Whole Life Insurance Versus Term Life

Life insurance is an essential aspect of financial planning, offering peace of mind and security to individuals and their families. When it comes to choosing the right type of life insurance, two primary options stand out: Whole Life Insurance and Term Life Insurance. Both policies have their unique features, benefits, and considerations. This article aims to provide an in-depth analysis of these two life insurance types, helping you make an informed decision based on your specific needs and circumstances.

Understanding Whole Life Insurance

Whole Life Insurance, often referred to as permanent life insurance, is a type of coverage that remains active for the policyholder’s entire life, provided all premiums are paid. It combines both a death benefit and a cash value component, making it a comprehensive and long-term financial solution. Here’s a deeper look at the key aspects of Whole Life Insurance.

Death Benefit and Premiums

The death benefit is the core feature of any life insurance policy. In the case of Whole Life Insurance, the death benefit is guaranteed and remains constant throughout the policyholder’s life. This means that regardless of when the insured passes away, their beneficiaries will receive the full amount stated in the policy.

The premiums for Whole Life Insurance are typically higher compared to Term Life Insurance. These premiums are fixed and remain the same throughout the policy’s duration. The advantage of fixed premiums is that policyholders can budget effectively, knowing their premium amount will not increase over time.

Moreover, Whole Life Insurance premiums are often level-loaded, meaning they remain the same regardless of the policyholder’s age. This feature makes Whole Life Insurance an attractive option for those seeking long-term financial protection and stability.

Cash Value Accumulation

One of the distinctive features of Whole Life Insurance is its cash value accumulation. Part of the premium payments goes towards building a cash value within the policy. This cash value grows over time, earning interest and providing policyholders with a financial asset.

The cash value can be used for various purposes, such as taking out loans, making withdrawals, or even surrendering the policy and receiving the accumulated cash value. It serves as a savings component, offering policyholders additional financial flexibility.

However, it’s important to note that accessing the cash value through loans or withdrawals may have tax implications and could impact the death benefit. Policyholders should carefully consider their financial goals and consult with professionals to understand the potential drawbacks.

Policy Dividends

Some Whole Life Insurance policies offer dividends, which are a unique feature of certain permanent life insurance plans. Dividends are essentially a share of the insurance company’s profits that are distributed to policyholders.

These dividends can be used to reduce future premiums, purchase additional coverage, or even be paid out in cash. While dividends are not guaranteed and can vary based on the insurance company’s performance, they provide an additional benefit for policyholders.

Policyholders should carefully review the terms and conditions of dividend payments and understand how they can maximize the benefits of these dividends.

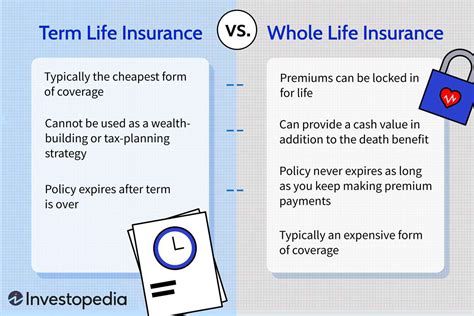

Term Life Insurance: A Different Approach

Term Life Insurance takes a different approach to life insurance coverage. Unlike Whole Life Insurance, Term Life Insurance provides coverage for a specified period, known as the term. Here’s a closer look at the characteristics and considerations of Term Life Insurance.

Policy Term and Coverage

Term Life Insurance policies are typically available for specific periods, such as 10, 20, or 30 years. During this term, the policyholder is covered, and their beneficiaries will receive the death benefit if the insured passes away within the specified term.

The coverage amount is predetermined and remains constant throughout the term. However, unlike Whole Life Insurance, Term Life Insurance does not offer a cash value component, focusing solely on providing financial protection during the policy’s term.

Term Life Insurance is often more affordable than Whole Life Insurance, making it an attractive option for those seeking coverage for a specific period, such as while they have financial dependents or outstanding debts.

Renewal and Conversion Options

One key consideration with Term Life Insurance is the option for renewal or conversion. Many Term Life Insurance policies allow policyholders to renew their coverage at the end of the term, often at a higher premium rate due to the increased age of the insured.

Additionally, some policies offer the option to convert Term Life Insurance into a Whole Life Insurance policy, providing policyholders with the opportunity to transition from term coverage to permanent coverage if their financial circumstances change.

Understanding the renewal and conversion options is crucial when choosing Term Life Insurance, as it allows policyholders to plan for their long-term financial needs and adjust their coverage accordingly.

Affordability and Flexibility

Term Life Insurance is often favored for its affordability and flexibility. The lower premiums make it accessible to a wider range of individuals, especially those with limited budgets or specific financial goals.

Furthermore, the flexibility of Term Life Insurance allows policyholders to tailor their coverage to their changing needs. For example, a young couple with dependent children may opt for a 20-year term policy to provide financial protection until their children become independent. Once the children are grown, they can reassess their coverage needs and decide whether to renew, convert, or let the policy lapse.

Comparing Whole Life and Term Life Insurance

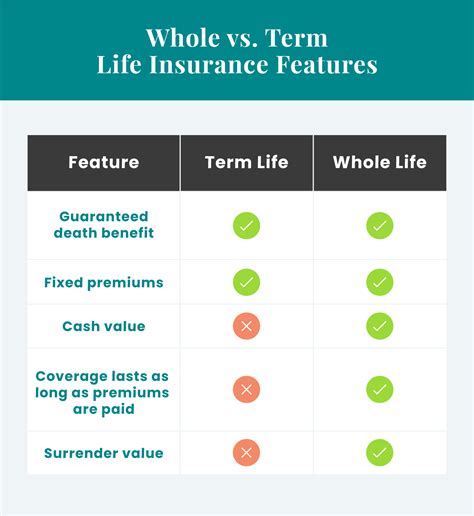

Now that we’ve explored the key features of both Whole Life and Term Life Insurance, let’s delve into a comparative analysis to help you better understand the differences and make an informed decision.

Cost and Premium Structure

The most significant difference between Whole Life and Term Life Insurance is the cost and premium structure. Whole Life Insurance premiums are generally higher and remain fixed throughout the policy’s duration. On the other hand, Term Life Insurance premiums are typically lower and may increase at the end of each term.

Policyholders should consider their budget and long-term financial goals when deciding between the two. Those seeking long-term financial protection and stability may find Whole Life Insurance more suitable, while those with short-term coverage needs or budget constraints may prefer Term Life Insurance.

Cash Value and Investment Opportunities

Whole Life Insurance’s cash value component offers policyholders an opportunity to build savings within their policy. This cash value can grow over time and provide a financial asset that can be accessed through loans, withdrawals, or surrender of the policy.

In contrast, Term Life Insurance does not offer a cash value component, focusing solely on providing death benefit coverage. Policyholders who prioritize investment opportunities and savings within their life insurance policy may find Whole Life Insurance more appealing.

Flexibility and Customization

Term Life Insurance often provides more flexibility and customization options. Policyholders can choose the term length and coverage amount based on their specific needs and circumstances. This flexibility allows for better alignment with short-term financial goals and changing life stages.

Whole Life Insurance, while offering long-term financial protection, may have more rigid terms and conditions. Policyholders should carefully review the policy’s fine print and understand the limitations and restrictions associated with Whole Life Insurance.

Renewal and Conversion Options

Term Life Insurance policies typically offer renewal options, allowing policyholders to extend their coverage beyond the initial term. However, renewal often comes at a higher premium rate due to the increased age of the insured.

Some Term Life Insurance policies also provide conversion options, enabling policyholders to convert their term coverage into a Whole Life Insurance policy. This feature provides an opportunity to transition from temporary to permanent coverage if financial circumstances or needs change.

On the other hand, Whole Life Insurance does not typically offer renewal or conversion options, as it is designed to provide lifelong coverage with fixed premiums.

Suitability for Different Life Stages

The suitability of Whole Life and Term Life Insurance can vary based on an individual’s life stage and financial goals. For example, young professionals with limited financial resources may find Term Life Insurance more accessible and suitable for their short-term coverage needs.

As individuals progress through different life stages, such as starting a family, purchasing a home, or planning for retirement, their financial goals and needs may change. In such cases, Whole Life Insurance’s long-term financial protection and stability can become more appealing.

It’s essential to regularly review and reassess your financial situation and goals to determine whether Whole Life or Term Life Insurance aligns better with your needs at different stages of life.

Making an Informed Decision

Choosing between Whole Life and Term Life Insurance involves careful consideration of your unique circumstances, financial goals, and budget. Here are some key factors to keep in mind when making your decision.

Financial Stability and Longevity

Whole Life Insurance provides financial stability and longevity, as it offers lifelong coverage with fixed premiums. If you prioritize long-term financial protection and stability, Whole Life Insurance may be the better choice.

On the other hand, if you have specific financial goals or concerns that require coverage for a limited period, Term Life Insurance can provide the necessary protection without committing to lifelong premiums.

Budget and Affordability

Your budget plays a crucial role in determining which type of life insurance is more suitable for you. Whole Life Insurance’s higher premiums may not be feasible for everyone, especially those with limited financial resources.

Term Life Insurance, with its lower premiums, offers an affordable option for those seeking coverage during specific life stages or for a set period. It’s essential to assess your budget and determine which type of insurance aligns better with your financial capabilities.

Savings and Investment Opportunities

If you are looking for life insurance that also serves as a savings or investment vehicle, Whole Life Insurance’s cash value component may be attractive. The cash value can grow over time, providing an additional financial asset.

However, it’s important to understand the potential drawbacks and tax implications of accessing the cash value. Consulting with financial professionals can help you make informed decisions regarding the use of the cash value.

Policy Flexibility and Customization

Term Life Insurance often provides more flexibility and customization options, allowing you to tailor the policy to your specific needs. If you require coverage for a limited period or have changing financial goals, Term Life Insurance may offer the necessary flexibility.

Whole Life Insurance, while providing lifelong coverage, may have more rigid terms and conditions. Policyholders should carefully review the policy’s details and understand the limitations before making a decision.

Seeking Professional Advice

Navigating the complex world of life insurance can be challenging, and seeking professional advice is highly recommended. Financial advisors and insurance experts can provide personalized guidance based on your financial situation, goals, and risk tolerance.

They can help you understand the nuances of both Whole Life and Term Life Insurance, assess your needs, and make recommendations tailored to your circumstances. Their expertise can ensure you make an informed decision that aligns with your long-term financial well-being.

Conclusion

Whole Life and Term Life Insurance are two distinct types of life insurance policies, each with its unique features and benefits. Whole Life Insurance offers lifelong coverage, fixed premiums, and a cash value component, making it a comprehensive financial solution. Term Life Insurance, on the other hand, provides coverage for a specified term, offering affordability and flexibility.

The decision between Whole Life and Term Life Insurance depends on your individual circumstances, financial goals, and budget. By understanding the key differences, considering your needs, and seeking professional advice, you can make an informed choice that provides the necessary financial protection and peace of mind.

Can I switch from Term Life Insurance to Whole Life Insurance later in life?

+Yes, many Term Life Insurance policies offer conversion options, allowing policyholders to transition from term coverage to Whole Life Insurance. However, it’s important to review the terms and conditions of your specific policy and consult with an insurance professional to understand the conversion process and any potential limitations.

Are Whole Life Insurance premiums guaranteed to remain the same throughout the policy’s duration?

+Yes, one of the key features of Whole Life Insurance is its fixed premiums. Once the policy is in force, the premiums remain the same for the entire duration of the policy, providing policyholders with long-term financial stability and predictability.

What happens if I stop paying premiums for my Whole Life Insurance policy?

+If you stop paying premiums for your Whole Life Insurance policy, the policy will typically enter a grace period, allowing you a certain amount of time to make the overdue payment. If the grace period expires without payment, the policy may lapse, and you may lose the coverage and any accumulated cash value.

Can I access the cash value of my Whole Life Insurance policy without penalties?

+Yes, you can access the cash value of your Whole Life Insurance policy through loans, withdrawals, or surrender of the policy. However, it’s important to note that accessing the cash value may have tax implications and could impact the death benefit. Consulting with a financial advisor is recommended to understand the potential drawbacks and make informed decisions.