The Best Dog Insurance

When it comes to pet ownership, one of the most important decisions you'll make is ensuring your furry friend's health and well-being. Dog insurance plans have gained popularity among pet parents, offering a safety net for unexpected veterinary expenses. However, with numerous providers and policies available, choosing the best dog insurance can be a daunting task. This comprehensive guide aims to navigate you through the world of pet insurance, highlighting key factors to consider and providing insights into some of the top-rated dog insurance plans available in the market today.

Understanding the Need for Dog Insurance

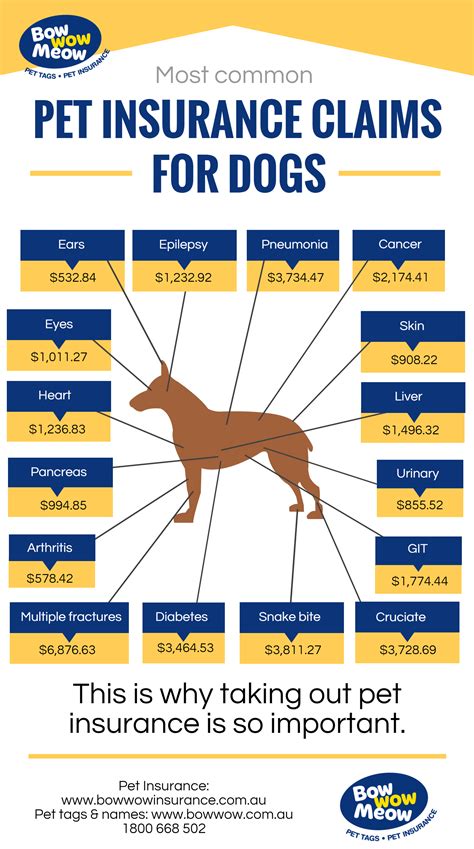

Veterinary care has advanced significantly, offering a wide range of treatments and procedures to improve the health and longevity of our canine companions. However, these advancements often come with a hefty price tag. A single surgery or specialized treatment can cost thousands of dollars, which can be a financial burden for many pet owners. This is where dog insurance steps in as a valuable tool to protect you and your pet from unexpected costs.

Key Factors to Consider When Choosing Dog Insurance

When evaluating dog insurance plans, several critical factors should be taken into account to ensure you select the policy that best suits your needs and those of your four-legged family member.

Coverage Options

Dog insurance policies offer a variety of coverage options, from basic accident-only plans to comprehensive packages covering accidents, illnesses, and even routine care. Consider the age and health of your dog, as well as any pre-existing conditions they may have. For younger, healthier dogs, a basic plan might suffice, while older dogs or those with known health issues might benefit from more extensive coverage.

Reimbursement Methods

Dog insurance companies typically offer two main reimbursement methods: reimbursement based on actual vet bill or based on a schedule of fees. The actual vet bill method reimburses you for the exact amount you’ve paid, while the schedule of fees method provides a predetermined amount for specific treatments. The former offers more flexibility but might not cover the entire cost, while the latter provides a more predictable reimbursement but may not cover all expenses.

Waiting Periods and Pre-Existing Conditions

Most dog insurance policies have waiting periods for certain conditions, ranging from 14 to 30 days. During this period, any claims related to accidents or illnesses that occurred before the policy’s start date will not be covered. Additionally, pre-existing conditions, which are typically defined as illnesses or injuries that were present before the policy’s effective date, are generally excluded from coverage. Understand these limitations to ensure you’re not caught off guard when making a claim.

Cost and Deductibles

The cost of dog insurance policies can vary significantly based on factors such as your dog’s breed, age, location, and the coverage level you choose. Additionally, most policies have deductibles, which are the amount you must pay out of pocket before the insurance coverage kicks in. Higher deductibles often result in lower monthly premiums, so it’s essential to find a balance that suits your budget and risk tolerance.

Additional Benefits and Perks

Beyond basic coverage, some dog insurance plans offer additional benefits and perks that can be highly valuable. These may include wellness plans covering routine care such as vaccinations and check-ups, prescription medication coverage, and even alternative therapy treatments like acupuncture or hydrotherapy. Consider these extras when comparing policies to find the best value for your money.

Top-Rated Dog Insurance Plans

Now that we’ve covered the key factors to consider, let’s delve into some of the top-rated dog insurance plans currently available. These providers have consistently received high marks for their coverage, customer service, and claims processing.

ASPCA Pet Insurance

ASPCA Pet Insurance offers a range of customizable plans to suit different budgets and needs. Their Complete Coverage plan provides comprehensive coverage for accidents, illnesses, and even hereditary conditions. With a wide network of veterinarians and a simple claims process, ASPCA Pet Insurance is a popular choice among pet owners.

| Plan Type | Coverage | Reimbursement |

|---|---|---|

| Complete Coverage | Accidents, Illnesses, Hereditary Conditions | 80% of actual vet bills |

| Accident-Only | Accidents only | 80% of actual vet bills |

Petplan

Petplan is known for its comprehensive coverage and excellent customer service. Their Ultimate plan provides extensive coverage for accidents, illnesses, and even chronic conditions. Additionally, Petplan offers a unique Wellness plan that covers routine care, vaccinations, and even weight management programs.

| Plan Type | Coverage | Reimbursement |

|---|---|---|

| Ultimate | Accidents, Illnesses, Chronic Conditions | 90% of actual vet bills |

| Wellness | Routine Care, Vaccinations, Weight Management | 100% up to annual limit |

Healthy Paws Pet Insurance

Healthy Paws offers a straightforward and customizable insurance plan with no limits on payouts for life. Their plan covers accidents, illnesses, and even congenital and hereditary conditions. With a simple claims process and excellent customer reviews, Healthy Paws is a top choice for pet owners seeking peace of mind.

| Plan Type | Coverage | Reimbursement |

|---|---|---|

| Customizable Plan | Accidents, Illnesses, Congenital/Hereditary Conditions | 90% of actual vet bills |

Embrace Pet Insurance

Embrace Pet Insurance offers a range of customizable plans with optional add-ons, allowing you to tailor your coverage to your needs. Their Elite plan provides comprehensive coverage for accidents, illnesses, and even wellness care. Additionally, Embrace offers a unique Wag’N Overextension feature, which allows you to borrow funds for unexpected veterinary costs without interest.

| Plan Type | Coverage | Reimbursement |

|---|---|---|

| Elite | Accidents, Illnesses, Wellness Care | 90% of actual vet bills |

| Wellness Rewards | Routine Care, Vaccinations, Grooming | 100% up to annual limit |

Trupanion

Trupanion is a leading pet insurance provider known for its straightforward coverage and easy-to-understand policies. Their Medical Insurance plan covers accidents, illnesses, and even hereditary conditions, with no limits on payouts. With a simple claims process and a dedicated team of pet advocates, Trupanion is a popular choice among pet owners.

| Plan Type | Coverage | Reimbursement |

|---|---|---|

| Medical Insurance | Accidents, Illnesses, Hereditary Conditions | 90% of actual vet bills |

Conclusion

Dog insurance is an essential consideration for any pet owner, offering financial protection and peace of mind. With a wide range of options available, it’s crucial to carefully evaluate your needs and choose a plan that provides the right balance of coverage and cost. The top-rated dog insurance plans we’ve discussed offer excellent coverage, customer service, and claims processing, making them some of the best options on the market.

Remember, choosing the best dog insurance plan is a personal decision that should align with your pet's unique needs and your financial situation. By understanding the key factors and exploring the available options, you can make an informed choice to ensure your furry friend receives the best care possible.

What is the average cost of dog insurance per month?

+

The cost of dog insurance can vary significantly based on factors such as your dog’s breed, age, location, and the coverage level you choose. On average, you can expect to pay anywhere from 20 to 100 per month for a basic accident-only plan, and up to $100 or more for comprehensive coverage. It’s important to shop around and compare policies to find the best value for your needs.

Do all dog insurance plans cover pre-existing conditions?

+

No, most dog insurance plans do not cover pre-existing conditions. Pre-existing conditions are typically defined as illnesses or injuries that were present before the policy’s effective date. However, some plans offer optional add-ons or riders that can provide limited coverage for certain pre-existing conditions. It’s important to carefully review the policy’s terms and conditions to understand what is and isn’t covered.

How do I choose the right deductible for my dog’s insurance plan?

+

Choosing the right deductible for your dog’s insurance plan involves balancing your budget and risk tolerance. A higher deductible often results in lower monthly premiums, making it more affordable in the short term. However, it’s important to consider your financial situation and ability to cover unexpected veterinary costs. Opting for a lower deductible can provide more financial protection, but it may increase your monthly premiums.

Can I switch dog insurance providers if I’m not satisfied with my current plan?

+

Yes, you can switch dog insurance providers if you’re not satisfied with your current plan. It’s important to carefully review the terms and conditions of your existing policy, as some providers may have cancellation fees or other restrictions. When switching providers, be sure to compare coverage options, reimbursement methods, and customer reviews to find a plan that better suits your needs.

What should I look for in a dog insurance provider’s customer service?

+

When evaluating a dog insurance provider’s customer service, look for prompt and courteous response times, clear and transparent communication, and a dedicated team of pet advocates or customer support representatives. It’s also beneficial to read customer reviews and ratings to gauge the overall satisfaction and experiences of other pet owners with the provider.