Long Term Care Insurance Premiums

Long-term care insurance (LTCI) is a crucial financial tool that helps individuals plan for and manage the costs associated with extended care needs. These policies offer a safety net, ensuring that policyholders can access quality care without incurring substantial financial burdens. As such, understanding the factors that influence long-term care insurance premiums is essential for both potential policyholders and industry professionals.

In this comprehensive guide, we delve into the intricacies of LTCI premiums, exploring the key variables that impact their cost and providing expert insights to help readers make informed decisions. By the end of this article, readers will have a deeper understanding of the factors at play and the strategies to navigate the complex world of long-term care insurance.

Understanding Long-Term Care Insurance Premiums

Long-term care insurance premiums are the regular payments made by policyholders to secure coverage for future long-term care needs. These premiums are tailored to the individual’s circumstances and the specific coverage they require. The cost of premiums can vary significantly based on several factors, and understanding these variables is crucial for effective financial planning.

Key Factors Influencing Premiums

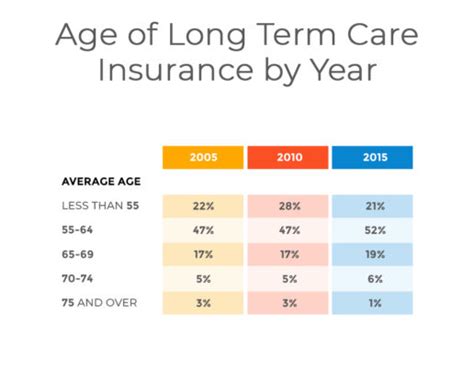

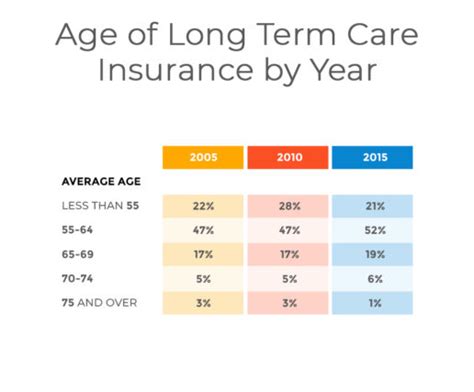

- Age at Purchase: One of the most significant factors affecting LTCI premiums is the age at which the policy is purchased. Generally, younger individuals pay lower premiums as they are less likely to require long-term care in the near future. As we age, the risk of needing long-term care increases, leading to higher premiums.

- Health Status: The health of the policyholder plays a pivotal role in determining premiums. Those with existing health conditions or a history of chronic illnesses may face higher premiums, as they are statistically more likely to require long-term care. Conversely, individuals with a clean bill of health may enjoy more competitive rates.

- Policy Coverage and Benefits: The scope and benefits of the chosen policy also influence premiums. Policies with comprehensive coverage, including a wide range of services and benefits, will naturally cost more. On the other hand, more basic policies with limited coverage may offer lower premiums.

- Inflation Protection: Many LTCI policies offer inflation protection, which ensures that the benefits keep pace with rising costs over time. While this feature provides valuable peace of mind, it also increases the premium cost.

- Elimination Period: The elimination period, or waiting period, refers to the time an individual must wait before their policy starts paying benefits. Policies with longer elimination periods often have lower premiums, as the insurer bears less financial responsibility in the short term.

- Type of Policy: There are various types of LTCI policies, including traditional indemnity policies and asset-based policies. Each type has its own pricing structure and considerations. For instance, asset-based policies may offer unique features like a death benefit or a return of premium, influencing their premium cost.

Real-World Premium Examples

To illustrate the impact of these factors, let’s consider two hypothetical scenarios:

| Scenario | Premium Cost |

|---|---|

| John, a 55-year-old healthy individual, purchases a traditional LTCI policy with a 90-day elimination period, 150 daily benefit, and 3% compound inflation protection. He opts for a comprehensive policy with a lifetime benefit period.</td> <td>2,400 annually | |

| Sarah, a 60-year-old with a history of diabetes, purchases an asset-based LTCI policy with a 180-day elimination period, 200 daily benefit, and simple inflation protection. She chooses a policy with a 5-year benefit period.</td> <td>3,600 annually |

These examples showcase how individual circumstances and policy choices can lead to vastly different premium costs.

Strategies for Managing Long-Term Care Insurance Premiums

Given the significant financial commitment of LTCI premiums, it’s essential to explore strategies to manage and optimize these costs. Here are some expert recommendations:

Purchase Early

One of the most effective ways to reduce LTCI premiums is to purchase a policy when you’re younger and healthier. As mentioned earlier, age and health status are key factors in premium determination. By purchasing early, individuals can lock in lower rates and potentially save thousands of dollars over the life of their policy.

Understand Your Needs

Before selecting a policy, it’s crucial to thoroughly assess your long-term care needs. Consider your current and future health, the likelihood of requiring care, and the level of coverage you desire. By understanding your unique circumstances, you can choose a policy that aligns with your needs, ensuring you’re not overpaying for unnecessary benefits.

Explore Policy Options

There is no one-size-fits-all approach to LTCI. Different policies offer varying levels of coverage, benefits, and premium structures. Take the time to research and compare multiple policies from different insurers. Look for features that align with your needs and budget, such as flexible benefit periods, different inflation protection options, or unique policy types like asset-based policies.

Consider Inflation Protection

Inflation protection is a valuable feature that ensures your benefits keep pace with rising costs. However, it’s essential to strike a balance. While simple inflation protection may be sufficient for some, others may opt for compound inflation protection for added peace of mind. Weigh the benefits against the premium cost to make an informed decision.

Negotiate and Bundle

Don’t be afraid to negotiate with insurers. Many companies offer discounts or promotions, especially if you’re bundling LTCI with other insurance policies, such as life or health insurance. Additionally, some insurers may provide loyalty discounts for long-term customers. Always inquire about potential savings opportunities.

Seek Professional Advice

Navigating the complex world of LTCI can be challenging. Consider seeking advice from a qualified insurance broker or financial advisor who specializes in long-term care planning. They can provide personalized guidance based on your circumstances and help you make informed decisions to optimize your premium costs.

The Future of Long-Term Care Insurance Premiums

The landscape of long-term care insurance is constantly evolving, influenced by various factors such as demographic shifts, healthcare advancements, and economic trends. Here’s a glimpse into the future of LTCI premiums:

Increasing Demand

As the global population ages, the demand for long-term care services is expected to rise significantly. This increasing demand may lead to higher premiums as insurers adjust to the changing risk landscape.

Technological Advancements

The integration of technology in healthcare is set to revolutionize long-term care. Telehealth services, remote monitoring, and assistive technologies could reduce the overall cost of care, potentially leading to more affordable LTCI premiums.

Changing Policy Design

Insurers are continually innovating their product offerings. We may see the emergence of new policy designs, such as hybrid policies that combine LTCI with life or health insurance, offering more flexible and cost-effective options.

Regulatory Changes

Government policies and regulations play a significant role in the LTCI industry. Changes in legislation, such as tax incentives or reforms in the healthcare sector, could impact premium costs and the overall availability of LTCI policies.

Conclusion

Long-term care insurance premiums are a critical consideration for individuals planning for their future care needs. By understanding the key factors that influence premiums and adopting strategic approaches, policyholders can make informed decisions to secure affordable and comprehensive coverage. As the industry evolves, staying informed about emerging trends and innovations will be essential for navigating the future of long-term care insurance.

How often should I review my long-term care insurance policy?

+It’s recommended to review your policy at least once every three to five years or whenever there is a significant change in your health or financial situation. Regular reviews ensure your coverage remains adequate and aligned with your needs.

Can I change my long-term care insurance policy after purchase?

+In most cases, you can make changes to your policy, such as adjusting the benefit amount or the elimination period. However, these changes may impact your premium, and some insurers may have restrictions on when and how often you can modify your policy.

What happens if I can no longer afford my long-term care insurance premiums?

+If you find yourself in a situation where you can no longer afford your premiums, it’s important to reach out to your insurer. They may offer options such as premium waivers or reduced benefit amounts to help you maintain some level of coverage.