Affordable Health Insurance Nevada

Are you a resident of the Silver State seeking accessible and affordable health insurance options? Nevada offers a range of plans designed to cater to various needs and budgets. In this comprehensive guide, we will explore the nuances of health insurance in Nevada, providing you with the knowledge to make informed decisions about your coverage.

Understanding Nevada’s Health Insurance Landscape

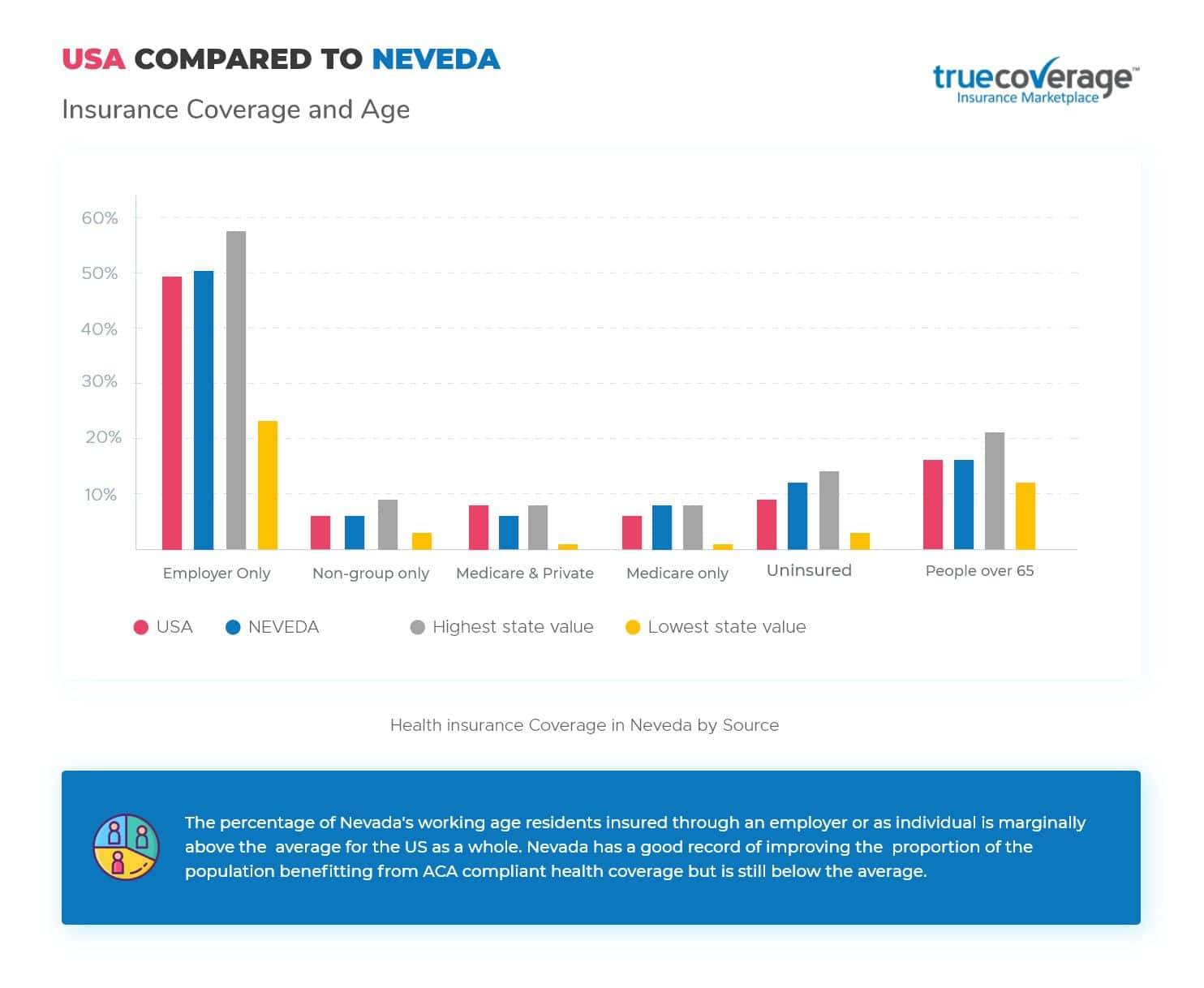

Nevada’s health insurance market is regulated by the state’s Division of Insurance, ensuring that residents have access to a competitive and transparent system. The state actively promotes affordable coverage through various initiatives, making it an ideal environment for consumers seeking cost-effective plans.

Key Factors Impacting Affordability

State Initiatives: Nevada has implemented programs like the Silver State Health Insurance Exchange, which aims to provide affordable options for individuals and families. This platform offers a user-friendly interface to compare and select plans based on individual needs.

Federal Subsidies: Under the Affordable Care Act (ACA), many Nevadans are eligible for financial assistance to reduce their monthly premiums. These subsidies are based on income, making health insurance more accessible for those with lower incomes.

Competitive Market: With multiple insurance carriers offering plans on the Nevada exchange, residents benefit from a competitive market. This competition often drives down prices and improves the range of benefits offered.

Exploring Plan Options

When it comes to health insurance plans in Nevada, there are several types to consider, each with its own set of features and costs.

Bronze Plans

Bronze plans are ideal for individuals who are generally healthy and don't anticipate frequent medical expenses. These plans have lower monthly premiums but higher deductibles, meaning you pay more out-of-pocket before your insurance coverage kicks in.

| Premium | Deductible |

|---|---|

| $250/month | $5,000 |

Silver Plans

Silver plans strike a balance between cost and coverage. They offer a reasonable premium and deductible, making them a popular choice for many Nevadans. These plans typically cover a wider range of services, providing a good balance for those who want comprehensive coverage without excessive costs.

| Premium | Deductible |

|---|---|

| $320/month | $2,500 |

Gold Plans

Gold plans are designed for individuals who prioritize comprehensive coverage and are willing to pay a higher premium for it. These plans offer lower deductibles and copayments, ensuring you have access to a wide range of medical services without significant out-of-pocket expenses.

| Premium | Deductible |

|---|---|

| $450/month | $1,000 |

Catastrophic Plans

Catastrophic plans are specifically designed for individuals under the age of 30 or those with a certified hardship exemption. These plans offer very low premiums but have high deductibles, making them suitable for those who rarely need medical care but want protection against unexpected emergencies.

| Premium | Deductible |

|---|---|

| $180/month | $7,500 |

Navigating the Enrollment Process

Understanding the enrollment process is crucial to securing the right health insurance plan.

Open Enrollment Period

In Nevada, the open enrollment period typically runs from November 1st to December 15th each year. This is the time when individuals can enroll in a new health insurance plan or make changes to their existing coverage for the upcoming year. Outside of this period, you may only qualify for a Special Enrollment Period if you experience a qualifying life event, such as losing your job or getting married.

Special Enrollment Period

A Special Enrollment Period (SEP) allows individuals to enroll outside of the open enrollment window due to specific life changes. These could include marriage, birth or adoption of a child, loss of other health coverage, or moving to a new area. It's important to note that each qualifying event has a limited time frame for enrollment, so staying informed is key.

Cost-Saving Strategies

Nevada offers several strategies to help residents reduce the cost of their health insurance.

Financial Assistance

The Affordable Care Act provides financial assistance to eligible individuals in the form of premium tax credits and cost-sharing reductions. These subsidies can significantly reduce the cost of your monthly premiums and out-of-pocket expenses. To qualify, your household income must be between 100% and 400% of the federal poverty level.

Health Savings Accounts (HSAs)

If you're enrolled in a high-deductible health plan, you may be eligible to open a Health Savings Account. HSAs allow you to save pre-tax dollars to cover eligible medical expenses. These accounts can be a powerful tool for managing your healthcare costs and building savings for future needs.

Finding the Right Plan for You

Choosing the right health insurance plan involves considering your unique needs and circumstances.

Assessing Your Medical Needs

Take time to evaluate your past and potential future medical needs. Consider factors such as chronic conditions, prescription medication requirements, and anticipated healthcare services. Understanding your needs will help you choose a plan that provides adequate coverage without unnecessary expenses.

Comparing Network Providers

Each health insurance plan has a network of healthcare providers it works with. Ensure that your preferred doctors, hospitals, and specialists are included in the plan's network to avoid out-of-network charges. Some plans offer broader networks, while others may be more cost-effective if you're willing to use a more limited network.

Staying Informed and Prepared

Keeping up with the latest developments in health insurance is essential to making the most of your coverage.

Understanding Plan Benefits

Familiarize yourself with the benefits and limitations of your chosen plan. This includes understanding your deductible, copayments, and coinsurance, as well as the plan's coverage for various services like prescription drugs, mental health services, and preventive care. Being aware of these details can help you budget effectively and make informed healthcare decisions.

Staying Up-to-Date with Policy Changes

Health insurance policies and regulations can change annually. Stay informed about any updates to your plan's coverage, benefits, or costs. This includes being aware of any changes to your provider network or the addition of new services covered by your plan. Regularly reviewing your plan's materials can help you stay prepared and make necessary adjustments.

Conclusion: Empowering Nevadans with Affordable Health Insurance

In Nevada, the path to affordable health insurance is well-lit, thanks to state initiatives and federal subsidies. By understanding the different plan options, navigating the enrollment process, and employing cost-saving strategies, residents can secure comprehensive coverage that fits their unique needs and budgets. Remember, staying informed is key to making the most of your health insurance and ensuring your peace of mind.

What is the average cost of health insurance in Nevada?

+

The average monthly premium for health insurance in Nevada varies based on the plan type and individual factors such as age and location. However, with the available financial assistance and competitive market, many Nevadans can secure affordable coverage.

Can I enroll in a health insurance plan outside of the open enrollment period?

+

Yes, you can enroll outside of the open enrollment period if you qualify for a Special Enrollment Period due to a qualifying life event. These events could include losing your job, getting married, or having a baby.

How do I know if I’m eligible for financial assistance with my health insurance premiums?

+

You may be eligible for financial assistance if your household income is between 100% and 400% of the federal poverty level. You can estimate your eligibility by using the Health Insurance Marketplace calculator or consulting with a local insurance agent.