What Is Fha Insured Loan

An FHA insured loan, commonly known as an FHA loan, is a mortgage loan backed by the Federal Housing Administration (FHA). This government-backed program is designed to facilitate homeownership, especially for first-time buyers, by offering a range of benefits and advantages that make it an attractive option for those seeking to purchase a home.

Understanding FHA Loans: A Government-Backed Solution

The FHA, established in 1934 during the Great Depression, plays a pivotal role in the housing market. Its primary mission is to stimulate the housing industry and make homeownership more accessible. FHA loans are a cornerstone of this mission, providing a stable and affordable path to homeownership for countless individuals and families.

Here's a deeper look at how FHA loans work and why they are a popular choice in the real estate market:

Loan Features and Benefits

- Lower Down Payment Requirements: One of the most notable advantages of FHA loans is the flexibility in down payment amounts. Unlike conventional loans, which often require a down payment of 20% or more, FHA loans typically allow for down payments as low as 3.5% of the purchase price. This means that borrowers can access homeownership with a significantly smaller upfront investment.

- Flexible Credit Requirements: FHA loans are known for their leniency when it comes to credit scores. While a credit score of at least 580 is generally preferred for the lowest down payment, borrowers with scores as low as 500 may still qualify with a 10% down payment. This makes FHA loans an excellent option for those who may have experienced credit challenges in the past.

- Favorable Interest Rates: FHA loans often come with competitive interest rates, making them an affordable choice for homebuyers. These rates are typically lower than those offered by traditional mortgages, providing borrowers with significant long-term savings.

- Seller Assistance: In certain situations, FHA loans allow for a portion of the closing costs to be covered by the seller. This feature can further reduce the financial burden on borrowers, making the home buying process more manageable.

- Streamlined Refinance Options: FHA loans offer a streamlined refinance program, known as the FHA Streamline Refinance, which allows borrowers to reduce their interest rate or switch from an adjustable-rate mortgage to a fixed-rate mortgage without the need for an extensive qualification process.

| FHA Loan Highlights | Description |

|---|---|

| Loan Limits | Vary by location; check FHA guidelines for specific limits. |

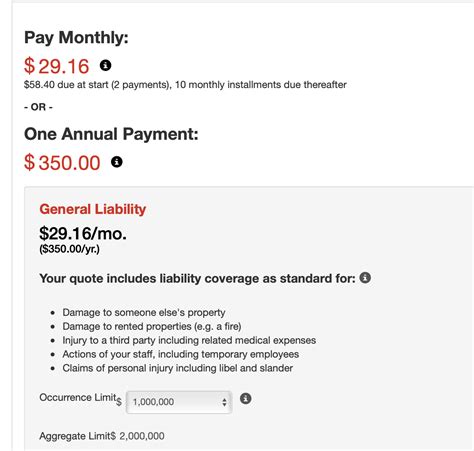

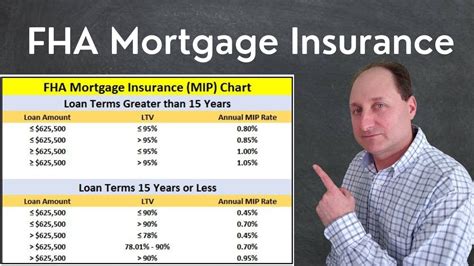

| Mortgage Insurance | Required; includes an upfront premium and an annual premium, which can be financed into the loan. |

| Property Requirements | Properties must meet FHA standards for safety, security, and soundness. |

Who Benefits from FHA Loans

FHA loans are particularly beneficial for first-time homebuyers, as they provide a low-barrier entry into the housing market. Additionally, individuals with lower credit scores, those who have experienced financial setbacks, and buyers who may not have the means to make a large down payment can find significant advantages in this loan program.

Furthermore, FHA loans are not limited to primary residences. Borrowers can also use FHA loans to purchase second homes or investment properties, expanding their real estate portfolio.

The Application and Qualification Process

To qualify for an FHA loan, borrowers must meet certain criteria. While the specific requirements can vary based on individual circumstances, here are some general guidelines:

Income and Employment

- Stable employment history: Lenders typically require at least two years of consistent employment to demonstrate stability.

- Debt-to-income ratio: The FHA generally recommends a debt-to-income ratio of 31% for housing costs and 43% for total debts, including the new mortgage.

Credit Score and History

- Credit score: As mentioned earlier, a credit score of at least 580 is preferred, but scores as low as 500 may be considered.

- Credit history: Borrowers should have a history of managing credit responsibly, including timely payments and a low utilization ratio.

Down Payment and Closing Costs

- Down payment: As low as 3.5% of the purchase price, depending on the borrower’s credit score.

- Closing costs: Borrowers can expect to pay closing costs, which may include origination fees, appraisal fees, and other associated expenses.

Property Requirements

The FHA has strict guidelines for the properties that can be purchased with its loans. Properties must be in good condition, free of health and safety hazards, and must meet the FHA’s minimum property standards. This ensures that borrowers are investing in homes that are structurally sound and habitable.

The Pros and Cons of FHA Loans

Like any financial product, FHA loans have their advantages and disadvantages. Here’s a closer look at some of the key considerations:

Pros

- Low Down Payment: The ability to buy a home with as little as 3.5% down makes FHA loans an attractive option for those who may not have significant savings.

- Flexible Credit Requirements: FHA loans are more forgiving of past credit challenges, making homeownership accessible to a broader range of borrowers.

- Competitive Interest Rates: Borrowers can secure favorable interest rates, often lower than those offered by traditional mortgages.

- Seller Assistance: The option for the seller to contribute to closing costs can reduce the financial burden on the borrower.

- Refinance Options: The FHA Streamline Refinance program provides an efficient way to reduce interest rates or switch mortgage types.

Cons

- Mortgage Insurance: FHA loans require mortgage insurance, which can increase the overall cost of the loan. This insurance is typically required for the life of the loan or until the borrower reaches 20% equity in the property.

- Strict Property Requirements: The FHA’s strict guidelines for property conditions may limit the types of properties available to borrowers.

- Limited Loan Limits: FHA loans have loan limits that vary by location. In high-cost areas, borrowers may find that the loan limits are insufficient for their needs.

FAQs

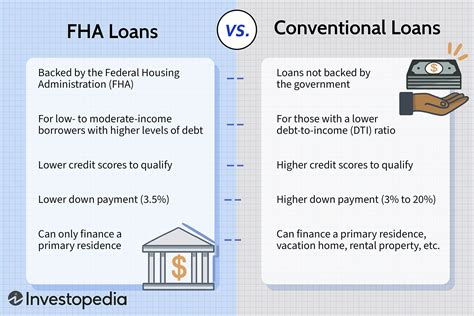

What is the difference between an FHA loan and a conventional loan?

+FHA loans and conventional loans are two distinct types of mortgages. FHA loans are insured by the Federal Housing Administration and are known for their low down payment requirements and flexible credit guidelines. Conventional loans, on the other hand, are not backed by any government agency and typically require a higher credit score and a larger down payment. Conventional loans may offer more flexibility in terms of loan limits and property types, but they can be more challenging to qualify for.

Are there any income restrictions for FHA loans?

+FHA loans do not have specific income restrictions. However, borrowers must demonstrate the ability to repay the loan. Lenders will evaluate factors such as employment history, debt-to-income ratio, and credit score to determine if a borrower qualifies. While there are no set income limits, the FHA does have loan limits that vary by location, which can impact the overall loan amount.

Can I use an FHA loan to purchase a vacation home or investment property?

+Yes, FHA loans can be used to purchase second homes or investment properties. However, there are certain restrictions and guidelines that apply. For example, the property must meet FHA standards for occupancy, and the borrower must meet specific income and credit requirements. It’s important to consult with a lender to understand the specific guidelines for using an FHA loan for a second home or investment property.