Aig Life Insurance Payment

In the ever-evolving landscape of financial services, life insurance stands as a cornerstone of personal and family financial planning. Among the myriad of providers, AIG Life has established itself as a trusted name in the industry, offering a comprehensive suite of life insurance products tailored to meet diverse needs. This article delves into the intricacies of AIG Life insurance payments, shedding light on the processes, options, and benefits that underpin their services.

Understanding AIG Life Insurance Payment Options

AIG Life Insurance understands that financial circumstances vary, and thus, offers a range of payment options to accommodate different customer needs. These options provide flexibility and ensure that policyholders can choose a payment plan that aligns with their financial situation and preferences.

Premium Payment Frequency

Policyholders have the flexibility to choose the frequency of their premium payments. AIG Life Insurance offers several options, including:

- Annual Payments: For those who prefer a more straightforward approach, annual payments are a convenient option. This method involves paying the full premium amount once a year, typically due on the policy anniversary date.

- Semi-Annual Payments: As the name suggests, this option allows for premium payments to be made twice a year. It provides a balance between convenience and flexibility, reducing the financial burden compared to annual payments.

- Quarterly Payments: For individuals who want more frequent and manageable payments, quarterly installments are available. This option breaks down the premium into four equal payments, making it easier to budget and manage financially.

- Monthly Payments: The most frequent payment option, monthly installments, allows policyholders to spread out their premium payments over 12 months. This method is ideal for those who prefer a consistent and predictable financial plan.

Payment Methods

AIG Life Insurance provides a range of payment methods to ensure convenience and accessibility. Policyholders can choose from the following options:

- Direct Debit: This is a popular and efficient method, where the premium amount is automatically deducted from the policyholder’s bank account on the due date. It eliminates the risk of missed payments and ensures timely premium payments.

- Credit/Debit Card Payments: For added convenience, policyholders can opt to pay their premiums using credit or debit cards. This method allows for quick and secure transactions, providing flexibility and control over payment timing.

- Online Banking Transfers: AIG Life Insurance accepts premium payments via online banking platforms. This option is especially beneficial for individuals who prefer to manage their finances digitally, offering a secure and convenient payment method.

- Cash/Cheque Payments: Traditional payment methods are also available. Policyholders can choose to pay their premiums in cash or by cheque at designated AIG Life Insurance branches or authorized payment centers.

| Payment Method | Convenience | Accessibility |

|---|---|---|

| Direct Debit | High | Good |

| Credit/Debit Card | Very High | Excellent |

| Online Banking | High | Excellent |

| Cash/Cheque | Low | Good |

The table above provides a quick comparison of the different payment methods based on convenience and accessibility. It's important to note that the actual experience may vary based on individual circumstances and the specific policy.

Benefits of AIG Life Insurance Payment Plans

The payment plans offered by AIG Life Insurance come with several benefits that enhance the overall policyholder experience. These benefits contribute to the convenience, security, and financial well-being of policyholders, making AIG Life Insurance an attractive choice for those seeking comprehensive life insurance coverage.

Convenience and Flexibility

AIG Life Insurance’s payment plans prioritize convenience and flexibility. Policyholders can choose the frequency of their payments, ranging from annual to monthly installments, depending on their financial situation and preferences. This flexibility ensures that individuals can manage their finances effectively and choose a payment plan that aligns with their budget.

Automatic Payment Options

To further enhance convenience, AIG Life Insurance offers automatic payment options such as direct debit. With this method, policyholders can set up automatic deductions from their bank accounts, ensuring timely premium payments without the hassle of manual transactions. This feature is especially beneficial for those who lead busy lives or prefer a hands-off approach to financial management.

Secure Payment Methods

AIG Life Insurance places a strong emphasis on security when it comes to premium payments. The range of payment methods offered, including credit/debit card payments and online banking transfers, are secured by advanced encryption technologies. This ensures that policyholders’ financial information remains protected and their transactions are conducted safely and securely.

Online Payment Portal

AIG Life Insurance provides a user-friendly online payment portal, accessible via their official website. This portal allows policyholders to manage their payments, view payment history, and update their payment details with ease. It offers a convenient and efficient way to stay on top of premium payments, providing real-time updates and ensuring a seamless experience.

Grace Period and Late Payment Options

AIG Life Insurance understands that unforeseen circumstances may arise, leading to missed premium payments. To address this, they offer a grace period, typically ranging from 30 to 60 days, during which policyholders can make their payments without any additional penalties. This grace period provides a safety net for policyholders, ensuring that their coverage remains intact even if a payment is delayed.

Interest-Free Payment Plans

For policyholders who prefer to spread out their premium payments over a longer period, AIG Life Insurance offers interest-free payment plans. This option allows individuals to pay their premiums in installments without incurring additional interest charges. It provides a cost-effective solution for those who may have financial constraints or prefer a more manageable payment structure.

AIG Life Insurance Payment Process

Understanding the payment process for AIG Life Insurance is essential for policyholders to navigate their financial obligations seamlessly. From the initial application to the regular premium payments, each step is designed to be straightforward and secure, ensuring a positive and hassle-free experience.

Application and Policy Issuance

The first step in the AIG Life Insurance payment process is the application stage. Policyholders can apply for coverage either online through the official AIG Life Insurance website or by visiting a local AIG Life Insurance branch. The application process typically involves providing personal and financial information, as well as completing a health assessment to determine eligibility and premium rates.

Once the application is approved, AIG Life Insurance will issue a policy document outlining the terms and conditions of coverage, including the premium amount and payment due dates. Policyholders should carefully review this document to ensure they understand their financial obligations and the benefits of their chosen coverage.

Premium Payment Due Dates

AIG Life Insurance assigns specific due dates for premium payments, depending on the policyholder’s chosen payment frequency. These due dates are typically aligned with the policy anniversary date or a predetermined schedule, such as monthly, quarterly, or semi-annual payments.

Policyholders should make a note of these due dates to ensure timely payments. Late payments may result in additional fees or, in some cases, policy cancellation, depending on the terms of the policy.

Making Premium Payments

AIG Life Insurance offers a variety of payment methods to accommodate different preferences and circumstances. Policyholders can choose from the following options to make their premium payments:

- Online Payment: Policyholders can log in to their AIG Life Insurance account via the official website and make payments using their preferred payment method, such as a credit/debit card or online banking transfer.

- Direct Debit: For added convenience, policyholders can set up automatic direct debit payments. This method allows the premium amount to be automatically deducted from their bank account on the due date, ensuring timely payments without manual intervention.

- Cash/Cheque Payment: Traditional payment methods are also available. Policyholders can visit an AIG Life Insurance branch or authorized payment center to make cash or cheque payments.

- Mobile Payment Apps: In today’s digital age, AIG Life Insurance recognizes the convenience of mobile payment apps. Policyholders can utilize mobile payment platforms, such as mobile wallets or digital banking apps, to make secure and quick premium payments.

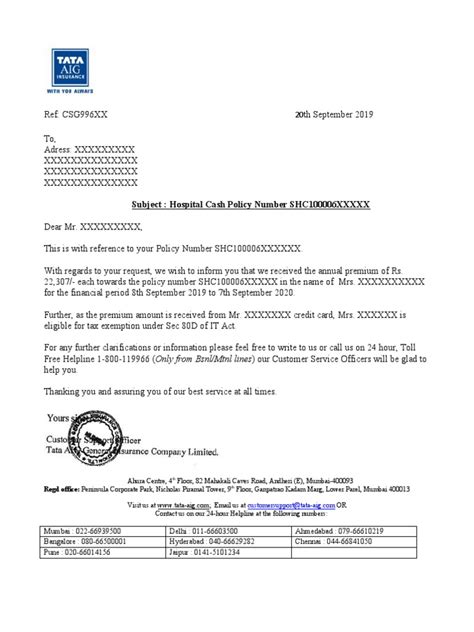

Payment Receipts and Records

Upon making a premium payment, policyholders should receive a payment receipt or confirmation. This document serves as proof of payment and should be retained for future reference. It’s essential to keep accurate records of premium payments to avoid any discrepancies or misunderstandings.

AIG Life Insurance also provides an online payment history feature, accessible through the policyholder's account. This feature allows individuals to view and track their payment records, ensuring transparency and ease of reference.

Conclusion

AIG Life Insurance’s commitment to providing flexible and secure payment options enhances the overall customer experience. By offering a range of payment frequencies and methods, policyholders can choose a plan that suits their financial situation and preferences. The benefits of these payment plans, such as convenience, security, and grace periods, further contribute to the peace of mind that AIG Life Insurance aims to provide.

The seamless payment process, coupled with the benefits of the payment plans, positions AIG Life Insurance as a trusted partner in financial planning. Policyholders can rest assured that their payments are managed efficiently, allowing them to focus on their lives and the protection of their loved ones.

For those seeking comprehensive life insurance coverage, AIG Life Insurance stands as a reliable choice, offering not only robust financial protection but also a streamlined and secure payment experience.

Can I change my payment frequency or method after the policy is issued?

+Yes, policyholders have the flexibility to change their payment frequency or method after the policy is issued. AIG Life Insurance understands that financial circumstances may change, and they accommodate such adjustments. Policyholders can contact their agent or AIG Life Insurance customer service to discuss and make the necessary changes to their payment plan.

What happens if I miss a premium payment?

+Missing a premium payment can have consequences, but AIG Life Insurance provides a grace period to allow policyholders to make their payments without immediate cancellation. The grace period typically ranges from 30 to 60 days, depending on the policy terms. If the payment is not made within the grace period, the policy may lapse, and coverage may be terminated. It’s important for policyholders to stay up to date with their payments to maintain continuous coverage.

Can I make additional premium payments or pay in advance?

+Yes, policyholders have the option to make additional premium payments or pay in advance. This flexibility allows individuals to manage their finances proactively and potentially reduce the overall cost of their policy. Policyholders can contact AIG Life Insurance to discuss the process and ensure that any additional payments are properly recorded and reflected in their policy.