Cheapest Insurance

When it comes to finding the cheapest insurance options, understanding the factors that influence insurance rates and knowing how to navigate the insurance market is crucial. In this comprehensive guide, we will delve into the world of insurance, exploring the various types, the key considerations for finding affordable coverage, and the strategies to ensure you get the best value for your money.

Unraveling the Complexity: Types of Insurance and Their Costs

Insurance is a diverse landscape, offering protection for a wide range of risks. Let’s explore some of the most common types and their associated costs.

Auto Insurance: The Essential Cover

Auto insurance is a legal requirement in most regions and is often the first insurance policy individuals seek. The cost of auto insurance can vary significantly based on factors such as:

- Vehicle Type and Usage: Sports cars and luxury vehicles typically attract higher premiums due to their higher repair costs. Additionally, the more you drive, the higher the risk, leading to increased premiums.

- Driver Profile: Young drivers and those with a history of accidents or violations are considered higher risk, resulting in higher insurance costs. On the other hand, mature drivers with a clean record often enjoy lower rates.

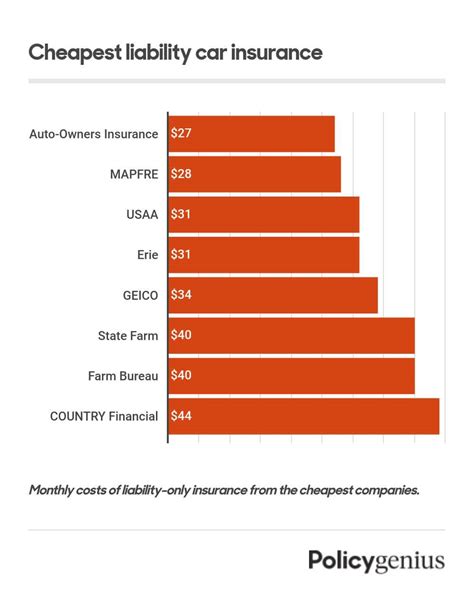

- Coverage Options: The level of coverage you choose plays a significant role. Comprehensive and collision coverage provide broader protection but come at a higher cost compared to liability-only coverage.

According to a recent study, the average cost of auto insurance in the United States is approximately $1,674 per year, but this can vary widely based on the factors mentioned above.

Homeowners Insurance: Protecting Your Nest

Homeowners insurance is essential for safeguarding your home and its contents. The cost of this coverage depends on several factors, including:

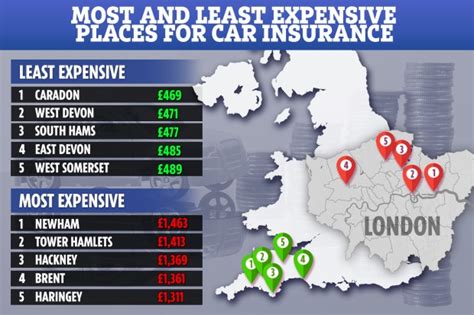

- Location: Areas prone to natural disasters like hurricanes or earthquakes may have higher premiums due to the increased risk.

- Home Value and Size: Larger homes with more valuable assets will typically require higher insurance coverage, leading to increased costs.

- Coverage Options: Similar to auto insurance, the level of coverage you choose impacts the cost. Comprehensive policies that cover both the structure and its contents are more expensive than basic coverage.

The average cost of homeowners insurance in the US is around $1,312 per year, but this can vary significantly based on the location and the specific coverage chosen.

Health Insurance: A Necessity for Well-Being

Health insurance is a critical aspect of financial planning, ensuring access to healthcare services. The cost of health insurance can be influenced by various factors, such as:

- Age and Health Status: Younger, healthier individuals often pay lower premiums compared to older adults or those with pre-existing conditions.

- Plan Type: Different health insurance plans offer varying levels of coverage. HMO (Health Maintenance Organization) plans, for example, typically have lower premiums but more restrictions, while PPO (Preferred Provider Organization) plans offer more flexibility but at a higher cost.

- Employer-Provided Insurance: Many individuals obtain health insurance through their employers, and the cost can be significantly reduced with employer contributions.

The average cost of health insurance in the US is approximately $7,739 per year for an individual and $22,221 per year for a family, according to recent data. However, these costs can vary greatly depending on the plan and provider.

Life Insurance: Securing Your Legacy

Life insurance provides financial protection for your loved ones in the event of your passing. The cost of life insurance depends on factors such as:

- Age and Health: Younger individuals in good health often qualify for lower premiums. As you age or if you have health complications, the cost of life insurance increases.

- Coverage Amount: The amount of coverage you choose directly impacts the cost. Higher coverage amounts result in higher premiums.

- Term vs. Permanent: Term life insurance offers coverage for a specific period, typically 10-30 years, and is generally more affordable than permanent life insurance, which provides coverage for the insured’s entire life.

The average cost of term life insurance for a 30-year-old non-smoker in the US is around $22 per month for a $500,000 policy, according to industry data. However, this can vary based on the individual's health and the coverage amount chosen.

Strategies for Finding the Cheapest Insurance

Now that we’ve explored the various types of insurance and their associated costs, let’s delve into some strategies to help you find the cheapest insurance options available.

Shop Around and Compare Quotes

One of the most effective ways to find cheap insurance is to compare quotes from multiple providers. Insurance companies use different algorithms to calculate premiums, and the rates can vary significantly between them. By shopping around and obtaining quotes from at least three to five providers, you can identify the most affordable option for your needs.

Additionally, consider using online insurance comparison tools. These platforms allow you to input your details once and receive multiple quotes from different providers, saving you time and effort.

Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies with them. For example, if you have auto and homeowners insurance with the same provider, you may be eligible for a multi-policy discount. By bundling your insurance needs, you can often save a significant amount on your overall premiums.

Understand Your Coverage Needs

Before purchasing insurance, it’s essential to understand your specific coverage needs. Overinsuring yourself can lead to unnecessary expenses, while underinsuring may leave you vulnerable in the event of a claim. Assess your risks and choose coverage that provides adequate protection without being excessive.

For example, if you own a home with valuable assets, consider the replacement cost of those assets when choosing homeowners insurance coverage. Similarly, when selecting auto insurance, assess your driving habits and choose a policy that provides adequate liability coverage while considering your vehicle's value.

Explore Discounts and Rewards

Insurance companies often offer a variety of discounts and rewards to attract and retain customers. Some common discounts include:

- Safe Driver Discount: If you have a clean driving record, you may be eligible for a discount on your auto insurance.

- Loyalty Discount: Staying with the same insurance provider for an extended period can lead to loyalty discounts.

- Homeowner Discounts: Installing security systems, smoke detectors, or fire sprinklers in your home can qualify you for discounts on homeowners insurance.

- Group Discounts: Belonging to certain professional organizations or alumni associations may entitle you to group discounts on insurance.

It's worth exploring these discounts and discussing them with your insurance provider to ensure you're taking advantage of all available savings.

Consider High Deductibles

Opting for a higher deductible can reduce your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you’re assuming more financial responsibility in the event of a claim, which can result in lower premiums.

However, it's important to strike a balance. Ensure that the deductible you choose is an amount you can comfortably afford in the event of a claim. Otherwise, you may find yourself in a difficult financial situation if an unexpected expense arises.

Maintain a Good Credit Score

Your credit score can impact your insurance premiums, particularly for auto and homeowners insurance. Insurance companies often use credit-based insurance scores to assess the risk of insuring an individual. A higher credit score may result in lower premiums, as it indicates a lower risk of filing claims.

If you have a low credit score, consider taking steps to improve it. This can include paying your bills on time, reducing your debt, and maintaining a good credit history. Over time, a higher credit score can lead to lower insurance costs.

Utilize Technology and Telematics

Advancements in technology have led to innovative ways to save on insurance premiums. Some insurance providers offer telematics devices or smartphone apps that track your driving habits. These devices can provide data on your driving behavior, such as sudden braking or acceleration, and reward safe driving with lower premiums.

Additionally, many insurance companies now offer digital tools and apps that allow you to manage your policies, file claims, and access policy documents online. Utilizing these digital resources can often result in discounts and improved efficiency.

The Future of Affordable Insurance

As the insurance industry continues to evolve, new technologies and innovations are shaping the way insurance is offered and accessed. Here are some insights into the future of affordable insurance:

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are transforming the insurance landscape. These technologies enable insurance providers to analyze vast amounts of data, identify patterns, and make more accurate predictions about risks. This can lead to more precise underwriting, improved risk assessment, and ultimately, more affordable insurance premiums.

Telemedicine and Digital Health

The rise of telemedicine and digital health solutions is revolutionizing the healthcare industry, and it’s having a direct impact on health insurance costs. With telemedicine, individuals can access medical advice and treatment remotely, reducing the need for in-person visits and lowering healthcare costs. As a result, health insurance providers can offer more affordable plans that incorporate telemedicine benefits.

Blockchain Technology

Blockchain technology has the potential to disrupt the insurance industry by enhancing transparency, security, and efficiency. By leveraging blockchain, insurance providers can streamline processes, reduce administrative costs, and offer more competitive premiums. Additionally, blockchain-based smart contracts can automate certain insurance processes, further reducing costs and improving customer experiences.

Parametric Insurance

Parametric insurance is an innovative approach that provides coverage based on predefined parameters rather than actual losses. This type of insurance is particularly useful for natural disaster risks, such as hurricanes or earthquakes. By using parametric triggers, insurance providers can offer more affordable coverage, as the claims process is simplified and the risk is spread across a larger pool of policyholders.

Conclusion

Finding the cheapest insurance requires a combination of understanding your coverage needs, shopping around, and utilizing the strategies outlined above. By comparing quotes, bundling policies, exploring discounts, and leveraging technology, you can ensure you’re getting the best value for your insurance dollar.

As the insurance industry continues to evolve, staying informed about new technologies and innovations can help you make more informed decisions and take advantage of emerging opportunities for affordable coverage. Remember, insurance is a critical aspect of financial planning, and by being proactive and knowledgeable, you can protect your assets and your future without breaking the bank.

What is the cheapest type of insurance?

+The cheapest type of insurance varies based on individual needs and circumstances. However, generally speaking, term life insurance is often considered the most affordable type of insurance. It provides coverage for a specific period, typically 10-30 years, and is designed to protect your loved ones in the event of your passing. The premiums for term life insurance are often significantly lower compared to permanent life insurance options.

How can I lower my insurance premiums?

+There are several strategies you can employ to lower your insurance premiums. These include shopping around and comparing quotes from multiple providers, bundling your insurance policies with the same company to take advantage of multi-policy discounts, maintaining a good credit score, and exploring discounts and rewards offered by insurance companies. Additionally, considering a higher deductible can reduce your premiums, but it’s important to choose a deductible you can comfortably afford.

Are there any government programs to help with insurance costs?

+Yes, there are government programs in place to assist individuals with insurance costs, particularly for health insurance. In the United States, the Affordable Care Act (ACA) provides subsidies and tax credits to help make health insurance more affordable for low- and middle-income individuals and families. Additionally, Medicaid and Medicare are government-funded programs that provide health insurance coverage to eligible individuals.