Auto Insurance Price Quotes

Finding the right auto insurance coverage at an affordable price is a priority for most vehicle owners. With numerous insurance providers offering various policies, understanding how to get accurate price quotes is essential for making informed decisions. This comprehensive guide will walk you through the process, providing insights and tips to help you navigate the world of auto insurance quotes effectively.

Understanding Auto Insurance Price Quotes

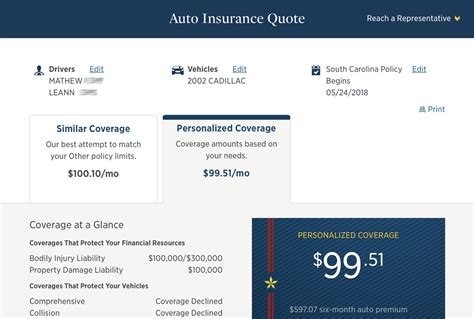

Auto insurance price quotes are estimates provided by insurance companies to give you an idea of how much you might pay for a specific coverage plan. These quotes are tailored to your unique circumstances, including factors like your driving history, the make and model of your vehicle, and your location. It’s important to note that a price quote is not a final price; it’s an estimation based on the information you provide.

Price quotes serve as a starting point for your insurance journey. They allow you to compare different policies, assess their affordability, and choose the one that best fits your needs and budget. However, keep in mind that the actual cost of your insurance policy may vary once you complete the application process and the insurer reviews all the details.

Factors Influencing Auto Insurance Quotes

Several key factors play a significant role in determining the price quotes you receive for auto insurance:

- Driving Record: Your driving history is a major consideration. Insurers take into account factors like traffic violations, accidents, and claims made in the past. A clean driving record often leads to lower quotes, while a history of accidents or violations may result in higher premiums.

- Vehicle Type: The make, model, and year of your vehicle impact the quote. Sports cars and luxury vehicles generally cost more to insure due to their higher repair and replacement costs. On the other hand, safe and economical cars often attract lower quotes.

- Location: Where you live and where you typically drive your vehicle matters. Insurance rates can vary significantly based on the state, city, or even the neighborhood you reside in. Areas with higher accident rates or instances of car theft tend to have higher insurance costs.

- Coverage Options: The type and level of coverage you choose also affect the quote. Comprehensive and collision coverage, which provide protection for a wide range of situations, can increase the cost. On the other hand, liability-only coverage may be more affordable but offers limited protection.

- Personal Information: Your age, gender, and marital status can influence quotes. Younger drivers, especially males, often pay higher premiums due to their perceived higher risk of accidents. Additionally, your credit score can play a role, with higher scores often leading to lower quotes.

Obtaining Accurate Price Quotes

Getting accurate auto insurance price quotes involves providing precise information and exploring various options. Here’s a step-by-step guide to help you through the process:

Gather Essential Information

Before requesting quotes, ensure you have the following details readily available:

- Personal information: Your full name, date of birth, address, and contact details.

- Vehicle details: Make, model, year, VIN number, and any additional modifications.

- Driving history: Any accidents, violations, or claims made in the past few years.

- Current insurance status: Information about your existing policy, if you have one.

- Desirable coverage: The type and level of coverage you’re seeking.

Compare Multiple Quotes

It’s crucial to compare quotes from several insurance providers to find the best deal. Online comparison tools can be a convenient way to gather quotes from multiple companies in one place. Additionally, consider reaching out to local insurance agents or brokers who can provide personalized recommendations based on your needs.

Be Transparent and Honest

When providing information for quotes, it’s essential to be truthful and accurate. Misrepresenting your driving history or vehicle details can lead to inaccurate quotes and potential issues down the line. Insurance companies have ways to verify the information you provide, so it’s best to be upfront to avoid any surprises later.

Explore Coverage Options

Don’t settle for the first quote you receive. Take the time to understand the coverage options available and tailor them to your specific needs. Consider factors like the value of your vehicle, your daily driving habits, and any additional risks you may face. For instance, if you frequently drive in areas prone to natural disasters, you might want to prioritize comprehensive coverage.

Consider Bundling

If you have multiple insurance needs, such as auto, home, or life insurance, consider bundling your policies with one insurer. Many companies offer discounts for customers who insure multiple aspects of their lives with them. This can lead to significant savings on your overall insurance costs.

Tips for Lowering Auto Insurance Costs

While price quotes are essential, it’s also beneficial to know strategies for reducing your auto insurance costs. Here are some tips to consider:

Shop Around Regularly

Insurance rates can change over time, and what was a competitive quote a year ago might not be as attractive now. Regularly compare quotes from different providers to ensure you’re still getting the best deal. Shopping around every six months or before your policy renews can help you stay informed about the market and potentially save money.

Maintain a Good Driving Record

A clean driving record is one of the most effective ways to keep your insurance costs low. Avoid traffic violations and reduce your chances of being involved in accidents. If you’ve had a violation or accident in the past, focus on improving your driving habits to demonstrate a commitment to safety.

Choose a Higher Deductible

Opting for a higher deductible can lower your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By agreeing to pay a larger portion in the event of a claim, you can reduce your overall insurance costs. However, it’s essential to choose a deductible amount that you’re comfortable paying if the need arises.

Explore Discounts

Insurance companies offer a variety of discounts to attract customers. Some common discounts include safe driver discounts, good student discounts, loyalty discounts, and multi-policy discounts. Ask your insurer about the discounts they offer and ensure you’re taking advantage of all the opportunities available to you.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach where your insurance premium is based on your actual driving behavior. Insurers use telematics devices or smartphone apps to track factors like miles driven, driving speed, and braking habits. If you drive safely and sparingly, you may qualify for lower premiums with this type of insurance.

Conclusion: Empowering Your Insurance Journey

Understanding the process of obtaining auto insurance price quotes and the factors that influence them is the first step toward making informed decisions. By gathering accurate information, comparing multiple quotes, and exploring various coverage options, you can find the best policy that suits your needs and budget. Additionally, implementing strategies to lower your insurance costs can help you save money over time.

Remember, auto insurance is a vital aspect of responsible vehicle ownership. It provides financial protection in case of accidents, theft, or other unforeseen events. Take the time to research, compare, and choose a policy that gives you peace of mind without straining your finances. Your diligence in this process can lead to significant savings and a more secure future on the road.

What is the difference between a price quote and an insurance policy?

+A price quote is an estimated cost of an insurance policy based on the information you provide. It’s a preliminary step in the insurance process. An insurance policy, on the other hand, is the actual contract you enter into with an insurance company, outlining the coverage, terms, and conditions of your insurance.

How often should I compare auto insurance quotes?

+It’s a good practice to compare quotes every six months or before your policy renews. This allows you to stay updated on the latest rates and ensure you’re still getting the best deal.

Can I get an auto insurance quote without providing my Social Security number?

+Yes, in most cases, you can get a preliminary quote without providing your Social Security number. However, for an accurate quote and to finalize your policy, you may need to provide this information.

Are there any downsides to switching insurance providers frequently?

+Frequent switching can sometimes be seen as a red flag by insurance companies. It may lead to higher premiums or even difficulty in finding a new insurer. However, if you’re shopping around and switching to save money or get better coverage, it can be a wise decision.