How To Get Health Insurance Immediately

Navigating the healthcare system and securing adequate insurance coverage can be a complex and often urgent task. In this comprehensive guide, we delve into the strategies and steps to acquire health insurance swiftly, ensuring immediate protection for you and your loved ones. From understanding the different types of plans to exploring enrollment options, we aim to provide a clear roadmap for prompt insurance acquisition.

Understanding Health Insurance Plans

Health insurance plans come in various forms, each with unique features and coverage options. The two primary types are private health insurance and public health insurance, often offered through government programs. Private plans offer more flexibility and a wider range of options, while public plans provide essential coverage and are often more affordable.

Private Health Insurance Plans

Private health insurance plans are typically offered by insurance companies and can be purchased directly or through an insurance broker. These plans offer a diverse range of coverage options, from comprehensive plans that cover a wide array of medical services to more specialized plans focused on specific health needs.

For instance, some private plans offer dental and vision coverage, which can be crucial for maintaining overall health. Others provide prescription drug coverage, ensuring access to essential medications. Additionally, private plans often feature wellness programs and preventative care services, encouraging proactive health management.

Public Health Insurance Plans

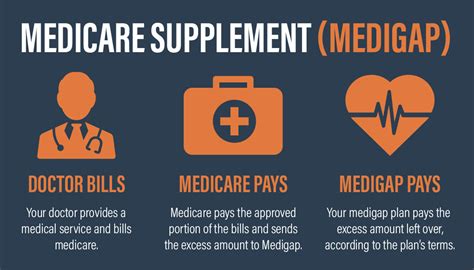

Public health insurance plans are typically government-sponsored and are designed to provide affordable, essential health coverage to specific populations. In the United States, for example, programs like Medicaid and Medicare are key public health insurance options. Medicaid provides health coverage for eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. Medicare, on the other hand, primarily serves individuals aged 65 and older, as well as younger people with disabilities.

These public plans often have lower premiums and deductibles, making them more accessible for those with limited financial resources. However, they may have more restricted coverage options compared to private plans.

Exploring Immediate Enrollment Options

When time is of the essence, it’s essential to explore the various avenues for immediate enrollment in health insurance plans. Here are some strategies to consider:

Special Enrollment Periods (SEPs)

Many countries and regions offer Special Enrollment Periods (SEPs) outside of the standard open enrollment period. These SEPs allow individuals to enroll in health insurance plans due to specific life events, such as losing existing coverage, moving to a new area, getting married, or having a baby. Check the eligibility criteria and deadlines for SEPs in your region to take advantage of this immediate enrollment opportunity.

Short-Term Health Insurance Plans

Short-term health insurance plans are a temporary solution for individuals needing immediate coverage. These plans offer limited coverage for a short duration, typically lasting from a few months to a year. They can be a viable option for those in-between jobs, awaiting long-term coverage, or facing a temporary gap in their insurance.

While short-term plans are more affordable than traditional plans, they often have higher out-of-pocket costs and more restrictive coverage. It’s essential to carefully review the plan’s terms and conditions to ensure it meets your specific health needs.

Government-Sponsored Programs

Government-sponsored programs, such as Medicaid and Medicare, often have enrollment periods that allow for immediate coverage. These programs prioritize the enrollment of eligible individuals, ensuring prompt access to essential health services. Check the enrollment timelines and requirements for these programs to assess your eligibility and expedite the enrollment process.

Comparing Costs and Coverage

When selecting a health insurance plan, it’s crucial to compare costs and coverage to find the best fit for your needs. Here’s a breakdown of key factors to consider:

Premiums and Deductibles

Premiums are the regular payments you make to maintain your insurance coverage. Deductibles, on the other hand, are the amount you pay out of pocket before your insurance coverage kicks in. When comparing plans, consider the balance between premium affordability and deductible manageability. Lower premiums may seem attractive, but they often come with higher deductibles, impacting your overall out-of-pocket expenses.

Coverage Limits and Networks

Health insurance plans have coverage limits, which define the maximum amount the insurer will pay for specific services. Additionally, they have provider networks, which are lists of healthcare providers and facilities that the insurer has contracted with. When selecting a plan, ensure that your preferred doctors and hospitals are within the plan’s network to avoid unexpected out-of-network costs.

Benefits and Exclusions

Each health insurance plan comes with a unique set of benefits and exclusions. Benefits are the services and treatments covered by the plan, while exclusions are the services and treatments that are not covered. Carefully review the plan’s benefits and exclusions to ensure it aligns with your specific health needs and any pre-existing conditions you may have.

Performance and Reputation Analysis

Assessing the performance and reputation of health insurance providers is crucial to ensuring you receive quality coverage and care. Here are some factors to consider:

Claim Satisfaction and Processing Times

The efficiency and accuracy of claim processing are essential indicators of an insurer’s performance. Look for insurers with high claim satisfaction rates and prompt processing times. Delayed or denied claims can lead to financial strain and hinder access to necessary healthcare services.

Provider Networks and Quality of Care

The quality of an insurer’s provider network directly impacts the quality of care you receive. Research the reputation and expertise of the doctors, specialists, and hospitals within the plan’s network. Ensure they have a good track record and are known for providing high-quality, patient-centered care.

Customer Service and Support

Access to responsive and knowledgeable customer service is crucial when navigating the complexities of health insurance. Look for insurers with easily accessible support channels, such as online portals, phone lines, and live chat options. Positive customer reviews and feedback can also indicate a provider’s commitment to excellent customer service.

| Plan Type | Key Features |

|---|---|

| Private Health Insurance | Flexible coverage options, wellness programs, specialized plans |

| Public Health Insurance | Affordable premiums, essential coverage, government-sponsored |

Can I get health insurance immediately if I have a pre-existing condition?

+Yes, under the Affordable Care Act (ACA), insurance companies cannot deny coverage based on pre-existing conditions. However, the specific rules and regulations vary by region and plan. It’s essential to review the plan’s terms and conditions to understand how pre-existing conditions are handled.

Are there any financial assistance programs for health insurance?

+Yes, many regions offer financial assistance programs to help individuals and families afford health insurance. These programs often provide subsidies or tax credits based on income and family size. Check with your local government or insurance provider to learn about the available assistance programs.

What happens if I miss the enrollment deadline for health insurance?

+Missing the enrollment deadline can result in a gap in coverage. However, you may still have options. Explore Special Enrollment Periods (SEPs) triggered by life events or consider short-term health insurance plans as a temporary solution until the next open enrollment period.