Great Auto Insurance

The Ultimate Guide to Choosing the Right Auto Insurance: Expert Insights and Industry Trends

In the vast landscape of automotive insurance, making informed choices can be a daunting task. With countless options and varying policies, how do you navigate this complex terrain? This comprehensive guide aims to empower you with the knowledge and insights needed to make confident decisions when selecting the ideal auto insurance coverage.

We'll delve into the intricacies of auto insurance, from understanding the essential components to tailoring your policy to your unique needs. Whether you're a seasoned driver or a newcomer to the roads, this expert guide will ensure you're equipped with the tools to protect yourself and your vehicle effectively.

Unraveling the Complex World of Auto Insurance: A Comprehensive Overview

Auto insurance is a critical aspect of responsible vehicle ownership, offering financial protection in the event of accidents, theft, or other vehicle-related incidents. It's a legal requirement in many regions and a vital safeguard for your financial well-being.

At its core, auto insurance operates on the principle of risk sharing. When you purchase a policy, you essentially enter into a contract with an insurance provider. This contract outlines the specific risks covered, the financial limits of that coverage, and the premium you'll pay in exchange for this protection. Understanding these fundamental concepts is key to navigating the auto insurance landscape with confidence.

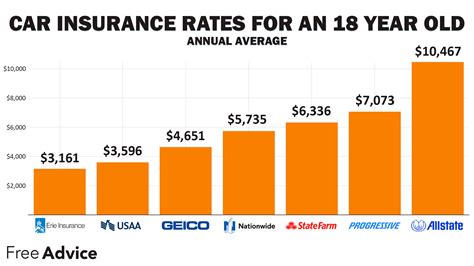

The complexity of auto insurance lies in the multitude of factors that influence your coverage and premium. These include your personal details (such as age, driving history, and credit score), the make and model of your vehicle, and the specific coverage options you choose. Each of these elements plays a significant role in determining the cost and scope of your policy.

Key Components of Auto Insurance Policies

Auto insurance policies typically comprise several key components, each designed to address specific risks. These include:

- Liability Coverage: This covers the costs associated with bodily injury or property damage you cause to others in an accident. It's essential for protecting your financial well-being in the event of a claim against you.

- Collision Coverage: This option pays for the repair or replacement of your vehicle if it's damaged in an accident, regardless of fault. It's particularly valuable for newer or more expensive vehicles.

- Comprehensive Coverage: Comprehensive coverage extends beyond accidents, providing protection against theft, vandalism, natural disasters, and other non-collision incidents. It's a crucial component for comprehensive vehicle protection.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses for you and your passengers, regardless of fault. It's an essential safeguard for ensuring timely medical attention after an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who doesn't have insurance or doesn't have enough insurance to cover the costs.

- Rental Car Reimbursement: If your vehicle is being repaired or is deemed a total loss, this coverage provides a rental car while yours is out of commission.

Each of these components can be tailored to your specific needs, allowing you to create a customized auto insurance policy that suits your unique circumstances. The balance between these coverages and your premium will depend on your individual preferences and financial situation.

Assessing Your Auto Insurance Needs: A Tailored Approach

When it comes to auto insurance, a one-size-fits-all approach simply doesn't work. Your unique circumstances, such as your driving history, the value of your vehicle, and your personal financial situation, all play a role in determining the right coverage for you.

For instance, if you have a pristine driving record and own an older, less valuable vehicle, you might opt for a more basic liability-only policy. On the other hand, if you have a newer, high-end vehicle and a history of accidents or traffic violations, a comprehensive policy with higher liability limits might be a wiser choice.

Factors to Consider When Tailoring Your Auto Insurance Policy

To ensure you're adequately covered without overspending, consider the following factors when tailoring your auto insurance policy:

- Vehicle Value: The value of your vehicle is a significant factor in determining the cost of your insurance. Newer, more expensive vehicles typically require more extensive coverage to ensure they're adequately protected.

- Driving History: Your driving record is a key indicator of your risk level. A clean record with no accidents or traffic violations can lead to lower premiums and a wider range of coverage options.

- Financial Situation: Your financial stability plays a role in the type of coverage you choose. While it's essential to have adequate protection, you also need to ensure your insurance premiums fit within your budget.

- State Requirements: Different states have varying minimum insurance requirements. Ensure you understand the legal requirements in your state to avoid any potential penalties or legal issues.

- Discounts and Bundles: Many insurance providers offer discounts for safe driving, multiple policies (such as bundling auto and home insurance), or other specific criteria. Explore these options to potentially reduce your premiums.

By carefully considering these factors and understanding your unique needs, you can create a customized auto insurance policy that offers the right balance of coverage and cost.

Navigating the Auto Insurance Market: Choosing the Right Provider

With countless auto insurance providers in the market, selecting the right one can be a challenging task. Each provider offers a unique set of coverage options, discounts, and customer service, making it essential to do your research before making a decision.

When choosing an auto insurance provider, consider the following factors to ensure you're making an informed choice:

Coverage Options and Policy Customization

Different providers offer varying levels of customization for your auto insurance policy. Some might specialize in specific types of coverage, such as high-risk drivers or classic car owners, while others might offer more comprehensive options for a wider range of drivers.

Ensure the provider you choose offers the coverage options you need, whether it's basic liability coverage or more extensive collision and comprehensive protection. The ability to customize your policy to your specific needs is a key factor in ensuring you're adequately protected.

Premiums and Discounts

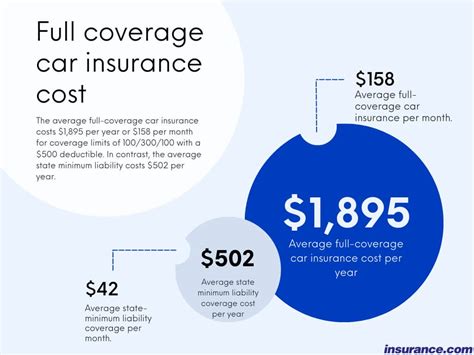

The cost of your auto insurance premium is a significant consideration. Compare premiums from different providers to ensure you're getting a competitive rate. Keep in mind that the cheapest option might not always be the best, as it might come with limitations on coverage or customer service.

Also, look for providers that offer a range of discounts. These can include safe driving discounts, multi-policy discounts (for bundling auto insurance with other types of insurance), or even discounts for specific occupations or affiliations. Taking advantage of these discounts can help reduce your overall premium.

Customer Service and Claims Handling

When you need to make a claim, the quality of your insurance provider's customer service can make a significant difference. Look for providers with a strong reputation for prompt, efficient claims handling and excellent customer service.

Consider reading reviews and testimonials from other customers to get a sense of the provider's customer service reputation. You can also reach out to friends and family for recommendations based on their personal experiences.

Financial Stability and Reputation

Choosing an insurance provider with a solid financial foundation is crucial. A provider with strong financial stability ensures they'll be able to pay out claims promptly, even in the event of a large-scale disaster or widespread claims.

Look for providers that have been in business for a significant period and have a track record of financial stability. You can also check their financial ratings from independent agencies to get an objective assessment of their financial health.

The Future of Auto Insurance: Trends and Innovations

The auto insurance industry is constantly evolving, with new trends and innovations shaping the way insurance is delivered and consumed. Staying abreast of these developments can help you make more informed choices and potentially access new, more cost-effective coverage options.

Telematics and Usage-Based Insurance

Telematics and usage-based insurance are innovative approaches to auto insurance that use real-time data to assess driving behavior and set premiums. These programs use telematics devices installed in your vehicle to track factors such as speed, braking, and mileage.

By monitoring these factors, insurance providers can offer more personalized premiums based on your actual driving behavior. This can be particularly beneficial for safe drivers, who can potentially see significant savings on their insurance premiums.

Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics are transforming the auto insurance industry, enabling providers to make more accurate risk assessments and offer more tailored coverage options.

AI-powered systems can analyze vast amounts of data, including driving behavior, vehicle performance, and even weather conditions, to predict potential risks and tailor coverage accordingly. This technology also allows for more efficient claims handling, potentially reducing the time and cost of settling claims.

Connected Car Technology

The rise of connected car technology is opening up new opportunities for auto insurance providers. Connected cars, equipped with advanced sensors and communication systems, can provide real-time data on vehicle performance and driving behavior.

This data can be used by insurance providers to offer more precise risk assessments and potentially lower premiums for safe drivers. It also enables more efficient claims handling, as the connected car technology can provide valuable insights into the circumstances of an accident.

Environmental and Sustainability Initiatives

With growing environmental awareness, many auto insurance providers are embracing sustainability initiatives. These initiatives can range from offering discounts for eco-friendly vehicles to implementing paperless processes and supporting carbon offset programs.

By choosing an insurance provider that aligns with your sustainability values, you can contribute to a more environmentally conscious industry while potentially accessing more cost-effective coverage options.

Conclusion: Empowering Your Auto Insurance Choices

Navigating the complex world of auto insurance requires a thorough understanding of the various components, a tailored approach to your unique needs, and a discerning eye when choosing the right provider. By following the insights and trends outlined in this guide, you can make confident decisions that ensure you're adequately protected while keeping your insurance costs manageable.

Remember, auto insurance is a critical aspect of responsible vehicle ownership. By staying informed and proactive, you can navigate the auto insurance landscape with ease, ensuring you're always protected on the road ahead.

How do I know if I have adequate auto insurance coverage?

+Adequate auto insurance coverage ensures you’re protected against financial loss in the event of an accident, theft, or other vehicle-related incidents. To determine if your coverage is sufficient, consider the value of your vehicle, your driving history, and your financial situation. A good rule of thumb is to have liability limits that exceed the value of your assets, ensuring you’re protected in the event of a major claim. Additionally, consider adding comprehensive and collision coverage for newer or more expensive vehicles, as well as other optional coverages like rental car reimbursement or roadside assistance.

What are some common discounts offered by auto insurance providers?

+Auto insurance providers offer a range of discounts to make coverage more affordable. Common discounts include safe driving discounts for maintaining a clean driving record, multi-policy discounts for bundling auto insurance with other types of insurance (such as home or life insurance), and discounts for specific occupations or affiliations. Some providers also offer usage-based insurance programs, where premiums are based on your actual driving behavior, potentially offering significant savings for safe drivers.

How can I save money on my auto insurance premiums?

+There are several strategies you can employ to save money on your auto insurance premiums. Start by comparing quotes from multiple providers to find the most competitive rates. Take advantage of discounts for safe driving, multiple policies, or specific affiliations. Consider increasing your deductible, as this can significantly lower your premiums. Additionally, maintain a clean driving record and explore usage-based insurance programs, which can offer substantial savings for safe drivers.