Auto Insurance Comparisons Quotes

Auto insurance is a crucial aspect of vehicle ownership, providing financial protection and peace of mind to drivers. With a vast array of insurance providers and policies available, comparing quotes and understanding the nuances of coverage is essential for making an informed decision. This comprehensive guide aims to delve into the world of auto insurance, offering expert insights and practical advice to help you navigate the complex landscape and secure the best coverage for your needs.

Understanding Auto Insurance Coverage

Auto insurance serves as a safety net, protecting drivers and vehicle owners from financial losses resulting from accidents, theft, or other unforeseen events. It is a legal requirement in most regions, ensuring that individuals can cover potential damages and liabilities associated with operating a motor vehicle. The coverage provided by auto insurance policies can vary significantly, and understanding the different components is vital for making an informed choice.

Liability Coverage

Liability coverage is a fundamental component of auto insurance, safeguarding policyholders from claims made by others for bodily injury or property damage caused by the insured vehicle. This coverage is typically divided into two main categories: bodily injury liability and property damage liability.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other related costs incurred by individuals injured in an accident caused by the insured driver. It also covers legal defense costs if a lawsuit is filed against the policyholder.

- Property Damage Liability: Property damage liability covers the cost of repairing or replacing property damaged in an accident for which the insured driver is at fault. This can include damage to other vehicles, fences, buildings, or any other type of property.

The limits of liability coverage are typically set by the policyholder and can vary significantly between different insurance providers and states. It is crucial to select liability limits that provide adequate protection, ensuring that policyholders are not left financially vulnerable in the event of a serious accident.

Collision and Comprehensive Coverage

Collision and comprehensive coverage are additional forms of auto insurance that provide protection for the insured vehicle itself. Collision coverage pays for repairs or replacement costs if the insured vehicle is involved in an accident, regardless of fault. This coverage is particularly beneficial for newer or more valuable vehicles, as it can help cover the cost of extensive repairs or total losses.

Comprehensive coverage, on the other hand, protects against damage or loss caused by events other than collisions. This can include theft, vandalism, natural disasters, falling objects, or damage caused by animals. Comprehensive coverage is essential for protecting your vehicle from a wide range of potential hazards, offering peace of mind and financial security.

Personal Injury Protection (PIP) and Medical Payments Coverage

Personal Injury Protection (PIP) and Medical Payments coverage are designed to cover the medical expenses and lost wages of the insured driver and passengers, regardless of fault. These coverages are particularly valuable in no-fault states, where insurance claims are primarily settled through the insured’s own policy rather than through the policy of the at-fault driver.

PIP coverage typically provides a broader range of benefits, including coverage for lost wages, funeral expenses, and even child care services. Medical Payments coverage, on the other hand, is more focused on covering medical expenses, often with a lower limit than PIP.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage is an essential addition to any auto insurance policy. It provides protection in the event that the at-fault driver in an accident does not have adequate insurance coverage to compensate for the damages caused. UM/UIM coverage can help cover medical expenses, lost wages, and other related costs, ensuring that policyholders are not left to bear the financial burden of an accident caused by an uninsured or underinsured driver.

Factors Influencing Auto Insurance Quotes

When comparing auto insurance quotes, it’s important to understand the various factors that insurance providers consider when determining premiums. These factors can significantly impact the cost of your policy, and being aware of them can help you make more informed choices.

Driver Profile and History

Insurance providers evaluate a range of factors related to the driver’s profile and history when calculating quotes. These include age, gender, driving record, and credit score. Younger drivers, particularly those under 25, are often considered higher risk and may face higher premiums. Similarly, drivers with a history of accidents, traffic violations, or claims may also be seen as higher risk and charged higher rates.

Credit score is another significant factor in auto insurance pricing. Many insurance providers use credit-based insurance scoring to assess the risk associated with a driver. A higher credit score may result in lower premiums, as it is seen as an indicator of financial responsibility and stability.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can also impact your auto insurance quotes. Insurance providers consider factors such as the make, model, and age of the vehicle, as well as its safety features and accident history. Vehicles that are more expensive to repair or replace, or those with a higher incidence of theft or vandalism, may result in higher premiums.

The purpose for which you use your vehicle can also influence your insurance rates. Insurance providers may offer different rates for personal use, business use, or commercial use. Additionally, the average annual mileage driven can impact your premiums, as higher mileage may be associated with a greater risk of accidents.

Location and Coverage Requirements

Your geographic location can play a significant role in determining your auto insurance rates. Insurance providers consider factors such as the population density, crime rates, and weather conditions in your area. Urban areas with higher populations and traffic congestion may result in higher premiums due to the increased risk of accidents and theft.

Coverage requirements also vary by state and region. Some states have mandatory minimum coverage limits that must be met, while others have no-fault insurance systems that impact the structure of claims and payouts. Understanding the specific requirements and regulations in your area is crucial for ensuring you meet all legal obligations and obtain adequate coverage.

Discounts and Bundling Options

Insurance providers often offer a range of discounts and bundling options that can help reduce your auto insurance premiums. These may include:

- Multi-Policy Discounts: Bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, can result in significant savings.

- Safe Driver Discounts: Insurance providers often reward drivers with clean driving records and no recent accidents or violations with lower premiums.

- Vehicle Safety Discounts: Vehicles equipped with advanced safety features, such as anti-lock brakes, air bags, or collision avoidance systems, may qualify for discounts.

- Payment Method Discounts: Some insurance providers offer discounts for certain payment methods, such as automatic payments or electronic billing.

- Loyalty Discounts: Staying with the same insurance provider for an extended period may result in loyalty discounts or reduced rates.

Comparing Auto Insurance Quotes: A Step-by-Step Guide

Comparing auto insurance quotes is a crucial step in finding the best coverage for your needs. Here’s a step-by-step guide to help you through the process:

Step 1: Determine Your Coverage Needs

Before you begin comparing quotes, it’s essential to understand your specific coverage needs. Consider the value of your vehicle, your driving habits, and any unique circumstances that may impact your risk profile. Determine the level of coverage you require, including liability limits, collision and comprehensive coverage, and any additional coverages such as PIP or UM/UIM.

Step 2: Gather Information

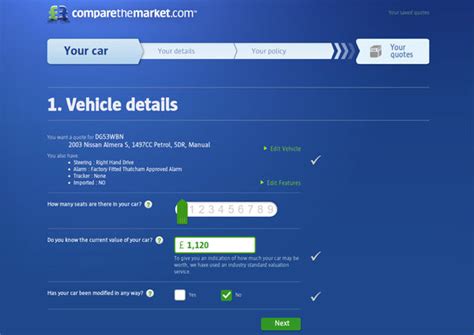

Collect the necessary information to obtain accurate quotes. This includes your driver’s license number, vehicle identification number (VIN), and information about your vehicle’s make, model, and year. Additionally, gather details about your driving history, including any accidents, traffic violations, or claims, as well as your credit score and any relevant insurance discounts you may qualify for.

Step 3: Choose Insurance Providers to Compare

Select a range of insurance providers to compare quotes. While it may be tempting to choose the first few results that appear in an online search, it’s important to explore a diverse range of providers to ensure you’re getting the best possible coverage and rates. Consider both well-known national providers and smaller, regional companies that may offer more specialized coverage or lower rates.

Step 4: Obtain Quotes

Contact the insurance providers you’ve selected and request quotes. You can often obtain quotes online, over the phone, or through an insurance broker. Provide the necessary information and be sure to ask about any available discounts or special offers. Compare the quotes you receive, paying close attention to the coverage limits, deductibles, and any exclusions or limitations.

Step 5: Analyze and Evaluate

Once you have obtained several quotes, take the time to carefully analyze and evaluate them. Compare the coverage limits, deductibles, and overall cost of each policy. Consider the financial stability and reputation of the insurance providers, as well as their customer service ratings and claims handling processes. Ensure that the policies you’re considering meet your specific coverage needs and provide adequate protection.

Step 6: Negotiate and Finalize

If you’re satisfied with the coverage and pricing of a particular policy, reach out to the insurance provider to finalize the process. Negotiate any necessary adjustments or additions to the policy to ensure it meets your exact needs. Discuss payment options and review the policy documents to ensure you understand all the terms and conditions.

Remember, auto insurance is a complex and ever-changing landscape. Regularly review your coverage and shop around for new quotes to ensure you’re always getting the best value and protection for your needs.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects policyholders from claims for bodily injury or property damage caused by the insured vehicle. |

| Collision Coverage | Covers repairs or replacement costs if the insured vehicle is involved in an accident, regardless of fault. |

| Comprehensive Coverage | Protects against damage or loss caused by events other than collisions, such as theft or natural disasters. |

| Personal Injury Protection (PIP) | Provides coverage for medical expenses and lost wages of the insured driver and passengers, regardless of fault. |

| Uninsured/Underinsured Motorist Coverage | Protects policyholders in the event that the at-fault driver in an accident does not have adequate insurance coverage. |

What is the average cost of auto insurance in the United States?

+

The average cost of auto insurance in the U.S. varies significantly depending on factors such as the state, driver’s age and gender, vehicle type, and coverage limits. As of 2021, the national average for auto insurance premiums was around 1,674 per year, but this can range from under 1,000 to over $3,000 depending on individual circumstances.

Are there any ways to lower my auto insurance premiums?

+

Yes, there are several strategies to potentially lower your auto insurance premiums. These include maintaining a clean driving record, increasing your deductible, taking advantage of discounts (such as multi-policy or safe driver discounts), and comparing quotes from multiple insurance providers to find the best rates for your specific circumstances.

How often should I review and compare my auto insurance quotes?

+

It’s generally recommended to review and compare your auto insurance quotes at least once a year, or whenever your policy is up for renewal. This allows you to stay up-to-date with changes in the market, ensure you’re still getting the best value for your money, and make any necessary adjustments to your coverage.