Average Vehicle Insurance Cost Per Month

Vehicle insurance is an essential aspect of owning and operating a motor vehicle. It provides financial protection and peace of mind for drivers, covering various risks and potential liabilities. Understanding the average monthly cost of vehicle insurance is crucial for individuals planning to purchase a car or those looking to manage their expenses effectively. In this comprehensive guide, we delve into the factors influencing vehicle insurance rates, explore real-world examples, and provide valuable insights to help you navigate the world of auto insurance.

Understanding Average Vehicle Insurance Costs

The average cost of vehicle insurance per month can vary significantly depending on several key factors. These factors include the driver’s age, driving record, location, type of vehicle, coverage options, and the insurance provider. Let’s break down these elements to gain a clearer understanding of how they impact insurance premiums.

Driver Profile and History

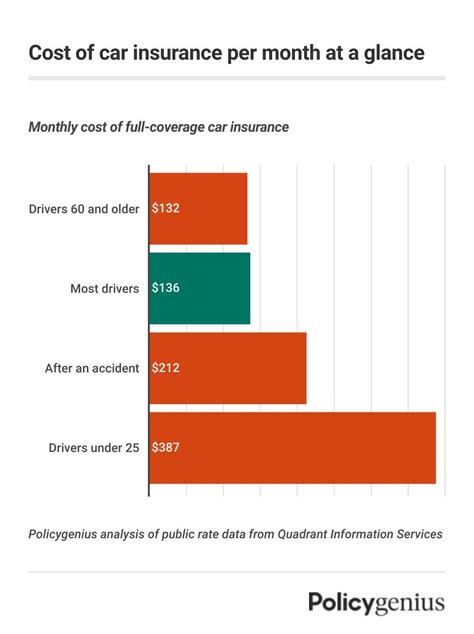

One of the most influential factors in determining insurance rates is the driver’s profile and history. Insurance companies consider age, gender, and driving experience when assessing risk. Young drivers, particularly those under 25, often face higher premiums due to their lack of experience on the road. Statistically, younger drivers are involved in more accidents, which leads to increased insurance costs. On the other hand, mature drivers with a clean driving record and extensive experience can enjoy lower premiums.

Your driving history plays a vital role as well. A clean record with no accidents or traffic violations can result in significant savings. Insurance companies reward safe driving habits and offer discounts for maintaining a positive record over an extended period.

| Driver Age | Average Monthly Premium |

|---|---|

| 18-24 | $250 - $350 |

| 25-34 | $180 - $280 |

| 35-44 | $150 - $220 |

| 45-54 | $130 - $180 |

| 55 and above | $110 - $150 |

These average monthly premiums are based on national averages and can vary depending on the specific state and insurance provider. It's important to note that individual driving histories and unique circumstances can greatly impact the actual cost of insurance.

Location and Geographic Factors

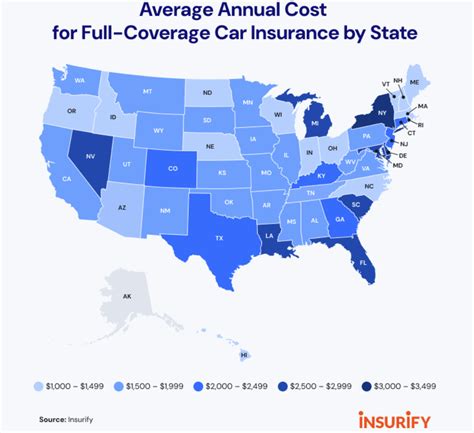

Where you live can significantly influence your insurance rates. Insurance companies consider the geographic location of the vehicle when assessing risk. Areas with higher population densities, busy roads, and a history of frequent accidents or claims may result in higher insurance costs. Additionally, factors such as weather conditions, crime rates, and the overall cost of living in a particular region can impact insurance premiums.

For instance, living in a metropolitan area with heavy traffic and a high incidence of accidents may lead to increased insurance costs. On the other hand, rural areas with fewer vehicles and a lower accident rate can result in more affordable insurance rates.

| City | Average Monthly Premium |

|---|---|

| New York City | $220 - $300 |

| Los Angeles | $180 - $250 |

| Chicago | $160 - $220 |

| Houston | $140 - $180 |

| Phoenix | $120 - $160 |

The above averages are estimates and can vary greatly depending on the specific neighborhood or suburb within these cities. Local factors, such as the prevalence of theft or the proximity to accident-prone areas, can further influence insurance rates.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can impact your insurance costs. Insurance companies consider factors such as the make, model, and age of the vehicle when calculating premiums. Sports cars, luxury vehicles, and SUVs often carry higher insurance costs due to their higher repair expenses and increased risk of theft or damage.

Additionally, the purpose for which you use your vehicle can affect insurance rates. If you primarily use your car for personal commuting, your insurance costs may be lower compared to those who use their vehicles for business or commercial purposes. Commercial vehicles are typically subjected to higher insurance premiums due to the increased risk and potential for accidents.

| Vehicle Type | Average Monthly Premium |

|---|---|

| Sports Car | $200 - $300 |

| Sedan | $150 - $200 |

| SUV | $160 - $220 |

| Minivan | $140 - $180 |

| Electric Vehicle | $130 - $170 |

These averages are indicative and can vary based on the specific make and model of the vehicle, as well as the insurance provider.

Coverage Options and Deductibles

The level of coverage you choose and the deductibles you select play a significant role in determining your insurance costs. Comprehensive and collision coverage, which provide protection for damages to your vehicle, can increase your premiums. On the other hand, opting for higher deductibles can lead to lower monthly payments.

It's essential to strike a balance between the coverage you need and the cost of insurance. While higher deductibles may result in lower premiums, they also mean you'll have to pay more out of pocket in the event of a claim. Understanding your risk tolerance and financial capabilities is crucial when deciding on the right coverage and deductible options.

Tips for Managing Vehicle Insurance Costs

While various factors influence insurance rates, there are strategies you can employ to manage and potentially reduce your vehicle insurance costs. Here are some practical tips to consider:

- Shop Around and Compare: Obtain quotes from multiple insurance providers to compare rates and coverage options. Shopping around can help you identify the most competitive prices and find the best value for your insurance needs.

- Bundle Policies: If you have multiple vehicles or own a home, consider bundling your insurance policies with the same provider. Many insurance companies offer discounts when you combine multiple policies, resulting in potential savings.

- Review Coverage Regularly: Regularly assess your insurance coverage to ensure it aligns with your current needs and circumstances. As your life changes, your insurance requirements may evolve as well. Reviewing your coverage annually can help you identify opportunities to adjust and optimize your insurance plan.

- Maintain a Clean Driving Record: As mentioned earlier, a clean driving record is crucial for keeping insurance costs down. Avoid accidents and traffic violations, and consider taking defensive driving courses to improve your skills and potentially earn discounts from insurance providers.

- Consider Telematics-Based Insurance: Some insurance companies offer telematics-based insurance programs that track your driving behavior and reward safe driving habits. These programs can provide personalized insurance rates based on your actual driving habits, potentially resulting in lower premiums for safe drivers.

- Pay Annually or Semi-Annually: Paying your insurance premiums annually or semi-annually instead of monthly can sometimes result in savings. Insurance providers may offer discounts for paying in full, so it's worth exploring this option to reduce overall costs.

Conclusion: Navigating Vehicle Insurance Costs

Understanding the average vehicle insurance cost per month is an essential step in managing your financial responsibilities as a vehicle owner. By considering factors such as driver profile, location, vehicle type, and coverage options, you can make informed decisions about your insurance coverage and explore ways to optimize your premiums. Remember, the key to effective cost management is staying informed, shopping around, and maintaining a safe driving record.

As you navigate the world of vehicle insurance, keep in mind that your unique circumstances and individual needs will influence the final cost. By staying proactive and making smart choices, you can ensure you have the necessary coverage at a price that fits your budget.

What is the average monthly cost of vehicle insurance for a new driver under 25 years old?

+The average monthly cost of vehicle insurance for a new driver under 25 years old can range from 250 to 350. However, it’s important to note that individual circumstances and driving histories can greatly impact the actual cost. Factors such as the make and model of the vehicle, location, and the driver’s record play a significant role in determining insurance rates.

How can I lower my vehicle insurance costs if I live in an area with high insurance rates?

+If you live in an area with high insurance rates, there are several strategies you can employ to lower your costs. First, shop around and compare quotes from multiple insurance providers to find the most competitive rates. Consider bundling your insurance policies, such as auto and home insurance, to take advantage of potential discounts. Additionally, maintaining a clean driving record and avoiding accidents or traffic violations can lead to significant savings over time.

Are there any discounts available for vehicle insurance, and how can I qualify for them?

+Yes, insurance companies often offer various discounts to attract and retain customers. Common discounts include multi-policy discounts (bundling auto and home insurance), safe driver discounts for maintaining a clean driving record, loyalty discounts for long-term customers, and good student discounts for young drivers with high grades. To qualify for these discounts, it’s essential to maintain a positive driving history, explore bundling options, and inquire about available discounts with your insurance provider.

What is the impact of vehicle usage on insurance costs, and how can I optimize my insurance plan for my specific needs?

+Vehicle usage, such as personal commuting, business travel, or commercial purposes, can impact insurance costs. Insurance providers consider the purpose of your vehicle when assessing risk and calculating premiums. To optimize your insurance plan, review your coverage annually to ensure it aligns with your current needs. If your usage patterns have changed, consider adjusting your coverage to reflect your actual usage and potentially save on insurance costs.