How Much Does Insurance Cost For A Small Business

Running a small business comes with its fair share of challenges, and one of the most critical aspects to consider is insurance coverage. The cost of insurance for small businesses can vary significantly based on numerous factors, including the type of business, industry, location, and level of risk associated with the operations. In this comprehensive guide, we will delve into the world of small business insurance, exploring the various factors that influence costs and providing actionable insights to help you make informed decisions.

Understanding the Importance of Insurance for Small Businesses

Insurance is an essential component of any small business’s risk management strategy. It provides a safety net against potential financial losses that could arise from unexpected events, such as property damage, liability claims, or employee injuries. By having the right insurance coverage, small business owners can protect their assets, maintain financial stability, and ensure the long-term viability of their enterprises.

Factors Influencing Insurance Costs for Small Businesses

The cost of insurance for small businesses is determined by a complex interplay of various factors. Understanding these factors is crucial for business owners to make informed decisions and potentially negotiate better rates.

Industry and Business Type

Different industries and business types carry varying levels of risk. For instance, a construction company will likely face higher insurance premiums compared to a consulting firm due to the inherent risks associated with construction work. Similarly, retail stores may require different coverage compared to online businesses, reflecting the unique challenges of each sector.

| Industry | Average Annual Premium (Est.) |

|---|---|

| Construction | $5,000 - $10,000 |

| Retail | $2,000 - $5,000 |

| Professional Services | $1,500 - $3,000 |

| Manufacturing | $4,000 - $8,000 |

These estimates provide a rough idea, but actual premiums can vary significantly based on other factors.

Business Size and Revenue

Insurance premiums often scale with the size and revenue of a business. Larger businesses with higher revenues typically pay more for insurance due to the increased potential for losses. However, economies of scale can sometimes work in favor of larger businesses, as they may qualify for bulk discounts on insurance policies.

Location and Regional Factors

The geographical location of a business can significantly impact insurance costs. Regions prone to natural disasters, such as hurricanes or earthquakes, may face higher premiums due to the increased risk of property damage. Similarly, areas with high crime rates or a history of lawsuits can also result in higher insurance costs.

| Region | Average Annual Premium Increase (Est.) |

|---|---|

| Hurricane-prone Areas | +10% - +20% |

| High Crime Rate Areas | +5% - +15% |

| Regions with Frequent Lawsuits | +8% - +12% |

Claims History and Risk Assessment

Insurance companies carefully evaluate a business’s claims history and overall risk profile when determining premiums. Businesses with a history of frequent claims or those engaged in activities considered high-risk may face higher insurance costs. Conversely, businesses with a strong safety record and effective risk management strategies may enjoy lower premiums.

Coverage Types and Limits

The type and extent of coverage chosen by a small business can significantly impact insurance costs. General liability insurance, workers’ compensation, and property insurance are common types of coverage. Businesses may opt for higher coverage limits or additional endorsements, which can increase the overall cost of their insurance policy.

Deductibles and Self-Insured Retention

Deductibles and self-insured retention (SIR) are mechanisms that allow businesses to share the risk with their insurance provider. By choosing higher deductibles or SIR, businesses can reduce their insurance premiums. However, this strategy requires careful consideration, as it means the business will bear more financial responsibility in the event of a claim.

Strategies to Optimize Insurance Costs for Small Businesses

While insurance costs are influenced by various factors beyond a business owner’s control, there are strategies that can help optimize expenses and potentially reduce premiums.

Conduct a Comprehensive Risk Assessment

Performing a thorough risk assessment is crucial for identifying potential hazards and implementing effective risk management strategies. By understanding the specific risks associated with your business, you can take proactive measures to mitigate them, which may lead to lower insurance costs.

Implement Safety Measures and Loss Prevention Programs

Insurance companies often reward businesses that demonstrate a commitment to safety and loss prevention. Implementing robust safety protocols, employee training programs, and regular maintenance checks can not only reduce the likelihood of accidents but also result in lower insurance premiums.

Bundle Policies and Utilize Group Purchasing

Bundling multiple insurance policies with the same provider can often lead to cost savings. Additionally, small business owners can explore group purchasing options through industry associations or business networks. By leveraging the collective buying power of a group, members can often negotiate better rates and discounts.

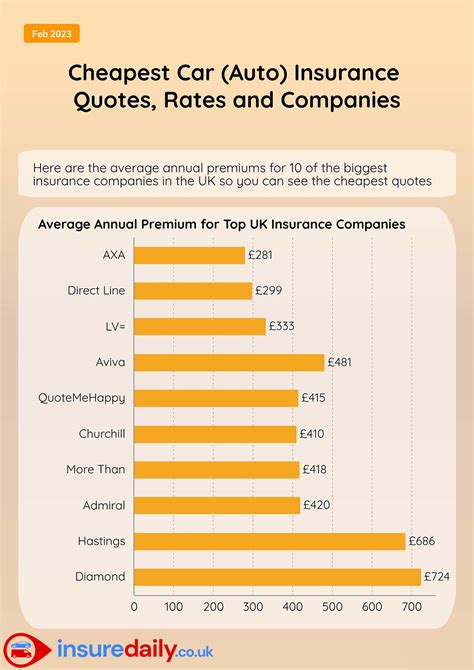

Compare Quotes and Shop Around

Insurance rates can vary significantly between providers, so it’s essential to shop around and compare quotes. Obtain quotes from multiple insurance companies and brokers to understand the market rates and identify the most competitive options. Don’t be afraid to negotiate and ask for discounts based on your business’s unique circumstances.

Consider Captive Insurance Companies

For larger small businesses or those with specific risk management needs, captive insurance companies can be a viable option. Captive insurance is a form of self-insurance where a group of businesses comes together to create their own insurance company. While it requires significant capital and expertise, captive insurance can provide greater control over coverage and potentially reduce overall insurance costs.

The Future of Small Business Insurance: Trends and Innovations

The insurance industry is constantly evolving, and several trends and innovations are shaping the landscape of small business insurance.

Technology-Driven Insurance Solutions

The rise of InsurTech (insurance technology) is transforming the way small businesses access and manage insurance. Digital platforms and data analytics are making it easier for businesses to obtain quotes, manage policies, and file claims. Additionally, the use of IoT (Internet of Things) devices and sensors can provide real-time data, allowing for more accurate risk assessment and potentially lower premiums.

Parametric Insurance and Innovative Coverage

Parametric insurance is an emerging trend that provides coverage based on predefined parameters rather than traditional claim assessments. This innovative approach, often used in disaster-prone regions, offers swift payouts based on the severity of the event, such as a hurricane or earthquake, without the need for individual claim adjustments.

Personalized Insurance and Risk Profiling

Insurance companies are increasingly leveraging data analytics and machine learning to create personalized insurance products. By analyzing a business’s unique characteristics and risk profile, insurers can offer tailored coverage options that align with the specific needs of small businesses, potentially resulting in more efficient and cost-effective insurance solutions.

Conclusion: Empowering Small Businesses with Insurance Knowledge

Understanding the factors that influence insurance costs for small businesses is a critical step toward financial empowerment and long-term success. By conducting thorough research, implementing effective risk management strategies, and exploring innovative insurance solutions, small business owners can navigate the complex world of insurance with confidence. Remember, insurance is an investment in the future of your business, and with the right knowledge and strategies, it can be a powerful tool for growth and stability.

How can I determine the right level of insurance coverage for my small business?

+Determining the right level of insurance coverage involves a careful assessment of your business’s unique risks and potential liabilities. Consider factors such as the value of your assets, the likelihood of accidents or claims, and the potential financial impact of such events. Consulting with an insurance broker or risk management specialist can help you identify the appropriate coverage limits and types of insurance required for your specific business.

Are there any tax benefits associated with small business insurance premiums?

+Yes, small business insurance premiums are generally tax-deductible. By treating insurance costs as a legitimate business expense, you can reduce your taxable income and potentially lower your overall tax liability. It’s important to consult with a tax professional to understand the specific deductions available in your jurisdiction and ensure compliance with tax regulations.

What are some common misconceptions about small business insurance?

+One common misconception is that small businesses don’t need insurance because they are too small to attract significant risks. However, even small businesses face various risks, and insurance provides crucial protection against financial losses. Another misconception is that insurance is too expensive for small businesses. While insurance costs can be significant, there are strategies to optimize premiums and ensure cost-effective coverage.