Purchase Home Insurance Online

Home insurance is an essential aspect of protecting your most valuable asset, your home. In today's digital age, purchasing home insurance online has become a convenient and efficient process, offering a wide range of benefits and options. This comprehensive guide will walk you through the steps of buying home insurance online, providing you with the knowledge and insights to make an informed decision. We will delve into the factors to consider, the types of coverage available, and the advantages of online insurance purchasing.

Understanding Your Home Insurance Needs

Before diving into the online insurance market, it's crucial to assess your specific needs and understand the different types of coverage available. Home insurance policies typically cover two main aspects: the structure of your home and its contents. Here's a breakdown of the key considerations:

Structural Coverage

Structural coverage protects the physical structure of your home, including the walls, roof, and permanent fixtures. This coverage is essential as it safeguards you from financial losses due to damage caused by events such as fire, storms, vandalism, or natural disasters. It's important to note that flood and earthquake damage often require separate policies, as they are typically excluded from standard home insurance.

Contents Coverage

Contents coverage, also known as personal property coverage, protects the belongings inside your home. This includes furniture, electronics, clothing, and other personal items. It's essential to evaluate the value of your possessions and choose a policy that provides adequate coverage. Some policies offer replacement cost coverage, which ensures you receive the full cost to replace your items, while others provide actual cash value, which considers depreciation.

Additional Coverages and Riders

Beyond the basic structural and contents coverage, home insurance policies often offer additional protections. These can include liability coverage, which protects you from legal claims arising from accidents on your property, and personal injury coverage, which covers legal costs related to defamation or libel. Additionally, you may opt for riders or endorsements to extend your coverage for specific high-value items like jewelry, artwork, or collectibles.

Comparing Deductibles and Limits

When comparing home insurance policies, pay close attention to the deductibles and coverage limits. Deductibles are the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but it's essential to select a deductible that you can afford to pay in the event of a claim. Coverage limits, on the other hand, represent the maximum amount your insurance provider will pay for a covered loss.

Researching Online Home Insurance Providers

The online marketplace for home insurance is vast, offering a plethora of options and providers. Conducting thorough research is key to finding the right policy for your needs. Here are some steps to guide your research process:

Identify Reputable Providers

Start by identifying reputable home insurance providers in your area. You can begin with well-known national brands and then explore regional or local insurers. Check their financial stability and customer satisfaction ratings through independent rating agencies like AM Best, Moody's, or Standard & Poor's. Look for providers with a strong financial standing and positive customer reviews.

Compare Policy Features and Coverage Options

Once you have a list of potential providers, compare their policy features and coverage options. Pay attention to the specific inclusions and exclusions in each policy. For example, some policies may offer more comprehensive coverage for water damage, while others may have better liability protection. Ensure that the policies you're considering align with your identified needs.

Evaluate Customer Service and Claims Handling

The quality of customer service and claims handling can significantly impact your experience as a policyholder. Research the provider's reputation for prompt and efficient claims processing. Check online reviews and forums to gauge customer satisfaction levels. Look for providers with a track record of fair and timely claims settlements.

Assess Technological Capabilities

In the digital age, many insurance providers offer online tools and resources to enhance the policyholder experience. Evaluate the provider's website and mobile app for ease of use and functionality. Look for features like online quote generation, policy management, and the ability to file and track claims digitally. A user-friendly interface can streamline the entire insurance process.

Obtaining Online Quotes and Selecting a Policy

Once you've narrowed down your options, it's time to obtain online quotes and select the best policy for your needs. Here's a step-by-step guide:

Generate Online Quotes

Most insurance providers offer online quote tools on their websites. These tools allow you to input your personal and home information to generate a personalized quote. Ensure you provide accurate details to receive an accurate estimate. Compare quotes from multiple providers to identify the most competitive rates and coverage options.

Review Policy Details and Exclusions

When reviewing quotes, carefully examine the policy details and exclusions. Pay attention to the coverage limits, deductibles, and any specific exclusions that may apply to your situation. Understand the fine print to avoid any surprises down the line. If you have any questions or concerns, reach out to the provider's customer service team for clarification.

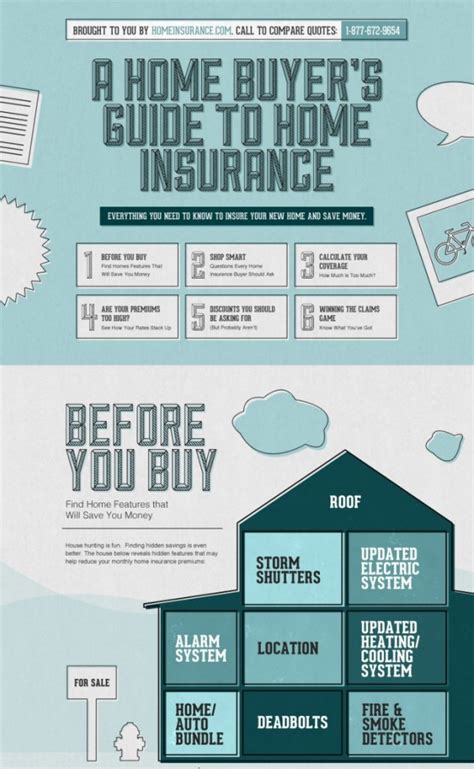

Consider Bundling Options

Many insurance providers offer bundling options, allowing you to combine multiple insurance policies, such as home and auto insurance, under one provider. Bundling can often result in significant savings, as providers offer discounts for multiple policies. Evaluate whether bundling makes financial sense for your situation.

Read and Understand the Policy Contract

Before finalizing your purchase, take the time to read and understand the entire policy contract. This document outlines the rights and responsibilities of both the insurer and the policyholder. Pay close attention to the terms and conditions, including any restrictions or limitations. Ensure you are comfortable with the terms before committing to the policy.

Purchasing Home Insurance Online: Step-by-Step Guide

Now that you've researched and selected the best home insurance policy for your needs, it's time to make the purchase. Here's a step-by-step guide to purchasing home insurance online:

Choose Your Preferred Provider

Based on your research and comparison, select the insurance provider that offers the best combination of coverage, price, and customer service. Ensure you feel confident in their ability to meet your insurance needs.

Fill Out the Online Application

Access the provider's website and locate the online application form. This form will require detailed information about your home, including its location, size, construction materials, and any recent improvements or renovations. Provide accurate and honest information to ensure your policy is tailored to your specific needs.

Select Your Coverage Options

During the application process, you'll be prompted to select your desired coverage options. Choose the level of coverage that aligns with your identified needs, considering both structural and contents coverage. Review the policy's deductibles and limits to ensure they meet your expectations.

Review and Confirm Your Policy

Before finalizing your purchase, carefully review the policy details, including the coverage options, deductibles, and limits. Ensure that the policy matches the expectations set during your research and quote comparison. If you have any questions or concerns, reach out to the provider's customer service team for clarification.

Make Your Payment and Receive Your Policy

Once you're satisfied with the policy, proceed to make your payment. Most providers offer secure online payment options, including credit card, debit card, or electronic transfer. After completing the payment, you should receive your policy documents electronically or by mail, depending on your preference.

Tips for Maximizing Your Home Insurance Experience

Purchasing home insurance online is just the beginning of your insurance journey. To ensure a positive experience, here are some tips to keep in mind:

Regularly Review and Update Your Policy

Your home insurance policy should evolve with your changing needs and circumstances. Review your policy annually to ensure it still provides adequate coverage. Update your policy if you make significant improvements to your home or acquire new valuable possessions. Regular reviews ensure you're always protected.

Understand Your Deductibles and Limits

Familiarize yourself with your policy's deductibles and coverage limits. Know the amount you'll need to pay out of pocket in the event of a claim. Understanding these details will help you make informed decisions when filing a claim and ensure you're not left with unexpected expenses.

Maintain Open Communication with Your Provider

Establish a positive relationship with your insurance provider by maintaining open and honest communication. Keep them informed of any changes to your home or personal circumstances that may impact your coverage. This includes renovations, additions, or changes in occupancy. Clear communication can help avoid coverage gaps or misunderstandings.

Utilize Online Resources and Tools

Take advantage of the online resources and tools provided by your insurance provider. These may include policy management portals, claim filing and tracking systems, and educational materials. Online resources can simplify the insurance process and provide valuable insights into your coverage and options.

Explore Discounts and Savings Opportunities

Insurance providers often offer various discounts and savings opportunities. These can include discounts for loyalty, bundling multiple policies, or maintaining a claims-free record. Explore these options and discuss them with your provider to see if you're eligible for any additional savings.

| Discount Type | Description |

|---|---|

| Loyalty Discount | A reward for long-term customers who have maintained their policies without claims. |

| Bundling Discount | Savings offered when you combine multiple insurance policies, such as home and auto insurance, under one provider. |

| Claims-Free Discount | A reduction in premium for policyholders who have not filed any claims within a specified period. |

FAQs

How do I know if my home insurance coverage is adequate?

+Adequate coverage depends on your specific needs and the value of your home and possessions. As a general rule, your home insurance policy should cover the full replacement cost of your home and its contents. Regularly review your policy and adjust coverage as needed to ensure it keeps up with the increasing value of your home and possessions.

What happens if I need to file a claim with my home insurance provider?

+If you experience a covered loss, such as a fire, theft, or storm damage, you’ll need to file a claim with your insurance provider. Typically, you’ll start by notifying your provider of the incident and providing relevant details. They will guide you through the claims process, which may involve inspections and documentation. It’s important to act promptly and follow the provider’s instructions to ensure a smooth claims experience.

Can I customize my home insurance policy to fit my specific needs?

+Yes, home insurance policies can often be customized to meet your specific needs. You can choose the level of coverage for your home’s structure and contents, select additional coverages like liability or personal injury protection, and opt for riders to extend coverage for high-value items. Working with your insurance provider, you can create a policy that provides the protection you require.

Are there any alternatives to purchasing home insurance online?

+While purchasing home insurance online is convenient and efficient, you can also explore other options. You can consult with an independent insurance agent who can provide guidance and quotes from multiple providers. Additionally, some insurance providers offer over-the-phone or in-person consultations to discuss your insurance needs and provide personalized recommendations.

What should I do if I have a dispute with my home insurance provider?

+In the event of a dispute with your insurance provider, it’s important to communicate your concerns clearly and document all interactions. If the issue remains unresolved, you may consider seeking assistance from an independent insurance ombudsman or consumer protection agency. These organizations can provide guidance and mediation to help resolve insurance-related disputes.