Self Insure

Self-insurance is a financial strategy that involves an entity, typically a business or organization, assuming the risk and financial responsibility for its own potential losses, rather than relying solely on traditional insurance policies. This practice has gained prominence in recent years as a cost-effective and flexible alternative to traditional insurance models. By self-insuring, businesses can gain more control over their financial strategies and potentially reduce expenses associated with insurance premiums.

While the concept of self-insurance has been around for decades, it has evolved significantly, particularly with the advent of advanced risk management techniques and the growing focus on data-driven decision-making. This article delves into the intricacies of self-insurance, exploring its benefits, challenges, and the strategic considerations involved in implementing this alternative insurance model.

Understanding Self-Insurance: Definition and Key Principles

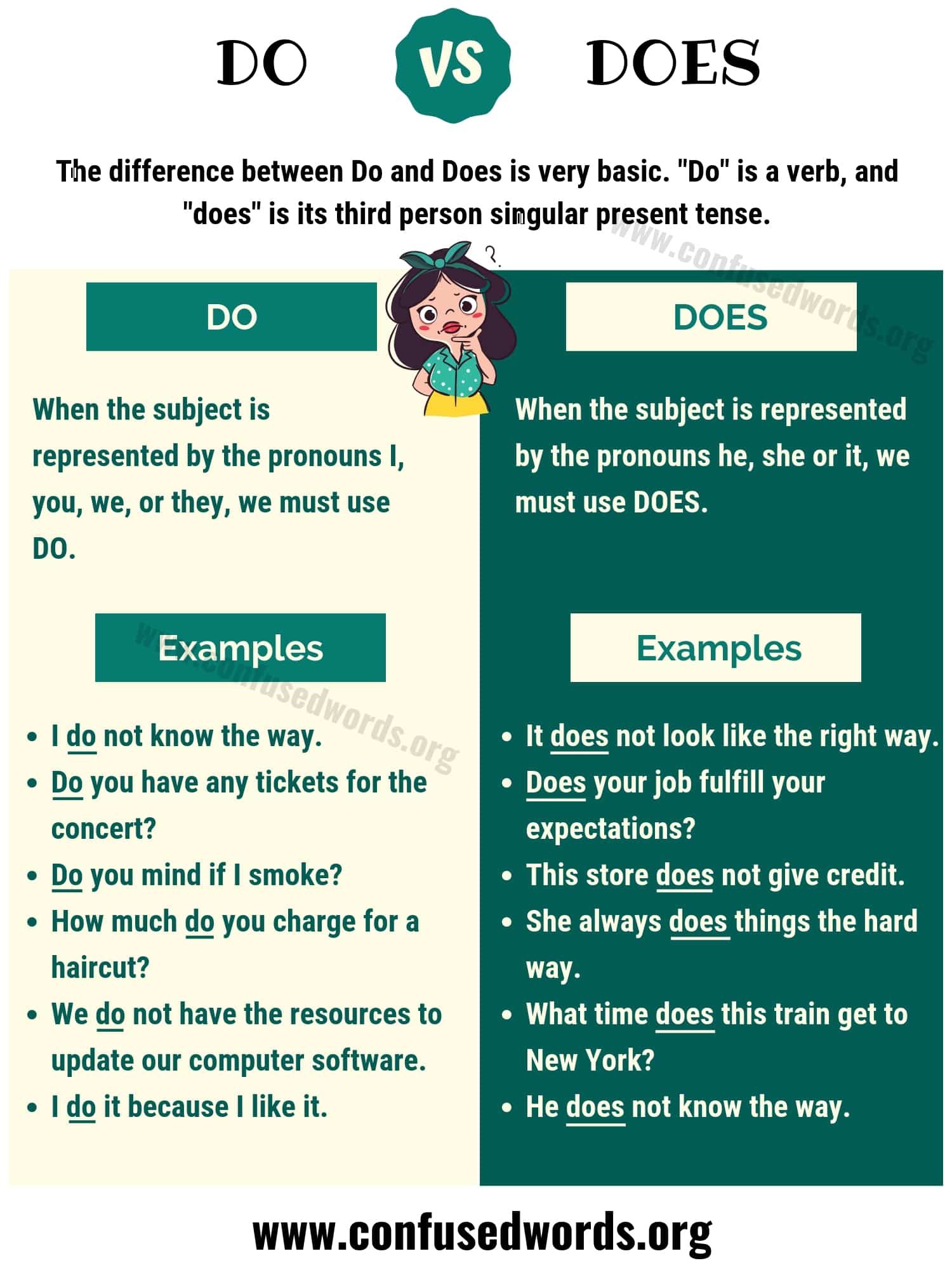

Self-insurance, also known as self-funded insurance or retained risk, is a strategy where an entity retains the financial responsibility for its own risks and losses, rather than transferring them to an insurance company through traditional insurance policies. This approach allows businesses to directly manage their own risk pool and control their exposure to potential losses.

At its core, self-insurance involves setting aside funds to cover anticipated losses. This can be done through a variety of methods, including the establishment of dedicated reserve funds, the use of captive insurance companies, or the creation of specialized self-insurance pools. By retaining risk, businesses can tailor their risk management strategies to their specific needs and operational environments.

The key principles of self-insurance include:

- Risk Assessment and Management: Thorough analysis of potential risks and the development of strategies to mitigate or control them. This includes identifying risks, quantifying their potential impact, and implementing measures to reduce or transfer residual risks.

- Financial Reserves: Setting aside sufficient funds to cover anticipated losses. These reserves should be strategically managed to ensure they can meet the entity's financial obligations in the event of a loss.

- Loss Control and Prevention: Implementing measures to reduce the frequency and severity of losses. This can include safety protocols, employee training, and the use of technology to minimize the likelihood of incidents.

- Claim Management: Efficient handling of claims to ensure prompt resolution and minimize costs. This involves establishing clear claim processes, negotiating with claimants, and managing the financial impact of claims.

- Risk Transfer: While self-insurance primarily involves retaining risk, entities may still choose to transfer certain high-value or catastrophic risks to insurance companies or other risk-sharing entities.

Benefits of Self-Insurance: Cost Savings and Control

Self-insurance offers a range of benefits to businesses and organizations, particularly those with a good understanding of their risk profile and financial capabilities. Some of the key advantages include:

Cost Savings

One of the most significant benefits of self-insurance is the potential for cost savings. By retaining risk and managing it internally, businesses can avoid the high premiums often associated with traditional insurance policies. Self-insurance allows entities to set aside funds specifically for potential losses, which can be more cost-effective than paying regular insurance premiums, especially for businesses with a good loss history.

| Cost Comparison | Traditional Insurance | Self-Insurance |

|---|---|---|

| Premium Payments | Fixed, regardless of claims | Flexible, based on actual losses |

| Claim Settlements | Dependent on insurance coverage | Directly controlled by the entity |

| Risk Management | Limited control over risk mitigation | Full control over risk strategies |

Entities can save on administrative costs associated with traditional insurance, such as broker fees and insurance company overhead expenses. Additionally, self-insurance allows for a more direct and efficient claims process, reducing the costs and time associated with claim settlements.

Control and Flexibility

Self-insurance provides businesses with a higher degree of control over their financial strategies and risk management processes. By retaining risk, entities can customize their risk management approaches to align with their specific needs and operational realities. This level of control allows for more efficient allocation of resources and the ability to adapt to changing risk landscapes.

Furthermore, self-insurance offers flexibility in how funds are allocated. Unlike traditional insurance, where premiums are often fixed regardless of claims history, self-insured entities can adjust their financial reserves based on their actual loss experience. This flexibility enables businesses to optimize their financial strategies and respond to changing market conditions.

Financial Stability and Cash Flow Management

Self-insurance can contribute to financial stability by providing a more predictable and controlled approach to managing potential losses. By setting aside funds for anticipated losses, entities can better manage their cash flow and financial obligations. This stability is particularly beneficial for businesses with a steady and predictable loss history, as it allows for more accurate financial planning and budgeting.

Challenges and Considerations in Self-Insurance

While self-insurance offers numerous benefits, it also presents several challenges and considerations that entities must carefully navigate. Some of the key challenges include:

Financial Capacity and Reserve Management

Self-insurance requires entities to have the financial capacity to set aside sufficient reserves to cover potential losses. This can be a significant challenge, especially for smaller businesses or those with limited financial resources. Entities must carefully assess their financial capabilities and ensure that they can adequately fund their self-insurance reserves without compromising their overall financial stability.

Effective reserve management is crucial to the success of self-insurance. Entities must strike a balance between maintaining sufficient reserves to cover potential losses and optimizing the use of these funds for other business needs. This requires a thorough understanding of the entity's risk profile, loss history, and the ability to accurately forecast future losses.

Risk Assessment and Mitigation

Accurate risk assessment is fundamental to the success of self-insurance. Entities must have a deep understanding of their risk exposure and the potential impact of various losses. This involves identifying all relevant risks, assessing their likelihood and severity, and developing effective strategies to mitigate or control these risks.

Risk mitigation measures can include implementing safety protocols, investing in technology to reduce risk exposure, and providing employee training to minimize the likelihood of incidents. By actively managing risks, entities can reduce the frequency and severity of losses, making self-insurance a more viable and cost-effective option.

Regulatory and Legal Considerations

Self-insurance is subject to various regulatory and legal requirements, which can vary depending on the jurisdiction and industry. Entities must ensure they comply with all relevant laws and regulations, including those related to reserve requirements, financial reporting, and claim handling. Non-compliance can result in significant penalties and legal consequences.

Additionally, entities should consider the potential impact of self-insurance on their insurance coverage. In some cases, self-insurance may affect the availability or cost of traditional insurance policies. It is important to carefully assess the potential implications and ensure that the entity maintains adequate coverage for all risks, including those that may be difficult or costly to self-insure.

Implementing Self-Insurance: A Strategic Approach

Implementing self-insurance requires a strategic and well-planned approach. Entities should consider the following key steps to ensure a successful transition:

Risk Assessment and Planning

Begin by conducting a comprehensive risk assessment to identify all relevant risks and their potential impact. This assessment should consider historical loss data, industry trends, and the entity’s unique operational environment. Based on this assessment, develop a risk management plan that outlines strategies for mitigating or controlling identified risks.

Financial Reserve Strategies

Determine the appropriate financial reserves needed to cover potential losses. This involves analyzing historical loss data, forecasting future losses, and setting aside sufficient funds to meet these anticipated obligations. Consider the entity’s financial capacity and explore options for funding reserves, such as dedicated accounts, captive insurance companies, or third-party funding arrangements.

Claim Management and Administration

Establish efficient claim management processes to ensure prompt and fair claim settlements. Develop clear guidelines for claim handling, including procedures for claim reporting, investigation, and resolution. Consider outsourcing claim administration to specialized firms to ensure expertise and efficiency in managing claims.

Risk Transfer and Reinsurance

While self-insurance primarily involves retaining risk, entities should still consider the benefits of risk transfer for certain high-value or catastrophic risks. Evaluate the potential for reinsurance or other risk-sharing arrangements to ensure adequate coverage for extreme or unpredictable losses. These arrangements can provide additional financial protection and stability.

Continuous Monitoring and Adaptation

Self-insurance is an ongoing process that requires continuous monitoring and adaptation. Regularly review the entity’s risk profile, loss history, and financial reserves to ensure they remain adequate and aligned with the entity’s needs. Stay informed about industry trends, regulatory changes, and new risk management techniques to optimize the self-insurance strategy over time.

Conclusion: Self-Insurance as a Strategic Financial Tool

Self-insurance offers businesses and organizations a strategic alternative to traditional insurance models, providing cost savings, control, and flexibility. By assuming financial responsibility for their own risks, entities can tailor their risk management approaches to their specific needs and operational environments. However, successful self-insurance requires a comprehensive understanding of risk, financial capabilities, and regulatory requirements.

As businesses navigate an increasingly complex risk landscape, self-insurance can be a powerful tool for financial stability and strategic advantage. By implementing a well-planned and carefully managed self-insurance strategy, entities can optimize their financial resources, improve cash flow management, and maintain control over their risk management processes.

Ultimately, self-insurance represents a shift from a reactive approach to risk management to a proactive and strategic one, empowering businesses to take ownership of their financial destinies and adapt to the ever-changing risk environment.

How does self-insurance differ from traditional insurance policies?

+Self-insurance differs from traditional insurance policies in that it involves an entity assuming financial responsibility for its own risks and losses, rather than transferring them to an insurance company. This means that instead of paying premiums to an insurer, the entity sets aside funds to cover anticipated losses. Self-insurance provides more control over risk management strategies and can lead to cost savings, especially for entities with a good loss history.

What are the key challenges in implementing self-insurance?

+The key challenges in implementing self-insurance include financial capacity, as entities must have the resources to set aside sufficient reserves. Accurate risk assessment and mitigation are also crucial, as entities must understand their risk exposure and implement effective strategies to control losses. Additionally, regulatory and legal considerations must be carefully navigated to ensure compliance and avoid penalties.

How can entities ensure they have adequate financial reserves for self-insurance?

+Entities should conduct a thorough financial analysis to determine their capacity to set aside reserves for self-insurance. This involves assessing historical loss data, forecasting future losses, and evaluating their financial resources. They may also consider seeking professional advice to develop a robust financial reserve strategy, which could include options such as dedicated accounts, captive insurance companies, or third-party funding arrangements.

What are the potential benefits of self-insurance for businesses?

+Self-insurance offers businesses several benefits, including cost savings on insurance premiums, increased control over risk management strategies, and flexibility in financial planning. It allows businesses to tailor their risk management approaches to their specific needs and can provide a more efficient and direct claims process. Additionally, self-insurance can contribute to financial stability by providing a controlled approach to managing potential losses.