Sign Up For Health Insurance Online

In today's digital age, the process of obtaining health insurance has evolved, offering a convenient and efficient experience right at your fingertips. Whether you're a tech-savvy millennial or a seasoned individual seeking a simpler way to secure your healthcare needs, online enrollment has become an indispensable tool. This guide will walk you through the entire process, from understanding the basics of health insurance to successfully enrolling online, empowering you to take control of your health and financial well-being.

Understanding Health Insurance: A Foundation for Your Journey

Before diving into the world of online enrollment, it’s essential to grasp the fundamentals of health insurance. At its core, health insurance is a contract between you and an insurance company, providing financial protection against unexpected medical expenses. This protection comes in the form of various plans, each designed to meet different needs and budgets.

Types of Health Insurance Plans

Health insurance plans can be broadly categorized into several types, each with its own unique features and coverage options. Understanding these plans is crucial for selecting the right coverage for your specific needs.

- Health Maintenance Organization (HMO): HMOs typically offer comprehensive coverage but require you to choose a primary care physician (PCP) and receive referrals for specialist visits. They often have lower premiums and deductibles, making them an attractive option for those seeking cost-effective coverage.

- Preferred Provider Organization (PPO): PPO plans provide more flexibility, allowing you to choose from a network of healthcare providers without requiring referrals. While they may have higher premiums, they offer the convenience of wider provider choices.

- Exclusive Provider Organization (EPO): EPO plans are similar to PPOs but with a narrower network of providers. You can visit any in-network provider without referrals but may face higher costs for out-of-network care.

- Point of Service (POS) Plans: POS plans combine elements of HMOs and PPOs, offering flexibility in choosing providers but typically requiring referrals for specialist care. They often have lower out-of-pocket costs compared to PPOs.

- High Deductible Health Plans (HDHPs): HDHPs are designed to be paired with Health Savings Accounts (HSAs). They have higher deductibles but lower premiums, making them a cost-effective option for those who prioritize saving for future healthcare expenses.

Key Insurance Terms to Know

To navigate the world of health insurance, it’s essential to familiarize yourself with some key terms:

- Premium: The amount you pay to the insurance company for your coverage, typically on a monthly basis.

- Deductible: The amount you must pay out of pocket before your insurance coverage kicks in. Higher deductibles often result in lower premiums.

- Copayment (Copay): A fixed amount you pay for a specific service, like a doctor’s visit or prescription medication.

- Coinsurance: The percentage of costs you pay after meeting your deductible. For example, if you have an 80⁄20 coinsurance, the insurance covers 80% of the costs, and you pay the remaining 20%.

- Out-of-Pocket Maximum: The maximum amount you’ll pay out of pocket in a year, including deductibles, copays, and coinsurance. Once you reach this limit, your insurance covers 100% of eligible expenses.

The Importance of Enrollment Periods

Health insurance enrollment periods are crucial to understand. In the United States, there are typically two main enrollment periods:

- Open Enrollment Period: This is a set period, usually lasting a few months, during which anyone can enroll in or switch health insurance plans. It typically occurs once a year, and missing this window may result in having to wait until the next open enrollment period to make changes to your coverage.

- Special Enrollment Period: These periods are triggered by specific life events, such as losing job-based coverage, getting married, or having a baby. They allow you to enroll outside of the open enrollment period, providing flexibility when your circumstances change.

Online Enrollment: Step-by-Step Guide

Now that you have a solid understanding of health insurance, let’s dive into the process of enrolling online. Online enrollment is not only convenient but also allows you to compare plans and choose the one that best suits your needs.

Step 1: Research and Compare Plans

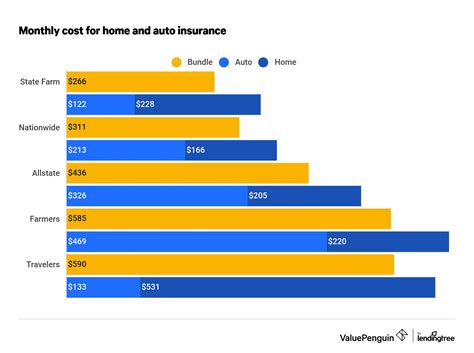

Before you begin the enrollment process, take the time to research and compare different health insurance plans. Consider factors such as your healthcare needs, budget, and preferred providers. Many online platforms and insurance company websites offer tools to help you compare plans side by side.

Key factors to consider during your research include:

- Premium Costs: Compare the monthly premiums for each plan. Keep in mind that lower premiums may result in higher deductibles and vice versa.

- Network of Providers: Check if your preferred doctors, hospitals, and specialists are in-network for the plan you’re considering. Out-of-network care can be significantly more expensive.

- Coverage Details: Review the plan’s coverage details, including deductibles, copays, and coinsurance. Ensure that the plan covers the services you anticipate needing, such as prescription medications, mental health services, or specialized treatments.

- Out-of-Pocket Maximum: Understand the plan’s out-of-pocket maximum, which can vary significantly between plans. A lower out-of-pocket maximum can provide financial security in case of unexpected medical emergencies.

- Additional Benefits: Some plans offer extra benefits like vision or dental coverage, wellness programs, or fitness reimbursements. Consider whether these additional benefits align with your personal goals and needs.

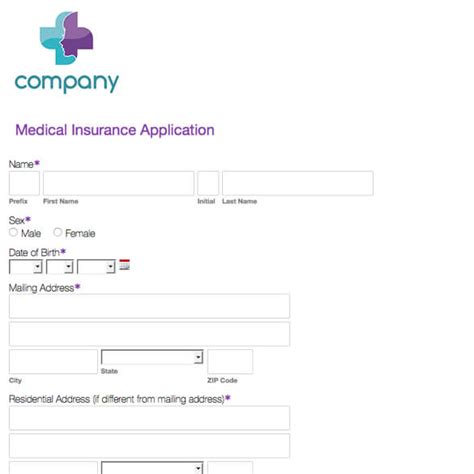

Step 2: Gather Necessary Documents

To ensure a smooth enrollment process, gather the necessary documents beforehand. These documents may include:

- Proof of identity (e.g., driver’s license, passport)

- Social Security number

- Income and tax information (for income-based plans)

- Employer details (if enrolling through an employer-sponsored plan)

- Family information (for family plans)

- Details of any existing health insurance coverage

Step 3: Choose Your Enrollment Platform

There are several online platforms and websites where you can enroll in health insurance. Some popular options include:

- Healthcare.gov: The official government website for the Affordable Care Act (ACA) provides a user-friendly platform to compare and enroll in health insurance plans. It’s a great option for those seeking individual or family coverage.

- State-Based Marketplaces: Many states have their own health insurance marketplaces, which can offer additional plan options and regional-specific information. Check if your state has its own marketplace.

- Insurance Company Websites: Individual insurance companies often have their own online platforms for enrollment. This can be a good choice if you already have a preferred insurance provider or are familiar with their plans.

- Online Insurance Brokers: Websites like eHealthInsurance or HealthCare.com act as brokers, providing a wide range of plans from multiple insurance companies. These platforms can be useful for comparing various options and finding the best fit.

Step 4: Create an Account and Begin Enrollment

Once you’ve chosen your enrollment platform, create an account by providing your personal information. This step ensures that your information is secure and allows you to track your progress throughout the enrollment process.

Step 5: Select Your Plan

After creating your account, you’ll be guided through the process of selecting your health insurance plan. The platform will ask you questions about your healthcare needs, budget, and preferences to help narrow down your options. Carefully review the plan details, including coverage, costs, and provider networks, to ensure it aligns with your requirements.

Step 6: Provide Personal and Financial Information

During the enrollment process, you’ll be prompted to provide personal and financial information. This step is crucial for verifying your identity and determining your eligibility for certain plans or subsidies. Ensure that the information you provide is accurate and up-to-date.

Step 7: Review and Confirm Your Enrollment

Before finalizing your enrollment, carefully review all the plan details, costs, and coverage information. Double-check that the information provided is correct and that you understand the terms and conditions of your chosen plan. Once you’re satisfied, confirm your enrollment, and you’re well on your way to having comprehensive health insurance coverage.

Frequently Asked Questions (FAQ)

Can I enroll in health insurance outside of the open enrollment period?

+Yes, you can enroll outside of the open enrollment period if you experience a qualifying life event, such as losing job-based coverage, getting married, or having a baby. These events trigger a special enrollment period, allowing you to enroll or make changes to your coverage.

What if I have pre-existing medical conditions? Will I be covered?

+Thanks to the Affordable Care Act (ACA), insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions. This means that regardless of your medical history, you have the right to enroll in health insurance and receive coverage for essential health benefits.

Are there any subsidies or financial assistance available for health insurance?

+Yes, depending on your income and family size, you may be eligible for subsidies or tax credits to help offset the cost of your health insurance premiums. These subsidies are available through the ACA’s Marketplace, and you can find out more about your eligibility during the enrollment process.

Can I enroll in a health insurance plan if I’m self-employed?

+Absolutely! Many self-employed individuals choose to enroll in health insurance plans through the ACA Marketplace or directly with insurance companies. These plans offer the same coverage and benefits as traditional employer-sponsored plans, ensuring you have the protection you need.

By following this comprehensive guide, you can navigate the world of health insurance with confidence and take control of your healthcare journey. Remember, online enrollment is a convenient and efficient way to secure the coverage you need, so don’t hesitate to explore your options and find the perfect plan for your unique circumstances.