Progressive Insurance Quote

When it comes to safeguarding our vehicles and assets, obtaining a reliable insurance quote is paramount. Progressive Insurance, a leading provider in the industry, offers comprehensive coverage options tailored to meet diverse needs. In this article, we will delve into the process of acquiring a Progressive Insurance quote, exploring the key factors that influence the final price, and providing valuable insights to help you make informed decisions about your insurance coverage.

Understanding Progressive Insurance Quotes

Progressive Insurance is renowned for its innovative approach to insurance, providing customers with a seamless experience when seeking quotes. The company’s online platform allows users to quickly and easily obtain personalized quotes based on their unique circumstances. Whether you’re looking for auto, home, or life insurance, Progressive offers a range of coverage options to suit your requirements.

One of the distinctive features of Progressive Insurance quotes is their adaptability. The company understands that each individual's insurance needs are unique, and thus, their quotes are designed to be flexible and customizable. By considering various factors, Progressive can offer tailored coverage options that align with your specific requirements and budget.

Factors Influencing Progressive Insurance Quotes

Several key elements play a significant role in determining the cost of your Progressive Insurance quote. These factors include:

- Vehicle Type and Age: The make, model, and age of your vehicle are essential considerations. Progressive assesses the risk associated with different vehicles and adjusts quotes accordingly. Newer vehicles or those with advanced safety features may qualify for lower premiums.

- Driving Record: Your driving history is a crucial factor in determining your insurance quote. Progressive evaluates factors such as accidents, traffic violations, and claims made in the past. A clean driving record often leads to more favorable quotes.

- Coverage Preferences: The level of coverage you choose directly impacts your quote. Progressive offers various coverage options, including liability, collision, comprehensive, and additional add-ons. Selecting the right coverage ensures you have the protection you need without paying for unnecessary extras.

- Location and Usage: The area where you live and the primary use of your vehicle influence the quote. Progressive takes into account factors like crime rates, accident statistics, and the average mileage driven. Urban areas or regions with higher accident rates may result in slightly higher quotes.

- Discounts and Promotions: Progressive Insurance regularly offers discounts and promotions to attract new customers and reward loyal policyholders. These discounts can significantly reduce your overall quote. Common discounts include safe driver incentives, multi-policy discounts, and loyalty rewards.

By considering these factors, Progressive Insurance strives to provide accurate and competitive quotes that reflect your individual circumstances. Their commitment to transparency and customer satisfaction ensures that you receive a fair assessment of your insurance needs.

Obtaining a Progressive Insurance Quote: Step-by-Step Guide

Securing a Progressive Insurance quote is a straightforward process that can be completed online or with the assistance of a dedicated agent. Here’s a step-by-step guide to help you navigate the process:

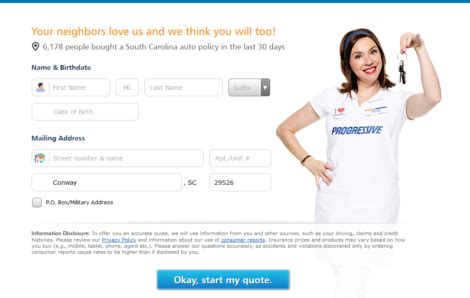

- Visit the Progressive Website: Start by accessing the official Progressive Insurance website. The homepage provides a user-friendly interface with clear navigation options to guide you through the quoting process.

- Choose Your Insurance Type: Select the type of insurance you're interested in. Whether it's auto, home, renters, or life insurance, Progressive offers a wide range of coverage options. Select the appropriate category to begin your quote journey.

- Provide Basic Information: You'll be prompted to enter some basic details, including your name, contact information, and the desired coverage start date. Ensure that the information you provide is accurate to receive an accurate quote.

- Enter Vehicle Details: For auto insurance quotes, you'll need to input information about your vehicle, such as the make, model, year, and VIN. Progressive uses this data to assess the risk associated with your vehicle and determine the appropriate coverage.

- Customize Your Coverage: Progressive allows you to tailor your insurance coverage to meet your specific needs. You can choose the level of liability, collision, and comprehensive coverage you desire. Additionally, you can explore optional add-ons like rental car coverage or roadside assistance.

- Provide Driving Record Information: To obtain an accurate quote, Progressive may request details about your driving history. This includes information about accidents, violations, and any claims made in the past. Providing honest and accurate information ensures a more precise quote.

- Review Discounts and Promotions: Progressive offers a variety of discounts to help you save on your insurance premiums. Review the available discounts and determine which ones apply to your situation. Applying these discounts can significantly reduce your overall quote.

- Receive Your Quote: Once you've provided all the necessary information and customized your coverage, Progressive will generate a personalized quote. The quote will outline the estimated cost of your insurance policy, including any applicable discounts. Review the quote carefully to ensure it aligns with your expectations.

- Compare and Purchase: If you're satisfied with the Progressive quote, you can proceed with purchasing the insurance policy. Progressive provides a seamless online purchasing process, allowing you to complete the transaction securely. Alternatively, you can connect with a Progressive agent for further assistance and guidance.

By following this step-by-step guide, you can efficiently obtain a Progressive Insurance quote that meets your needs and budget. Progressive's commitment to customer satisfaction and transparency ensures that you receive a fair and accurate assessment of your insurance requirements.

Progressive Insurance Quote: Comparative Analysis

To provide a comprehensive understanding of Progressive Insurance quotes, it’s beneficial to compare them with quotes from other leading insurance providers. By examining key aspects such as coverage options, customer service, and overall value, we can gain insights into Progressive’s competitive position in the market.

Coverage Options

Progressive Insurance offers a wide range of coverage options to cater to diverse customer needs. Whether you’re seeking auto, home, renters, or life insurance, Progressive provides comprehensive coverage tailored to your specific requirements. Their customizable policies allow customers to select the level of coverage that best suits their lifestyle and budget.

Progressive's auto insurance coverage includes standard options such as liability, collision, and comprehensive coverage. Additionally, they offer various add-ons like rental car coverage, gap coverage, and roadside assistance. For home insurance, Progressive provides coverage for dwellings, personal property, liability, and additional living expenses. Renters insurance covers personal belongings and liability protection for tenants.

Progressive's life insurance options include term life, whole life, and universal life insurance. They also offer specialized policies for unique situations, such as final expense insurance and accidental death coverage.

Customer Service and Support

Progressive Insurance prides itself on delivering exceptional customer service and support. Their dedicated team of agents is readily available to assist customers throughout the insurance journey, from quote acquisition to policy management and claims processing. Progressive offers multiple channels for customer support, including phone, email, and live chat, ensuring prompt and efficient assistance.

Progressive's customer service representatives are known for their expertise and willingness to go the extra mile. They provide personalized guidance and help customers navigate the often complex world of insurance. Whether it's answering questions about coverage options, explaining policy details, or assisting with claims, Progressive's customer service team ensures a positive and stress-free experience.

Value and Cost Analysis

When comparing Progressive Insurance quotes with those of other providers, it’s essential to consider the value proposition and overall cost of the policies. Progressive’s competitive pricing and flexible coverage options often make them an attractive choice for many customers.

Progressive offers a range of discounts and promotions to help customers save on their insurance premiums. These discounts can significantly reduce the overall cost of the policy, making Progressive a cost-effective option for budget-conscious individuals. Additionally, Progressive's online quoting and policy management tools streamline the insurance process, saving customers time and effort.

While Progressive's quotes may vary depending on individual circumstances and coverage preferences, their commitment to transparency and customer satisfaction ensures that customers receive fair and accurate assessments of their insurance needs. Progressive's competitive pricing, combined with their extensive coverage options and excellent customer service, positions them as a reliable and trustworthy insurance provider.

The Future of Progressive Insurance Quotes

As technology continues to advance and consumer preferences evolve, Progressive Insurance is committed to staying at the forefront of the insurance industry. The company recognizes the importance of innovation and is constantly exploring new ways to enhance the quoting process and overall customer experience.

Progressive is investing in cutting-edge technology to streamline the quoting process further. They are developing advanced algorithms and machine learning capabilities to provide more accurate and personalized quotes. By leveraging data analytics, Progressive aims to offer tailored coverage recommendations based on individual risk profiles, ensuring customers receive the most suitable and cost-effective insurance options.

Additionally, Progressive is exploring the integration of emerging technologies such as artificial intelligence and blockchain into their quoting and policy management systems. These technologies have the potential to revolutionize the insurance industry by enhancing security, efficiency, and customer engagement. Progressive aims to leverage these advancements to provide customers with a seamless and secure insurance experience.

Furthermore, Progressive is dedicated to fostering a culture of continuous improvement and customer-centricity. They actively seek feedback from customers and industry experts to identify areas for enhancement and implement innovative solutions. By staying attuned to market trends and customer needs, Progressive ensures that their quoting process remains relevant, user-friendly, and aligned with the evolving expectations of modern consumers.

As Progressive continues to embrace technological advancements and customer-centric approaches, their quotes are expected to become even more accurate, efficient, and tailored to individual needs. The company's commitment to innovation positions them as a leader in the insurance industry, providing customers with a seamless and reliable quoting experience that meets their unique insurance requirements.

Conclusion: Making an Informed Decision

Obtaining a Progressive Insurance quote is a crucial step in securing the right coverage for your assets and peace of mind. By understanding the factors that influence your quote and following the step-by-step guide provided, you can navigate the process with confidence. Progressive’s commitment to transparency, customer satisfaction, and innovation ensures that you receive a fair and accurate assessment of your insurance needs.

When comparing Progressive's quotes with other providers, consider their extensive coverage options, exceptional customer service, and competitive pricing. Progressive's dedication to staying at the forefront of the insurance industry through technological advancements and customer-centric approaches positions them as a reliable and forward-thinking insurance provider.

As you embark on your insurance journey, remember that your choice of insurance provider should align with your unique circumstances and priorities. By carefully evaluating your options and considering the insights provided in this article, you can make an informed decision that safeguards your assets and provides the peace of mind you deserve.

Can I get a Progressive Insurance quote without providing personal information?

+While Progressive offers a quick quote option that doesn’t require extensive personal information, obtaining an accurate quote typically involves providing basic details such as your name, contact information, and vehicle details. This information helps Progressive assess your insurance needs and provide a more precise quote.

Are Progressive Insurance quotes binding?

+No, Progressive Insurance quotes are not binding. They are estimates based on the information you provide and serve as a starting point for your insurance coverage. Once you receive a quote, you can further customize your coverage and make any necessary adjustments before purchasing the policy.

Can I compare Progressive Insurance quotes with other providers online?

+Absolutely! There are online platforms and comparison websites that allow you to compare insurance quotes from multiple providers, including Progressive. These tools can help you quickly assess different coverage options and premiums, enabling you to make an informed decision about your insurance coverage.