Cheap Insurance

When it comes to insurance, finding affordable coverage is a top priority for many individuals and businesses. The term "cheap insurance" often evokes a sense of skepticism, as we naturally associate affordability with reduced quality or limited coverage. However, in this comprehensive guide, we will explore the world of insurance and uncover strategies to secure the best value without compromising on protection.

Understanding Cheap Insurance: A Balanced Approach

In the insurance industry, the concept of "cheap" can be subjective. It is not solely about the lowest price but rather about achieving a balance between cost and the level of coverage that suits your needs. Cheap insurance aims to provide adequate protection at a price that is accessible and sustainable for the policyholder.

Key Factors Affecting Insurance Costs

Several elements contribute to the cost of insurance premiums. Understanding these factors is crucial in your quest for cheap insurance:

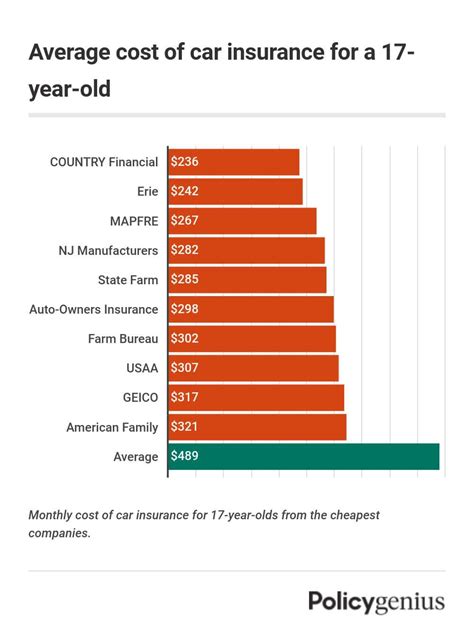

- Risk Assessment: Insurance companies evaluate various risks associated with the policyholder. For example, in auto insurance, factors like driving history, age, and location impact the premium.

- Coverage Selection: The type and extent of coverage you choose play a significant role. Opting for comprehensive coverage might be more expensive but provides broader protection.

- Deductibles and Limits: Higher deductibles can lead to lower premiums, as you assume more financial responsibility. Understanding the right deductible for your situation is essential.

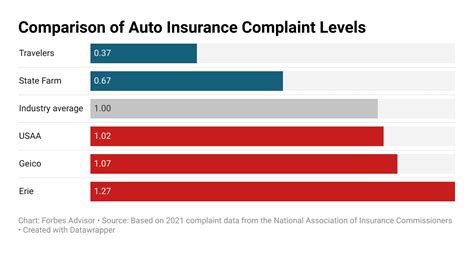

- Provider Reputation: Established insurance companies often offer more comprehensive services and stability but may come at a higher cost. Exploring smaller, specialized providers can sometimes result in better rates.

The Perks of Shopping Around

One of the simplest yet effective ways to find cheap insurance is by comparing quotes from multiple providers. Insurance rates can vary significantly between companies, even for similar coverage. Utilizing online comparison tools and seeking quotes from various insurers allows you to identify the most competitive rates.

| Insurance Type | Average Premium (USD) |

|---|---|

| Auto Insurance | $1,200 - $1,800 annually |

| Homeowners' Insurance | $1,000 - $2,000 annually |

| Health Insurance (Individual) | $5,000 - $8,000 annually |

Note: The above figures are approximate and can vary based on location, coverage, and other factors.

Strategies for Affordable Insurance Coverage

Securing cheap insurance requires a combination of informed decision-making and strategic planning. Here are some practical strategies to consider:

1. Evaluate Your Coverage Needs

Before seeking insurance, assess your specific requirements. Are you looking for comprehensive coverage or a more basic plan? Understanding your needs will help you avoid overpaying for unnecessary features.

2. Explore Discounts and Rewards

Insurance providers often offer discounts to attract and retain customers. Some common discounts include:

- Multi-Policy Discounts: Bundling multiple insurance policies, such as auto and home insurance, can result in significant savings.

- Safe Driver or Good Student Discounts: These are common perks for auto insurance, rewarding safe driving habits or academic achievements.

- Loyalty Discounts: Long-term customers may be eligible for loyalty rewards, so it's worth inquiring about these perks.

3. Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive (PAYD) or telematics insurance, is a modern approach that uses technology to monitor driving behavior. Insurers use this data to assess risk and offer personalized premiums. For safe drivers, this can lead to substantial savings.

4. Optimize Your Policy Regularly

Insurance needs evolve over time. Regularly reviewing and optimizing your policy can help you identify areas where you might be overinsured or where you can negotiate better rates. For instance, if you've installed safety features in your home, you may qualify for a lower premium on your homeowners' insurance.

5. Explore Group Insurance Plans

Group insurance plans, often offered through employers or associations, can provide access to discounted rates. These plans leverage the collective bargaining power of the group to secure favorable terms.

6. Maintain a Good Credit Score

Believe it or not, your credit score can impact your insurance premiums. Insurers often use credit scores as an indicator of financial responsibility. Improving your credit score can potentially lead to lower insurance costs.

The Impact of Cheap Insurance on Society

Cheap insurance has far-reaching implications beyond individual savings. It plays a crucial role in promoting financial stability and security for communities and nations:

Increased Access to Coverage

Affordable insurance options encourage more individuals and businesses to purchase coverage. This leads to a more comprehensive safety net, reducing the financial burden on public services and social support systems.

Economic Growth and Stability

Cheap insurance contributes to economic growth by providing a safety net for businesses and individuals. It encourages entrepreneurship, promotes investment, and fosters a more resilient economy. Businesses, in particular, can focus on growth and innovation without the fear of catastrophic losses.

Social Equality and Inclusion

Affordable insurance helps bridge the gap between the insured and the uninsured. It ensures that a larger portion of the population has access to essential services like healthcare and property protection, promoting social equality and a sense of shared responsibility.

The Future of Cheap Insurance

As technology advances and consumer needs evolve, the insurance industry is undergoing significant transformations. Here's a glimpse into the future of cheap insurance:

1. Digital Transformation

The rise of digital insurance platforms and apps is making insurance more accessible and transparent. These platforms often provide instant quotes, streamlined processes, and personalized recommendations, making it easier for consumers to find and manage affordable coverage.

2. Data-Driven Risk Assessment

Advanced analytics and machine learning are enabling insurers to make more accurate risk assessments. This precision allows for better pricing models, leading to more affordable and tailored insurance plans.

3. Focus on Prevention

Insurers are increasingly recognizing the value of prevention over cure. They are incentivizing policyholders to adopt healthy lifestyles, implement safety measures, and take proactive steps to mitigate risks. This shift towards prevention can lead to lower insurance costs over time.

4. Personalized Insurance Products

The future of insurance lies in customization. Insurers are developing products that cater to the unique needs of individuals and businesses. This personalized approach ensures that policyholders only pay for the coverage they truly require, making insurance more affordable and efficient.

Conclusion

Finding cheap insurance is not merely about chasing the lowest price. It's about achieving a harmonious balance between cost and coverage. By adopting a strategic approach, leveraging technology, and staying informed about industry trends, you can secure insurance that provides the protection you need without straining your finances.

Frequently Asked Questions

How can I lower my auto insurance premiums without compromising coverage?

+You can lower your auto insurance premiums by exploring discounts such as safe driver or good student discounts. Additionally, consider increasing your deductible, as this can significantly reduce your premium. However, ensure you can afford the higher deductible in the event of a claim.

<div class="faq-item">

<div class="faq-question">

<h3>What is the difference between cheap insurance and low-quality coverage?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Cheap insurance refers to affordable coverage that suits your specific needs. Low-quality coverage, on the other hand, may offer minimal protection and exclude essential benefits. When seeking cheap insurance, ensure you understand the coverage limits and exclusions to avoid unpleasant surprises.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any hidden costs associated with cheap insurance policies?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Some cheap insurance policies may have hidden costs or exclusions. Always carefully review the policy documents to understand what's included and what's not. Be cautious of policies that seem too good to be true, as they might have significant limitations.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I find cheap insurance providers that offer reliable service?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To find reliable cheap insurance providers, start by researching and comparing multiple companies. Look for reviews and ratings from independent sources. Additionally, consider seeking recommendations from trusted friends or family members who have had positive experiences with affordable insurance providers.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What should I do if I'm unhappy with my current insurance provider's rates or service?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you're unhappy with your insurance provider's rates or service, it's worth shopping around for alternatives. Compare quotes from different providers to find a better deal. Additionally, consider voicing your concerns to your current provider; they may be willing to negotiate or offer solutions to improve your experience.</p>

</div>

</div>