Average Cost For Health Insurance For Family Of 5

Securing adequate health coverage for a family of five is a critical consideration for any household. With the rising costs of medical care, understanding the average expenses associated with health insurance is essential for financial planning and ensuring access to quality healthcare. This article aims to delve into the specifics of health insurance costs for families, providing an in-depth analysis of the average expenses, coverage options, and strategies to navigate this complex landscape.

Understanding the Average Cost of Health Insurance for a Family of Five

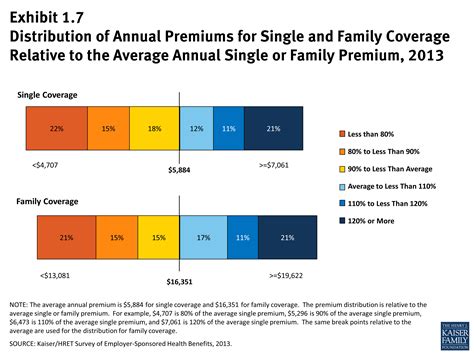

The average cost of health insurance for a family of five can vary significantly based on a multitude of factors. These include the geographical location, the specific healthcare plan chosen, the age and health status of family members, and any additional coverage options selected. As such, providing an exact figure is challenging; however, we can explore the range of expenses and the key considerations that influence them.

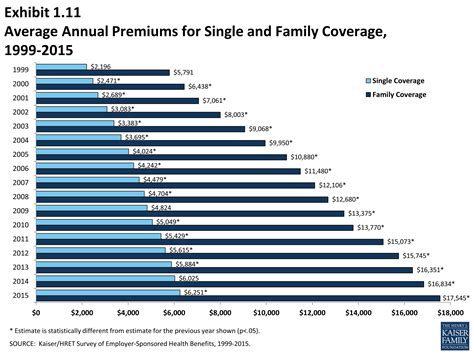

According to recent data from leading insurance providers and industry reports, the average annual premium for a family health insurance plan ranges from $15,000 to $25,000. This estimate considers a standard family plan that includes comprehensive coverage for essential health benefits, such as doctor visits, hospitalizations, prescription drugs, and preventive care. However, it's crucial to note that this is an average, and actual costs can deviate significantly based on the aforementioned factors.

Impact of Location on Insurance Costs

Geographical location plays a pivotal role in determining the cost of health insurance. Healthcare expenses, including the cost of living and medical services, can vary significantly between urban, suburban, and rural areas, as well as across different states. For instance, a family residing in a major metropolitan area may face higher insurance premiums due to the generally higher cost of living and medical services in such regions.

Additionally, state-specific regulations and mandates can influence the structure and cost of health insurance plans. Some states may require insurers to cover specific benefits or adhere to certain standards, which can impact the overall cost of the plan. Understanding the local healthcare market and state-specific regulations is essential for families to make informed decisions about their health insurance coverage.

| Location | Average Annual Premium |

|---|---|

| Urban Areas | $18,000 - $22,000 |

| Suburban Areas | $16,000 - $19,000 |

| Rural Areas | $14,000 - $17,000 |

Age and Health Status of Family Members

The age and health status of family members are significant factors influencing insurance costs. Typically, younger families tend to have lower premiums as they are generally healthier and require fewer medical services. Conversely, as families age, the risk of developing health issues increases, which can lead to higher insurance costs.

Pre-existing health conditions can also significantly impact insurance costs. If any family member has a chronic illness or requires specialized medical care, the insurance premiums may increase to cover the expected higher healthcare expenses. Some insurers may even deny coverage for certain pre-existing conditions or impose waiting periods before providing coverage for those conditions.

Coverage Options and Plan Types

The choice of coverage options and plan types is another critical factor in determining health insurance costs for families. There are various types of health insurance plans available, each with its own set of benefits, limitations, and costs. The most common plan types include:

- Health Maintenance Organizations (HMOs): HMOs typically offer lower premiums but may have more restrictions on provider choice and require prior authorization for certain services.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility in choosing healthcare providers and typically cover a wider range of services, but they often come with higher premiums.

- Exclusive Provider Organizations (EPOs): EPOs are similar to PPOs but usually have a more limited network of providers and no out-of-network coverage.

- Point-of-Service (POS) Plans: POS plans combine features of HMOs and PPOs, offering flexibility in provider choice but with varying levels of coverage and cost depending on the chosen provider.

Additionally, families may choose to enhance their coverage with additional options such as dental, vision, and disability insurance. These add-ons can significantly increase the overall cost of the insurance plan but may provide valuable peace of mind and comprehensive healthcare coverage.

Strategies for Affording Health Insurance for a Family of Five

Securing affordable health insurance for a family of five can be a challenging task, especially with the rising costs of healthcare. However, there are several strategies that families can employ to navigate this complex landscape and find the best value for their healthcare needs.

Evaluating Multiple Plan Options

When selecting a health insurance plan, it’s essential to compare multiple options to find the best fit for your family’s needs. Each insurance provider offers a range of plans with varying benefits, limitations, and costs. By evaluating these options, families can identify the plan that provides the most comprehensive coverage at the most affordable price.

Online comparison tools and insurance brokers can be invaluable resources in this process. These tools allow families to input their specific needs and preferences, and they generate a list of suitable plans with detailed information about their coverage, limitations, and costs. This enables families to make an informed decision and select the plan that aligns best with their budget and healthcare requirements.

Utilizing Government Programs and Subsidies

Government programs and subsidies can significantly reduce the cost of health insurance for eligible families. The Affordable Care Act (ACA), also known as Obamacare, provides several options for families to access affordable healthcare coverage.

The ACA's Marketplace offers a range of health insurance plans with standardized benefits and cost-sharing reductions for eligible individuals and families. Families with low to moderate incomes may qualify for premium tax credits, which can significantly reduce their monthly insurance premiums. Additionally, the ACA's expansion of Medicaid coverage provides low-cost or no-cost healthcare for eligible individuals and families with limited incomes.

It's essential for families to understand their eligibility for these programs and explore all available options to reduce their healthcare expenses.

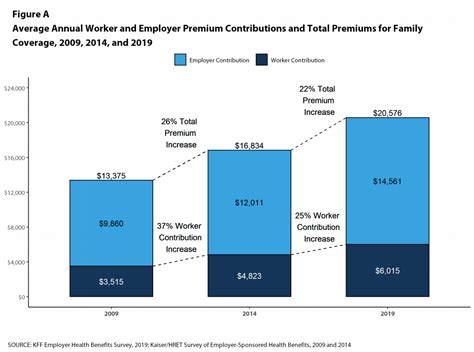

Exploring Employer-Sponsored Plans

Employer-sponsored health insurance plans are a common way for families to access comprehensive healthcare coverage. Many employers offer a range of health insurance plans as part of their employee benefits package. These plans often come with significant cost savings, as employers typically contribute to the premium costs and may offer additional perks and discounts.

When considering employer-sponsored plans, families should evaluate the coverage options, limitations, and costs carefully. It's essential to understand the specific benefits and limitations of each plan and ensure that it aligns with their healthcare needs. Additionally, families should explore any additional benefits or discounts that the employer may offer, such as wellness programs or discounted rates for certain services.

Adopting Healthy Lifestyle Habits

Adopting healthy lifestyle habits can not only improve overall health but also reduce the cost of health insurance for families. Many insurance providers offer incentives and discounts for individuals and families who demonstrate a commitment to healthy living. These incentives can include reduced premiums, waivers for certain deductibles or copayments, or access to additional wellness programs.

Families can take advantage of these incentives by engaging in regular physical activity, maintaining a healthy diet, quitting smoking, and participating in preventive healthcare measures. By adopting these healthy habits, families can not only reduce their healthcare expenses but also improve their overall well-being and quality of life.

Conclusion

Understanding the average cost of health insurance for a family of five is a critical step in navigating the complex landscape of healthcare coverage. While the exact costs can vary significantly based on various factors, families can employ strategies such as evaluating multiple plan options, utilizing government programs and subsidies, exploring employer-sponsored plans, and adopting healthy lifestyle habits to secure affordable and comprehensive healthcare coverage.

By staying informed and proactive in their approach to health insurance, families can make informed decisions that align with their healthcare needs and financial capabilities. With the right plan and a commitment to healthy living, families can ensure access to quality healthcare and peace of mind for their loved ones.

How can I find out if I’m eligible for government subsidies for health insurance?

+To determine your eligibility for government subsidies, you can visit the official Healthcare.gov website or use online tools provided by reputable insurance brokers. These resources will guide you through a series of questions to assess your income, family size, and other relevant factors to determine if you qualify for premium tax credits or other subsidies.

Are there any alternatives to traditional health insurance plans for families?

+Yes, there are alternative healthcare models that families can explore. One option is to consider high-deductible health plans (HDHPs) coupled with a health savings account (HSA). HDHPs typically have lower premiums but higher deductibles, while HSAs allow you to save money tax-free for healthcare expenses. Another alternative is to explore direct primary care (DPC) models, where you pay a monthly fee for primary care services without insurance involvement.

What should I consider when choosing a health insurance plan for my family?

+When selecting a health insurance plan, consider factors such as the plan’s coverage for essential health benefits, out-of-pocket costs (deductibles, copays, and coinsurance), provider network, and any additional benefits or perks. Evaluate your family’s healthcare needs and preferences, and compare multiple plans to find the best fit.