Are Health Insurance Payments Tax Deductible

Understanding the intricacies of health insurance payments and their tax implications is crucial for individuals seeking to optimize their financial strategies. In many countries, including the United States, the deductibility of health insurance premiums is a topic that garners significant attention due to its potential impact on taxpayers' financial planning and overall tax liabilities.

The Role of Health Insurance in Tax Planning

Health insurance plays a vital role in managing healthcare costs and providing financial protection against unexpected medical expenses. In the context of tax planning, the deductibility of health insurance premiums can offer significant advantages, allowing individuals to reduce their taxable income and potentially lower their overall tax burden.

Tax Treatment of Health Insurance Premiums

The tax treatment of health insurance premiums varies based on several factors, including the individual's employment status, the type of insurance plan, and the specific tax regulations in their country or region. In general, there are two primary categories of health insurance premium deductions:

- Employer-Sponsored Health Insurance: Many employers offer health insurance plans as a benefit to their employees. In such cases, the premiums paid by the employer are typically considered a business expense and are not taxable to the employee. This means that employees do not include these premiums in their taxable income, and they do not directly benefit from a tax deduction.

- Self-Employed or Individually Purchased Plans: Individuals who are self-employed or purchase health insurance plans on their own may be eligible for a tax deduction for their premium payments. This deduction is often available when the insurance is considered a necessary business expense for self-employed individuals or when it is purchased through a Health Savings Account (HSA) or similar tax-advantaged arrangement.

Health Savings Accounts (HSAs)

Health Savings Accounts are a popular tax-advantaged option for individuals with high-deductible health plans. HSAs allow individuals to set aside pre-tax dollars to cover qualified medical expenses. The key advantage of HSAs is that contributions are tax-deductible (or tax-free if made through payroll deduction), earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free. This makes HSAs an attractive option for those seeking to optimize their health insurance and tax strategies.

Eligibility and Limitations

The eligibility for health insurance premium deductions is subject to various conditions and limitations. Here are some key considerations:

- Income Level: In many cases, the deductibility of health insurance premiums is subject to income thresholds. Higher-income individuals may face limitations or phase-outs in their ability to deduct premiums.

- Filing Status: The filing status of the taxpayer, whether single, married filing jointly, or head of household, can also impact the deductibility of health insurance premiums.

- Itemized Deductions: To claim a deduction for health insurance premiums, individuals typically need to itemize their deductions on their tax return. This means that the premium deduction is often not available to those who take the standard deduction.

Impact of Tax Reform

Tax reforms, such as the Tax Cuts and Jobs Act (TCJA) in the United States, can significantly affect the deductibility of health insurance premiums. For instance, the TCJA eliminated the individual mandate penalty, which had previously imposed a fine on individuals without qualifying health insurance coverage. This change had implications for the tax treatment of health insurance, as it reduced the number of individuals claiming deductions for health insurance premiums.

Maximizing Tax Benefits

For individuals seeking to maximize the tax benefits associated with health insurance, there are several strategies to consider:

- Utilize Tax-Advantaged Accounts: Explore options like Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), or similar tax-advantaged arrangements offered by employers. These accounts allow for tax-free contributions and withdrawals for qualified medical expenses, providing significant tax savings.

- Itemize Deductions: If eligible, itemize deductions on your tax return to claim the deduction for health insurance premiums. This may involve careful consideration of other itemized deductions to ensure that the total exceeds the standard deduction threshold.

- Review Income Levels: Stay informed about income thresholds and phase-out ranges for health insurance premium deductions. Adjust your financial strategies to ensure you remain within the eligible income levels for deductions.

Conclusion

The deductibility of health insurance premiums is a complex aspect of tax planning, offering potential benefits to individuals who qualify. By understanding the tax treatment of health insurance, exploring tax-advantaged accounts, and staying informed about relevant tax regulations, individuals can make informed decisions to optimize their financial strategies and potentially reduce their tax liabilities.

Frequently Asked Questions

Can I deduct health insurance premiums if I’m self-employed?

+Yes, self-employed individuals can often deduct health insurance premiums as a business expense. This deduction is subject to specific conditions and income thresholds, so it’s essential to consult with a tax professional to ensure you meet the requirements.

Are there any limitations on the amount of health insurance premiums I can deduct?

+Yes, the deductibility of health insurance premiums may be subject to income limitations or phase-outs. These thresholds can vary based on your filing status and other factors. It’s crucial to review the latest tax guidelines to understand the specific limits applicable to your situation.

Can I deduct health insurance premiums if I’m covered by my employer’s plan?

+In most cases, health insurance premiums paid by your employer are not taxable to you, and you cannot deduct them on your tax return. However, if you contribute to a Health Savings Account (HSA) through payroll deduction, those contributions may be tax-deductible.

What is the difference between a Health Savings Account (HSA) and a Flexible Spending Account (FSA)?

+HSAs and FSAs are both tax-advantaged accounts, but they have some key differences. HSAs are typically associated with high-deductible health plans and offer triple tax benefits (tax-deductible contributions, tax-free earnings, and tax-free withdrawals for qualified medical expenses). FSAs, on the other hand, allow you to set aside pre-tax dollars for specific qualified medical expenses, but any unused funds are forfeited at the end of the year or grace period.

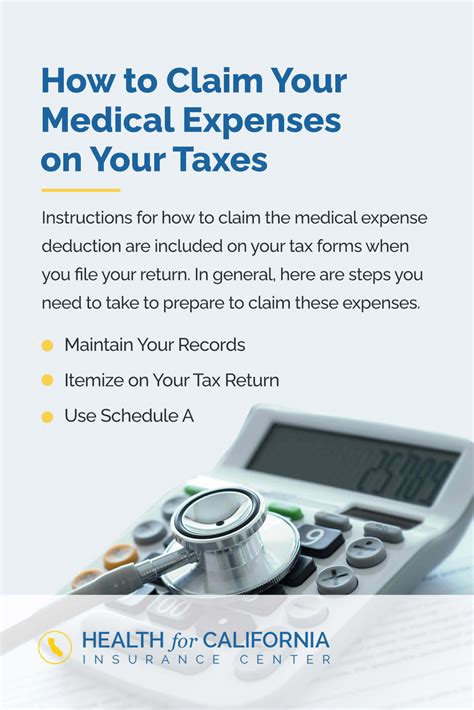

How do I claim the deduction for health insurance premiums on my tax return?

+To claim the deduction for health insurance premiums, you will need to itemize your deductions on your tax return. This typically involves completing Schedule A (Form 1040) and entering the amount of your qualified medical expenses, including health insurance premiums. It’s important to consult the specific instructions and guidelines provided by your tax authority for accurate reporting.