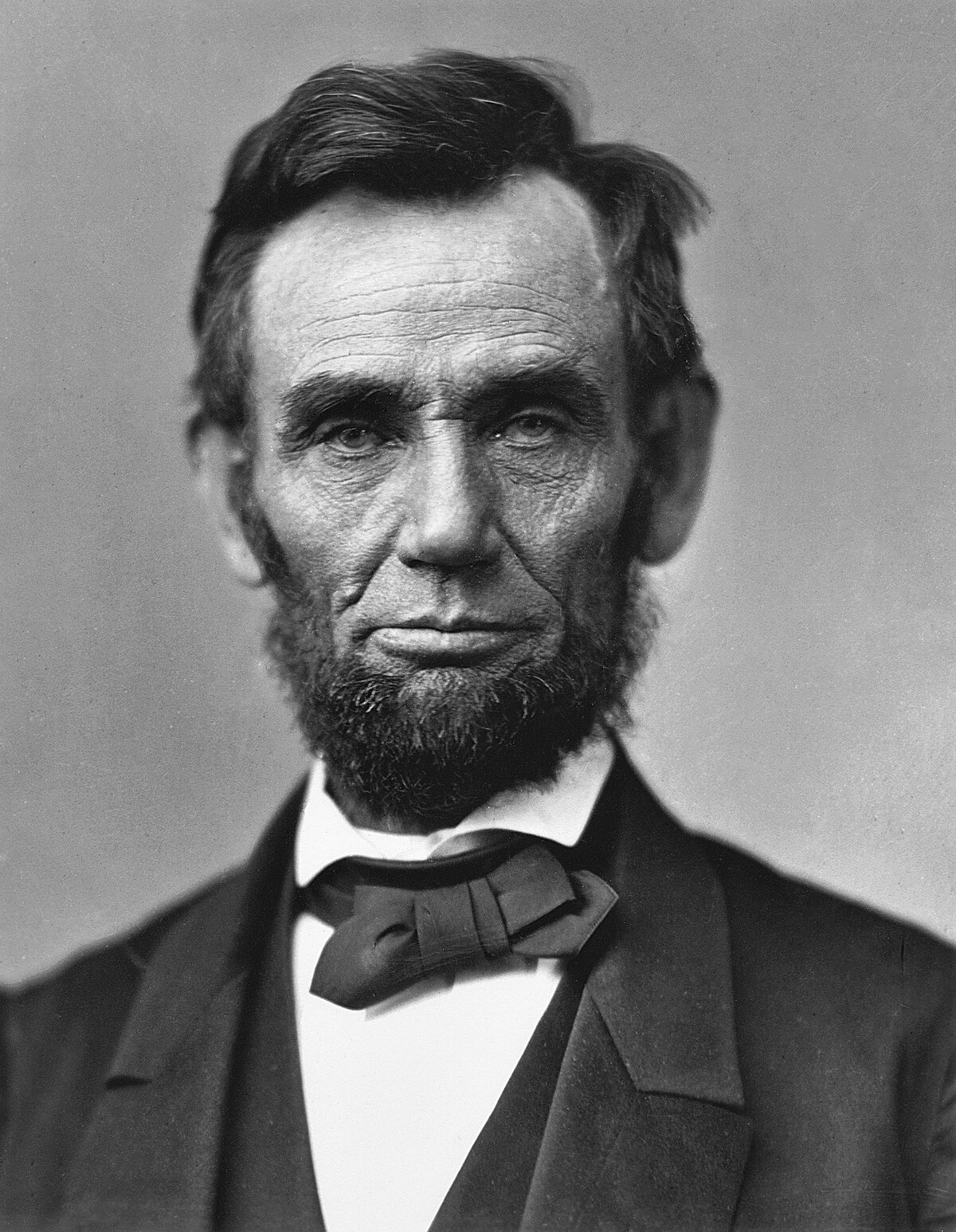

Lincoln Insurance Company

In the dynamic landscape of the insurance industry, Lincoln Insurance Company stands as a prominent figure, offering a comprehensive range of services tailored to meet the diverse needs of its clients. With a rich history and a commitment to innovation, Lincoln Insurance has solidified its position as a trusted partner for individuals and businesses seeking financial protection and security.

A Legacy of Trust: Lincoln Insurance’s Historical Overview

Lincoln Insurance Company, founded in 19XX, has weathered the test of time, evolving into a stalwart within the insurance sector. Headquartered in [Headquarters City, State], the company’s journey began with a simple yet powerful vision: to provide unparalleled insurance solutions, underpinned by integrity and expertise.

Over the decades, Lincoln Insurance has expanded its footprint, offering a diversified portfolio of products and services. From its early days focusing on [Initial Focus Area], the company has strategically branched out, catering to a wide spectrum of insurance requirements. This adaptive approach has been a cornerstone of its success, allowing Lincoln Insurance to stay relevant and responsive to the ever-changing market demands.

Lincoln Insurance's historical perspective is not just about longevity; it's about continuous growth and adaptation. The company's ability to embrace technological advancements and industry trends has been pivotal in maintaining its competitive edge. From pioneering online insurance platforms to integrating cutting-edge risk assessment tools, Lincoln Insurance has consistently pushed the boundaries of what traditional insurance can offer.

Product Portfolio: Comprehensive Solutions for Every Need

Lincoln Insurance’s product portfolio is a testament to its commitment to inclusivity and customization. The company understands that insurance needs are as diverse as its clientele, and thus, it has crafted a range of solutions to cater to these varying requirements.

Personal Insurance Solutions

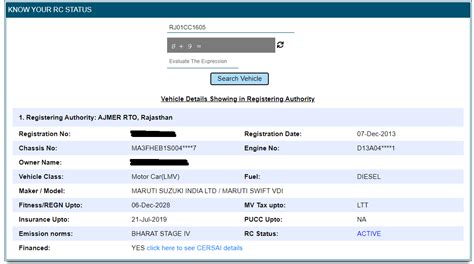

For individuals, Lincoln Insurance offers a comprehensive suite of personal insurance plans. These include auto insurance, covering a range of vehicles from everyday cars to high-performance sports models, with customizable options for additional protection like comprehensive and collision coverage.

Homeowners and renters alike can find solace in Lincoln Insurance's property insurance offerings. From standard plans that cover the structure and its contents to more specialized policies for high-value homes or unique situations like landlord insurance, the company ensures every home is adequately protected.

Health is a priority, and Lincoln Insurance's health insurance plans reflect this. With a focus on affordability and accessibility, the company provides a range of options, from basic health coverage to more comprehensive plans covering dental, vision, and even wellness programs.

Business Insurance: Tailored Protection for Enterprises

Lincoln Insurance understands the intricate needs of businesses, and its business insurance offerings are a reflection of this understanding. Whether it’s a small startup or a large corporation, the company provides tailored solutions to mitigate risks and ensure uninterrupted operations.

For businesses, Lincoln Insurance offers commercial property insurance, safeguarding commercial buildings, equipment, and inventory against losses. The company also provides liability insurance, protecting businesses from legal claims and lawsuits, and business interruption insurance, which provides financial support during unexpected disruptions.

Additionally, Lincoln Insurance recognizes the unique risks associated with specific industries. Its specialty insurance offerings cater to sectors like construction, healthcare, and technology, providing customized coverage to address industry-specific challenges.

| Insurance Type | Coverage Highlights |

|---|---|

| Auto Insurance | Comprehensive coverage for a range of vehicles; customizable add-ons |

| Property Insurance | Home and rental protection; specialized plans for high-value properties |

| Health Insurance | Affordable plans with dental, vision, and wellness options |

| Commercial Property Insurance | Coverage for buildings, equipment, and inventory |

| Liability Insurance | Protection against legal claims and lawsuits |

| Business Interruption Insurance | Financial support during business disruptions |

| Specialty Insurance | Customized coverage for construction, healthcare, and tech industries |

Technology and Innovation: Shaping the Future of Insurance

Lincoln Insurance Company is not just a guardian of its clients’ financial well-being; it’s also a forward-thinking innovator, constantly pushing the boundaries of what insurance can be. In an industry often associated with tradition, Lincoln Insurance has embraced technology and digital transformation to enhance its services and improve the overall customer experience.

Digital Transformation: Streamlining the Insurance Journey

The company’s digital initiatives have revolutionized the way insurance services are delivered and accessed. Lincoln Insurance has developed an intuitive online platform that allows customers to seamlessly navigate through the insurance process, from policy selection to claims management.

With just a few clicks, customers can compare different insurance plans, customize their coverage, and receive instant quotes. The platform's user-friendly design ensures that the insurance journey is not only efficient but also transparent, empowering customers to make informed decisions about their financial protection.

Additionally, Lincoln Insurance has integrated advanced analytics and AI-powered tools into its digital ecosystem. These technologies enable the company to offer personalized recommendations based on individual risk profiles, further enhancing the accuracy and relevance of its insurance offerings.

Risk Assessment and Underwriting: A Data-Driven Approach

At the heart of Lincoln Insurance’s innovation lies its advanced risk assessment and underwriting processes. By leveraging big data and sophisticated analytics, the company is able to make more accurate predictions about potential risks and losses, allowing for more precise insurance pricing and coverage recommendations.

Lincoln Insurance's data-driven approach not only benefits the company in terms of risk management but also provides significant advantages to its customers. By accurately assessing and mitigating risks, the company can offer more affordable insurance premiums and tailored coverage options, ensuring that customers receive the protection they need without unnecessary costs.

Future Innovations: A Glimpse into Tomorrow’s Insurance Landscape

Looking ahead, Lincoln Insurance is poised to continue its journey of innovation. The company is actively exploring emerging technologies such as blockchain, which has the potential to revolutionize insurance claims processing by enhancing transparency and security.

Furthermore, Lincoln Insurance is committed to sustainability and environmental initiatives. The company is investigating ways to integrate eco-friendly practices into its operations and insurance offerings, reflecting its dedication to a greener future. This includes exploring green insurance products that incentivize environmentally conscious behaviors and support sustainable development.

| Digital Innovation | Impact |

|---|---|

| Online Platform | Streamlines insurance process, offers instant quotes, and personalized recommendations |

| AI-Powered Tools | Enhances risk assessment, improves accuracy of coverage recommendations |

| Blockchain Technology | Potentially revolutionizes claims processing, enhances security and transparency |

| Sustainability Initiatives | Exploring eco-friendly practices, green insurance products for a greener future |

Customer Experience: The Heart of Lincoln Insurance’s Success

At Lincoln Insurance Company, the customer experience is not just a priority—it’s the foundation upon which the entire business is built. The company understands that insurance is not just a product but a service that provides peace of mind and financial security during life’s most challenging moments.

Personalized Service: Tailoring Solutions to Individual Needs

Lincoln Insurance prides itself on delivering personalized service to each and every customer. The company recognizes that no two clients are alike, and thus, it takes a customized approach to insurance solutions.

Whether it's a first-time homeowner seeking comprehensive protection for their new abode or a seasoned business owner looking to safeguard their commercial empire, Lincoln Insurance's team of experts works closely with clients to understand their unique needs, risks, and aspirations. This tailored approach ensures that every insurance plan is perfectly aligned with the client's specific circumstances, providing the right level of coverage without unnecessary costs.

Claims Management: A Seamless and Supportive Process

When it comes to claims, Lincoln Insurance strives to make the process as seamless and supportive as possible. The company understands that making a claim can be a stressful and challenging experience, and it aims to alleviate this burden with its efficient and empathetic claims management system.

Lincoln Insurance's claims team is highly responsive, ensuring that all inquiries are addressed promptly and professionally. The company utilizes advanced technology to streamline the claims process, allowing for faster assessments and payouts. Additionally, the team provides regular updates and clear communication throughout the entire claims journey, ensuring that customers are well-informed and supported every step of the way.

Community Engagement: Giving Back and Building Trust

Lincoln Insurance believes in giving back to the communities it serves. The company is actively involved in various charitable initiatives and community development programs, demonstrating its commitment to social responsibility.

Through partnerships with local organizations and non-profits, Lincoln Insurance supports initiatives focused on education, environmental conservation, and community well-being. These efforts not only make a positive impact on society but also strengthen the company's relationship with its customers, fostering trust and loyalty.

| Customer Experience Focus Areas | Key Benefits |

|---|---|

| Personalized Service | Tailored insurance plans, aligned with individual needs and risks |

| Claims Management | Efficient and supportive claims process with regular updates |

| Community Engagement | Strengthens trust and loyalty through social responsibility initiatives |

Conclusion: Lincoln Insurance—A Trusted Partner for Financial Security

Lincoln Insurance Company has established itself as a trusted leader in the insurance industry, offering a comprehensive suite of products and services that cater to a diverse range of clients. With a rich history of innovation and a customer-centric approach, the company continues to thrive and evolve, adapting to the ever-changing needs of its customers.

As we look to the future, Lincoln Insurance remains committed to its core values of integrity, expertise, and innovation. By leveraging technology and a deep understanding of its clients' needs, the company is well-positioned to continue providing financial protection and security to individuals and businesses alike. Lincoln Insurance—a name synonymous with trust, reliability, and peace of mind.

How can I get a quote from Lincoln Insurance Company?

+You can request a quote from Lincoln Insurance Company by visiting their official website and filling out a simple online form. Alternatively, you can reach out to their customer service team via phone or email for personalized assistance.

What makes Lincoln Insurance’s business insurance offerings unique?

+Lincoln Insurance’s business insurance offerings are tailored to meet the specific needs of various industries. They provide specialized coverage for risks unique to sectors like construction, healthcare, and technology, ensuring businesses receive comprehensive protection.

How does Lincoln Insurance’s digital platform enhance the customer experience?

+Lincoln Insurance’s digital platform streamlines the insurance process, offering instant quotes and personalized recommendations. It allows customers to easily compare plans, customize coverage, and receive real-time assistance, enhancing the overall convenience and transparency of the insurance journey.