Car Insurance Auto Quote

Welcome to an in-depth exploration of the world of car insurance, where we'll dive into the intricacies of obtaining an auto quote, understanding its importance, and navigating the process with ease. In today's fast-paced and competitive insurance market, making informed decisions is crucial, and we're here to guide you through this essential aspect of vehicle ownership.

Understanding the Auto Quote Process

An auto quote, at its core, is an estimated cost of insurance coverage for your vehicle. It is a personalized assessment that takes into account various factors to determine the premium you would pay for a specific insurance policy. This process is an essential step in ensuring you receive the right coverage for your needs and that you’re not overpaying for your insurance.

The auto quote process typically begins with a thorough evaluation of your vehicle and driving history. Insurance providers consider a multitude of factors to provide an accurate quote. These factors can include the make and model of your car, your age and gender, your driving record, the location where your car is primarily garaged, and the coverage limits you require. Each of these elements plays a crucial role in shaping the final quote.

The Impact of Your Driving Record

One of the most significant factors influencing your auto quote is your driving record. Insurance companies closely scrutinize your history to assess the level of risk they would be taking on by insuring you. A clean driving record, free from accidents and traffic violations, is ideal and can lead to more favorable quotes. On the other hand, a history marked by accidents or moving violations may result in higher premiums, as these incidents indicate a higher level of risk to the insurance provider.

For instance, a driver with a record of multiple speeding tickets and a recent at-fault accident will likely receive a substantially higher quote compared to a driver with a pristine record. This is because the former is considered a higher risk, with a greater likelihood of making future insurance claims.

Coverage Options and Their Costs

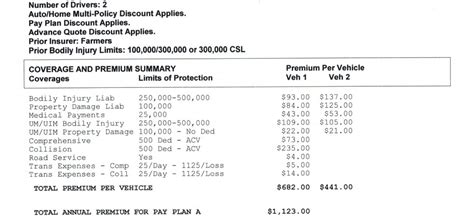

When obtaining an auto quote, it’s essential to understand the different coverage options available and their associated costs. Car insurance typically includes liability coverage, which protects you against claims for bodily injury or property damage that you may cause to others. This is usually the minimum required by law, but additional coverage types are often recommended to provide more comprehensive protection.

Collision coverage, for example, pays for the repair or replacement of your vehicle if it's damaged in an accident, regardless of fault. Comprehensive coverage, on the other hand, covers damage to your vehicle caused by factors other than collision, such as theft, vandalism, or natural disasters. These optional coverages can significantly increase your premium, so it's crucial to assess your specific needs and budget when choosing your coverage limits.

| Coverage Type | Description | Average Cost |

|---|---|---|

| Liability | Covers bodily injury and property damage to others | $300 - $700 annually |

| Collision | Covers damage to your vehicle in an accident | $200 - $600 annually |

| Comprehensive | Covers non-collision related damages | $150 - $400 annually |

The Role of Location and Vehicle Type

Your location and the type of vehicle you drive also play significant roles in determining your auto quote. Insurance rates can vary widely depending on where you live, as different regions have different levels of risk. For example, areas with high crime rates or a history of severe weather events may result in higher insurance premiums. Similarly, the make and model of your car, its age, and its safety and theft-prevention features can all influence the quote you receive.

Consider a comparison between two hypothetical drivers: Driver A, who lives in a suburban area with low crime and accident rates, and Driver B, who resides in an urban center known for high theft and accident frequency. Despite having similar driving records and vehicles, Driver A is likely to receive a significantly lower quote due to the reduced risk associated with their location.

Tips for Getting the Best Auto Quote

Obtaining the best auto quote requires a combination of knowledge, comparison, and negotiation. Here are some strategies to help you secure the most favorable insurance rates:

Shop Around for Quotes

Don’t settle for the first quote you receive. Compare multiple quotes from different insurance providers to get a sense of the market rates. Online quote comparison tools can be a great starting point, but be sure to follow up with individual insurers to discuss your specific needs and any discounts you may be eligible for.

For instance, imagine you're a young professional seeking car insurance. By comparing quotes from various providers, you might discover that while some insurers specialize in catering to younger drivers, others may offer more competitive rates for experienced drivers with a spotless record. This comparison ensures you find the insurer that best matches your profile and needs.

Understand Discounts and Savings

Insurance providers offer a variety of discounts to attract and retain customers. These can include multi-policy discounts (for bundling car insurance with other policies like home or life insurance), safe driver discounts, good student discounts, and loyalty discounts for long-term customers. By understanding the discounts available, you can position yourself to receive the best rates.

Let's say you're a parent with a teenage driver. By insuring both vehicles under the same policy, you may qualify for a multi-car discount. Additionally, if your teenager maintains good grades and takes a defensive driving course, they might be eligible for further discounts, reducing the overall cost of your insurance.

Negotiate and Personalize Your Policy

Don’t be afraid to negotiate with insurance providers. Many insurers are willing to work with you to find a policy that fits your budget and needs. This might involve adjusting your coverage limits, deductibles, or even exploring different payment plans. Remember, your goal is to find a policy that provides adequate coverage at a price you can afford.

Suppose you're a seasoned driver with a lengthy accident-free record. When negotiating your policy, you might emphasize this track record to secure a better rate. Additionally, by discussing your specific needs and concerns with the insurer, you can tailor your policy to ensure it meets your expectations.

The Future of Auto Insurance Quotes

The landscape of auto insurance is continually evolving, driven by advancements in technology and changing consumer preferences. The rise of telematics and usage-based insurance (UBI) is one such development that is reshaping the industry. Telematics involves the use of technology to track and analyze driving behavior, offering personalized insurance rates based on actual driving habits rather than general risk profiles.

For example, with UBI, a safe driver who rarely speeds or brakes harshly might see their insurance premiums decrease over time, as their data reflects a low-risk profile. Conversely, a driver with more erratic habits might see their premiums increase, as their data suggests a higher likelihood of accidents or claims.

The integration of artificial intelligence and machine learning is also set to revolutionize the auto insurance industry. These technologies can process vast amounts of data quickly and accurately, allowing insurers to offer more precise and tailored quotes. This shift towards data-driven underwriting is expected to lead to more efficient and fair pricing, benefiting both insurers and consumers.

As we move further into the digital age, the process of obtaining an auto quote is likely to become even more streamlined and personalized. The future of car insurance is promising, with technology at the forefront, offering consumers greater control and transparency in their insurance choices.

How often should I review my car insurance policy and quotes?

+It’s generally recommended to review your car insurance policy and quotes annually, or whenever you experience significant life changes (e.g., getting married, moving to a new area, purchasing a new vehicle). Regular reviews can help ensure you’re getting the best coverage and rates for your needs.

What factors can I control to lower my car insurance premiums?

+You can take steps to improve your driving record by avoiding accidents and traffic violations. Additionally, maintaining a good credit score can positively impact your insurance rates. You can also explore different coverage options and adjust your deductibles to find a balance between cost and protection.

Are there any hidden costs in car insurance quotes that I should be aware of?

+While auto quotes provide a comprehensive estimate, there may be additional fees or charges not included in the initial quote. These could include policy fees, surcharges for specific coverages, or state-mandated assessments. It’s important to carefully review the policy details to understand all associated costs.