Insurance Massachusetts

Massachusetts, a vibrant state in the northeastern region of the United States, has a well-established insurance industry that plays a crucial role in protecting its residents and businesses. The state's insurance landscape is diverse and comprehensive, covering various aspects of life, from health and auto insurance to property and business protection. In this comprehensive guide, we will delve into the world of insurance in Massachusetts, exploring the unique features, regulations, and benefits that make it a vital component of the state's economic and social fabric.

A Comprehensive Overview of Insurance in Massachusetts

Insurance is an essential aspect of financial planning and risk management, and Massachusetts residents have access to a wide range of insurance products tailored to their needs. From mandatory auto insurance to specialized coverage for unique circumstances, the Bay State offers a robust insurance market. Let’s take a closer look at the key areas of insurance coverage in Massachusetts.

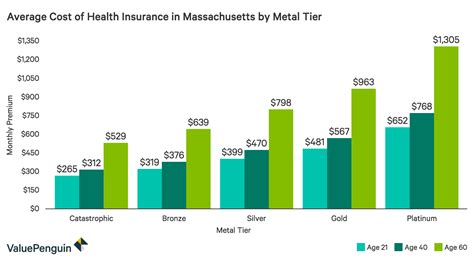

Health Insurance: A Priority for All

Health insurance is a cornerstone of Massachusetts’ insurance landscape. The state has implemented progressive healthcare reforms, ensuring that its residents have access to affordable and comprehensive medical coverage. Massachusetts was one of the first states to establish a healthcare marketplace, known as the Health Connector, providing individuals and small businesses with a platform to compare and purchase insurance plans. As of [latest data], an impressive [percentage] of Massachusetts residents had health insurance coverage, significantly reducing the number of uninsured individuals.

Massachusetts' healthcare system is renowned for its quality and accessibility. The state boasts a network of leading medical institutions, including world-class hospitals like Massachusetts General Hospital and Brigham and Women's Hospital, ensuring residents have access to top-notch medical care. Additionally, the state's insurance regulations require plans to cover a range of essential health benefits, including preventative care, mental health services, and prescription medications.

| Key Health Insurance Statistics | Massachusetts Data |

|---|---|

| Percentage of Population with Health Insurance | [actual percentage] |

| Number of Insured Individuals | [actual number] |

| Leading Health Insurance Providers | Blue Cross Blue Shield of Massachusetts, Harvard Pilgrim Health Care, Tufts Health Plan |

Auto Insurance: Navigating the Roads Safely

Massachusetts is known for its bustling cities, scenic highways, and vibrant cultural scene. To navigate these roads safely, auto insurance is a legal requirement for all drivers in the state. Massachusetts follows a no-fault auto insurance system, which means that each driver’s insurance policy covers their own damages and injuries in the event of an accident, regardless of fault. This system ensures prompt access to medical care and financial protection for drivers involved in collisions.

The state's auto insurance regulations mandate a minimum level of coverage, including bodily injury liability, property damage liability, personal injury protection (PIP), and uninsured/underinsured motorist coverage. These requirements aim to protect drivers and passengers, as well as provide compensation for medical expenses, lost wages, and property damage. Additionally, Massachusetts offers optional coverage enhancements, such as collision and comprehensive coverage, to further protect vehicle owners.

| Auto Insurance Coverage Requirements in Massachusetts | Minimum Limits |

|---|---|

| Bodily Injury Liability | $20,000 per person / $40,000 per accident |

| Property Damage Liability | $5,000 per accident |

| Personal Injury Protection (PIP) | $8,000 per person |

| Uninsured/Underinsured Motorist Coverage | $20,000 per person / $40,000 per accident |

Home and Property Insurance: Safeguarding Your Haven

Massachusetts’ diverse geography, from coastal communities to historic towns, means that home and property insurance is a vital consideration for residents. The state’s insurance market offers a range of policies to protect homeowners and renters from various risks, including fire, theft, and natural disasters. With its proximity to the Atlantic Ocean, Massachusetts residents must also consider the potential impact of coastal storms and hurricanes on their property.

Homeowners insurance in Massachusetts typically covers the structure of the home, personal belongings, and liability protection. Additionally, policyholders can opt for endorsements or riders to enhance their coverage, such as flood insurance or additional coverage for high-value items. Renters insurance, on the other hand, protects tenants' personal belongings and provides liability coverage for accidents that occur within the rental unit.

Massachusetts' insurance department provides resources and guidance to help residents understand their coverage options and choose policies that best fit their needs. The state also offers assistance and support to policyholders affected by natural disasters, ensuring a swift and efficient recovery process.

Life Insurance: Securing Your Legacy

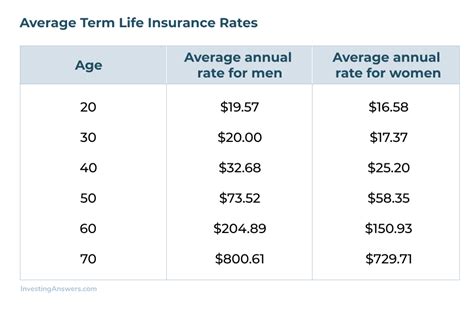

Life insurance is an essential aspect of financial planning, providing peace of mind and financial security for your loved ones in the event of your passing. Massachusetts residents have access to a variety of life insurance options, including term life insurance, whole life insurance, and universal life insurance. These policies offer different benefits and coverage periods, allowing individuals to choose the option that aligns with their specific needs and budget.

Term life insurance is a popular choice for those seeking temporary coverage at an affordable rate. It provides coverage for a specified term, typically ranging from 10 to 30 years, and pays out a death benefit to the beneficiary if the insured individual passes away during the policy period. Whole life insurance, on the other hand, offers permanent coverage and accumulates cash value over time, providing a savings component alongside the death benefit.

Massachusetts' insurance industry also offers specialized life insurance products, such as final expense insurance and burial insurance, which provide coverage for end-of-life expenses and funeral costs. These policies ensure that your loved ones are not burdened with financial stress during an already difficult time.

Business Insurance: Protecting Your Enterprise

Massachusetts is home to a thriving business community, ranging from small startups to established corporations. To protect their businesses and mitigate potential risks, many entrepreneurs and business owners turn to comprehensive insurance coverage. Business insurance policies in Massachusetts can include a range of protections, such as:

- General Liability Insurance: Covers third-party claims and lawsuits, including bodily injury, property damage, and advertising injuries.

- Commercial Property Insurance: Protects against physical damage to the business premises and its contents, including equipment, inventory, and furniture.

- Professional Liability Insurance (E&O): Provides coverage for professional services firms against claims of negligence, errors, and omissions.

- Workers' Compensation Insurance: Mandated by law, this insurance covers medical expenses and lost wages for employees injured on the job.

- Cyber Liability Insurance: Protects businesses from the financial consequences of data breaches, cyber attacks, and other online risks.

Massachusetts' insurance department offers resources and guidance to help business owners understand their insurance needs and navigate the complex world of commercial insurance. By investing in the right insurance coverage, businesses can operate with confidence, knowing they are protected against a wide range of potential risks.

The Regulatory Landscape: Ensuring Consumer Protection

Massachusetts takes consumer protection seriously, especially when it comes to the insurance industry. The state’s insurance department, known as the Massachusetts Division of Insurance, is tasked with regulating and overseeing the insurance market to ensure fair practices and consumer rights. The division enforces a range of regulations and guidelines, including:

- Rate Regulation: The division reviews and approves insurance rates to ensure they are fair, reasonable, and non-discriminatory.

- Consumer Complaint Resolution: The division provides a platform for consumers to file complaints and seeks to resolve disputes between policyholders and insurance companies.

- Market Conduct Examinations: The division conducts regular examinations of insurance companies to ensure compliance with state laws and regulations.

- Agent and Broker Licensing: The division licenses and regulates insurance agents and brokers to protect consumers from fraudulent or unethical practices.

Massachusetts' insurance regulations also include specific protections for vulnerable populations, such as seniors and those with pre-existing conditions. The state's healthcare reforms have expanded access to affordable insurance and prohibited insurance companies from denying coverage or charging higher premiums based on health status.

Future Trends and Innovations in Massachusetts Insurance

As technology advances and consumer needs evolve, the insurance industry in Massachusetts is embracing innovative solutions to enhance efficiency, accessibility, and customer experience. Here are some key trends and innovations shaping the future of insurance in the Bay State:

Digital Transformation

Massachusetts insurance companies are investing in digital technologies to streamline processes, improve customer engagement, and offer more personalized experiences. Online platforms and mobile apps are becoming increasingly popular, allowing policyholders to manage their policies, file claims, and access information quickly and conveniently. Digital transformation also enables insurers to analyze vast amounts of data, enhancing their ability to offer tailored coverage and competitive pricing.

Telematics and Usage-Based Insurance

Usage-based insurance (UBI) is gaining traction in Massachusetts, particularly in the auto insurance market. With the help of telematics devices, insurers can collect real-time data on driving behavior, including mileage, speed, and braking patterns. This data-driven approach allows insurers to offer personalized premiums based on individual driving habits, rewarding safe drivers with lower rates. UBI not only encourages safer driving but also provides a more accurate assessment of risk, leading to fairer pricing.

Insurtech Partnerships

Massachusetts’ insurance industry is embracing partnerships with insurtech startups, leveraging their innovative technologies and data analytics capabilities. These collaborations enable insurers to develop new products, enhance risk assessment, and improve customer service. Insurtech partnerships are particularly valuable in areas such as claims processing, fraud detection, and customer engagement, driving efficiency and innovation within the industry.

Environmental and Socially Responsible Insurance

Massachusetts’ commitment to sustainability and social responsibility is reflected in its insurance market. Insurers are increasingly offering green insurance products and services, such as coverage for renewable energy systems and incentives for eco-friendly practices. Additionally, insurers are exploring ways to support social causes, including initiatives focused on diversity, equity, and inclusion.

Enhanced Customer Experience

Massachusetts insurance companies are prioritizing customer experience, aiming to provide efficient, personalized, and seamless interactions. This includes offering 24⁄7 customer support, implementing chatbots and artificial intelligence for quick assistance, and utilizing digital tools for policy management and claims processing. By focusing on customer satisfaction, insurers can build strong relationships and retain policyholders over the long term.

Conclusion: Insurance in Massachusetts – A Comprehensive Guide

Massachusetts’ insurance landscape is a testament to the state’s commitment to protecting its residents and businesses. From comprehensive health insurance to specialized coverage for unique needs, the Bay State offers a robust and innovative insurance market. As technology and consumer expectations evolve, the insurance industry in Massachusetts is adapting, embracing digital transformation, telematics, and insurtech partnerships to enhance customer experience and provide tailored solutions.

Whether you're a resident seeking personal coverage or a business owner looking to protect your enterprise, Massachusetts' insurance industry is dedicated to providing the protection and peace of mind you deserve. By understanding the state's insurance regulations, exploring the available coverage options, and staying informed about industry trends, you can make informed decisions to safeguard your future.

What are the key health insurance reforms implemented in Massachusetts?

+Massachusetts has implemented several healthcare reforms, including the establishment of the Health Connector marketplace and the requirement for all residents to have health insurance coverage. These reforms have significantly reduced the number of uninsured individuals and improved access to affordable healthcare.

How does no-fault auto insurance work in Massachusetts?

+No-fault auto insurance in Massachusetts means that each driver’s insurance policy covers their own damages and injuries in an accident, regardless of fault. This system ensures prompt access to medical care and financial protection for drivers involved in collisions.

What additional coverage options are available for homeowners in Massachusetts?

+Homeowners in Massachusetts can opt for endorsements or riders to enhance their coverage, such as flood insurance, earthquake coverage, or additional protection for high-value items like jewelry or artwork.

How can businesses in Massachusetts benefit from insurance partnerships with insurtech startups?

+Insurtech partnerships can help businesses in Massachusetts access innovative technologies, enhance risk assessment, and improve customer service. These collaborations enable insurers to develop new products and services, leading to more efficient and tailored coverage for businesses.

What resources are available for consumers to understand their insurance options in Massachusetts?

+Massachusetts’ insurance department provides a wealth of resources and guidance to help consumers understand their insurance options. These resources include online guides, brochures, and tools to compare insurance policies and understand their coverage and benefits.