Cheapest For Car Insurance

When it comes to finding the cheapest car insurance, there are several factors to consider. Car insurance rates can vary significantly depending on various personal and environmental factors. Understanding these variables and how they influence insurance costs is essential for identifying the most affordable options available. In this comprehensive guide, we will delve into the intricacies of car insurance pricing, exploring the factors that impact rates and offering expert advice on how to secure the most cost-effective coverage for your vehicle.

Understanding Car Insurance Rates

Car insurance rates are influenced by a multitude of factors, including your driving history, location, vehicle type, and insurance provider. Each of these elements plays a crucial role in determining the cost of your policy. Let’s break down these factors and explore how they impact insurance premiums.

Your Driving Record

Your driving history is one of the most significant factors in determining car insurance rates. Insurance companies assess your driving record to evaluate your risk profile. A clean driving record with no accidents or traffic violations typically leads to lower insurance premiums. On the other hand, if you have a history of accidents or moving violations, your insurance rates may be higher. It’s essential to maintain a safe driving record to keep your insurance costs down.

Location Matters

The area where you live and drive has a significant impact on your car insurance rates. Insurance companies consider factors such as crime rates, traffic congestion, and the likelihood of accidents in your region. Areas with a higher risk of accidents or theft may result in higher insurance premiums. Additionally, some states have mandatory insurance requirements, which can influence the overall cost of your policy.

Vehicle Type and Age

The make, model, and age of your vehicle are crucial factors in determining insurance rates. Certain vehicle types, especially luxury or high-performance cars, may be more expensive to insure due to their higher repair costs and potential for theft. Older vehicles, on the other hand, may have lower insurance premiums as they are generally considered less risky. The safety features and overall value of your vehicle also play a role in determining insurance costs.

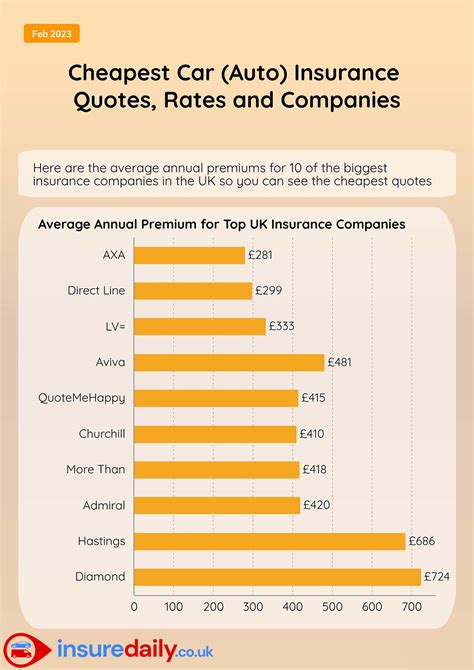

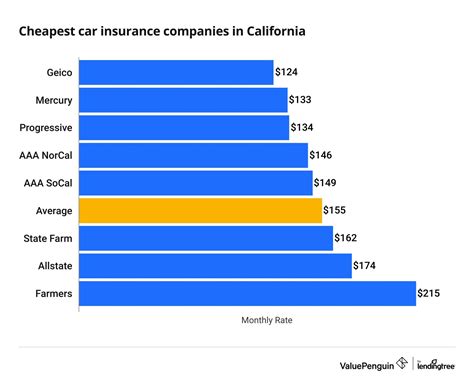

Insurance Provider Selection

Choosing the right insurance provider is essential for securing the most affordable car insurance. Different companies offer varying rates and coverage options. It’s advisable to compare quotes from multiple insurers to find the best deal. Consider factors such as customer service, financial stability, and the range of coverage options offered by each provider. Some companies may specialize in providing affordable coverage for specific demographics or vehicle types.

Strategies to Find the Cheapest Car Insurance

Now that we’ve explored the key factors influencing car insurance rates, let’s dive into some practical strategies to help you find the cheapest insurance options available.

Shop Around and Compare Quotes

Comparing quotes from multiple insurance providers is a fundamental step in finding the cheapest car insurance. Use online comparison tools or contact insurance companies directly to obtain quotes based on your specific needs. Consider factors such as coverage limits, deductibles, and any additional discounts or perks offered by each provider. By shopping around, you can identify the most competitive rates and choose the insurer that best fits your requirements.

Bundle Your Policies

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can often lead to significant savings. Many insurance companies offer multi-policy discounts, rewarding customers who choose to bundle their coverage. By consolidating your insurance needs with a single provider, you may qualify for reduced rates and streamlined billing.

Explore Discounts and Savings Opportunities

Insurance companies offer a variety of discounts to attract and retain customers. Some common discounts include safe driver discounts, multi-car discounts, good student discounts, and loyalty discounts. Additionally, certain professions or membership organizations may qualify for exclusive insurance discounts. Take the time to research and inquire about all the potential savings opportunities available to you.

Consider Higher Deductibles

Increasing your deductible can lower your insurance premiums. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you accept a larger financial responsibility in the event of an accident or claim. This approach can lead to significant savings on your insurance premiums, especially if you have a clean driving record and are unlikely to make frequent claims.

Maintain a Good Credit Score

Your credit score is often used as an indicator of financial responsibility, and it can impact your car insurance rates. Insurance companies may consider your credit score when determining your insurance premium. Maintaining a good credit score can potentially lead to lower insurance rates. Take steps to improve your credit score, such as paying bills on time, reducing debt, and regularly reviewing your credit report for accuracy.

Research Insurance Companies’ Financial Stability

When selecting an insurance provider, it’s crucial to consider their financial stability. A financially stable insurance company is more likely to honor your claims and provide long-term value. Research the insurer’s financial strength ratings from reputable rating agencies like AM Best or Standard & Poor’s. These ratings assess an insurer’s ability to meet its financial obligations and provide an indication of their stability and reliability.

Choose the Right Coverage

While it’s tempting to opt for the cheapest insurance option, it’s essential to ensure that you have adequate coverage. Evaluate your specific needs and choose a policy that provides sufficient protection for your vehicle and your financial well-being. Consider factors such as liability limits, collision and comprehensive coverage, and any additional coverage options that may be beneficial, such as rental car reimbursement or roadside assistance.

Case Study: Real-Life Savings

To illustrate the potential savings achievable through strategic insurance choices, let’s explore a real-life case study. John, a 30-year-old professional, recently decided to review his car insurance options. By shopping around and comparing quotes, he discovered that he could save over 300 annually by switching insurance providers. Additionally, by bundling his car insurance with his homeowners insurance policy, he qualified for a multi-policy discount, resulting in further savings of 150 per year. By implementing these simple strategies, John was able to reduce his insurance costs significantly without compromising on coverage.

| Strategy | Savings |

|---|---|

| Switching Insurance Providers | $300 annually |

| Bundling Policies | $150 annually |

Frequently Asked Questions

How can I lower my car insurance premiums if I have a poor driving record?

+If you have a less-than-perfect driving record, there are still ways to reduce your insurance premiums. Consider taking defensive driving courses, which may qualify you for a safe driver discount. Additionally, maintaining a clean driving record for an extended period can lead to reduced rates over time. Exploring insurance companies that specialize in providing coverage for high-risk drivers may also help you find more affordable options.

Are there any insurance companies that offer specialized policies for older vehicles?

+Yes, some insurance companies recognize that older vehicles have different insurance needs. They offer specialized policies for classic cars, antique vehicles, or vintage cars. These policies often provide tailored coverage options, such as agreed-value coverage, which ensures that your vehicle is insured for its actual value rather than its depreciated worth. It’s worth exploring these options if you own an older vehicle.

Can I get car insurance without a driver’s license?

+Obtaining car insurance without a valid driver’s license can be challenging. Most insurance companies require proof of a valid driver’s license to provide coverage. However, there may be exceptions for certain situations, such as if you’re the registered owner of a vehicle but do not intend to drive it yourself. It’s best to consult with insurance providers directly to understand their specific requirements and explore any potential alternatives.