, ensuring residents can receive quality care remotely.

- Addressing Health Disparities: The state is committed to addressing health disparities among vulnerable populations, including racial and ethnic minorities, LGBTQ+ individuals, and those with low incomes. Initiatives are underway to improve access to care and reduce healthcare disparities.

- Mental Health Services: California is investing in expanding mental health services, particularly for youth and individuals struggling with substance abuse. This includes increasing access to therapy, counseling, and support groups.

The Impact of Federal Policies

Federal policies, such as the Affordable Care Act (ACA) and Medicare reforms, significantly influence the future of health insurance in California. While the state has embraced these policies, ongoing political debates at the federal level could impact the availability and affordability of healthcare coverage.

Emerging Trends and Innovations

California’s healthcare industry is also embracing emerging trends and innovations to enhance patient care and improve outcomes. These include:

- Precision Medicine: California is at the forefront of precision medicine, which tailors medical treatment to individual characteristics, such as genes, environment, and lifestyle. This approach aims to improve treatment effectiveness and reduce adverse reactions.

- Digital Health Technologies: From telemedicine to health tracking apps, digital health technologies are transforming the way healthcare is delivered and accessed. California is exploring ways to leverage these technologies to improve patient engagement and outcomes.

- Value-Based Care: The state is shifting towards value-based care models, which focus on rewarding healthcare providers for delivering high-quality, cost-effective care. This approach aims to improve patient outcomes while reducing unnecessary healthcare costs.

FAQ

What is the average cost of health insurance in California for a family of four?

+

The average cost of health insurance for a family of four in California can vary significantly based on several factors, including the type of plan, the insurer, and the family’s age and location. As of 2022, the average monthly premium for a family of four enrolled in a mid-level Silver plan through Covered California was approximately $1,500. However, this amount can be reduced significantly with premium tax credits and cost-sharing reductions for eligible families.

Can I qualify for Medi-Cal if I’m not a citizen or permanent resident?

+

Yes, California’s Medi-Cal program provides coverage to eligible individuals regardless of citizenship status. Non-citizens and permanent residents may qualify for full-scope Medi-Cal if they meet certain criteria, such as being under 26 years old, pregnant, blind, or disabled. Additionally, all children under 19 years old in California are eligible for Medi-Cal, regardless of immigration status.