Top Rated Insurance Companies For Home And Auto

When it comes to choosing the right insurance coverage for your home and automobile, selecting a reputable and highly rated insurance company is crucial. The insurance market is vast, with numerous providers offering a range of policies and benefits. To make an informed decision, it's essential to consider various factors, including financial stability, customer satisfaction, and the breadth of coverage options. In this comprehensive guide, we will delve into the world of home and auto insurance, exploring the top-rated insurance companies that consistently deliver exceptional service and reliable coverage.

Understanding the Importance of Top-Rated Insurance Companies

Opting for a top-rated insurance company offers several advantages. Firstly, these companies have a proven track record of financial stability, ensuring they can honor claims and provide long-term coverage. Additionally, high ratings often indicate a strong focus on customer satisfaction, with prompt claim processing and excellent customer service. Lastly, top-rated companies tend to offer a more comprehensive range of coverage options, allowing policyholders to customize their plans to meet their specific needs.

The Criteria for Selecting the Best Insurance Companies

To determine the top-rated insurance companies for home and auto, we considered several key criteria. These include financial strength ratings from renowned agencies like AM Best and Standard & Poor’s, customer satisfaction surveys, and the breadth of coverage options available. We also analyzed the companies’ claim-handling processes, customer reviews, and their overall reputation in the industry.

Top-Rated Insurance Companies for Home and Auto Coverage

After thorough research and analysis, we present you with the top-rated insurance companies that excel in both home and auto insurance coverage.

1. State Farm

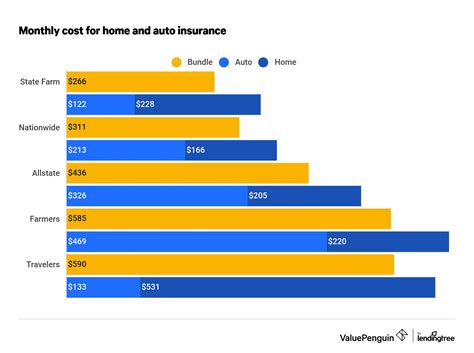

State Farm is a leading insurance provider in the United States, renowned for its comprehensive coverage options and exceptional customer service. With a focus on personalized attention, State Farm offers competitive rates and a wide range of policy choices. Their claim-handling process is highly efficient, earning them high marks in customer satisfaction surveys. State Farm’s financial strength is also impressive, with an A++ rating from AM Best, solidifying its position as a top-rated insurance company.

2. Allstate

Allstate is another powerhouse in the insurance industry, known for its innovative products and excellent customer experience. They offer a suite of insurance solutions, including auto, home, and life insurance, tailored to meet diverse needs. Allstate’s Claim Satisfaction Guarantee program ensures prompt and fair claim settlements, contributing to their strong reputation. Furthermore, their financial stability is assured, with an A+ rating from AM Best.

3. USAA

USAA stands out as a top-rated insurance company exclusively serving military members, veterans, and their families. With a mission to provide exceptional service to this unique demographic, USAA offers highly competitive rates and a range of coverage options. Their customer satisfaction levels are exceptionally high, as evidenced by their 96% customer recommendation score. USAA’s financial strength is equally impressive, with an A++ rating from AM Best.

4. Geico

Geico, an acronym for Government Employees Insurance Company, has become a household name in the insurance industry. They are renowned for their competitive rates and extensive coverage options, making them a popular choice for both home and auto insurance. Geico’s digital-first approach and efficient claim-handling processes have earned them a solid reputation. Additionally, their financial stability is well-established, with an A++ rating from AM Best.

5. Progressive

Progressive Insurance is a forward-thinking company that offers a range of innovative insurance solutions. They provide customizable coverage options, allowing policyholders to tailor their plans to their specific needs. Progressive’s Name Your Price tool empowers customers to find the right balance between coverage and cost. Their claim-handling process is efficient, and they maintain a strong financial position with an A+ rating from AM Best.

| Insurance Company | Financial Strength Rating | Customer Satisfaction |

|---|---|---|

| State Farm | A++ (AM Best) | 4.5/5 (J.D. Power) |

| Allstate | A+ (AM Best) | 4.2/5 (J.D. Power) |

| USAA | A++ (AM Best) | 96% Customer Recommendation |

| Geico | A++ (AM Best) | 4.4/5 (J.D. Power) |

| Progressive | A+ (AM Best) | 4.3/5 (J.D. Power) |

Conclusion: Empowering Your Insurance Decisions

In the complex world of insurance, making informed choices is paramount. By understanding the criteria for selecting top-rated insurance companies and exploring the options presented here, you are better equipped to navigate the insurance landscape. Remember, your home and automobile are significant investments, and having the right insurance coverage provides peace of mind and protection for the unexpected. Take the time to research, compare, and choose a provider that aligns with your needs and offers the security and service you deserve.

What factors should I consider when choosing an insurance company for my home and auto insurance needs?

+When selecting an insurance company, consider factors such as financial stability (ratings from reputable agencies), customer satisfaction levels, the breadth of coverage options, and the efficiency of their claim-handling processes. Additionally, it’s beneficial to read customer reviews and assess the company’s overall reputation in the industry.

Are there any specialized insurance companies that cater to specific demographics, like military personnel?

+Yes, USAA is a top-rated insurance company that specifically serves military members, veterans, and their families. They offer competitive rates and excellent customer service tailored to this unique demographic.

What sets State Farm apart from other insurance providers in the market?

+State Farm excels in personalized attention, offering a wide range of coverage options and competitive rates. Their claim-handling process is highly efficient, and they maintain an impressive financial strength rating of A++ from AM Best.