Ngl Life Insurance Company

The insurance industry is a vital sector that provides financial protection and peace of mind to individuals and families. Among the myriad of insurance providers, Ngl Life Insurance Company stands out as a prominent player, offering a comprehensive range of insurance products tailored to meet diverse needs. In this in-depth exploration, we delve into the world of Ngl Life Insurance Company, uncovering its history, product offerings, innovative approaches, and the impact it has on the lives of its policyholders.

A Legacy of Trust: Ngl Life Insurance Company’s Journey

Ngl Life Insurance Company, headquartered in the bustling metropolis of New York City, has etched its name in the annals of the insurance industry with a rich heritage spanning over six decades. Founded in 1962 by visionary entrepreneurs, the company set out on a mission to revolutionize the way people protect their livelihoods and secure their future.

Over the years, Ngl Life Insurance Company has consistently evolved, adapting to the changing needs of its clientele and the dynamic insurance landscape. The company's unwavering commitment to excellence and customer-centric approach has earned it a reputation as a trusted guardian of financial well-being, solidifying its position as a leading insurance provider in the United States.

Today, Ngl Life Insurance Company boasts a diverse portfolio of insurance products, ranging from life insurance policies to comprehensive health and wellness plans. Its innovative spirit and dedication to research and development have propelled the company to the forefront of the industry, enabling it to offer cutting-edge solutions that cater to the unique requirements of its policyholders.

The Ngl Life Insurance Company Advantage: A Suite of Insurance Products

At the heart of Ngl Life Insurance Company’s success lies its comprehensive suite of insurance products, meticulously designed to address a myriad of financial needs and concerns. The company’s flagship offering, the Ngl LifeShield policy, is a testament to its commitment to providing comprehensive protection.

Ngl LifeShield is a flexible life insurance plan that empowers individuals to tailor their coverage according to their specific needs. Whether it's securing the financial future of their loved ones, covering outstanding debts, or ensuring a dignified retirement, Ngl LifeShield offers a range of benefits that adapt to evolving life circumstances.

| Ngl LifeShield Benefits | Description |

|---|---|

| Death Benefit | Provides a lump sum payment to beneficiaries upon the policyholder's death, ensuring financial security for loved ones. |

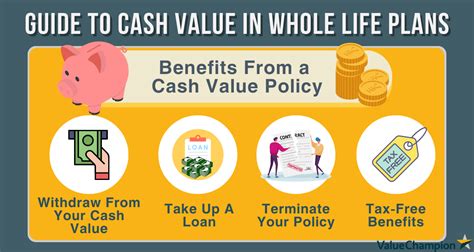

| Cash Value Accumulation | Allows policyholders to build savings within their policy, offering financial flexibility and potential tax advantages. |

| Flexible Premiums | Offers the option to adjust premium payments based on changing financial situations, providing added convenience and peace of mind. |

| Accelerated Benefits | Provides early access to a portion of the death benefit in the event of a terminal illness or critical condition, offering crucial financial support during challenging times. |

In addition to its flagship life insurance plan, Ngl Life Insurance Company offers a comprehensive range of other insurance products, including:

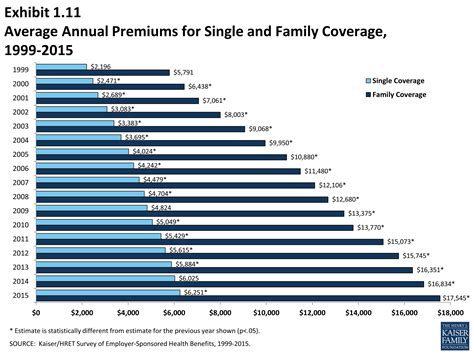

- Health Insurance Plans: Ngl Life Insurance Company provides a variety of health insurance options, covering medical, dental, and vision care. These plans offer flexible coverage, catering to the diverse needs of individuals, families, and businesses.

- Disability Insurance: The company's disability insurance policies provide income protection in the event of an accident or illness that impairs an individual's ability to work. This crucial coverage ensures financial stability during times of physical or mental incapacity.

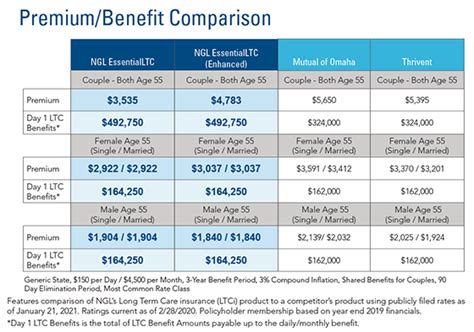

- Long-Term Care Insurance: Ngl Life Insurance Company recognizes the importance of long-term care planning. Its specialized policies offer coverage for extended care needs, including assisted living, nursing home care, and in-home services, ensuring policyholders can maintain their desired quality of life as they age.

- Travel Insurance: For those who embark on journeys near and far, Ngl Life Insurance Company offers travel insurance plans that provide comprehensive protection against unforeseen events, such as trip cancellations, medical emergencies, and lost luggage.

The Ngl Life Insurance Company Experience: A Journey of Protection and Empowerment

At Ngl Life Insurance Company, the customer experience is at the forefront of its operations. The company understands that insurance is more than just a financial transaction; it’s about providing security, peace of mind, and empowerment to its policyholders.

From the moment a potential customer interacts with Ngl Life Insurance Company, they are met with a seamless and personalized experience. The company's dedicated team of insurance professionals offers expert guidance, ensuring that individuals and businesses find the most suitable insurance solutions to meet their unique needs.

Ngl Life Insurance Company's online platform is a testament to its commitment to accessibility and convenience. Policyholders can manage their insurance policies, make payments, and access important documents with just a few clicks. The user-friendly interface ensures a smooth and intuitive experience, empowering individuals to take control of their financial protection.

Furthermore, Ngl Life Insurance Company places a strong emphasis on education and financial literacy. The company's comprehensive resource center provides valuable insights and tools to help individuals understand the complexities of insurance and make informed decisions. From informative articles to interactive calculators, Ngl Life Insurance Company equips its policyholders with the knowledge they need to navigate the world of insurance with confidence.

Ngl Life Insurance Company: Impacting Lives and Communities

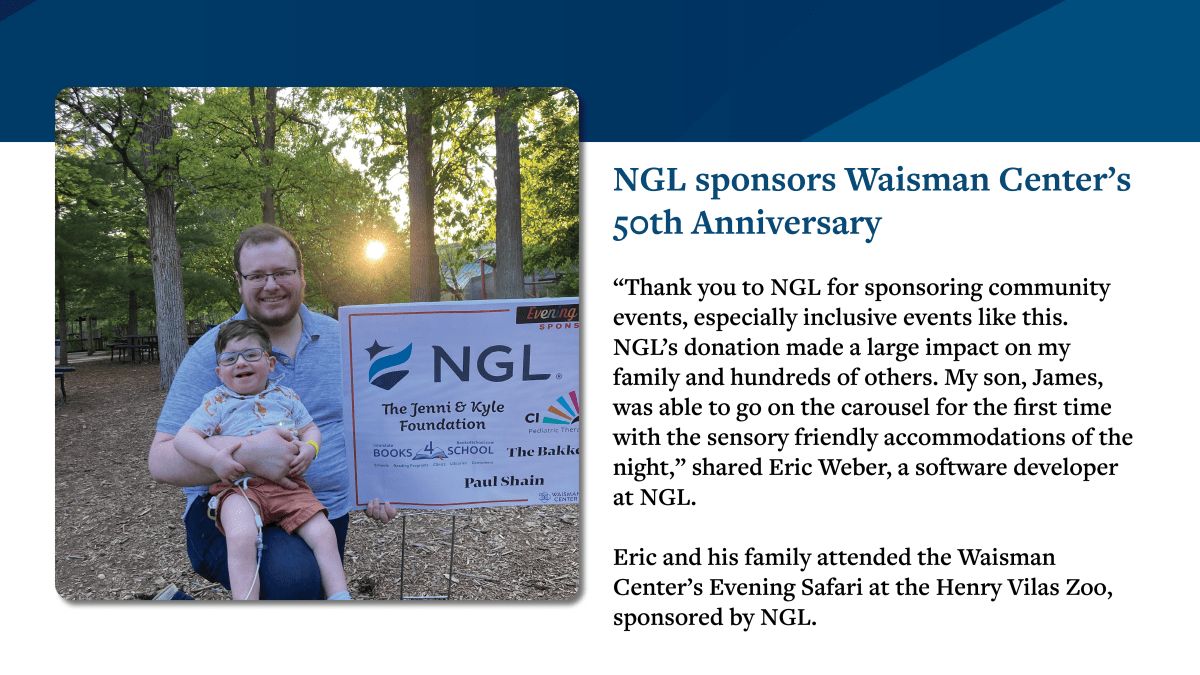

Beyond its role as a leading insurance provider, Ngl Life Insurance Company is deeply committed to making a positive impact on the communities it serves. The company’s corporate social responsibility initiatives are a testament to its values and dedication to giving back.

Through its Ngl Life Insurance Foundation, the company actively supports various charitable causes and organizations, focusing on areas such as education, healthcare, and environmental sustainability. The foundation's initiatives aim to create a lasting impact, empowering individuals and fostering positive change in communities across the nation.

Additionally, Ngl Life Insurance Company encourages its employees to engage in volunteerism and community service. The company believes that its workforce is its greatest asset, and by empowering them to give back, it strengthens the fabric of society and fosters a culture of compassion and social responsibility.

The Future of Ngl Life Insurance Company: Embracing Innovation and Growth

As the insurance industry continues to evolve, Ngl Life Insurance Company remains at the forefront, embracing technological advancements and innovative business practices. The company’s forward-thinking approach positions it for continued success and growth in an increasingly competitive landscape.

Ngl Life Insurance Company recognizes the potential of emerging technologies, such as blockchain and artificial intelligence, and is actively exploring their integration into its operations. These technologies have the potential to revolutionize the way insurance is delivered, enhancing efficiency, security, and customer experience.

Furthermore, the company is committed to expanding its reach and diversifying its product offerings to meet the evolving needs of its clientele. Whether it's introducing new insurance plans, enhancing existing policies, or exploring innovative partnerships, Ngl Life Insurance Company is dedicated to remaining a trusted partner in the financial journey of its policyholders.

How can I obtain a quote for Ngl Life Insurance Company's policies?

+Obtaining a quote for Ngl Life Insurance Company's policies is straightforward. You can visit the company's official website and use the online quote tool, providing basic information about yourself and your insurance needs. Alternatively, you can reach out to their customer service team via phone or email for personalized assistance.

What sets Ngl Life Insurance Company apart from its competitors?

+Ngl Life Insurance Company stands out for its commitment to innovation, customer-centric approach, and comprehensive suite of insurance products. The company's focus on leveraging technology to enhance its services and its dedication to giving back to the community are key factors that differentiate it from competitors.

How does Ngl Life Insurance Company ensure the security of its policyholders' information?

+Ngl Life Insurance Company prioritizes the security and privacy of its policyholders' information. The company employs robust data protection measures, including encryption technologies and secure servers, to safeguard sensitive data. Additionally, it adheres to industry best practices and regulatory standards to ensure the highest level of data security.

In conclusion, Ngl Life Insurance Company has established itself as a leading force in the insurance industry, offering a comprehensive range of insurance products and a customer-centric approach. With its rich legacy, innovative spirit, and commitment to community impact, the company continues to shape the future of financial protection, empowering individuals and families to secure their futures with confidence.