Insurance Company Dental

Dental health is a vital aspect of overall well-being, and access to quality dental care is an essential component of a comprehensive healthcare system. In the realm of insurance coverage, understanding the intricacies of dental insurance plans is crucial for individuals and families seeking to maintain optimal oral health. This comprehensive guide will delve into the world of Insurance Company Dental, shedding light on the key aspects, benefits, and considerations associated with dental insurance plans.

Understanding Insurance Company Dental Plans

Insurance Company Dental plans are specialized insurance policies designed to cover a range of dental services, procedures, and treatments. These plans aim to provide individuals with financial protection and access to necessary dental care, helping them maintain healthy teeth and gums. Dental insurance is unique in the insurance landscape, as it often offers more comprehensive coverage for preventative care compared to other types of insurance.

The specific features and benefits of Insurance Company Dental plans can vary widely depending on the insurance provider, the plan type, and the level of coverage chosen. Some common aspects of these plans include:

- Preventative Care: Most dental insurance plans prioritize preventative care, covering routine check-ups, cleanings, X-rays, and other diagnostic procedures. This emphasis on preventative care is a key differentiator from other insurance types and is aimed at catching potential issues early, thereby reducing the need for more extensive and costly treatments down the line.

- Restorative Procedures: Dental insurance plans typically cover a range of restorative procedures, such as fillings, root canals, and extractions. The level of coverage for these procedures may vary based on the plan and the specific treatment needed.

- Orthodontic Treatment: Many dental insurance plans offer some level of coverage for orthodontic treatment, including braces and clear aligners. However, the extent of coverage can be limited, and often, there are annual maximums or age restrictions for orthodontic benefits.

- Major Dental Work: Insurance Company Dental plans may also cover more extensive and costly procedures like dental implants, bridges, and crowns. However, these major dental works often have higher out-of-pocket costs and may require prior authorization from the insurance provider.

- Dental Networks: Similar to other insurance types, dental insurance plans often operate through a network of preferred providers. Choosing an in-network dentist can result in lower out-of-pocket costs and simpler claims processes.

The Benefits of Insurance Company Dental Plans

The advantages of enrolling in a dental insurance plan are multifaceted and can significantly impact an individual’s oral health and overall well-being. Here are some key benefits of Insurance Company Dental plans:

Financial Protection

One of the primary advantages of dental insurance is the financial protection it provides. Dental procedures, especially complex or specialized ones, can be costly. With dental insurance, a significant portion of these costs is covered, making essential dental care more accessible and affordable.

Encouraging Preventative Care

Dental insurance plans place a strong emphasis on preventative care, covering regular check-ups, cleanings, and diagnostic procedures. This focus on prevention helps identify potential oral health issues early on, allowing for timely treatment and potentially preventing more serious, costly issues from developing.

For example, a simple dental check-up can reveal early signs of gum disease, which, if left untreated, could lead to tooth loss and more complex health issues. By catching these issues early, individuals can undergo treatment such as scaling and root planing, which can reverse the effects of gum disease and prevent further complications.

Access to Quality Dental Care

Dental insurance provides individuals with access to a network of qualified dental professionals. In-network dentists are required to meet certain standards of care and are often more affordable for policyholders. This ensures that individuals receive high-quality dental care without incurring excessive out-of-pocket expenses.

Peace of Mind

Having dental insurance can provide peace of mind, knowing that one’s oral health is protected. With dental insurance, individuals can prioritize their dental health without worrying about the financial burden of unexpected dental issues. This can lead to improved overall well-being and quality of life.

Considerations and Limitations of Dental Insurance

While Insurance Company Dental plans offer numerous benefits, it’s important to understand the potential limitations and considerations associated with these policies.

Out-of-Pocket Costs

Dental insurance plans typically come with out-of-pocket costs, such as premiums, deductibles, copayments, and coinsurance. These costs can vary based on the plan and the specific procedures being performed. Understanding these costs is crucial when selecting a dental insurance plan to ensure it aligns with one’s financial capabilities and needs.

Coverage Limitations

Dental insurance plans have specific coverage limitations and exclusions. Certain procedures or treatments may not be covered, or they may be subject to annual maximums or frequency limitations. It’s essential to carefully review the plan’s coverage details to understand what is and isn’t covered.

Network Restrictions

Most dental insurance plans operate through a network of preferred providers. While this can lead to lower costs, it also restricts policyholders to choosing from these in-network dentists. If an individual has a preferred dentist outside the network, they may incur higher out-of-pocket costs or be unable to utilize their insurance coverage.

Waiting Periods

Some dental insurance plans have waiting periods before certain benefits become effective. This means that even after enrolling in a plan, there may be a delay before certain procedures or treatments are covered. Understanding these waiting periods is crucial to avoid unexpected surprises.

Choosing the Right Dental Insurance Plan

Selecting the right Insurance Company Dental plan involves careful consideration of one’s oral health needs, financial situation, and personal preferences. Here are some key factors to consider when choosing a dental insurance plan:

Coverage Needs

Assess your current and potential future dental needs. Consider factors such as the state of your oral health, any existing dental conditions, and your propensity for certain dental issues. Choose a plan that provides adequate coverage for your anticipated needs.

Cost

Evaluate the plan’s premiums, deductibles, copayments, and coinsurance. Ensure that the overall cost of the plan aligns with your budget and financial capabilities. Consider the potential out-of-pocket costs for procedures you may require.

Network of Dentists

Review the plan’s network of dentists to ensure that it includes providers in your area. Consider whether you have a preferred dentist and whether they are in-network. If not, evaluate the costs and benefits of staying with your current dentist versus switching to an in-network provider.

Plan Type and Coverage

Compare different plan types, such as indemnity plans, Preferred Provider Organization (PPO) plans, and Dental Health Maintenance Organization (DHMO) plans. Understand the coverage details, including what procedures are covered, any annual maximums, and any waiting periods.

Flexibility and Convenience

Consider the plan’s flexibility in terms of appointment availability and the ease of making changes or adding dependents. Also, evaluate the plan’s claims process and whether it aligns with your preferred method of submitting and tracking claims.

Maximizing Your Dental Insurance Benefits

Once you’ve enrolled in an Insurance Company Dental plan, it’s important to make the most of your benefits to ensure you’re getting the best value from your insurance coverage. Here are some tips to maximize your dental insurance benefits:

Regular Check-ups and Cleanings

Take advantage of the preventative care benefits provided by your dental insurance plan. Schedule regular check-ups and cleanings to maintain optimal oral health and catch potential issues early. Most plans cover two check-ups and cleanings per year, so be sure to use these benefits to their fullest extent.

Understand Your Coverage

Familiarize yourself with the specifics of your dental insurance plan. Know what procedures are covered, any annual maximums, and any waiting periods. This knowledge will help you plan your dental care and financial responsibilities accordingly.

Choose In-Network Providers

When selecting a dentist, opt for an in-network provider. This will typically result in lower out-of-pocket costs and a smoother claims process. If you have a preferred dentist outside the network, consider the costs and benefits of staying with them versus switching to an in-network provider.

Utilize Discounts and Incentives

Some dental insurance plans offer discounts or incentives for certain procedures or treatments. Take advantage of these opportunities to save on your dental care costs.

Submit Claims Promptly

When you receive dental treatment, be sure to submit your claims promptly. This ensures you receive your insurance benefits in a timely manner and helps you keep track of your out-of-pocket expenses.

Future Trends in Insurance Company Dental

The landscape of Insurance Company Dental is evolving, and several trends are shaping the future of dental insurance. Here are some key trends to watch:

Focus on Preventative Care

The industry is likely to continue emphasizing preventative care, with a growing focus on early intervention and patient education. This shift aims to reduce the incidence of dental diseases and promote better overall oral health.

Digital Transformation

The digital revolution is impacting the dental insurance industry, with a growing trend towards digital claims processing, online enrollment, and virtual consultations. This shift towards digital solutions is aimed at streamlining processes and enhancing the overall patient experience.

Expansion of Orthodontic Coverage

There is a growing trend towards expanding orthodontic coverage, especially for adult patients. This shift is driven by the increasing awareness of the importance of orthodontic treatment in maintaining overall oral health and the aesthetic benefits associated with a straight smile.

Integration with Overall Healthcare

The dental insurance industry is likely to become more integrated with overall healthcare, with a growing recognition of the interconnection between oral health and overall systemic health. This integration may lead to more comprehensive plans that cover a wider range of dental procedures and treatments.

Conclusion

Insurance Company Dental plans are an essential component of comprehensive healthcare coverage, providing individuals with financial protection and access to quality dental care. By understanding the key aspects, benefits, and considerations associated with dental insurance, individuals can make informed decisions about their oral health and insurance coverage. With a focus on preventative care, financial protection, and access to quality dental professionals, Insurance Company Dental plans play a vital role in maintaining optimal oral health and overall well-being.

FAQ

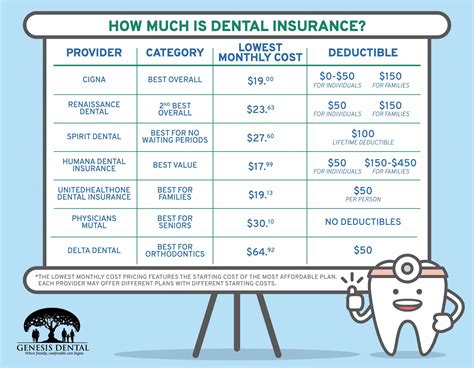

What is the average cost of a dental insurance plan?

+The cost of a dental insurance plan can vary widely based on factors such as the plan type, coverage level, and geographic location. On average, individual dental insurance plans range from 30 to 50 per month, while family plans can cost upwards of $200 per month. It’s important to note that these costs are in addition to any out-of-pocket expenses, such as deductibles, copayments, and coinsurance.

How do I choose the right dental insurance plan for my needs?

+When selecting a dental insurance plan, consider your current and potential future dental needs, financial situation, and personal preferences. Assess the coverage needs, cost, network of dentists, plan type and coverage details, and flexibility and convenience. It’s important to carefully review the plan’s benefits and limitations to ensure it aligns with your oral health requirements.

What procedures are typically covered by dental insurance plans?

+Dental insurance plans typically cover a range of procedures, including preventative care (check-ups, cleanings, X-rays), restorative procedures (fillings, root canals, extractions), and orthodontic treatment (braces, clear aligners). The level of coverage for these procedures can vary based on the plan and the specific treatment needed. Major dental work, such as implants and bridges, may also be covered but often with higher out-of-pocket costs.

Can I use my dental insurance plan outside my network?

+Most dental insurance plans operate through a network of preferred providers. While you can use your insurance plan outside the network, you may incur higher out-of-pocket costs and a more complex claims process. It’s important to review your plan’s network restrictions and consider the costs and benefits of staying within the network versus seeking care outside it.