Buy Online Insurance

In today's fast-paced world, convenience and efficiency are key factors in our decision-making processes, and this extends to how we manage our insurance needs. The traditional methods of visiting insurance agents or brokers in person are slowly being replaced by the ease and accessibility of buying insurance online. This shift towards digital platforms offers numerous benefits, not only for consumers but also for insurance providers, creating a more streamlined and personalized experience. As we delve into the world of online insurance, we'll uncover the advantages, the considerations, and the future prospects of this evolving industry.

The Rise of Online Insurance: A Digital Revolution

The insurance industry has witnessed a significant transformation with the advent of digital technology. The rise of online insurance platforms has revolutionized the way we access and purchase insurance policies. No longer confined to physical offices or lengthy paperwork, consumers now have the power to compare policies, obtain quotes, and make informed decisions from the comfort of their homes or on-the-go via their mobile devices.

This digital shift has not only simplified the insurance shopping experience but has also empowered consumers with greater control and transparency. Online insurance platforms provide a vast array of options, allowing users to tailor their policies to their specific needs. Whether it's auto, home, health, or life insurance, the ability to customize coverage and compare prices has become a game-changer, fostering a more competitive and consumer-centric market.

Moreover, the convenience of online insurance extends beyond just the purchasing process. Many platforms now offer digital tools and resources to manage policies, file claims, and access important documents, providing a seamless and efficient experience that aligns with the modern consumer's expectations.

Benefits of Buying Insurance Online

The advantages of purchasing insurance online are multifaceted and have contributed significantly to its popularity. Firstly, the convenience factor cannot be overstated. With online insurance, consumers can access a wide range of policies and providers 24⁄7, eliminating the need for physical appointments or office hours. This flexibility is particularly beneficial for those with busy schedules or those who prefer the convenience of shopping from home.

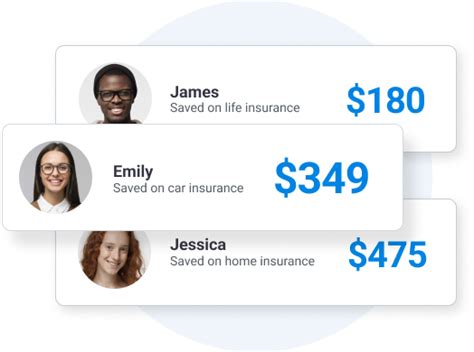

Secondly, the transparency and comparability offered by online platforms are unparalleled. Consumers can easily compare multiple policies side-by-side, ensuring they make well-informed decisions. The ability to quickly assess coverage, premiums, and additional benefits empowers individuals to choose the best option for their needs. This level of transparency also fosters a competitive market, driving insurance providers to offer more attractive rates and benefits.

Additionally, online insurance platforms often provide a more personalized experience. Through advanced algorithms and data analysis, these platforms can offer tailored recommendations based on an individual's specific circumstances and preferences. This level of customization ensures that consumers receive policies that are not only cost-effective but also comprehensive and suited to their unique needs.

| Key Benefits of Online Insurance | Description |

|---|---|

| Convenience | Access policies and providers anytime, anywhere, without physical appointments. |

| Transparency | Compare policies side-by-side, ensuring informed decisions and competitive rates. |

| Personalization | Tailored recommendations based on individual circumstances for a customized experience. |

Choosing the Right Online Insurance Platform

With the proliferation of online insurance platforms, selecting the right one can be a daunting task. It’s crucial to consider various factors to ensure you make an informed decision. Firstly, assess the platform’s reputation and track record. Look for reviews and testimonials from other users to gauge the platform’s reliability and customer satisfaction.

Secondly, evaluate the range of policies and providers available on the platform. A diverse selection ensures that you have ample options to choose from, catering to your specific insurance needs. Additionally, consider the platform's user-friendliness and navigation. A well-designed interface can significantly enhance your experience, making it easier to compare policies, obtain quotes, and complete the purchasing process.

Furthermore, explore the platform's additional features and services. Many online insurance platforms offer value-added tools such as policy management, claim filing assistance, and educational resources. These features can provide ongoing support and convenience, ensuring a seamless experience beyond the initial purchase.

Key Considerations for Platform Selection

When navigating the vast landscape of online insurance platforms, it’s essential to keep certain key considerations in mind. Firstly, the platform’s security and data protection protocols should be a top priority. Ensure that the platform employs robust measures to safeguard your personal information and financial details. Look for platforms that adhere to industry standards and regulations, providing peace of mind regarding data privacy.

Secondly, consider the platform's customer support offerings. While online platforms provide convenience, there may be instances where you require assistance or have complex queries. A platform with responsive and knowledgeable customer support ensures that you receive timely help and guidance when needed.

Lastly, explore the platform's additional features and benefits. Many online insurance platforms go beyond the basic policy comparison and purchasing process. They may offer resources for policy management, claim tracking, and even provide insights or tips to optimize your insurance coverage. These value-added services can greatly enhance your overall experience and provide long-term benefits.

| Key Considerations | Description |

|---|---|

| Security and Data Protection | Ensure the platform employs robust measures to safeguard your personal and financial information. |

| Customer Support | Look for responsive and knowledgeable support to assist with queries and concerns. |

| Additional Features and Benefits | Explore platforms that offer value-added services such as policy management, claim tracking, and educational resources. |

The Future of Online Insurance: A Digital Evolution

The online insurance industry is poised for continued growth and innovation, shaping the future of how we manage our insurance needs. With the increasing adoption of digital technology, online insurance platforms are expected to become even more sophisticated and consumer-centric.

One of the key trends is the integration of artificial intelligence (AI) and machine learning algorithms. These technologies will further enhance the personalization and efficiency of online insurance platforms. AI-powered platforms will be able to analyze vast amounts of data, providing even more accurate and tailored policy recommendations. This level of customization will ensure that consumers receive policies that perfectly align with their unique circumstances and preferences.

Furthermore, the rise of blockchain technology and smart contracts is set to revolutionize the insurance claims process. By leveraging the secure and transparent nature of blockchain, online insurance platforms can streamline claims management, reducing processing times and minimizing fraud. Smart contracts, self-executing contracts with the terms of the agreement directly written into code, can automate various aspects of the claims process, ensuring a more efficient and fair experience for policyholders.

The future of online insurance also holds promise for greater integration with other digital services and devices. With the Internet of Things (IoT) becoming increasingly prevalent, insurance policies may soon be linked to smart home devices or health tracking wearables. This integration will enable real-time data collection and analysis, allowing for more dynamic and responsive insurance policies that adapt to individual behaviors and needs.

Emerging Trends in Online Insurance

The insurance industry is witnessing a digital evolution, with several emerging trends shaping the future of online insurance. Firstly, the concept of usage-based insurance is gaining traction. This innovative approach utilizes data from connected devices, such as vehicles or fitness trackers, to offer policies that are tailored to an individual’s actual usage patterns. By incentivizing safe behaviors and providing personalized rates, usage-based insurance is set to revolutionize the industry, offering a more fair and dynamic pricing model.

Additionally, the integration of insurtech solutions is transforming the online insurance landscape. Insurtech refers to the use of technology to enhance insurance services, and it encompasses a wide range of innovations, from AI-powered chatbots for customer support to blockchain-based platforms for secure and transparent transactions. These technologies not only streamline processes but also provide new avenues for personalized and efficient insurance solutions.

Moreover, the focus on data-driven decision-making is becoming increasingly prominent. Online insurance platforms are leveraging advanced analytics to gain deeper insights into consumer behavior and preferences. By analyzing vast amounts of data, these platforms can offer more accurate risk assessments and personalized policy recommendations, ensuring that consumers receive the coverage they need at competitive rates.

| Emerging Trends | Description |

|---|---|

| Usage-Based Insurance | Incentivizes safe behaviors and offers personalized rates based on actual usage patterns. |

| Insurtech Solutions | Utilizes technology to enhance insurance services, including AI, blockchain, and data analytics. |

| Data-Driven Decision-Making | Leverages advanced analytics to provide accurate risk assessments and personalized policy recommendations. |

Conclusion: Embracing the Digital Insurance Landscape

The evolution of online insurance has transformed the way we manage our insurance needs, offering convenience, transparency, and personalization. With the continued growth and innovation in the digital insurance space, consumers can expect an even more seamless and efficient experience. As we embrace this digital landscape, it’s essential to stay informed about the latest trends and developments, ensuring we make the most of the opportunities presented by online insurance platforms.

From the rise of AI-powered platforms to the integration of blockchain and insurtech solutions, the future of online insurance is bright and full of potential. By leveraging these digital advancements, consumers can enjoy a more tailored and dynamic insurance experience, receiving the coverage they need at competitive rates. As the industry continues to evolve, staying ahead of the curve will be key to unlocking the full benefits of online insurance.

In conclusion, the shift towards online insurance represents a significant step forward in the insurance industry, offering consumers greater control, convenience, and value. As we navigate this digital revolution, it's important to stay informed, explore the various platforms and their features, and make informed decisions that align with our insurance needs. The future of insurance is indeed digital, and embracing this evolution will be crucial for both consumers and providers alike.

Frequently Asked Questions

What are the advantages of buying insurance online compared to traditional methods?

+

Buying insurance online offers several advantages over traditional methods. Online platforms provide convenience, allowing you to access policies and providers anytime, anywhere. They also offer transparency, enabling you to compare policies side-by-side and make informed decisions. Additionally, online insurance often provides personalized recommendations based on your specific circumstances, ensuring you get the coverage you need at competitive rates.

How can I ensure the security and privacy of my information when using online insurance platforms?

+

Ensuring the security and privacy of your information is crucial when using online insurance platforms. Look for platforms that prioritize data protection and adhere to industry standards and regulations. Check for secure connections (HTTPS) and privacy policies that outline how your information is handled. Additionally, consider using a secure browser and enabling two-factor authentication for added protection.

What additional features or benefits should I look for in an online insurance platform?

+

When choosing an online insurance platform, look for additional features that enhance your overall experience. These may include policy management tools, claim filing assistance, educational resources, and even personalized recommendations. Some platforms also offer discounts or rewards programs, providing ongoing value beyond the initial purchase.