How To Get Insurance

Obtaining insurance is an essential step towards safeguarding your financial well-being and protecting yourself from unforeseen circumstances. Whether it's health, life, property, or liability coverage, having the right insurance can provide peace of mind and help you navigate life's uncertainties. In this comprehensive guide, we will delve into the process of securing insurance, exploring the key considerations, types of policies, and strategies to ensure you make informed decisions.

Understanding Your Insurance Needs

The first step in acquiring insurance is identifying your specific needs. Different life stages, personal circumstances, and assets require varying levels of coverage. Consider the following factors to determine your insurance priorities:

- Health Insurance: Assess your current and future healthcare needs. Do you have any pre-existing conditions or a family history of specific illnesses? Health insurance provides coverage for medical expenses, prescriptions, and treatments, ensuring you can access quality healthcare without incurring significant financial burdens.

- Life Insurance: Life insurance is crucial for those with financial dependents, such as spouses, children, or aging parents. It provides a financial safety net in the event of your untimely passing, ensuring your loved ones can maintain their standard of living and cover expenses like mortgages, education, and daily costs.

- Property Insurance: If you own a home, rental property, or valuable assets, property insurance is essential. It protects against damages or losses due to natural disasters, theft, or accidents, ensuring you can rebuild or replace your belongings.

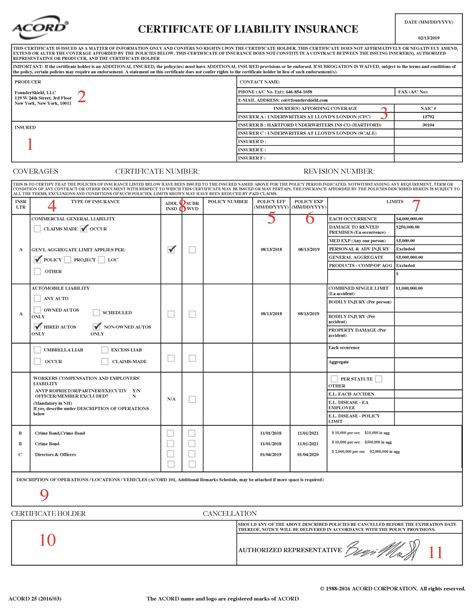

- Liability Insurance: This type of insurance safeguards you against legal and financial liabilities. It’s particularly important for business owners, professionals, or those with high-risk hobbies. Liability insurance covers legal expenses and compensates others if you’re found liable for their injuries or property damage.

Researching Insurance Providers and Policies

Once you’ve identified your insurance needs, it’s time to research and compare providers and policies. Here are some key steps to navigate this process effectively:

- Identify Reputable Insurers: Start by creating a list of reputable insurance companies in your region. Consider recommendations from trusted sources, online reviews, and industry ratings to narrow down your options.

- Understand Policy Types: Each insurance provider offers various policy types tailored to different needs. Familiarize yourself with the specifics of health, life, property, and liability insurance, ensuring you understand the coverage, exclusions, and limitations of each.

- Compare Coverage and Premiums: Request quotes from multiple insurers for the policies you’re interested in. Compare the coverage limits, deductibles, co-payments, and overall premiums. Remember, the cheapest option might not always provide the best value, so assess the policy’s terms and conditions thoroughly.

- Check Financial Stability: Research the financial stability and reputation of the insurance companies you’re considering. Look for ratings from independent agencies like A.M. Best or Standard & Poor’s to ensure the insurer is financially sound and capable of paying out claims.

- Read Reviews and Customer Experiences: Online reviews and customer testimonials can provide valuable insights into an insurer’s service quality and claim handling process. Look for patterns in customer feedback to gauge the overall satisfaction and reliability of the company.

- Consider Bundling Policies: Some insurers offer discounts when you bundle multiple policies together. For instance, you might save by purchasing health and life insurance from the same provider. However, always compare the bundled option with individual policies to ensure you’re getting the best value.

Assessing Your Insurance Options

Now that you’ve researched and compared insurers and policies, it’s time to assess your options and make informed decisions. Here’s a step-by-step guide to help you through this process:

- Evaluate Coverage and Premiums: Carefully review the coverage limits, deductibles, and premiums of each policy. Ensure the coverage aligns with your identified needs and budget. Consider the potential financial impact of higher deductibles and lower premiums, and vice versa.

- Analyze Exclusions and Limitations: Pay close attention to the policy’s exclusions and limitations. Understand what circumstances or events are not covered, as well as any conditions that may impact your eligibility for coverage.

- Consider Add-Ons and Riders: Many insurance policies offer optional add-ons or riders that can enhance your coverage. For example, you might add dental or vision coverage to a health insurance policy, or include travel insurance as a rider on your home insurance. Assess these options and determine if they’re worth the additional cost.

- Assess Claim Handling and Customer Service: The insurer’s claim handling process and customer service reputation are crucial. Research how promptly and fairly the company processes claims, and consider reaching out to the insurer’s customer support to gauge their responsiveness and helpfulness.

- Seek Professional Advice: If you’re unsure about your insurance needs or the best policy for your circumstances, consider consulting an insurance broker or financial advisor. These professionals can provide impartial advice and help you navigate the complex world of insurance.

Applying for Insurance

Once you’ve selected the insurance provider and policy that best meets your needs, it’s time to apply. Here’s what you can expect during the application process:

- Complete Application Forms: You’ll need to provide personal and financial information, as well as details about your health, lifestyle, or business, depending on the type of insurance. Ensure you complete the forms accurately and honestly, as any misrepresentations can impact your coverage.

- Provide Additional Documentation: Depending on the policy, you may need to submit supporting documentation, such as medical records, property appraisals, or business financial statements. Gather and organize these documents beforehand to streamline the application process.

- Underwriting Process: The insurer will assess your application and determine your eligibility for coverage. This process may involve medical exams, property inspections, or financial analysis. Cooperate fully with the underwriting process to ensure a smooth application experience.

- Policy Approval and Issuance: If your application is approved, you’ll receive a policy document outlining the terms and conditions of your coverage. Review this document carefully to ensure it aligns with your expectations and understand your rights and responsibilities as a policyholder.

- Premium Payment: Once your policy is in place, you’ll need to pay the agreed-upon premium. Premiums can be paid monthly, quarterly, or annually, depending on your preference and the insurer’s options. Ensure you understand the payment schedule and set up automatic payments if possible to avoid lapses in coverage.

Maintaining and Reviewing Your Insurance

Insurance is not a one-time transaction; it’s an ongoing relationship with your insurer. Regularly reviewing and updating your insurance policies ensures they continue to meet your changing needs. Here’s how to maintain and optimize your insurance coverage:

- Annual Policy Review: Schedule an annual review of your insurance policies with your insurer or broker. This review helps you assess whether your coverage remains adequate and make any necessary adjustments based on life changes or new risks.

- Life Event Changes: Significant life events, such as marriage, divorce, the birth of a child, or retirement, can impact your insurance needs. Review your policies whenever such events occur to ensure your coverage aligns with your new circumstances.

- Keep Records and Documentation: Maintain a comprehensive record of your insurance policies, including policy numbers, coverage limits, deductibles, and contact information for your insurer. This documentation is essential when filing claims or resolving disputes.

- Regularly Update Contact Information: Ensure your insurer has your most up-to-date contact details, including your physical address, email address, and phone number. This enables them to reach you promptly in case of emergencies or to provide important policy updates.

- File Claims Promptly: In the event of a covered loss or accident, file your claim with the insurer as soon as possible. Provide all the necessary documentation and cooperate fully with the claims process to ensure a timely resolution.

FAQ

How often should I review my insurance policies?

+It’s recommended to review your insurance policies annually or whenever you experience significant life changes. Regular reviews ensure your coverage remains adequate and aligned with your evolving needs.

Can I switch insurance providers mid-policy term?

+Yes, you can switch insurance providers during your policy term, but it may come with some costs or penalties. Check your current policy’s terms and conditions to understand the implications of canceling early. Consider the remaining time on your policy and the potential savings or benefits of switching to a new provider.

What happens if I miss a premium payment?

+Missing a premium payment can result in the cancellation of your insurance policy. Most insurers provide a grace period for late payments, typically around 30 days. If you miss the grace period, your policy may be canceled, and you’ll need to reapply for coverage, potentially at a higher rate.

How do I file an insurance claim?

+To file an insurance claim, contact your insurer’s customer service or claims department. They will guide you through the process, which typically involves providing details of the incident, submitting documentation, and cooperating with the insurer’s investigation. Ensure you have all the necessary information and documentation ready to expedite the claims process.