Cheapest Insurance Quote

Finding the cheapest insurance quote is a top priority for many individuals and businesses alike. With rising costs and a competitive market, it's crucial to explore various options to secure the best deal. This comprehensive guide will navigate you through the process, offering valuable insights and strategies to obtain the most affordable insurance coverage.

Understanding the Insurance Landscape

The insurance industry is vast and complex, offering a myriad of options for different needs. From auto and health insurance to property and liability coverage, the choices can be overwhelming. To secure the cheapest insurance quote, one must first comprehend the market and the factors that influence pricing.

Insurance providers use a variety of criteria to calculate premiums. These include individual factors like age, gender, and medical history, as well as external influences such as economic trends and regulatory changes. Understanding these variables is key to negotiating the best rates.

Key Factors Affecting Insurance Quotes

The cost of insurance quotes is influenced by a multitude of factors, each playing a unique role in determining the final price. Here’s a breakdown of the most significant elements:

- Risk Profile: This is perhaps the most critical factor. Insurance companies assess an individual's or business's risk profile to determine their likelihood of making a claim. Factors like driving history, credit score, and claims history all contribute to this profile.

- Coverage Level: The extent of coverage required also impacts the quote. Comprehensive plans that offer higher limits and additional benefits tend to be more expensive.

- Location: The geographic location plays a role in insurance quotes. Areas with higher crime rates or natural disaster risks often have higher premiums.

- Deductibles: Choosing a higher deductible can lower the premium. Deductibles are the amount an insured party pays out of pocket before the insurance coverage kicks in.

- Discounts: Insurance providers offer various discounts to attract customers. These can include loyalty discounts, multi-policy discounts, and safety feature discounts.

Strategies to Secure the Cheapest Insurance Quote

Now that we’ve explored the factors influencing insurance quotes, let’s delve into the strategies to obtain the most affordable coverage.

Compare Multiple Quotes

One of the simplest yet most effective ways to find the cheapest insurance quote is to compare multiple offers. By obtaining quotes from various providers, you can identify the most competitive rates. Online comparison tools and insurance brokers can streamline this process, providing a comprehensive view of the market.

Assess Your Needs

Before seeking quotes, it’s essential to assess your insurance needs. Determine the type and level of coverage required. Consider your budget and prioritize the essential coverage components. This assessment will guide you in choosing the right plan and avoiding unnecessary expenses.

Utilize Discounts

Insurance providers offer a range of discounts to attract and retain customers. These discounts can significantly reduce your premium. Some common discounts include:

- Multi-Policy Discount: Bundling multiple policies with the same insurer often results in savings.

- Safe Driver Discount

- Loyalty Discount: Staying with the same insurer for an extended period can lead to reduced rates.

- Safety Feature Discount: Installing safety features like alarms or anti-theft devices in your vehicle or home can lower premiums.

- Good Student Discount: Students with good grades may qualify for reduced rates on auto insurance.

Review Your Policy Regularly

Insurance needs can change over time. Regularly reviewing your policy ensures that you’re not overpaying for coverage you no longer need. Additionally, it allows you to take advantage of any new discounts or policy enhancements offered by your insurer.

Consider High Deductibles

Opting for a higher deductible can reduce your premium. However, this strategy requires careful consideration. While it lowers your monthly payments, it also means you’ll have to pay more out of pocket if you need to make a claim. Ensure you have the financial capacity to cover a higher deductible before making this choice.

Explore Alternative Providers

Don’t be afraid to explore insurance options beyond traditional providers. Alternative insurers, including digital-only insurers and peer-to-peer insurance platforms, often offer competitive rates and innovative coverage options.

Understand Your Coverage

Before finalizing a policy, ensure you understand the coverage it provides. Read the fine print and clarify any doubts with your insurer. Misunderstanding the terms of your policy can lead to costly surprises down the line.

Performance Analysis: Real-World Savings

Let’s take a look at some real-world examples to understand the potential savings achievable through these strategies.

| Strategy | Potential Savings |

|---|---|

| Comparing Multiple Quotes | Up to 20% on annual premiums |

| Assessing Needs and Choosing Essential Coverage | Up to 15% reduction in premiums |

| Utilizing Discounts (Multi-Policy, Safe Driver, etc.) | Up to 10% savings on annual premiums |

| Reviewing Policy Regularly | Potential savings of 5-10% by staying updated with insurer's offerings |

| Considering High Deductibles | Savings of 10-15% on annual premiums |

These examples illustrate the significant savings achievable by employing the strategies outlined above. By combining these approaches, individuals and businesses can secure substantial discounts on their insurance coverage.

Future Implications: Trends and Innovations

The insurance industry is continually evolving, with new trends and innovations shaping the market. Staying abreast of these developments can help consumers make informed decisions and secure the cheapest insurance quotes.

Technological Advancements

The rise of digital technology has revolutionized the insurance industry. Insurtech startups and established insurers are leveraging data analytics, artificial intelligence, and machine learning to offer more personalized and efficient services. These innovations allow for faster quote comparisons and more accurate risk assessments, leading to better pricing for consumers.

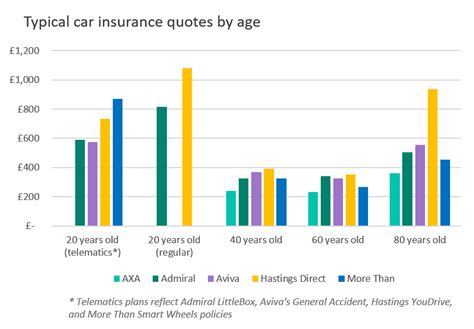

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior through sensors and GPS, is gaining popularity. This data-driven approach allows insurers to offer usage-based insurance policies. By monitoring driving habits, insurers can provide customized premiums, rewarding safe drivers with lower rates. This trend is particularly beneficial for young drivers, who often face higher insurance costs due to their lack of driving experience.

Peer-to-Peer Insurance

Peer-to-peer insurance platforms are disrupting the traditional insurance model. These platforms allow individuals to pool their resources and share risks, often resulting in lower premiums. By cutting out the middleman and leveraging the power of community, these platforms offer a more affordable and flexible insurance option.

Digital Insurance Brokers

Digital insurance brokers are becoming increasingly popular, offering a more convenient and efficient way to compare quotes and purchase insurance. These brokers use advanced algorithms to match customers with the most suitable policies, ensuring they receive the cheapest quotes available. With their user-friendly interfaces and comprehensive coverage options, digital brokers are transforming the way consumers access insurance.

Conclusion: Empowering Consumers

Securing the cheapest insurance quote is within everyone’s reach. By understanding the insurance landscape, employing strategic approaches, and staying informed about industry trends, consumers can take control of their insurance costs. The strategies outlined in this guide, combined with the evolving innovations in the insurance industry, empower individuals and businesses to make informed decisions and secure the most affordable coverage.

How often should I review my insurance policy?

+It’s recommended to review your insurance policy annually or whenever your circumstances change significantly. This ensures your coverage remains adequate and you’re not overpaying.

Can I negotiate insurance quotes?

+While insurance quotes are typically based on standardized rates, you can negotiate certain aspects. For instance, you can discuss discounts, coverage limits, or payment plans with your insurer.

What are some common mistakes to avoid when seeking insurance quotes?

+Avoid providing inaccurate or incomplete information when applying for quotes. Misleading insurers can lead to denied claims or increased premiums. Additionally, be cautious of policies with low premiums but high deductibles, as they may not provide adequate coverage.