Senior Health Insurance

As the world's population continues to age, the demand for comprehensive and affordable healthcare options becomes increasingly crucial. Among the various health insurance plans available, Senior Health Insurance stands out as a vital component of the healthcare landscape, specifically catering to the unique needs of older adults. This article aims to delve into the intricacies of Senior Health Insurance, offering a detailed exploration of its benefits, coverage options, and the impact it can have on the lives of seniors.

Understanding Senior Health Insurance: A Comprehensive Overview

Senior Health Insurance, also known as Medicare Supplement Insurance or Medigap, is a type of health coverage designed to fill the gaps left by original Medicare plans. It is specifically tailored to meet the healthcare needs of individuals aged 65 and above, as well as those under 65 with certain disabilities. While original Medicare provides a solid foundation of coverage, Senior Health Insurance takes it a step further, offering enhanced benefits and financial protection.

Key Features and Benefits of Senior Health Insurance

Senior Health Insurance offers a range of advantages that can significantly improve the healthcare experience for seniors. One of its primary benefits is the expanded coverage it provides. Unlike original Medicare, which often leaves individuals responsible for various out-of-pocket costs, Senior Health Insurance plans cover a broader spectrum of expenses. This includes deductibles, co-payments, and coinsurance, ensuring that seniors are not burdened with excessive financial obligations during their medical journeys.

Additionally, Senior Health Insurance plans often cover services not typically included in original Medicare. These may include prescription drugs, which are crucial for managing chronic conditions commonly experienced by older adults. By including prescription drug coverage, Senior Health Insurance plans ensure that seniors have access to the medications they need without facing the financial strain of high drug costs.

Another key benefit is the flexibility and customization that Senior Health Insurance plans offer. With a variety of plan options available, seniors can choose the level of coverage that best suits their individual needs and preferences. This flexibility allows for a more personalized healthcare experience, ensuring that seniors receive the care they require without unnecessary over- or under-coverage.

| Senior Health Insurance Benefits | Description |

|---|---|

| Enhanced Coverage | Reduced out-of-pocket expenses, including deductibles, co-payments, and coinsurance. |

| Prescription Drug Coverage | Access to medications without the financial burden of high drug costs. |

| Plan Flexibility | Choice of coverage levels to suit individual needs and preferences. |

Coverage Options and Plan Types

Senior Health Insurance plans come in various forms, each offering a unique set of benefits and coverage options. Understanding the different plan types is essential for seniors to make informed decisions about their healthcare coverage.

The most common Senior Health Insurance plans are categorized as Medigap plans A through N. Each plan offers a specific set of benefits, with varying levels of coverage. For instance, Plan A provides basic coverage, while Plan F offers the most comprehensive benefits, including coverage for Medicare Part B deductible and excess charges. Plan G, on the other hand, offers a more cost-effective option with similar benefits to Plan F, but with the exception of the Part B deductible.

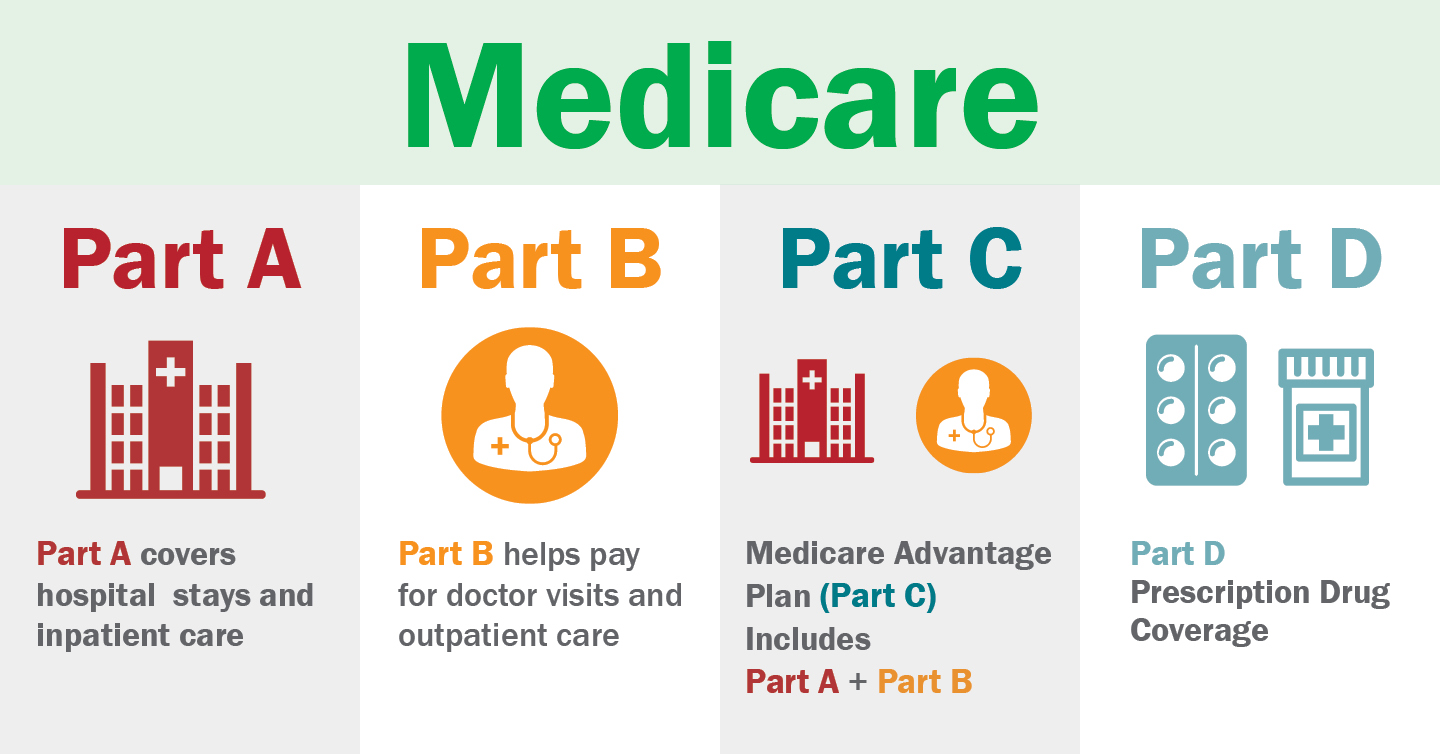

Additionally, there are Medicare Advantage plans (Part C), which are an alternative to original Medicare. These plans are offered by private insurance companies and often include additional benefits such as prescription drug coverage and vision or dental care. While Medicare Advantage plans provide comprehensive coverage, it's important to note that they may have restrictions on the healthcare providers and facilities one can use.

To further illustrate the coverage options, consider the following table comparing the benefits of different Senior Health Insurance plans:

| Plan Type | Benefits Covered |

|---|---|

| Plan A | Hospital coinsurance, Part A hospice care coinsurance, skilled nursing facility coinsurance |

| Plan F | All benefits covered, including Part B deductible and excess charges |

| Plan G | All benefits except Part B deductible |

| Medicare Advantage (Part C) | Varies based on the plan, but may include prescription drugs, vision, and dental care |

The Impact of Senior Health Insurance on the Lives of Seniors

Senior Health Insurance plays a transformative role in the lives of older adults, offering peace of mind and improved access to quality healthcare. By providing enhanced coverage and financial protection, these plans empower seniors to focus on their health without the constant worry of mounting medical expenses.

Financial Security and Peace of Mind

One of the most significant impacts of Senior Health Insurance is the financial security it offers. With the majority of healthcare costs covered, seniors can avoid the stress and anxiety associated with unexpected medical bills. This financial stability allows them to plan their retirement funds more effectively and allocate resources towards other essential aspects of their lives, such as travel, hobbies, or supporting family members.

Additionally, Senior Health Insurance reduces the risk of medical debt, which is a common concern among older adults. By covering a broader range of expenses, these plans ensure that seniors are not left with overwhelming medical bills, protecting them from the potential consequences of unpaid medical debts, such as ruined credit scores or financial strain.

Improved Access to Quality Healthcare

Senior Health Insurance plans not only provide financial protection but also enhance access to quality healthcare services. With reduced out-of-pocket costs, seniors are more likely to seek the medical attention they need without hesitation. This proactive approach to healthcare can lead to early detection and treatment of health issues, ultimately improving overall health outcomes.

Furthermore, the expanded coverage of Senior Health Insurance plans often includes specialized care and services that may not be covered by original Medicare. This includes access to innovative treatments, specialized therapies, and support services that can significantly improve the quality of life for seniors. By covering these additional services, Senior Health Insurance plans ensure that older adults receive the comprehensive care they deserve.

Promoting Independence and Well-being

Senior Health Insurance plays a crucial role in promoting independence and overall well-being among older adults. By covering a wide range of healthcare expenses, these plans enable seniors to maintain their independence and continue living active, fulfilling lives. With the assurance of comprehensive coverage, seniors can participate in social activities, engage in physical exercise, and pursue hobbies without the constant concern of healthcare costs.

Moreover, Senior Health Insurance plans often include preventive care services, such as annual wellness visits and screenings. These services are vital in detecting potential health issues early on, allowing for timely intervention and management. By investing in preventive care, Senior Health Insurance plans contribute to the overall health and longevity of seniors, ensuring they can enjoy their golden years to the fullest.

Conclusion: A Crucial Component of Senior Healthcare

Senior Health Insurance is an essential component of the healthcare landscape, offering older adults the coverage and financial protection they need to navigate their healthcare journeys with confidence. By providing expanded benefits and customized plans, these insurance options empower seniors to make informed decisions about their healthcare and focus on their well-being.

As the population continues to age, the demand for Senior Health Insurance will only grow. It is imperative that seniors, caregivers, and policymakers alike understand the significance of these plans and the positive impact they can have on the lives of older adults. With the right Senior Health Insurance coverage, seniors can age gracefully, knowing that their healthcare needs are well-supported and their financial security is protected.

How do I enroll in Senior Health Insurance?

+

Enrollment in Senior Health Insurance, also known as Medicare Supplement Insurance, typically occurs during specific enrollment periods. These periods include the Initial Enrollment Period, which begins three months before the month you turn 65 and continues for seven months, and the Annual Enrollment Period, which runs from October 15 to December 7 each year. During these periods, you can enroll in a Medigap plan that suits your needs. It’s important to research and compare different plans to find the one that best aligns with your healthcare requirements and budget.

Can I have both original Medicare and Senior Health Insurance?

+

Yes, you can have both original Medicare and Senior Health Insurance. Senior Health Insurance, or Medigap, is designed to supplement original Medicare coverage. It fills the gaps left by original Medicare, covering expenses such as deductibles, co-payments, and coinsurance. Having both original Medicare and Senior Health Insurance provides a more comprehensive level of coverage, ensuring that you have financial protection for a wider range of healthcare expenses.

What are the differences between Senior Health Insurance plans A, F, and G?

+

Senior Health Insurance plans A, F, and G are Medigap plans that offer different levels of coverage. Plan A provides the most basic coverage, covering hospital coinsurance, Part A hospice care coinsurance, and skilled nursing facility coinsurance. Plan F offers the most comprehensive coverage, including all benefits covered by Medicare Part A and Part B, as well as the Part B deductible and excess charges. Plan G is similar to Plan F but does not cover the Part B deductible. It’s important to carefully consider your healthcare needs and budget when choosing between these plans.