Check Vehicle Insurance

Vehicle insurance is an essential aspect of owning and operating a vehicle, providing financial protection and peace of mind for drivers. In this comprehensive guide, we will delve into the world of vehicle insurance, exploring its importance, coverage options, and the steps involved in obtaining the right policy. Whether you're a seasoned driver or a first-time car owner, understanding vehicle insurance is crucial to ensuring your safety and the security of your vehicle.

Understanding Vehicle Insurance

Vehicle insurance, often referred to as auto insurance or car insurance, is a contract between an individual (the policyholder) and an insurance company. This contract outlines the terms and conditions of coverage, including the types of risks insured against and the financial obligations of both parties. The primary purpose of vehicle insurance is to protect drivers and vehicle owners from the financial consequences of accidents, theft, and other unforeseen events.

In many regions, vehicle insurance is a legal requirement. It serves as a social responsibility, ensuring that individuals can bear the costs of damages and liabilities they may incur while driving. By having insurance, drivers can drive with confidence, knowing that they are prepared for unexpected situations and potential legal obligations.

Key Components of Vehicle Insurance

Vehicle insurance policies typically consist of several key components, each addressing different aspects of coverage. These components can be customized to meet the specific needs and preferences of the policyholder.

- Liability Coverage: This is a fundamental component of any vehicle insurance policy. It covers the policyholder's legal responsibility for bodily injury and property damage caused to others in an accident. Liability coverage ensures that the policyholder can fulfill their financial obligations to others, providing protection against potential lawsuits and medical expenses.

- Collision Coverage: Collision coverage is an optional add-on that provides protection for the policyholder's own vehicle in the event of an accident. It covers damages caused by collisions with other vehicles, objects, or as a result of rolling over. Collision coverage is particularly beneficial for individuals who want comprehensive protection for their vehicle, ensuring repairs or replacements are covered.

- Comprehensive Coverage: Comprehensive coverage is another optional add-on that offers protection against non-collision related incidents. This includes damage caused by theft, vandalism, natural disasters, and collisions with animals. Comprehensive coverage provides a more comprehensive form of protection, ensuring that the policyholder is covered for a wider range of unforeseen events.

- Personal Injury Protection (PIP): PIP coverage, also known as no-fault insurance, provides benefits to the policyholder and their passengers regardless of who is at fault in an accident. It covers medical expenses, lost wages, and other related costs, ensuring that injured individuals can receive the necessary care and support.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the policyholder in the event of an accident involving an uninsured or underinsured driver. It provides compensation for bodily injury and property damage, ensuring that the policyholder is not left financially burdened due to the actions of another driver.

Assessing Your Insurance Needs

When it comes to vehicle insurance, one size does not fit all. It’s essential to assess your specific needs and circumstances to determine the most suitable coverage for your situation. Here are some factors to consider when evaluating your insurance requirements:

Vehicle Type and Value

The type and value of your vehicle play a significant role in determining the level of insurance coverage you may need. For instance, if you own a classic or luxury car, you may want to consider additional protection to cover the unique value and potential risks associated with such vehicles.

| Vehicle Type | Recommended Coverage |

|---|---|

| Standard Sedan | Liability, Collision, Comprehensive |

| Sports Car | Enhanced Liability, Collision, Comprehensive, Uninsured Motorist |

| Electric Vehicle | Specialized Coverage for EV Repairs, Additional Liability |

Driving Habits and Risk Profile

Your driving habits and overall risk profile can influence the type and extent of insurance coverage you should consider. For example, if you have a history of accidents or traffic violations, you may need to opt for higher liability limits to protect yourself financially. Additionally, if you frequently drive in high-risk areas or during adverse weather conditions, comprehensive coverage may be more beneficial.

State-Specific Requirements

Each state or region has its own set of legal requirements for vehicle insurance. It’s crucial to understand the minimum coverage limits and any additional mandates specific to your location. While these minimum requirements provide a baseline, it’s essential to consider your personal needs and the potential costs associated with accidents or damages.

Obtaining Vehicle Insurance

The process of obtaining vehicle insurance involves several steps, from comparing policies to making an informed decision. Here’s a step-by-step guide to help you navigate the insurance landscape:

Step 1: Research and Compare

Start by researching different insurance providers and the policies they offer. Compare coverage options, premiums, and additional benefits to find the best fit for your needs. Online comparison tools and insurance brokerages can be valuable resources for this initial research phase.

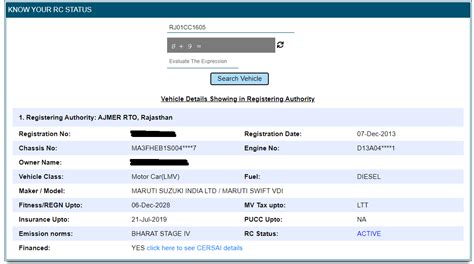

Step 2: Gather Necessary Information

To obtain an accurate quote, you’ll need to provide specific information about yourself and your vehicle. This includes personal details such as your age, driving record, and credit score, as well as vehicle information like make, model, and year. Having this information readily available will streamline the quoting process.

Step 3: Obtain Quotes

Contact multiple insurance providers or use online platforms to obtain quotes. Compare the quotes based on the coverage options, deductibles, and any additional perks or discounts offered. Consider the financial stability and reputation of the insurance companies to ensure you’re choosing a reliable provider.

Step 4: Review and Understand the Policy

Once you’ve selected a provider, carefully review the policy documents. Understand the coverage limits, exclusions, and any specific conditions that may apply. Ensure that the policy aligns with your needs and expectations. If you have any questions or concerns, reach out to the insurance company’s customer support for clarification.

Step 5: Make an Informed Decision

Based on your research, comparisons, and understanding of the policy, make an informed decision. Consider the coverage, premiums, and the overall value proposition offered by the insurance provider. Remember, vehicle insurance is a long-term commitment, so choose a provider and policy that provide the best combination of coverage and affordability.

Understanding Policy Terms and Conditions

Vehicle insurance policies come with a set of terms and conditions that outline the rights and responsibilities of both the policyholder and the insurance company. Understanding these terms is crucial to ensuring a smooth claims process and avoiding any potential pitfalls.

Key Policy Terms to Understand

- Premiums: The amount you pay for your insurance coverage, typically on a monthly or annual basis. Premiums can vary based on factors such as coverage limits, deductibles, and your personal risk profile.

- Deductibles: The amount you agree to pay out of pocket before your insurance coverage kicks in. Higher deductibles can result in lower premiums, but it’s important to choose a deductible you can afford in the event of a claim.

- Coverage Limits: The maximum amount your insurance company will pay for covered losses. Understanding these limits is crucial to ensure you have adequate coverage for potential liabilities.

- Exclusions: Specific situations or events that are not covered by your policy. It’s important to review the exclusions to avoid any surprises when filing a claim.

- Policy Period: The duration for which your insurance policy is valid. Policies typically have a one-year term, but some providers offer shorter or longer periods.

- Renewal Process: The process by which your policy is extended for another term. Some providers automatically renew policies, while others require active renewal.

Filing a Claim

In the event of an accident or other insured event, knowing how to file a claim is essential. Here’s a guide to help you navigate the claims process:

Step 1: Contact Your Insurance Company

As soon as possible after an accident or incident, contact your insurance company to report the claim. Provide them with all the necessary details, including the date, time, and location of the incident, as well as any relevant contact information for involved parties.

Step 2: Gather Documentation

Collect all relevant documentation related to the incident, such as police reports, photographs of the damage, and any witness statements. This information will be crucial when submitting your claim.

Step 3: Submit Your Claim

Follow the instructions provided by your insurance company to submit your claim. This may involve completing claim forms, providing additional documentation, and possibly undergoing an inspection of the vehicle.

Step 4: Wait for Claim Processing

Once your claim is submitted, it will undergo a review process. The insurance company will assess the details of the incident and determine the extent of coverage based on your policy terms. This process may take some time, so patience is key.

Step 5: Receive Settlement

If your claim is approved, you will receive a settlement based on the terms of your policy. This may involve repairs to your vehicle, reimbursement for damages, or other forms of compensation as outlined in your policy.

Tips for Saving on Vehicle Insurance

Vehicle insurance can be a significant expense, but there are strategies you can employ to reduce your premiums and save money. Here are some tips to consider:

Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies, such as vehicle insurance with homeowners or renters insurance. Bundling can result in substantial savings, so it’s worth exploring this option.

Maintain a Clean Driving Record

Insurance companies consider your driving history when determining your premiums. Maintaining a clean driving record, free from accidents and violations, can lead to lower insurance rates. Safe driving practices not only keep you and others safe but also benefit your wallet.

Consider Higher Deductibles

Opting for a higher deductible can result in lower premiums. However, it’s important to choose a deductible you can afford in the event of a claim. Higher deductibles may be suitable for individuals with a low risk profile or those who are confident in their ability to manage minor repairs out of pocket.

Shop Around for Discounts

Insurance companies often offer various discounts, such as safe driver discounts, good student discounts, or loyalty discounts. Research and inquire about these discounts to see if you qualify. Shopping around and comparing providers can help you identify the best combination of coverage and savings.

Future of Vehicle Insurance

The landscape of vehicle insurance is evolving, driven by advancements in technology and changing consumer needs. Here are some trends and developments to watch for in the future:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and vehicle usage, is gaining traction in the insurance industry. Usage-based insurance policies, also known as pay-as-you-drive or pay-how-you-drive, offer premiums based on real-time driving data. This technology allows insurance companies to offer more personalized and accurate pricing, rewarding safe drivers with lower premiums.

Autonomous Vehicles and Liability Shifts

The emergence of autonomous vehicles raises questions about liability and insurance coverage. As self-driving technology becomes more prevalent, the role of insurance may shift to cover the vehicle’s manufacturer or software provider rather than the individual driver. This shift could lead to new insurance models and a reevaluation of traditional liability coverage.

Digital Transformation and Online Platforms

The insurance industry is embracing digital transformation, with online platforms and mobile apps becoming increasingly popular for policy management and claims processing. These digital tools offer convenience, real-time updates, and streamlined processes, enhancing the overall customer experience.

Conclusion

Vehicle insurance is a critical component of responsible vehicle ownership, providing financial protection and peace of mind. By understanding the various coverage options, assessing your needs, and making informed decisions, you can obtain the right insurance policy to suit your circumstances. Remember, vehicle insurance is a long-term commitment, so choose a provider and policy that offer the best combination of coverage, affordability, and customer satisfaction.

Stay informed, drive safely, and ensure your vehicle is protected with the right insurance coverage.

Frequently Asked Questions

What is the average cost of vehicle insurance?

+

The average cost of vehicle insurance can vary significantly depending on factors such as location, driving record, and coverage options. According to recent studies, the national average for annual car insurance premiums is around $1,674. However, it’s important to note that this is just an average, and your specific premium may be higher or lower based on your individual circumstances.

How can I lower my vehicle insurance premiums?

+

There are several strategies you can employ to lower your vehicle insurance premiums. These include maintaining a clean driving record, shopping around for the best rates, considering higher deductibles, and exploring discounts such as multi-policy or safe driver discounts. Additionally, safe driving practices and avoiding high-risk behaviors can contribute to lower premiums over time.

What factors influence vehicle insurance rates?

+

Vehicle insurance rates are influenced by a variety of factors, including your age, gender, driving history, credit score, and the type of vehicle you own. Additionally, the location where you reside and drive, as well as any anti-theft devices installed in your vehicle, can impact your insurance rates. Insurance companies use these factors to assess the level of risk associated with insuring you and determine your premium accordingly.

Can I cancel my vehicle insurance policy anytime?

+

Canceling your vehicle insurance policy is generally possible, but it’s important to understand the potential consequences. Some insurance companies may charge a cancellation fee, and you may also need to provide proof of new insurance coverage before canceling. Additionally, canceling your policy mid-term could affect your future insurance rates, as it may be seen as a risk factor by other providers. It’s recommended to carefully consider your options and discuss the cancellation process with your insurance company.