On Line Auto Insurance

In today's fast-paced world, convenience and efficiency are at the forefront of our minds. When it comes to auto insurance, the traditional process of visiting an insurance agent's office, filling out lengthy forms, and waiting for quotes can be time-consuming and cumbersome. That's where online auto insurance steps in as a game-changer, offering a seamless and modern approach to securing coverage for your vehicle.

The Rise of Online Auto Insurance: A Digital Revolution

The digital age has transformed numerous industries, and the insurance sector is no exception. Online auto insurance has emerged as a popular choice for vehicle owners seeking a streamlined and hassle-free experience. With just a few clicks, drivers can now compare policies, obtain quotes, and even purchase coverage without leaving the comfort of their homes.

This digital revolution has not only benefited consumers but has also brought about significant changes in the insurance industry. Insurance providers have had to adapt to the evolving preferences of their customers, resulting in a more competitive and customer-centric market.

Benefits of Online Auto Insurance

Online auto insurance offers a plethora of advantages that make it an attractive option for modern drivers. Here’s a glimpse into some of the key benefits:

- Convenience and Accessibility: One of the most significant advantages is the convenience it provides. You can access insurance services from anywhere, at any time, using your preferred device. Whether you're at home, in the office, or on the go, a few taps on your smartphone or clicks on your laptop can lead you to a wide range of insurance options.

- Real-Time Quotes and Comparisons: With online auto insurance, obtaining quotes is lightning-fast. You can instantly compare prices, coverage options, and policy features from multiple providers. This transparency ensures that you make an informed decision, choosing the best policy for your needs and budget.

- Personalized Experience: Online platforms often use advanced algorithms to provide personalized recommendations based on your specific circumstances. Whether you're a young driver, a senior citizen, or have a unique vehicle, the system can tailor quotes to your situation, ensuring you get the coverage you deserve.

- Paperless Process: Say goodbye to piles of paperwork! Online auto insurance allows you to manage your policy digitally, from purchase to renewal. This eco-friendly approach saves time, reduces clutter, and minimizes the risk of misplacing important documents.

- Quick Claims Process: In the unfortunate event of an accident, online insurance providers often offer streamlined claims processes. You can file claims online, upload necessary documents, and track the progress of your claim, ensuring a faster and more efficient resolution.

These benefits have not only revolutionized the way we obtain auto insurance but have also empowered drivers to take control of their insurance journey.

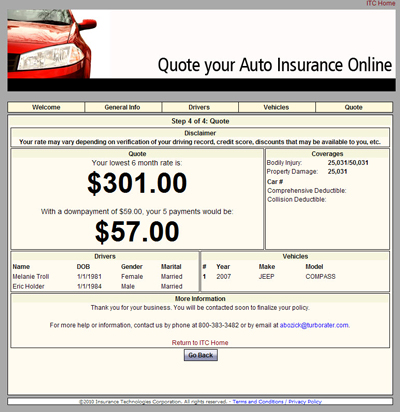

How Online Auto Insurance Works: A Step-by-Step Guide

Understanding the process behind online auto insurance can help you navigate this digital landscape with ease. Here’s a simplified breakdown of how it works:

- Choose an Online Platform: Start by selecting a reputable online insurance platform or comparison website. These platforms act as intermediaries, providing a user-friendly interface to explore various insurance options.

- Provide Basic Information: Enter your personal details, vehicle information, and driving history. This step helps the platform generate accurate quotes based on your specific circumstances.

- Compare Quotes: Once you've provided the necessary information, the platform will present you with a list of quotes from multiple insurance providers. Take the time to compare prices, coverage limits, and any additional perks or discounts offered.

- Review Policy Details: Dive deeper into the policies that catch your eye. Carefully read through the fine print, understanding the coverage limits, exclusions, and any potential gaps in coverage. Ensure the policy aligns with your needs and provides adequate protection.

- Select Your Policy: After thorough research and comparison, choose the policy that best suits your requirements and budget. The platform will guide you through the purchase process, allowing you to make secure payments and receive your policy documents instantly.

- Manage Your Policy Online: Online auto insurance platforms often provide robust online management systems. You can access your policy details, make payments, update your information, and even renew your policy with just a few clicks.

By following these steps, you can seamlessly navigate the online auto insurance landscape, securing the coverage you need without the traditional hassles.

Exploring the Features: What Sets Online Auto Insurance Apart

Online auto insurance platforms offer a range of innovative features that enhance the overall insurance experience. Let’s delve into some of these features:

Digital Underwriting and Risk Assessment

Traditional insurance underwriting processes often involve manual reviews and lengthy wait times. Online platforms, however, utilize advanced digital underwriting techniques. By analyzing your data and applying sophisticated algorithms, these platforms can assess your risk profile accurately and provide tailored quotes.

This digital underwriting process not only speeds up the quote generation but also ensures a more precise assessment of your insurance needs.

Telematics and Usage-Based Insurance

Some online insurance providers offer usage-based insurance policies, also known as telematics insurance. These policies leverage technology to monitor your driving behavior and habits. By installing a small device in your vehicle or using a smartphone app, the insurer can collect data on your driving patterns, such as mileage, speed, and braking habits.

This data-driven approach allows for more accurate risk assessment and can result in customized premiums based on your actual driving behavior. Safe drivers may benefit from lower premiums, while those with riskier driving habits may receive tailored advice to improve their driving and reduce costs.

Data-Driven Personalization

Online auto insurance platforms often utilize vast amounts of data to offer highly personalized experiences. By analyzing your demographics, driving history, and even external factors like weather conditions and traffic patterns, these platforms can provide tailored recommendations and quotes.

This data-driven personalization ensures that you receive insurance options that align with your unique circumstances, resulting in a more accurate and cost-effective coverage plan.

The Future of Online Auto Insurance: Innovations and Trends

As technology continues to advance, the future of online auto insurance looks promising. Here are some key innovations and trends that are shaping the industry:

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing the insurance industry. These technologies enable insurance providers to analyze vast amounts of data, identify patterns, and make more accurate predictions. From fraud detection to claims processing, AI and ML are enhancing the efficiency and accuracy of online auto insurance platforms.

Blockchain Technology

Blockchain, the technology behind cryptocurrencies like Bitcoin, is making its way into the insurance sector. By providing a secure and transparent ledger system, blockchain can streamline insurance processes, reduce administrative costs, and enhance data security. Smart contracts, powered by blockchain, can automate various insurance tasks, ensuring a more efficient and trustworthy experience.

Internet of Things (IoT) Integration

The Internet of Things (IoT) is connecting devices and vehicles, creating a network of smart technologies. This integration allows insurance providers to gather real-time data on vehicle usage, maintenance, and driving behavior. By leveraging IoT data, insurers can offer more precise and personalized insurance policies, rewarding safe driving habits and providing insights for improvement.

Enhanced Customer Experience

The focus on customer experience remains a top priority for online auto insurance providers. Expect to see continued improvements in user interfaces, mobile applications, and digital tools. These enhancements will make it even easier for customers to compare policies, obtain quotes, and manage their insurance needs, ensuring a seamless and satisfying journey.

Conclusion: Embracing the Digital Evolution

Online auto insurance has revolutionized the way we obtain coverage for our vehicles. With its convenience, accessibility, and personalized experience, it has become the preferred choice for many drivers. As technology continues to advance, the future of online auto insurance looks bright, with innovative features and trends promising an even more efficient and customer-centric experience.

By embracing this digital evolution, you can take control of your insurance journey, securing the protection you need while enjoying the benefits of a modern, streamlined process.

How can I ensure I’m getting the best online auto insurance quote?

+To ensure you’re getting the best quote, compare multiple providers and policies. Consider factors like coverage limits, deductibles, and any additional perks. Additionally, be transparent and accurate when providing your information to obtain the most precise quotes.

Are there any drawbacks to online auto insurance?

+One potential drawback is the lack of face-to-face interaction with an insurance agent. However, many online platforms offer excellent customer support and resources to guide you through the process. Additionally, some providers may have limitations on certain coverage options, so it’s essential to read the fine print.

Can I switch to online auto insurance if I already have a traditional policy?

+Absolutely! Many drivers switch to online auto insurance to enjoy the convenience and cost-effectiveness it offers. Just ensure you understand the terms of your existing policy and any potential penalties for early termination.