Low Car Insurance Full Coverage

Securing full coverage car insurance while aiming for low premiums is a balancing act that many drivers face. It's crucial to understand the factors that influence insurance rates and the steps you can take to get the best coverage without breaking the bank. This guide aims to provide an in-depth analysis, offering expert insights and real-world examples to help you navigate the complex world of auto insurance.

Understanding Full Coverage and its Benefits

Full coverage car insurance is a comprehensive policy that goes beyond the basic liability coverage. It typically includes collision and comprehensive coverage, which protect against a wide range of incidents, including accidents, theft, and natural disasters. This level of protection ensures that you’re financially safeguarded in various scenarios, offering peace of mind and potentially significant savings in the long run.

The benefits of full coverage are twofold. Firstly, it provides financial protection in the event of an accident or loss. Whether it's a fender bender or a more severe collision, full coverage insurance will cover the cost of repairs or, in the case of a total loss, the replacement value of your vehicle. Secondly, it offers legal protection, ensuring that you're not personally liable for damages or injuries caused in an accident. This aspect is particularly crucial, as it can protect your personal assets from being seized to cover potential lawsuits.

The Components of Full Coverage

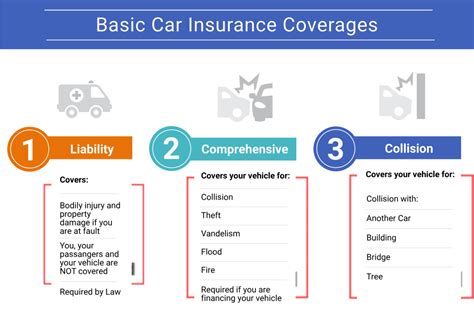

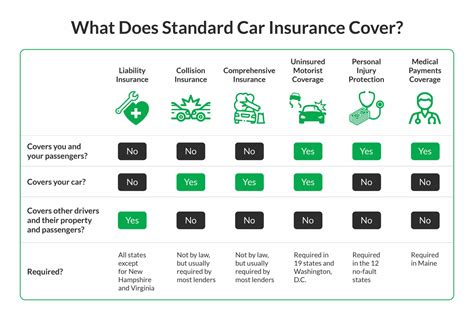

Full coverage insurance typically consists of the following key components:

- Collision Coverage: Pays for damages to your vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Covers damages from events other than accidents, such as theft, vandalism, weather damage, or hitting an animal.

- Liability Coverage: This is a legal requirement in most states and covers damages to other vehicles or property in an accident where you’re at fault. It also includes bodily injury liability, which covers medical expenses for injured parties.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages.

- Personal Injury Protection (PIP): Pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault.

While full coverage insurance offers extensive protection, it's important to note that the cost can be significantly higher than basic liability coverage. However, by understanding the factors that influence insurance rates and taking proactive steps, it's possible to find a policy that provides the right balance of coverage and affordability.

Factors Influencing Insurance Rates

Insurance rates are determined by a complex interplay of factors, each of which can have a significant impact on the cost of your premium. By understanding these factors, you can make informed decisions to potentially lower your insurance costs.

Vehicle-Related Factors

The type of vehicle you drive plays a significant role in determining your insurance rates. Generally, newer, more expensive cars tend to have higher premiums due to the cost of repairs and replacement parts. Additionally, certain vehicle features, such as anti-theft devices or safety ratings, can influence rates. For instance, vehicles with advanced safety features like lane departure warning systems or automatic emergency braking may qualify for insurance discounts.

| Vehicle Feature | Impact on Insurance Rates |

|---|---|

| Vehicle Age and Value | Older, less valuable vehicles often have lower insurance rates. |

| Vehicle Type | Sports cars, luxury vehicles, and SUVs may have higher rates due to increased risk and repair costs. |

| Safety Ratings | Vehicles with higher safety ratings may qualify for discounts. |

Driver-Related Factors

Your driving record and personal characteristics are key factors in insurance rates. Insurance companies use data to assess the risk of insuring a particular driver. Here’s how some driver-related factors can impact your rates:

- Driving History: A clean driving record with no accidents or violations can lead to lower rates. On the other hand, a history of accidents or traffic violations can significantly increase your insurance premiums.

- Age and Gender: Younger drivers, especially males under 25, are often considered higher-risk and may face higher premiums. Rates generally decrease with age and experience.

- Marital Status: Married individuals may receive discounts, as they're often considered lower-risk drivers.

- Credit Score: Believe it or not, your credit score can impact your insurance rates. Many insurance companies use credit-based insurance scores to assess risk, and a higher credit score may result in lower premiums.

Location-Based Factors

Where you live and drive can also affect your insurance rates. Insurance companies consider the geographic location of the vehicle when determining rates. Here’s why:

- Urban vs. Rural Areas: Urban areas often have higher rates due to increased traffic, higher risk of accidents, and higher likelihood of vehicle theft.

- Weather Conditions: Areas prone to severe weather, such as hurricanes or hailstorms, may have higher insurance rates due to the increased risk of weather-related damage.

- Crime Rates: Regions with higher crime rates may see increased insurance costs due to the risk of theft or vandalism.

Strategies to Get Low Car Insurance with Full Coverage

While full coverage insurance can be costly, there are several strategies you can employ to reduce your premiums without sacrificing the protection you need. Here are some expert tips to help you get the best deal on full coverage car insurance.

Shop Around and Compare Quotes

The insurance market is highly competitive, and rates can vary significantly between providers. Shopping around and comparing quotes is one of the most effective ways to find low-cost full coverage insurance. Use online comparison tools or get quotes directly from insurance companies to see where you can get the best deal. Remember, it’s not just about the price; you also want to ensure the coverage meets your needs.

Increase Your Deductible

One of the simplest ways to lower your insurance premiums is to increase your deductible. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you’re essentially agreeing to pay more in the event of a claim, which can result in lower monthly premiums. However, it’s important to choose a deductible amount that you’re comfortable paying if the need arises.

Bundle Your Policies

If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts when you combine multiple policies, as it’s more convenient for them to manage and they gain your loyalty. By bundling, you can often save a significant amount on your total insurance costs.

Take Advantage of Discounts

Insurance companies offer a wide range of discounts to attract customers and reward loyalty. Some common discounts include:

- Safe Driver Discount: For drivers with a clean record and no accidents or violations.

- Good Student Discount: Available for young drivers who maintain a certain GPA.

- Loyalty Discount: For customers who have been with the same insurer for a specified period.

- Multi-Car Discount: If you insure more than one vehicle with the same company.

- Anti-Theft Device Discount: For vehicles equipped with approved anti-theft devices.

It's worth asking your insurer about any discounts you may be eligible for, as they can significantly reduce your overall insurance costs.

Consider Usage-Based Insurance

Usage-based insurance, also known as telematics insurance, is an innovative approach where your insurance premium is based on your actual driving behavior. This type of insurance uses a device or app to track your driving habits, such as mileage, speed, and time of day you drive. If you’re a safe, low-mileage driver, you may be able to save significantly on your insurance costs with this type of policy.

The Importance of Maintaining Coverage

While it’s important to find low-cost insurance, it’s equally crucial to ensure you’re maintaining the right level of coverage. Here are some key points to consider when assessing your insurance needs:

Assessing Your Risk

Take the time to evaluate your personal risk factors. Consider your driving record, the type of vehicle you drive, and the area you live in. If you live in an area with a high risk of natural disasters or theft, for example, you may want to prioritize comprehensive coverage. On the other hand, if you have a long, clean driving record, you may be able to reduce your liability coverage without compromising your protection.

Understanding State Requirements

Each state has its own minimum insurance requirements, which often include liability coverage. It’s essential to understand these requirements to ensure you’re meeting the legal standards. However, keep in mind that meeting the minimum requirements may not provide adequate protection in the event of an accident. Full coverage insurance is often recommended to ensure you’re fully protected.

Regularly Review and Adjust Your Policy

Your insurance needs can change over time. As your life circumstances change, whether it’s buying a new car, moving to a different area, or getting married, it’s important to review your insurance policy to ensure it still meets your needs. Regularly reviewing your policy can also help you identify opportunities to save money or adjust your coverage.

Future Trends in Auto Insurance

The auto insurance industry is evolving rapidly, with new technologies and trends shaping the way insurance is offered and utilized. Here are some key trends to watch out for:

Increased Use of Telematics

Telematics, or usage-based insurance, is expected to become more prevalent in the coming years. As technology advances and more drivers become comfortable with sharing their driving data, this type of insurance is likely to offer more personalized and potentially lower-cost coverage.

Focus on Preventative Measures

Insurance companies are increasingly investing in preventative measures to reduce the likelihood of accidents. This includes partnering with auto manufacturers to integrate advanced safety features into vehicles and providing incentives for drivers to use these features. By reducing the number of accidents, insurance companies can potentially lower overall insurance costs.

Data-Driven Insurance

The use of big data and advanced analytics is transforming the insurance industry. Insurers are now able to use vast amounts of data to more accurately assess risk and price insurance policies. This data-driven approach can lead to more precise insurance rates, potentially benefiting lower-risk drivers with lower premiums.

How can I lower my car insurance premiums without compromising coverage?

+To lower your premiums, consider increasing your deductible, bundling your policies, and taking advantage of discounts. Additionally, maintaining a clean driving record and regularly reviewing your policy can help you find the best rates without sacrificing coverage.

What is the difference between liability coverage and full coverage insurance?

+Liability coverage is the minimum required insurance in most states, covering damages to other vehicles or property in an accident where you’re at fault. Full coverage insurance, on the other hand, provides comprehensive protection, including collision coverage, comprehensive coverage, and additional protections like uninsured/underinsured motorist coverage and personal injury protection.

Can I get full coverage insurance for an older vehicle?

+Yes, you can get full coverage insurance for older vehicles. However, the cost of full coverage may not be worth it if the vehicle’s value is low. In such cases, liability-only insurance may be a more cost-effective option.