Least Expensive Car Insurance

When it comes to finding the least expensive car insurance, many factors come into play, including your location, driving history, and the type of vehicle you own. While insurance rates can vary significantly, there are strategies and insights that can help you secure the most affordable coverage without compromising on quality. In this comprehensive guide, we'll delve into the world of car insurance, offering expert advice and insights to help you navigate the market and make informed decisions.

Understanding Car Insurance Premiums

The cost of car insurance, often referred to as the premium, is influenced by a multitude of factors. These include your age, gender, marital status, and even your credit score. Additionally, the make and model of your vehicle, as well as its safety features, can impact the price. Understanding these variables is crucial in your quest for affordable coverage.

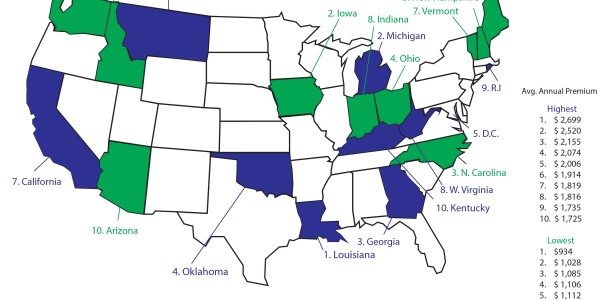

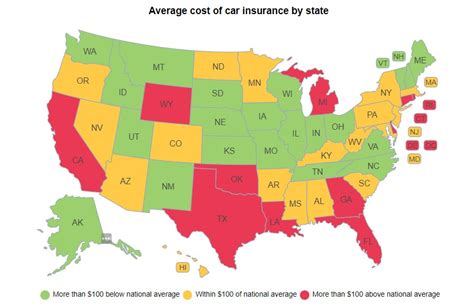

Location-Based Premiums

One of the most significant factors in determining car insurance rates is your location. Insurance providers consider various local factors, such as the number of accidents and claims in your area, traffic congestion, and even the prevalence of natural disasters. For instance, densely populated urban areas with higher traffic volumes and theft rates may result in higher premiums compared to rural regions.

| Location | Average Annual Premium |

|---|---|

| New York City, NY | $1,500 |

| Los Angeles, CA | $1,300 |

| Chicago, IL | $1,100 |

| Houston, TX | $900 |

| Phoenix, AZ | $800 |

Driving Record and History

Your driving record plays a pivotal role in determining insurance costs. A clean driving history with no accidents or traffic violations is ideal, as it demonstrates responsible driving behavior. Conversely, a history of accidents or moving violations can lead to higher premiums, as insurers view these individuals as higher risk.

Vehicle Choice and Safety Features

The make, model, and year of your vehicle can influence insurance rates. Generally, newer and more expensive vehicles cost more to insure due to higher repair and replacement costs. However, certain safety features, such as anti-lock brakes, airbags, and collision avoidance systems, can lower your premium. These features reduce the risk of accidents and injuries, making you a less risky candidate for insurers.

Strategies for Securing the Least Expensive Car Insurance

Now that we’ve explored the factors that influence insurance premiums, let’s delve into practical strategies to help you secure the least expensive car insurance coverage.

Shop Around and Compare Quotes

One of the most effective ways to find affordable car insurance is to shop around and compare quotes from multiple providers. Each insurer has its own formula for calculating premiums, and rates can vary significantly between companies. By obtaining quotes from various insurers, you can identify the most competitive offers and potentially save hundreds of dollars annually.

Bundle Policies for Discounts

If you have multiple insurance needs, such as home, renters, or life insurance, consider bundling your policies with the same provider. Many insurers offer discounts when you combine multiple policies, as it simplifies their operations and reduces administrative costs. Bundling can lead to substantial savings on your car insurance premium.

Choose Higher Deductibles

Your insurance deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you can lower your premium. This strategy works best for individuals who are confident in their ability to cover the initial costs of an accident or claim. However, it’s essential to choose a deductible that aligns with your financial capabilities.

Explore Discounts and Savings

Insurance providers offer a range of discounts to attract and retain customers. Common discounts include those for safe driving records, loyalty, good grades (for young drivers), and safety features in your vehicle. Additionally, some companies provide discounts for specific occupations, memberships, or even for paying your premium in full annually. Be sure to inquire about all available discounts to maximize your savings.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach that tailors your premium to your actual driving habits. These policies use devices or smartphone apps to track your mileage, driving behavior, and even the time of day you drive. Insurers then offer discounts based on your demonstrated safe driving habits. This option can be particularly advantageous for low-mileage drivers or those with excellent driving records.

Choosing the Right Coverage Levels

While it’s essential to find the least expensive car insurance, it’s equally crucial to ensure you have adequate coverage to protect yourself financially in the event of an accident. Balancing affordability and comprehensive coverage is key.

Liability Coverage

Liability coverage is a fundamental component of car insurance. It protects you financially if you’re found at fault in an accident, covering the costs of injuries and damages to others. Most states have minimum liability requirements, but it’s generally advisable to opt for higher limits to provide more comprehensive protection. Consider your assets and financial situation when determining the appropriate liability coverage.

Comprehensive and Collision Coverage

Comprehensive and collision coverage provide protection for your own vehicle. Comprehensive coverage covers damages caused by non-collision events, such as theft, vandalism, natural disasters, or collisions with animals. Collision coverage, on the other hand, covers damages to your vehicle resulting from collisions with other vehicles or objects. While these coverages can increase your premium, they offer essential protection for your vehicle.

Personal Injury Protection (PIP) and Medical Payments

Personal Injury Protection (PIP) and Medical Payments coverage provide financial support for your own medical expenses and those of your passengers in the event of an accident, regardless of fault. These coverages can be crucial in ensuring you’re not left with overwhelming medical bills after an accident. Consider your healthcare needs and the cost of medical care in your area when deciding on the appropriate levels of PIP and Medical Payments coverage.

The Future of Car Insurance: Telematics and Usage-Based Policies

The insurance industry is evolving, and one of the most significant trends is the rise of telematics and usage-based insurance policies. These innovative approaches to car insurance offer personalized rates based on your actual driving behavior and mileage. By embracing these new technologies, insurers can offer more accurate and fair premiums, rewarding safe drivers with lower rates.

The Benefits of Telematics

Telematics insurance utilizes advanced technology to track your driving habits, providing insurers with detailed data on your mileage, driving speed, acceleration, braking, and even the time of day you drive. This data allows insurers to assess your individual risk profile accurately. Safe drivers who demonstrate responsible behavior can benefit from significant premium discounts, as insurers recognize their lower risk potential.

Usage-Based Insurance: A Fairer Approach

Usage-based insurance policies are designed to reward drivers who exhibit safe and responsible driving habits. By tracking your driving behavior and providing feedback, these policies encourage safer driving practices. Over time, this can lead to substantial savings on your insurance premium. Additionally, usage-based insurance can provide valuable insights into your driving habits, helping you become a safer and more efficient driver.

FAQs

How often should I review my car insurance policy and rates?

+It’s recommended to review your car insurance policy and rates annually, or whenever you experience significant life changes such as moving to a new location, purchasing a new vehicle, or getting married. Regular reviews ensure you’re always getting the best value and coverage for your needs.

What factors can I control to lower my car insurance premium?

+You can take several steps to lower your car insurance premium, including maintaining a clean driving record, choosing a vehicle with good safety ratings and lower repair costs, and opting for higher deductibles. Additionally, bundling policies and exploring available discounts can lead to significant savings.

How does my credit score impact my car insurance rates?

+Your credit score can significantly influence your car insurance rates. Insurers often use credit-based insurance scores to assess your risk as a driver. Individuals with higher credit scores are generally viewed as lower risk, leading to more favorable insurance rates. Improving your credit score can potentially result in substantial savings on your insurance premium.