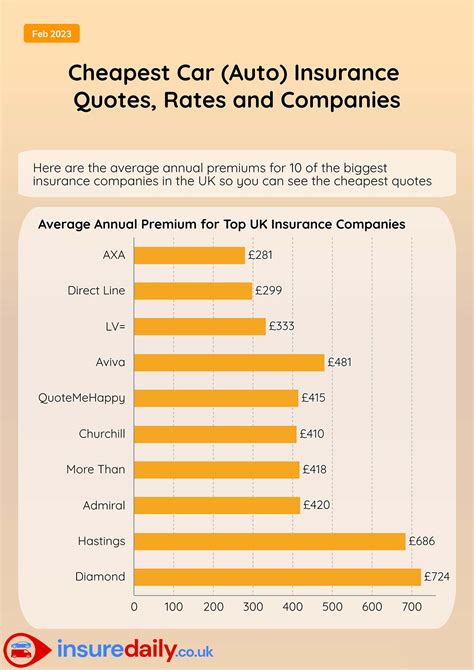

Who Has The Cheapest Car Insurance

Finding the cheapest car insurance can be a challenging task, as rates vary significantly based on individual circumstances and the specific coverage needed. However, understanding the factors that influence insurance premiums and exploring various options can help you secure the most affordable coverage for your vehicle. This comprehensive guide will delve into the world of car insurance, offering insights into the key considerations and strategies to find the best value for your money.

Factors Influencing Car Insurance Rates

Numerous variables come into play when insurance providers calculate premiums. These include:

Demographic Factors

Your age, gender, marital status, and location play a significant role in determining your insurance rates. For instance, young drivers, especially males, often face higher premiums due to their perceived higher risk profile. Similarly, urban areas with higher crime rates may attract higher insurance costs.

Driving Record

Your driving history is a crucial factor. A clean record with no accidents or traffic violations can lead to lower premiums, while multiple incidents can significantly increase your insurance costs.

Vehicle Type and Usage

The make, model, and year of your vehicle influence insurance rates. Sports cars and luxury vehicles generally attract higher premiums due to their higher repair costs and potential for theft. Additionally, the purpose of your vehicle’s usage, such as commuting, business, or pleasure, can impact your insurance rates.

Coverage and Deductibles

The type of coverage you choose and the deductibles you select can affect your insurance costs. Comprehensive coverage, which includes protection against theft, fire, and natural disasters, typically costs more than basic liability coverage. Higher deductibles can lower your premiums, but you’ll pay more out-of-pocket in the event of a claim.

Credit History

Believe it or not, your credit score can impact your insurance rates. Many insurance companies use credit-based insurance scores to assess risk, so maintaining a good credit history can lead to lower premiums.

Strategies to Find the Cheapest Car Insurance

With a clear understanding of the factors that influence insurance rates, you can now employ strategies to secure the cheapest car insurance that meets your needs.

Compare Quotes from Multiple Insurers

Don’t settle for the first quote you receive. Shop around and compare quotes from different insurance providers. Online quote comparison tools can be a great starting point, but it’s also beneficial to speak directly with insurance agents to understand the nuances of their offerings.

Bundling Policies

If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with the same insurer. Many providers offer discounts for customers who bundle their insurance needs, potentially saving you a significant amount.

Explore Discounts

Insurance companies often offer a range of discounts to attract and retain customers. These may include safe driver discounts, good student discounts, loyalty discounts, and discounts for completing defensive driving courses. Make sure to inquire about all available discounts and take advantage of those that apply to your situation.

Raise Your Deductibles

Increasing your deductibles can lower your insurance premiums. However, this strategy requires careful consideration, as it means you’ll have to pay more out-of-pocket in the event of a claim. Assess your financial situation and comfort level with risk to determine the right deductible amount for you.

Maintain a Good Driving Record

A clean driving record is one of the most effective ways to keep your insurance costs down. Avoid traffic violations and accidents to prevent your insurance premiums from increasing. If you have a less-than-perfect record, consider taking defensive driving courses to improve your skills and potentially qualify for discounts.

Choose the Right Coverage

While it’s tempting to opt for the cheapest insurance option, it’s crucial to ensure you have adequate coverage. Assess your specific needs and risks, and choose a policy that provides sufficient protection without unnecessary add-ons that drive up your premiums.

Understand Your State’s Requirements

Each state has its own minimum insurance requirements. Make sure you understand what coverage is mandatory in your state to avoid legal issues and financial penalties. However, keep in mind that meeting the minimum requirements may not provide sufficient protection in the event of an accident, so consider going beyond the minimums if your budget allows.

Performance Analysis of Insurers

When comparing insurance providers, it’s essential to assess their performance and reputation. Here’s a table showcasing the financial strength and customer satisfaction ratings of some of the top insurance companies in the United States:

| Insurers | Financial Strength Rating | Customer Satisfaction Rating |

|---|---|---|

| State Farm | A++ (Superior) | 4.4/5 |

| Geico | A++ (Superior) | 4.3/5 |

| Progressive | A+ (Superior) | 4.2/5 |

| Allstate | A+ (Superior) | 4.1/5 |

| USAA | A++ (Superior) | 4.5/5 |

Evidence-Based Future Implications

The car insurance landscape is continually evolving, influenced by technological advancements and changing consumer behaviors. Here are some future implications to consider:

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to monitor driving behavior, is gaining traction. This data-driven approach to insurance pricing offers the potential for more accurate premiums based on individual driving habits. Usage-based insurance policies, also known as pay-as-you-drive or pay-how-you-drive, could become more prevalent, providing an incentive for safe driving and potentially reducing costs for responsible drivers.

Autonomous Vehicles and Insurance

The advent of autonomous vehicles is expected to revolutionize the insurance industry. With fewer accidents attributed to human error, insurance premiums could decrease over time. However, the transition period as autonomous vehicles become mainstream may lead to initial increases in insurance costs as liability issues are sorted out.

Digitalization and Customer Experience

The insurance industry is embracing digitalization, with online quote comparisons, mobile apps for policy management, and digital claims processing becoming more common. This shift towards a more digital customer experience can lead to increased convenience and potentially lower costs for consumers.

Environmental Factors and Insurance

As climate change continues to impact weather patterns, insurance companies may need to adjust their risk assessment models. Extreme weather events, such as hurricanes and wildfires, could lead to higher insurance costs in vulnerable areas. Additionally, the growing focus on environmental sustainability may lead to new insurance products targeting eco-conscious consumers.

Conclusion

Finding the cheapest car insurance requires a combination of understanding the factors that influence rates, comparing quotes from multiple insurers, and employing cost-saving strategies. By staying informed and proactive, you can secure the best value for your money while ensuring adequate coverage for your vehicle. As the insurance landscape continues to evolve, staying abreast of technological advancements and industry trends will be crucial in navigating the future of car insurance.

Can I get car insurance if I have a poor driving record?

+Yes, it is possible to obtain car insurance with a poor driving record. However, you may face higher premiums and limited coverage options. Some insurance providers specialize in high-risk drivers, so it’s worth shopping around to find the best rates. Additionally, maintaining a clean driving record going forward can help reduce your insurance costs over time.

What is the difference between liability coverage and comprehensive coverage?

+Liability coverage is the most basic type of car insurance, providing protection against bodily injury and property damage claims made against you. It’s required by law in most states. Comprehensive coverage, on the other hand, offers broader protection, including damage caused by events other than collisions, such as theft, vandalism, or natural disasters. Comprehensive coverage is optional but highly recommended for comprehensive protection.

How often should I review my car insurance policy?

+It’s a good practice to review your car insurance policy annually, or whenever your circumstances change significantly. This could include buying a new car, moving to a different state, getting married or divorced, or experiencing a change in your driving record. Regular reviews ensure that your coverage remains adequate and that you’re not paying for unnecessary add-ons.