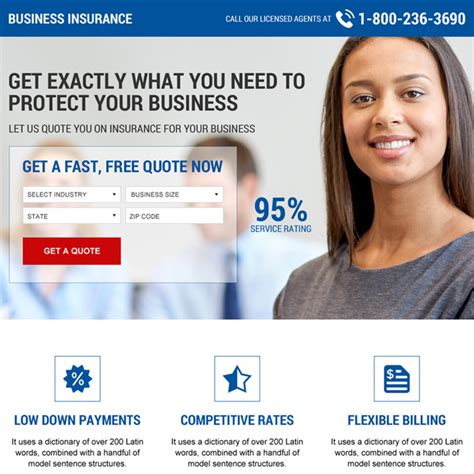

Purchase Business Insurance Online

Business insurance is an essential aspect of running a successful and protected enterprise. In today's digital age, purchasing business insurance online has become a convenient and efficient option for entrepreneurs and business owners. This article aims to provide a comprehensive guide to navigating the online business insurance market, highlighting the benefits, key considerations, and the steps involved in making an informed purchase decision.

Understanding the Benefits of Online Business Insurance

The online business insurance market offers a plethora of advantages to modern entrepreneurs. Firstly, it provides unparalleled convenience, allowing business owners to compare policies, obtain quotes, and purchase coverage without the need for physical meetings or extensive paperwork. This efficiency is particularly beneficial for startups and small businesses with limited time and resources.

Furthermore, the online platform enables a transparent comparison of various insurance providers and their offerings. Business owners can easily access detailed policy information, including coverage limits, deductibles, and exclusions, ensuring a thorough understanding of the protection they are purchasing. This transparency empowers entrepreneurs to make informed decisions, aligning their insurance coverage with their specific business needs.

Online business insurance also fosters a competitive environment, driving insurance providers to offer attractive rates and innovative coverage options. With a simple click, business owners can access a wide range of providers, encouraging price comparisons and the potential for significant cost savings. Additionally, the digital nature of the process ensures a streamlined experience, often resulting in faster policy issuance and claims processing, ultimately enhancing the overall efficiency of the insurance journey.

Key Considerations When Purchasing Business Insurance Online

While the online business insurance market presents numerous advantages, there are essential factors to consider to ensure a successful and satisfactory purchase experience.

Identifying Your Business Needs

The first step in purchasing business insurance online is to clearly understand your unique business requirements. Different industries and business operations face distinct risks and liabilities. For instance, a tech startup may prioritize cyber liability insurance, while a retail business may focus on product liability coverage. By identifying your specific needs, you can tailor your insurance search, ensuring you obtain the right coverage for your business.

Comparing Insurance Providers and Policies

The online marketplace offers a wide array of insurance providers and policies. It is crucial to compare not only the prices but also the coverage details, including limits, deductibles, and any exclusions. Additionally, consider the reputation and financial stability of the insurance providers. Reputable insurers with strong financial ratings are more likely to provide reliable coverage and efficient claims processing.

Utilize online resources and review platforms to research insurance providers' customer satisfaction levels and claims handling experiences. Positive feedback and high ratings can indicate a reliable and customer-centric insurer, enhancing your overall insurance experience.

Assessing Additional Benefits and Services

Beyond basic coverage, some insurance providers offer additional benefits and services that can enhance your overall insurance experience. These may include risk management resources, loss prevention programs, or access to a dedicated agent or broker who can provide personalized advice and support. Considering these value-added services can further strengthen your business's risk management strategy and provide peace of mind.

Steps to Purchase Business Insurance Online

Purchasing business insurance online involves a straightforward process, ensuring a seamless and efficient experience.

Research and Compare

Start by researching reputable online insurance marketplaces or directly visiting insurance providers' websites. Compare the coverage options, prices, and additional benefits offered by different providers. Consider using online comparison tools that aggregate insurance policies, making the comparison process more efficient and comprehensive.

Obtain Quotes

Once you have identified potential insurance providers, request quotes for the coverage you require. Many insurance providers offer instant online quotes, providing a quick and convenient way to understand the costs involved. Ensure you provide accurate and detailed information about your business to obtain precise quotes.

Review Policy Details

Before making a purchase, thoroughly review the policy details, including the coverage limits, deductibles, and any exclusions. Understand the terms and conditions, ensuring they align with your business needs and expectations. If you have any questions or concerns, reach out to the insurance provider for clarification. A clear understanding of the policy is crucial to avoid any surprises in the future.

Make an Informed Decision

Based on your research, comparisons, and policy reviews, make an informed decision on the insurance provider and policy that best suits your business. Consider not only the price but also the coverage, reputation, and additional services offered. Trusting a reputable insurer with a strong financial standing can provide peace of mind and ensure reliable coverage when you need it most.

Purchase and Manage Your Policy

Once you have decided on the insurance provider and policy, complete the purchase process online. Most insurance providers offer secure payment gateways, ensuring a safe and convenient transaction. After purchasing your policy, carefully review the policy documents and store them in a safe and accessible location. Regularly review and update your policy as your business grows and evolves to ensure continuous protection.

Frequently Asked Questions (FAQ)

What types of business insurance are available online?

+Online business insurance platforms offer a wide range of coverage options, including general liability insurance, professional liability insurance (E&O), workers' compensation insurance, commercial property insurance, business owner's policies (BOP), and industry-specific coverages like cyber liability insurance and errors and omissions insurance.

How do I determine the right coverage limits for my business?

+Determining the appropriate coverage limits involves assessing your business's unique risks and potential liabilities. Consider factors such as the size and nature of your business, the value of your assets, the potential impact of a claim, and any legal requirements or industry standards. Consulting with an insurance professional can also provide valuable guidance in setting the right coverage limits.

Can I customize my business insurance policy online?

+Yes, many online insurance providers offer customization options, allowing you to tailor your policy to your specific business needs. This may include adding or removing coverage options, adjusting limits, or including endorsements to address unique risks. Customization ensures you have a policy that provides the precise protection your business requires.

How do I ensure I'm getting a competitive price for my business insurance online?

+To ensure a competitive price, compare quotes from multiple insurance providers. Online comparison tools can be especially helpful in this regard. Additionally, consider the value-added services and benefits offered by each provider. While price is important, it's equally crucial to assess the overall value and reputation of the insurance company to ensure you're getting a fair and reliable policy.

What should I do if I have a claim under my business insurance policy?

+In the event of a claim, it's important to act promptly. Notify your insurance provider as soon as possible, providing all the necessary details and documentation. Follow the claims process outlined by your insurer, which may involve completing claim forms, submitting supporting evidence, and cooperating with any investigations. Staying in regular communication with your insurer can help ensure a smooth and efficient claims process.

In conclusion, purchasing business insurance online offers a convenient, efficient, and transparent way to protect your business. By understanding your needs, comparing providers, and making informed decisions, you can navigate the online business insurance market with confidence. Remember to regularly review and update your policy to ensure continuous and adequate protection for your growing business.