Life Insurance Quotes Without Medical Exam

In today's fast-paced world, finding the right life insurance coverage is a crucial aspect of financial planning. However, the traditional process of securing life insurance often involves lengthy medical exams and extensive paperwork, which can be daunting for many individuals. Fortunately, the insurance industry has evolved to offer more convenient options, such as life insurance quotes without the need for a medical exam. This article delves into the world of no-exam life insurance, exploring its benefits, the application process, and the factors that influence the quotes provided. By understanding this alternative approach, individuals can make informed decisions about their life insurance needs and protect their loved ones effectively.

The Appeal of No-Exam Life Insurance

No-exam life insurance policies have gained popularity among individuals seeking a streamlined and efficient way to obtain coverage. Unlike traditional life insurance, which often requires extensive medical assessments and a significant time investment, no-exam policies provide a quicker and more accessible route to protection. This approach appeals to a diverse range of individuals, including those who:

- Have busy schedules and limited time for extensive medical examinations.

- Dread the invasive nature of traditional medical exams.

- Are in excellent health and prefer a simplified process.

- Need temporary coverage for specific life events, such as travel or business ventures.

- Have pre-existing medical conditions that may complicate the traditional application process.

Benefits of Choosing No-Exam Life Insurance

Opting for life insurance quotes without a medical exam comes with several advantages. Firstly, the application process is significantly faster, allowing individuals to secure coverage in a matter of days rather than weeks or months. This expedited timeline ensures that protection is in place promptly, providing peace of mind for policyholders and their beneficiaries. Secondly, no-exam policies often offer flexibility in terms of coverage amounts and terms, catering to a wide range of needs and budgets.

Additionally, the absence of a medical exam can be particularly beneficial for individuals with medical histories that may impact their eligibility for traditional life insurance. No-exam policies typically have more relaxed eligibility criteria, making coverage accessible to a broader spectrum of applicants. This inclusivity ensures that individuals with pre-existing conditions or those who have faced health challenges in the past are not automatically excluded from obtaining life insurance.

| Advantages of No-Exam Life Insurance |

|---|

|

Understanding the Application Process

Securing life insurance quotes without a medical exam is a straightforward process that typically involves the following steps:

Step 1: Research and Comparison

Begin by researching reputable insurance providers that offer no-exam policies. Compare their coverage options, premiums, and policy terms to find the best fit for your needs. Consider factors such as the company’s financial strength, customer reviews, and the level of customer support provided.

Step 2: Online Application

Once you’ve identified suitable providers, initiate the application process online. This usually involves completing a detailed questionnaire about your personal and health-related information. Be prepared to provide accurate details about your age, gender, occupation, lifestyle habits, and any pre-existing medical conditions.

Step 3: Underwriting Evaluation

After submitting your application, the insurance company’s underwriting team will assess your eligibility and determine the risk associated with providing coverage. This evaluation considers your responses to the questionnaire and may involve a telephonic interview to clarify any uncertainties. The underwriters will then assign you a risk category, which influences the final quote.

Step 4: Quote and Policy Offer

Based on the underwriting evaluation, the insurance company will provide you with a quote for your life insurance policy. This quote outlines the coverage amount, the premium, and any specific terms or conditions associated with the policy. Review the quote carefully to ensure it aligns with your expectations and needs.

Step 5: Policy Acceptance and Issuance

If you are satisfied with the quote, you can accept the policy offer. At this stage, you will typically be required to pay the initial premium to activate the coverage. Once the payment is processed, the insurance company will issue your policy, providing you with the necessary documentation and details about your coverage.

Factors Influencing Life Insurance Quotes

When obtaining life insurance quotes without a medical exam, several factors play a crucial role in determining the cost of your policy. Understanding these factors can help you make informed decisions and potentially negotiate better rates.

Age and Gender

Age and gender are fundamental considerations in life insurance underwriting. Generally, younger individuals are offered lower premiums as they are statistically less likely to pass away during the policy term. Additionally, men often face higher premiums than women due to statistical differences in life expectancy and risk factors.

Health and Lifestyle

While no-exam policies do not require extensive medical assessments, the insurance company still considers your health and lifestyle habits. Factors such as smoking, excessive alcohol consumption, drug use, and certain high-risk hobbies or occupations can increase your risk profile and result in higher premiums.

Occupation and Risk Exposure

Your occupation and the associated risks it entails are significant factors in life insurance quotes. High-risk occupations, such as those involving heavy machinery, extreme sports, or dangerous environments, may lead to increased premiums or even exclusion from certain coverage options.

Coverage Amount and Policy Term

The amount of coverage you choose and the length of the policy term also impact your premiums. Higher coverage amounts and longer policy terms generally result in higher premiums. It’s essential to strike a balance between the level of coverage you need and what you can afford over the long term.

| Factors Affecting Life Insurance Quotes |

|---|

|

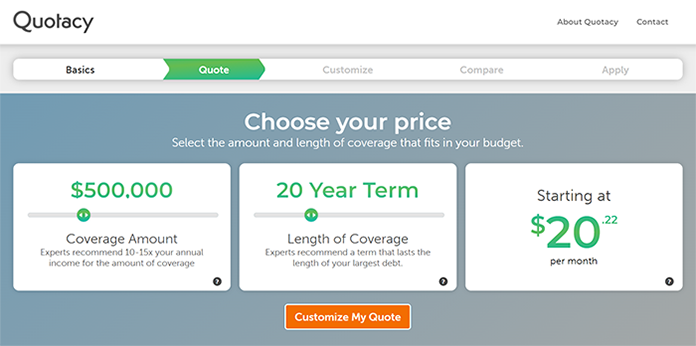

Case Study: Real-Life Example

To illustrate the process and benefits of no-exam life insurance, let’s consider the case of Sarah, a 35-year-old professional with a busy schedule and a young family. Sarah wanted to secure life insurance to protect her loved ones but was concerned about the time commitment and potential challenges associated with a traditional medical exam.

Sarah decided to explore no-exam life insurance options and found a reputable provider offering flexible coverage. She completed the online application, providing details about her age, occupation, and health status. During the underwriting evaluation, the insurance company assessed her responses and assigned her a favorable risk category.

Based on her application, Sarah received a quote for a $500,000 term life insurance policy with a 20-year term. The premium was affordable, and she was pleased with the coverage amount and term length. After accepting the policy offer and paying the initial premium, Sarah received her policy documents, providing her with the peace of mind that her family's financial future was secure.

Future Implications and Considerations

No-exam life insurance policies offer a convenient and accessible way to obtain coverage, but there are a few considerations to keep in mind. Firstly, while these policies provide a quick solution, they may not be suitable for individuals with complex health histories or those seeking extensive coverage. Traditional life insurance policies with medical exams often offer more comprehensive protection and tailored coverage options.

Additionally, no-exam policies typically have coverage limits and term lengths that may not align with everyone's needs. It's essential to carefully assess your financial goals and the level of protection required to ensure that a no-exam policy can adequately meet your long-term objectives.

As the insurance industry continues to evolve, it's likely that no-exam life insurance options will become even more sophisticated and widely available. Advances in technology and data analytics may further streamline the application process and enhance the accuracy of risk assessments. This could lead to more competitive pricing and an even broader range of coverage options for individuals seeking a convenient and efficient insurance experience.

Can I get life insurance with a pre-existing medical condition through a no-exam policy?

+Yes, no-exam life insurance policies are often more inclusive and may accommodate individuals with pre-existing conditions. However, the availability and terms of coverage may vary based on the severity of the condition and the insurance provider’s underwriting guidelines.

Are no-exam policies more expensive than traditional life insurance?

+No-exam policies can be more expensive than traditional life insurance with medical exams, primarily due to the increased risk associated with not having a medical assessment. However, the cost can vary based on individual factors and the specific policy terms.

What happens if I provide inaccurate information on my no-exam life insurance application?

+Providing inaccurate or misleading information on a life insurance application, whether it’s a no-exam policy or a traditional one, can lead to serious consequences. Insurance companies have the right to investigate and, if necessary, cancel the policy or deny a claim based on fraudulent information.