Does Whole Life Insurance Have Cash Value

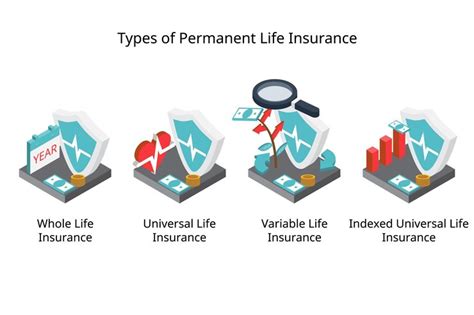

Whole life insurance, also known as permanent life insurance, is a type of coverage that provides lifetime protection and offers a unique financial benefit: the accumulation of cash value. Unlike term life insurance, which only provides coverage for a specified period, whole life insurance policies combine death benefit protection with a savings component, making them an attractive option for those seeking long-term financial planning.

Understanding Cash Value in Whole Life Insurance

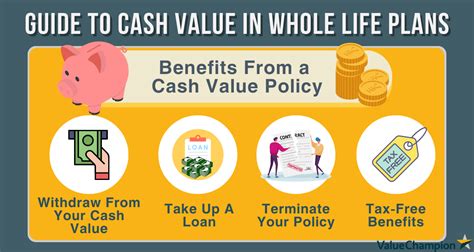

The cash value of a whole life insurance policy is a key feature that sets it apart from other types of life insurance. It refers to the portion of the policy’s premium that is invested and grows over time. This value accumulates on a tax-deferred basis, meaning it grows without immediate tax implications. As the policyholder, you can access this cash value through various means, providing flexibility and potential financial advantages.

Here's a breakdown of how cash value works in whole life insurance policies:

- Premium Payments: A portion of your premium payments goes towards the cost of insurance (COI), which covers the mortality risk, while the remaining amount is invested in the policy's cash value.

- Interest Earnings: The cash value grows due to interest earnings. Insurance companies invest the cash value in a variety of assets, such as bonds and stocks, which generate returns. These returns are credited to your policy, contributing to the growth of your cash value.

- Tax Benefits: The cash value grows on a tax-deferred basis. This means that you don't pay taxes on the interest earnings until you withdraw or use the funds. This tax advantage can significantly boost the growth of your policy's cash value over time.

- Policy Loan: You can borrow against the cash value of your whole life insurance policy. The loan amount is typically based on the policy's cash value and can be used for various purposes. Interest accrues on the loan, but if you keep the policy in force, the interest may be added to the policy's indebtedness rather than being immediately due.

- Cash Surrender Value: If you decide to terminate your whole life insurance policy, you can receive the cash surrender value, which is the amount of cash value available at that time. This value can be significant, especially if you've held the policy for a long period.

Benefits and Uses of Cash Value

The cash value feature of whole life insurance offers several advantages and can be used in various ways to meet your financial goals:

- Financial Flexibility: The cash value provides a financial cushion, allowing you to access funds for unexpected expenses or to take advantage of investment opportunities.

- Supplemental Income: In retirement, you can use the cash value to supplement your income, providing a reliable source of funds to maintain your lifestyle.

- Wealth Transfer: Whole life insurance policies with accumulated cash value can be an effective tool for transferring wealth to your beneficiaries, as the death benefit is paid tax-free.

- Policy Loans: Borrowing against the cash value can provide liquidity without affecting the death benefit. This can be especially useful for funding large purchases or covering short-term financial needs.

- Policy Continuation: If you encounter financial difficulties, you can use the cash value to pay premiums, ensuring your policy remains active and providing continued protection for your beneficiaries.

Factors Affecting Cash Value Growth

The growth of cash value in a whole life insurance policy can be influenced by several factors, including:

- Interest Rates: The rate of return on the invested cash value is influenced by prevailing interest rates. Higher interest rates can lead to faster cash value accumulation.

- Policy Design: Different whole life insurance policies have varying design features, including the guaranteed minimum interest rate, participation rates, and expense charges, which can impact cash value growth.

- Premium Payments: Consistent and timely premium payments contribute to the growth of cash value. Skipping or reducing premiums can slow down or halt cash value accumulation.

- Policy Duration: Cash value typically takes time to build up, and the longer you hold the policy, the more substantial the cash value can become.

| Factor | Impact on Cash Value |

|---|---|

| Interest Rates | Higher rates accelerate growth. |

| Policy Design | Guaranteed rates and participation rates influence returns. |

| Premium Payments | Consistent payments contribute to accumulation. |

| Policy Duration | Longer tenure leads to higher cash value. |

Considerations and Potential Drawbacks

While whole life insurance with cash value offers significant benefits, it’s essential to consider potential drawbacks and factors that may impact its suitability for your financial situation:

Cost and Affordability

Whole life insurance policies tend to have higher premiums compared to term life insurance. The cost of coverage, combined with the savings component, can make whole life insurance less affordable for some individuals. It’s crucial to assess your budget and financial goals to determine if the long-term benefits outweigh the initial cost.

Surrender Penalties

If you decide to surrender or cancel your whole life insurance policy before a certain period, you may incur surrender charges. These charges can reduce the cash value you receive, especially if you terminate the policy early in its tenure. Understanding the surrender penalties and the potential impact on your cash value is essential before making any decisions.

Investment Risk

While whole life insurance policies offer guaranteed minimum interest rates, the potential for higher returns often comes with investment risk. The insurance company’s investment strategy and market conditions can impact the rate of return on your cash value. It’s important to assess your risk tolerance and understand the potential impact on your financial goals.

Alternative Investment Options

When considering whole life insurance, it’s essential to compare it with other investment and savings options. Alternatives such as mutual funds, stocks, bonds, or even high-yield savings accounts may offer different risk-return profiles and tax implications. Assessing your investment goals and preferences is crucial to making an informed decision.

Flexibility and Accessibility

Whole life insurance policies typically have strict rules regarding premium payments and policy modifications. While the cash value provides flexibility, accessing it through policy loans or withdrawals may have restrictions and potential tax implications. Understanding the accessibility and liquidity of your funds is vital when considering whole life insurance.

Expert Insights

According to financial expert Dr. Alan Smith, “Whole life insurance with cash value can be a powerful tool for long-term financial planning, but it’s not a one-size-fits-all solution. The decision to opt for whole life insurance should be based on a thorough analysis of your financial goals, risk tolerance, and the potential trade-offs involved. Consulting with a trusted financial advisor who understands your unique circumstances is crucial to making an informed choice.”

Conclusion

Whole life insurance with cash value offers a unique combination of protection and savings, providing policyholders with financial flexibility and potential long-term benefits. The accumulation of cash value, the tax advantages, and the various ways it can be utilized make whole life insurance an attractive option for those seeking comprehensive financial planning. However, it’s essential to carefully consider the cost, potential risks, and alternative investment options to ensure that whole life insurance aligns with your financial goals and risk appetite.

Can I withdraw the entire cash value of my whole life insurance policy?

+Yes, you can typically withdraw a portion or the entire cash value of your whole life insurance policy. However, withdrawing the full cash value may result in the termination of the policy, and you may incur surrender charges. It’s important to carefully consider the impact on your coverage and financial goals before making a withdrawal.

How does the cash value grow in a whole life insurance policy?

+The cash value grows through interest earnings on the invested portion of your premium payments. Insurance companies invest the cash value in various assets, generating returns that are credited to your policy. The growth is influenced by factors such as interest rates, policy design, and consistent premium payments.

Can I use the cash value to pay for my whole life insurance premiums?

+Yes, you can use the cash value of your whole life insurance policy to pay for premiums. This feature, known as “policy loans,” allows you to borrow against the cash value to cover premium payments. However, it’s important to understand the potential impact on your policy’s cash value and the overall financial implications.