Coinsurance

Coinsurance is a fundamental concept in the insurance industry, particularly in health insurance plans, where it plays a crucial role in determining the financial responsibility of policyholders. It is a mechanism that ensures policyholders share the cost of healthcare services with their insurance provider, promoting cost-consciousness and incentivizing individuals to take an active role in managing their healthcare expenses. This article aims to delve into the intricacies of coinsurance, exploring its definitions, calculations, implications, and the various ways it impacts healthcare coverage and the overall healthcare landscape.

Understanding Coinsurance: Definitions and Concepts

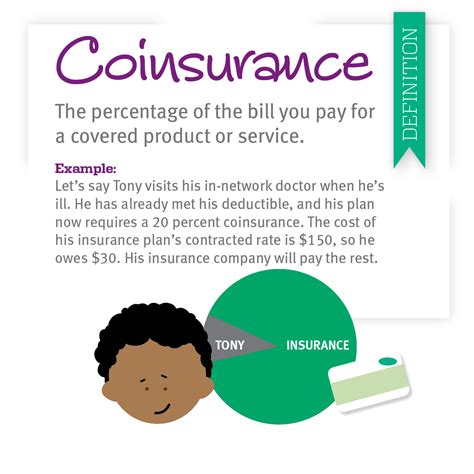

Coinsurance, in the context of health insurance, refers to the percentage of healthcare costs that an insured individual is required to pay out-of-pocket after the deductible has been met. It is a contractual agreement between the insurance provider and the policyholder, specifying the shared responsibility for healthcare expenses. Coinsurance is a critical component of many insurance plans, including employer-sponsored health insurance, individual market plans, and even some Medicare plans.

The concept of coinsurance arises from the idea that individuals should have some skin in the game when it comes to their healthcare. By sharing costs, policyholders are incentivized to make informed decisions about their healthcare needs, seek cost-effective treatment options, and prevent unnecessary or excessive medical procedures. Coinsurance rates are typically expressed as a percentage, such as 20% or 30%, indicating the portion of covered expenses that the insured individual is responsible for paying.

Calculating Coinsurance: A Step-by-Step Guide

Understanding how coinsurance works involves a straightforward yet essential calculation. Here’s a breakdown of the process:

-

Deductible Payment: First, the policyholder must pay the deductible, which is the initial amount they are responsible for covering before any insurance benefits kick in. Deductibles vary based on the insurance plan and can range from a few hundred dollars to several thousand dollars.

-

Determining Eligible Expenses: Once the deductible is met, the insurance company identifies the eligible expenses for coverage. These expenses typically include covered medical services, procedures, and prescriptions as outlined in the insurance plan's policy document.

-

Applying Coinsurance Rate: The insurance company then applies the coinsurance rate to the eligible expenses. For instance, if the coinsurance rate is 20%, the policyholder pays 20% of the eligible expenses, and the insurance company covers the remaining 80%.

-

Calculating Out-of-Pocket Costs: To calculate the out-of-pocket costs, the policyholder multiplies the eligible expenses by the coinsurance rate. For example, if the eligible expense is $1,000 and the coinsurance rate is 20%, the policyholder's out-of-pocket cost would be $200 ($1,000 x 0.20), while the insurance company would cover the remaining $800.

-

Tracking Out-of-Pocket Maximum: Many insurance plans also have an out-of-pocket maximum, which is the maximum amount a policyholder is required to pay in a given year. Once the out-of-pocket maximum is reached, the insurance company covers 100% of eligible expenses for the remainder of the year.

Coinsurance Implications: Navigating Healthcare Costs

Coinsurance has several implications for policyholders and the healthcare system as a whole. Understanding these implications is crucial for individuals to make informed decisions about their healthcare and insurance choices.

Promoting Cost-Conscious Behavior

One of the primary objectives of coinsurance is to encourage policyholders to be mindful of their healthcare costs. By requiring individuals to share the financial burden, coinsurance discourages unnecessary or excessive medical procedures and encourages individuals to explore cost-effective treatment options. This behavior not only benefits the policyholder’s wallet but also contributes to a more efficient healthcare system.

Incentivizing Preventive Care

Coinsurance rates can vary depending on the type of healthcare service. Many insurance plans offer lower coinsurance rates or even waive coinsurance for preventive care services, such as annual check-ups, vaccinations, and screenings. This strategy aims to incentivize policyholders to prioritize preventive care, which can help detect and manage health issues early on, potentially reducing the need for more costly treatments later.

Managing Out-of-Pocket Costs

Policyholders must carefully manage their out-of-pocket costs to avoid unexpected financial burdens. Understanding the coinsurance rate and the associated costs for different healthcare services is essential. Some insurance plans offer tools and resources to help policyholders estimate their out-of-pocket costs for various procedures, allowing them to make informed decisions about their healthcare choices.

Comparing Insurance Plans

When selecting an insurance plan, coinsurance rates are a critical factor to consider. Plans with lower coinsurance rates may be more appealing to individuals who anticipate frequent or costly medical needs. Conversely, plans with higher coinsurance rates might be more suitable for those who anticipate fewer healthcare expenses. Understanding the coinsurance structure is crucial for choosing a plan that aligns with an individual’s healthcare needs and financial situation.

The Role of Coinsurance in Healthcare Coverage

Coinsurance plays a pivotal role in shaping the healthcare coverage landscape. It is a key component of insurance plans, impacting the affordability and accessibility of healthcare services for policyholders.

Affordability and Access

Coinsurance rates directly influence the affordability of healthcare for policyholders. Lower coinsurance rates can make healthcare more accessible to individuals with lower incomes or those who require frequent medical care. On the other hand, higher coinsurance rates may pose financial challenges for some, potentially leading to delayed or forgone healthcare services.

Plan Design and Cost-Sharing

Insurance providers design their plans with specific coinsurance rates and structures to attract different types of policyholders. Plans with lower premiums but higher coinsurance rates may appeal to younger, healthier individuals who anticipate fewer healthcare needs. Conversely, plans with higher premiums but lower coinsurance rates might be more attractive to individuals with chronic conditions or those who require regular medical attention.

Network and Provider Selection

Coinsurance rates can also influence policyholders’ choices regarding healthcare providers and networks. Some insurance plans have preferred provider networks, where coinsurance rates are lower when using in-network providers. Policyholders may strategically choose providers within these networks to minimize their out-of-pocket expenses.

Coinsurance in Practice: Real-World Examples

To illustrate the impact of coinsurance, let’s consider a few real-world examples:

Example 1: Routine Check-up

Sarah, a healthy 30-year-old, has an insurance plan with a 500 deductible and a 20% coinsurance rate. She visits her primary care physician for an annual check-up, which costs 200. After meeting her deductible, Sarah’s coinsurance rate applies, and she pays 40 (20% of 200) out-of-pocket for the check-up.

Example 2: Emergency Room Visit

John, a policyholder with the same insurance plan as Sarah, has an emergency room visit due to a severe injury. The total cost of the visit is 5,000. After meeting his deductible, John's coinsurance rate comes into play, and he pays 1,000 (20% of 5,000) out-of-pocket, with the insurance company covering the remaining 4,000.

Example 3: Chronic Condition Management

Emily has a chronic condition and requires regular medical attention. Her insurance plan has a 1,500 deductible and a 30% coinsurance rate. She incurs 3,000 in medical expenses over a year. After meeting her deductible, Emily pays 600 (30% of 2,000, as the deductible has been met) out-of-pocket, and the insurance company covers the remaining $1,400.

Future Implications and Trends in Coinsurance

As the healthcare landscape continues to evolve, coinsurance is likely to play an increasingly important role in shaping insurance plans and policyholder behavior. Here are some potential future implications and trends to consider:

- Increased Focus on Preventive Care: With the growing emphasis on preventive care and its potential to reduce long-term healthcare costs, insurance providers may further incentivize policyholders to prioritize preventive measures by offering lower coinsurance rates for these services.

- Customized Coinsurance Plans: In the future, insurance providers may offer more personalized coinsurance plans based on an individual's health history and predicted healthcare needs. This approach could lead to more tailored and affordable insurance options.

- Integration with Digital Health Tools: The integration of digital health technologies, such as telemedicine and health tracking apps, could influence coinsurance rates. Insurance providers may offer incentives or discounts for policyholders who actively engage with these tools, promoting better health management and potentially reducing healthcare costs.

- Addressing Healthcare Disparities: Coinsurance rates and structures could be designed to address healthcare disparities, ensuring that individuals from diverse socioeconomic backgrounds have equitable access to healthcare. This may involve offering more affordable coinsurance rates for certain demographics or regions.

- Regulatory Changes: Government policies and regulations can significantly impact coinsurance rates and structures. Future legislative changes may aim to standardize coinsurance rates or introduce measures to protect policyholders from excessive out-of-pocket costs.

Conclusion: Navigating the Complex World of Coinsurance

Coinsurance is a vital component of health insurance plans, shaping the financial relationship between policyholders and insurance providers. By understanding how coinsurance works, individuals can make informed decisions about their healthcare choices, manage their out-of-pocket costs, and navigate the complex healthcare system more effectively. As the healthcare landscape evolves, coinsurance will continue to play a crucial role in promoting cost-conscious behavior, incentivizing preventive care, and ensuring affordable access to healthcare services.

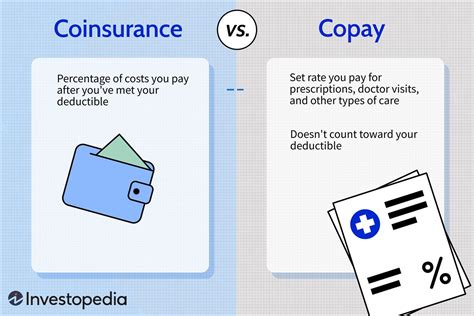

What is the difference between coinsurance and copayment?

+

Coinsurance and copayment are both cost-sharing mechanisms in health insurance plans, but they differ in their application. Coinsurance applies to eligible expenses after the deductible is met, with the policyholder paying a percentage of the costs. Copayments, on the other hand, are fixed amounts paid by the policyholder for specific services, regardless of the total cost of the service. For example, a copayment might be $20 for a doctor’s visit, regardless of the actual cost of the visit.

How do I calculate my out-of-pocket maximum under coinsurance?

+

Your out-of-pocket maximum is the maximum amount you will pay in a year for eligible expenses under your insurance plan. It includes your deductible, coinsurance payments, and any copayments. Once you reach this maximum, your insurance plan covers 100% of eligible expenses for the remainder of the year. You can typically find your out-of-pocket maximum in your insurance plan’s summary of benefits.

Can I negotiate my coinsurance rate with my insurance provider?

+

In most cases, insurance providers set coinsurance rates as part of their plan designs, and individual negotiation is not an option. However, if you have a specific medical condition or anticipate high healthcare costs, you may consider discussing your situation with your insurance provider. They might offer alternative plan options or provide guidance on choosing a plan that better suits your needs.

Are there any exceptions or limitations to coinsurance?

+

Yes, coinsurance may have exceptions and limitations depending on your insurance plan. Some plans may have different coinsurance rates for specific services or providers. Additionally, certain expenses, such as emergency services or out-of-network care, may have different rules or limitations. It’s essential to review your insurance plan’s summary of benefits to understand these exceptions and limitations.