What Is Trip Insurance

Trip insurance, also known as travel insurance, is a vital component of any journey, offering travelers protection and peace of mind during their adventures. With the unpredictability of travel, from unexpected medical emergencies to trip cancellations and lost luggage, trip insurance provides a safety net, ensuring that travelers can navigate these unforeseen circumstances with ease and confidence.

Understanding the Basics of Trip Insurance

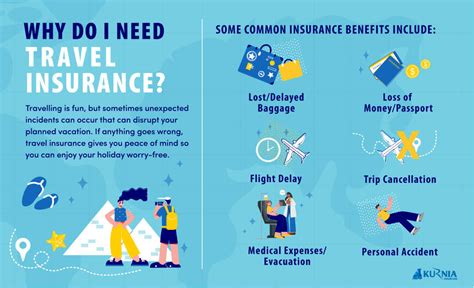

At its core, trip insurance is a comprehensive policy designed to safeguard travelers against a range of potential risks and inconveniences. It serves as a financial safety net, covering expenses that may arise due to unforeseen events during the course of a trip. These policies typically include coverage for medical emergencies, trip cancellations or interruptions, baggage loss or delay, and even emergency evacuation.

The beauty of trip insurance lies in its adaptability. Policies can be tailored to suit individual needs, offering coverage for specific risks that are most relevant to the traveler's destination and itinerary. Whether it's an adventurous hiking trip through the mountains or a relaxing beach vacation, trip insurance ensures that travelers are protected, no matter what life throws their way.

The Benefits of Investing in Trip Insurance

The advantages of trip insurance are manifold. Firstly, it provides essential medical coverage, ensuring that travelers can access necessary healthcare without incurring exorbitant costs. This is particularly crucial when traveling internationally, where healthcare systems and costs can vary significantly.

Secondly, trip insurance offers a buffer against financial losses due to trip cancellations or interruptions. Whether it's due to a family emergency, severe weather conditions, or unforeseen travel advisories, trip insurance ensures that travelers don't lose out on their hard-earned investment. Many policies also cover additional expenses incurred due to delays, such as accommodation or meal costs.

Furthermore, trip insurance provides reassurance for lost or delayed baggage. This coverage ensures that travelers are not left stranded without their essential items, providing financial support to purchase necessary items until their luggage is located or replaced.

Real-Life Scenarios: The Value of Trip Insurance

Consider a traveler embarking on a dream trip to a remote island destination. En route, their luggage is delayed, leaving them without their essential medications and crucial travel documents. With trip insurance, they can quickly file a claim, ensuring they receive the necessary items and can continue their journey smoothly.

In another scenario, a family plans a vacation to a popular theme park destination. Unfortunately, due to a sudden illness, they are forced to cancel their trip at the last minute. With trip insurance, they can recoup a significant portion of their expenses, easing the financial burden and providing an opportunity to reschedule their trip.

Choosing the Right Trip Insurance Policy

Selecting the appropriate trip insurance policy is crucial to ensure comprehensive coverage. When evaluating policies, travelers should consider the following factors:

- Destination and Itinerary: Evaluate the risks associated with your destination and planned activities. For instance, if you're planning an adventurous trip involving extreme sports, ensure your policy covers such activities.

- Medical Coverage: Verify the extent of medical coverage, including emergency evacuation and repatriation, to ensure you're adequately protected.

- Trip Cancellation and Interruption: Understand the triggers for trip cancellation and interruption coverage, ensuring they align with your specific needs.

- Baggage and Personal Effects: Check the policy limits and coverage for lost, stolen, or damaged baggage and personal items.

- Travel Delays: Assess the coverage for travel delays, ensuring it covers additional expenses incurred during delays.

Comparative Analysis: Top Trip Insurance Providers

When it comes to selecting a trip insurance provider, several reputable companies offer comprehensive policies. Here’s a comparative analysis of some top providers:

| Provider | Policy Highlights |

|---|---|

| Company A | Offers extensive medical coverage, including emergency evacuation, and provides generous limits for trip cancellation and baggage loss. |

| Company B | Known for its customizable policies, allowing travelers to tailor coverage to their specific needs. Provides robust coverage for adventure sports and extreme activities. |

| Company C | Specializes in providing comprehensive coverage for families, including child-specific benefits and family travel discounts. Offers generous limits for trip interruption and additional expense coverage. |

It's important to carefully review and compare policies to ensure you find the best fit for your travel needs and budget.

The Future of Trip Insurance: Innovations and Trends

The trip insurance industry is continually evolving, driven by technological advancements and changing consumer needs. Here are some key trends and innovations shaping the future of trip insurance:

- Digitalization and Instant Claims Processing: The rise of digital platforms and mobile apps is revolutionizing the trip insurance experience. Travelers can now easily purchase policies online and file claims instantly, receiving swift reimbursement.

- Personalized Coverage: Insurers are offering more tailored and customizable policies, allowing travelers to select coverage options that match their specific travel plans and preferences.

- Expanded Coverage for Emerging Risks: With the increasing prevalence of climate-related travel disruptions and health risks, insurers are expanding coverage to include events such as natural disasters and pandemic-related travel advisories.

- Traveler Support Services: Many insurers are now offering additional support services, such as travel assistance hotlines, concierge services, and even trip planning tools, to enhance the overall travel experience.

Frequently Asked Questions

What is the average cost of trip insurance?

+

The cost of trip insurance can vary widely depending on several factors, including the duration of your trip, your age, the destination, and the type of coverage you choose. On average, trip insurance can range from 4% to 8% of the total trip cost, but it’s important to review policies carefully to ensure you’re getting the coverage you need at a competitive price.

Does trip insurance cover COVID-19 related issues?

+

Yes, many trip insurance policies now offer coverage for COVID-19 related issues, including medical treatment, trip cancellations due to positive COVID tests, and even quarantine expenses. However, it’s crucial to review the policy’s fine print and understand the specific terms and conditions related to COVID-19 coverage.

Can I purchase trip insurance after my trip has started?

+

In most cases, trip insurance must be purchased prior to the start of your trip. However, some insurers offer limited coverage options that can be purchased during the trip, typically for emergencies or unforeseen circumstances. It’s best to research and purchase trip insurance well in advance to ensure comprehensive coverage.

How do I file a claim for trip insurance?

+

Filing a claim typically involves providing documentation of the incident or issue, such as medical reports, trip cancellation notices, or receipts for additional expenses. The process can vary between insurers, so it’s important to understand the specific requirements of your policy. Many insurers now offer online claim filing and tracking, making the process more efficient and convenient.

Are there any exclusions or limitations to trip insurance coverage?

+

Yes, trip insurance policies often have exclusions and limitations. Common exclusions include pre-existing medical conditions, acts of war or terrorism, and engaging in dangerous activities without proper supervision. It’s crucial to review the policy’s exclusions and limitations carefully to ensure you’re aware of any potential gaps in coverage.