Car Insurance Information

Car insurance is a vital aspect of vehicle ownership, providing financial protection and peace of mind for drivers and their vehicles. In this comprehensive guide, we delve into the world of car insurance, exploring its various facets, from the essential coverages to the factors influencing premiums and the claims process. Whether you're a seasoned driver or a first-time car owner, understanding car insurance is crucial for making informed decisions and ensuring adequate protection.

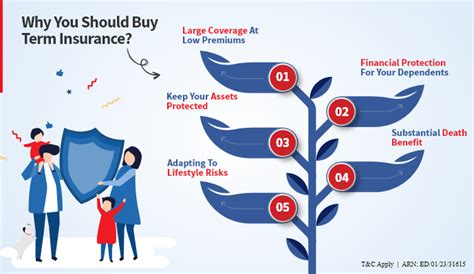

Understanding Car Insurance Coverage

Car insurance policies offer a range of coverages to protect against different risks. Let’s break down the key components:

Liability Coverage

Liability coverage is a fundamental aspect of car insurance. It safeguards policyholders against financial losses arising from accidents they cause. This coverage typically includes bodily injury liability and property damage liability. Bodily injury liability covers medical expenses and compensation for injuries sustained by others involved in an accident. Property damage liability, on the other hand, covers the cost of repairing or replacing damaged property, such as other vehicles or structures.

| Liability Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and injuries to others. |

| Property Damage Liability | Covers repairs or replacements for damaged property. |

Comprehensive and Collision Coverage

Beyond liability, car insurance policies often include comprehensive and collision coverage. Comprehensive coverage protects against non-collision incidents, such as theft, vandalism, natural disasters, or damage caused by animals. It provides financial assistance for repairs or replacements, ensuring your vehicle is protected from unforeseen events.

Collision coverage, as the name suggests, covers damages resulting from collisions with other vehicles, objects, or animals. This coverage is essential for ensuring your vehicle is repaired or replaced if you're at fault in an accident. It provides a safety net for unexpected incidents, giving you peace of mind.

Personal Injury Protection (PIP) and Medical Payments

Personal Injury Protection (PIP) and Medical Payments coverage are crucial for covering medical expenses for you and your passengers, regardless of who is at fault in an accident. PIP provides a broader range of benefits, including medical costs, lost wages, and funeral expenses. Medical Payments coverage, on the other hand, focuses solely on medical expenses.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist coverage is a vital safeguard against financial losses in the event of an accident with a driver who lacks adequate insurance coverage. This coverage ensures you’re protected from the financial burden of an accident caused by an uninsured or underinsured driver.

Factors Influencing Car Insurance Premiums

Car insurance premiums are influenced by a multitude of factors, each playing a role in determining the cost of coverage. Let’s explore these factors in detail:

Vehicle Type and Usage

The type of vehicle you drive and how you use it significantly impact your insurance premiums. High-performance cars, luxury vehicles, and sports cars often come with higher premiums due to their increased risk of accidents and higher repair costs. Additionally, the primary purpose of your vehicle, whether for personal use, business, or pleasure, can affect your insurance rates.

Driver’s Age and Experience

Age and driving experience are key factors in determining insurance premiums. Younger drivers, especially those under 25, are often considered high-risk due to their lack of experience. As a result, they typically pay higher premiums. Conversely, mature drivers with a long history of safe driving may benefit from lower rates.

Driving Record

Your driving record is a critical factor in insurance premium calculations. A clean driving record with no accidents or traffic violations can lead to lower premiums. On the other hand, a history of accidents, traffic citations, or DUI convictions can significantly increase your insurance costs.

Location and Geographic Factors

Where you live and drive plays a role in your insurance premiums. Urban areas with higher populations often have higher accident rates and theft risks, leading to increased premiums. Additionally, geographic factors like weather conditions, road quality, and crime rates can influence insurance rates.

Credit History

Surprisingly, your credit score can impact your car insurance premiums. Insurance companies often use credit-based insurance scores to assess the risk associated with insuring you. A higher credit score may result in lower premiums, as it indicates a lower risk of insurance claims.

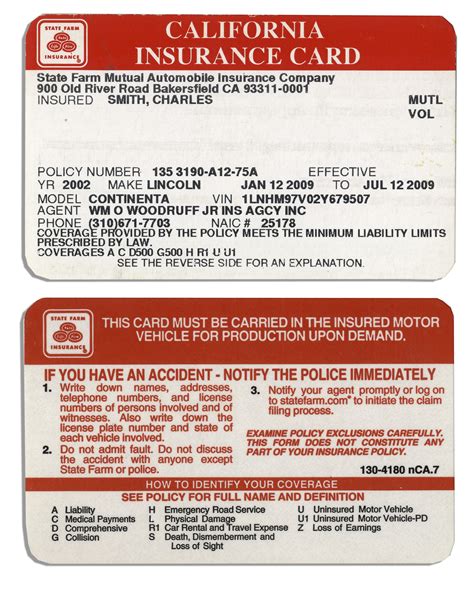

The Claims Process and Settlement

When an accident occurs, understanding the claims process is crucial for a smooth and efficient resolution. Here’s a step-by-step guide:

Reporting the Accident

Immediately after an accident, report it to your insurance company. Provide all the necessary details, including the date, time, location, and any relevant information about the other parties involved. Take photos of the accident scene and any visible damage to your vehicle.

Filing a Claim

Once you’ve reported the accident, you’ll need to file a formal claim with your insurance company. This typically involves filling out a claim form and providing additional information, such as police reports, witness statements, and repair estimates. Ensure you have all the necessary documentation ready.

Assessment and Investigation

After filing your claim, the insurance company will assess the damages and investigate the circumstances of the accident. This process may involve inspecting your vehicle, reviewing police reports, and interviewing witnesses. It’s important to cooperate fully with the investigation to ensure a swift resolution.

Settlement and Payment

Once the investigation is complete, the insurance company will determine the value of your claim and offer a settlement. This settlement will cover the repairs or replacements needed for your vehicle, as well as any medical expenses or other covered damages. If you agree with the settlement, the insurance company will process the payment, ensuring you receive the funds promptly.

Tips for Choosing the Right Car Insurance

Selecting the right car insurance policy can be a daunting task. Here are some expert tips to guide you:

Shop Around and Compare

Don’t settle for the first insurance quote you receive. Shop around and compare policies from multiple providers. Consider factors like coverage options, premiums, and customer service ratings. Online comparison tools can be a valuable resource for this process.

Understand Your Needs

Assess your specific needs and risks. Consider your vehicle’s value, your driving habits, and any additional coverage you may require. For example, if you frequently drive long distances, comprehensive coverage may be essential. Understanding your needs ensures you get the right coverage without overpaying.

Choose a Reputable Insurer

Select an insurance company with a strong reputation and financial stability. Look for companies that have a track record of prompt claim settlements and excellent customer service. Online reviews and ratings can provide valuable insights into an insurer’s reliability.

Review Your Policy Regularly

Life circumstances change, and so should your car insurance policy. Review your policy annually or whenever significant life events occur, such as getting married, buying a new car, or moving to a different location. Ensure your coverage remains adequate and aligned with your needs.

The Future of Car Insurance

The car insurance industry is evolving rapidly, driven by technological advancements and changing consumer preferences. Here’s a glimpse into the future:

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to monitor driving behavior, is gaining popularity. Usage-based insurance policies offer personalized premiums based on driving habits, encouraging safe driving practices. This technology is expected to revolutionize the way insurance premiums are calculated, making them more fair and accurate.

Connected Car Technology

With the rise of connected car technology, vehicles are becoming smarter and more integrated. This technology can provide real-time data on vehicle performance, maintenance needs, and driving behavior. Insurance companies are exploring ways to leverage this data to offer more tailored coverage and potentially reduce premiums for safe drivers.

AI and Data Analytics

Artificial Intelligence (AI) and data analytics are transforming the insurance industry. These technologies enable insurers to analyze vast amounts of data, identify patterns, and make more accurate risk assessments. This can lead to more efficient claims processing and personalized coverage options, enhancing the overall customer experience.

Sustainable and Electric Vehicles

The shift towards sustainable and electric vehicles is gaining momentum. Insurance companies are adapting their policies to accommodate these changes. Electric vehicle-specific insurance policies are becoming more common, offering tailored coverage for the unique needs of EV owners.

Conclusion

Car insurance is a vital aspect of responsible vehicle ownership, offering financial protection and peace of mind. By understanding the different coverages, factors influencing premiums, and the claims process, you can make informed decisions to ensure you have the right coverage for your needs. As the industry continues to evolve, embracing technology and sustainability, car insurance is poised to become even more personalized and efficient, benefiting both insurers and policyholders alike.

What is the difference between comprehensive and collision coverage?

+Comprehensive coverage protects against non-collision incidents like theft, vandalism, and natural disasters. Collision coverage, on the other hand, covers damages resulting from collisions with other vehicles or objects. While comprehensive coverage is optional, collision coverage is often required if you have a loan or lease on your vehicle.

How can I lower my car insurance premiums?

+There are several ways to reduce your insurance premiums. Maintaining a clean driving record, taking defensive driving courses, and bundling your insurance policies (e.g., car and home insurance) can often lead to lower rates. Additionally, consider increasing your deductible, as a higher deductible typically results in lower premiums.

What happens if I’m involved in an accident with an uninsured driver?

+If you have uninsured motorist coverage, your insurance company will step in to cover the damages caused by the uninsured driver. This coverage ensures you’re protected financially, even if the other driver lacks insurance. It’s crucial to have this coverage to safeguard yourself in such situations.