How Much Is Marketplace Insurance

Marketplace insurance, also known as the Health Insurance Marketplace, offers a range of health coverage options for individuals and families, providing an accessible and affordable way to obtain essential health benefits. The cost of marketplace insurance can vary significantly based on several factors, including your income, location, age, and the specific plan you choose. In this comprehensive guide, we will delve into the various aspects that influence the cost of marketplace insurance, providing you with the knowledge to make informed decisions about your health coverage.

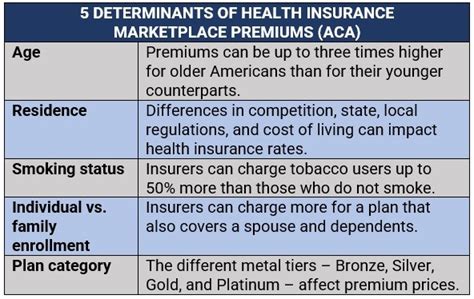

Understanding the Factors Affecting Marketplace Insurance Costs

Several key factors contribute to the overall cost of marketplace insurance. By understanding these elements, you can better navigate the marketplace and find a plan that aligns with your budget and healthcare needs.

Income and Subsidies

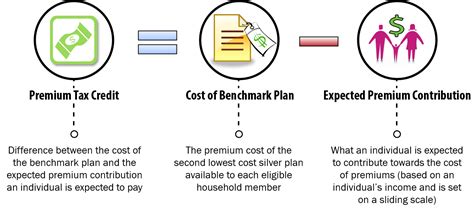

Your income plays a crucial role in determining the cost of marketplace insurance. The marketplace offers financial assistance, known as subsidies or premium tax credits, to individuals and families with qualifying incomes. These subsidies help reduce the monthly premium costs, making insurance more affordable. The amount of subsidy you receive is based on your estimated household income for the year. If your income is below a certain threshold, you may also qualify for Medicaid or the Children’s Health Insurance Program (CHIP), providing additional coverage options.

| Income Level | Subsidy Eligibility |

|---|---|

| Up to 138% of Federal Poverty Level (FPL) | May qualify for Medicaid or CHIP |

| 138% - 400% of FPL | Premium tax credits available |

| Above 400% of FPL | No subsidies, but still eligible for marketplace plans |

Location and Plan Availability

The cost of marketplace insurance can vary significantly based on your location. Different states have varying healthcare costs, and the availability of insurance plans and providers can also impact prices. Some states offer more competitive pricing and a wider range of plan options, while others may have limited choices or higher premiums. Researching the marketplace in your state and comparing plans can help you find the most cost-effective option for your region.

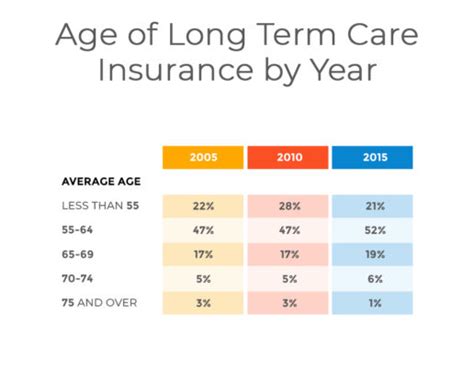

Age and Plan Type

Your age is another factor that influences the cost of marketplace insurance. Generally, younger individuals tend to have lower premiums, as they are considered less risky to insure. However, as you age, your premiums may increase to account for the higher likelihood of health issues. Additionally, the type of plan you choose, such as a bronze, silver, gold, or platinum plan, will also affect the cost. Platinum plans, for example, offer the most comprehensive coverage but come with higher premiums, while bronze plans have lower premiums but may have higher out-of-pocket costs.

| Age Group | Average Premium |

|---|---|

| Under 30 years | $250 - $400 per month |

| 30 - 40 years | $300 - $500 per month |

| 40 - 50 years | $400 - $600 per month |

| 50+ years | $500 - $800 per month |

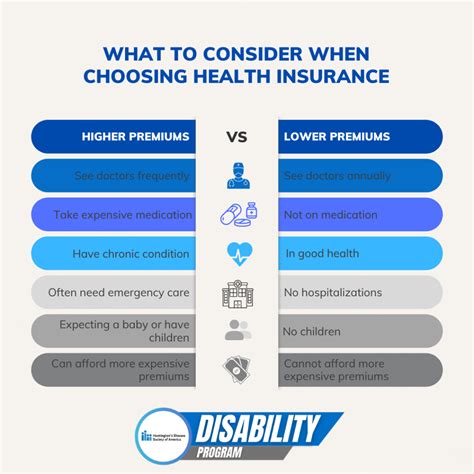

Tobacco Use and Health Status

The marketplace allows insurance companies to charge tobacco users higher premiums. If you use tobacco products, you may face a surcharge on your insurance plan, typically ranging from 25% to 50% of the base premium. Additionally, pre-existing health conditions or chronic illnesses can also impact your insurance costs. Some plans may offer specific coverage for certain conditions, while others may have higher premiums to account for the increased risk.

Estimating Marketplace Insurance Costs: A Case Study

Let’s consider a hypothetical scenario to illustrate how these factors come into play when estimating the cost of marketplace insurance.

Scenario: A Family of Four in California

Imagine a family of four residing in California. The parents, John and Jane, are both 35 years old, and their two children, aged 5 and 8, are covered under the same plan. The family’s estimated annual income is $75,000, placing them within the range for premium tax credits.

Estimating Premiums and Subsidies

Based on their income, the family qualifies for a premium tax credit of approximately 1,500 per month. This means that their out-of-pocket monthly premium cost for a silver plan would be reduced by this amount. Without the subsidy, a silver plan in their area may cost around 1,800 per month. With the subsidy, their monthly premium would be 300 (1,800 - $1,500) plus any applicable surcharges for tobacco use or health conditions.

Comparing Plan Options

The family has the option to choose from various plan types, each with its own cost structure. Here’s a comparison of the monthly premiums and out-of-pocket costs for different plan types:

| Plan Type | Monthly Premium | Out-of-Pocket Costs |

|---|---|---|

| Bronze | $250 (after subsidy) | Higher deductibles and copays |

| Silver | $300 (after subsidy) | Moderate deductibles and copays |

| Gold | $450 (after subsidy) | Lower deductibles and copays |

| Platinum | $600 (after subsidy) | Lowest deductibles and copays |

Considering Deductibles and Copays

When choosing a plan, it’s essential to consider the deductibles and copays associated with each option. A bronze plan may have a higher monthly premium, but it could result in significant savings if the family has minimal healthcare needs. On the other hand, a platinum plan offers the most comprehensive coverage but comes with higher out-of-pocket costs, making it a better choice for families with frequent medical needs.

Maximizing Savings and Finding the Right Plan

Navigating the marketplace and selecting the most suitable insurance plan can be a complex process. Here are some tips to help you maximize your savings and find the right coverage for your needs:

- Research and Compare Plans: Take the time to explore the various plan options available in your state. Compare premiums, deductibles, copays, and covered services to find the plan that best fits your budget and healthcare requirements.

- Consider Your Healthcare Needs: Evaluate your family's healthcare needs and choose a plan that aligns with those needs. If you anticipate frequent doctor visits or require specialized care, a plan with lower deductibles and copays may be more cost-effective in the long run.

- Check for Network Providers: Ensure that your preferred healthcare providers, including doctors and hospitals, are in-network with the plan you choose. Out-of-network care can result in higher costs.

- Review Subsidy Eligibility: Calculate your estimated household income for the year to determine if you qualify for premium tax credits or other financial assistance. This can significantly reduce your monthly premiums.

- Use Cost-Estimation Tools: The Health Insurance Marketplace provides tools to estimate the cost of plans based on your income and family size. Utilize these resources to get a more accurate picture of your potential insurance expenses.

- Seek Professional Guidance: If you find the process overwhelming, consider consulting with a licensed insurance agent or a healthcare navigator. They can provide personalized advice and help you understand the intricacies of different plans.

The Future of Marketplace Insurance

The Health Insurance Marketplace continues to evolve, with ongoing efforts to improve accessibility and affordability. Recent policy changes and legislative initiatives aim to expand coverage options and provide more financial assistance to individuals and families. Keeping up with these developments can help you stay informed about potential changes that may impact your insurance costs and coverage choices.

What happens if my income changes during the year?

+If your income changes significantly, you should report the change to the Health Insurance Marketplace. This may impact your subsidy eligibility and the amount of premium tax credit you receive. It's important to keep your information up-to-date to avoid any potential issues with your insurance coverage.

Can I switch marketplace plans during the year?

+In most cases, you can only switch marketplace plans during the annual Open Enrollment Period, which typically runs from November to January. However, if you experience a qualifying life event, such as marriage, divorce, or a change in employment, you may be eligible for a Special Enrollment Period, allowing you to switch plans outside of the Open Enrollment Period.

Are there any penalties for not having marketplace insurance?

+As of 2019, there is no longer a federal penalty for not having health insurance. However, some states may have their own individual mandate penalties. It's essential to check the specific laws in your state to understand any potential consequences for not having insurance coverage.

Marketplace insurance provides a valuable opportunity for individuals and families to obtain essential health coverage. By understanding the factors that influence costs and actively researching your options, you can make informed decisions and find a plan that offers the right balance of affordability and healthcare benefits. Remember to stay informed about any changes to the marketplace and seek professional guidance when needed to ensure you have the coverage you need at a price you can afford.