When Can I Enroll In Health Insurance

Health insurance is a vital aspect of financial planning and healthcare access. Understanding when and how to enroll in a health insurance plan is crucial for ensuring coverage and avoiding potential penalties. In this comprehensive guide, we will delve into the intricacies of the enrollment process, explore key timelines, and provide valuable insights to help you make informed decisions regarding your health insurance coverage.

The Open Enrollment Period: A Crucial Window

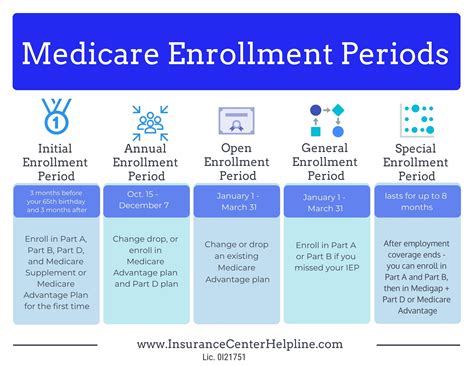

The Open Enrollment Period (OEP) is a designated time frame when individuals can enroll in a health insurance plan for the upcoming year. This period typically occurs annually, allowing individuals to review their coverage options, make changes, or enroll in a new plan. Missing the OEP can result in limited opportunities for obtaining health insurance coverage outside of specific qualifying life events.

The exact dates of the OEP can vary depending on the country and the specific health insurance system in place. In the United States, for example, the Affordable Care Act (ACA) established an annual Open Enrollment Period, which usually falls between November and December for coverage starting in January of the following year. However, it's important to note that some states may have slightly different timelines, so staying informed about your state's specific enrollment period is essential.

Understanding Qualifying Life Events

Outside of the Open Enrollment Period, individuals may still have the opportunity to enroll in health insurance if they experience a qualifying life event. These events include significant changes in personal circumstances that may impact an individual’s eligibility for health insurance coverage. Examples of qualifying life events include marriage, divorce, birth or adoption of a child, loss of job-based coverage, or a change in residence.

When a qualifying life event occurs, individuals are granted a Special Enrollment Period (SEP), which allows them to enroll in a health insurance plan outside of the regular OEP. The SEP provides a flexible window to ensure that individuals can obtain coverage when their circumstances change. It's crucial to note that the duration of the SEP varies depending on the specific event and the health insurance system.

Timeline and Deadlines

To ensure a seamless enrollment process, it’s essential to be aware of the key deadlines associated with health insurance enrollment. Missing these deadlines can result in delayed coverage or even the loss of opportunities to enroll.

| Timeline Event | Description |

|---|---|

| Open Enrollment Period | Annual period when individuals can review and select health insurance plans for the upcoming year. Dates may vary by country and region. |

| Special Enrollment Period | Flexible window for enrollment outside of the OEP, triggered by qualifying life events. The duration and eligibility criteria depend on the event and health insurance system. |

| Enrollment Deadline | The last day to enroll in a health insurance plan during the OEP to ensure coverage for the upcoming year. Missing this deadline may result in a gap in coverage. |

| Grace Period | A short period after the enrollment deadline during which individuals can still enroll in a plan without facing penalties. The grace period provides a buffer for late enrollees but may not be available in all regions. |

Key Factors to Consider During Enrollment

When navigating the health insurance enrollment process, several key factors should be carefully considered to make informed choices. Here are some crucial aspects to keep in mind:

Assessing Your Healthcare Needs

Before selecting a health insurance plan, it’s essential to evaluate your personal healthcare needs. Consider factors such as your age, pre-existing medical conditions, prescription medication requirements, and the likelihood of requiring specialized medical services. Understanding your unique healthcare needs will help you choose a plan that provides adequate coverage and financial protection.

Comparing Plan Options

During the enrollment period, you’ll have the opportunity to explore various health insurance plans offered by different providers. Compare the benefits, coverage limits, deductibles, copayments, and out-of-pocket maximums of each plan. Consider the network of healthcare providers associated with the plan to ensure that your preferred doctors and specialists are included. Additionally, review the plan’s coverage for preventive care, prescription drugs, and any specific treatments or procedures you may require.

Understanding Cost-Sharing Arrangements

Health insurance plans often involve cost-sharing arrangements, where you share the financial burden of healthcare expenses with the insurance provider. Familiarize yourself with the concept of deductibles, copayments, and coinsurance. Deductibles represent the amount you must pay out of pocket before your insurance coverage kicks in. Copayments are fixed amounts you pay for specific services, while coinsurance represents a percentage of the cost you share with the insurance company. Understanding these cost-sharing arrangements will help you estimate your potential out-of-pocket expenses.

Exploring Premium Payment Options

Health insurance plans typically require monthly premium payments to maintain coverage. Explore the different premium payment options available, such as automatic payments, direct deposit, or online payment portals. Consider the financial implications of paying premiums annually versus monthly, as some plans may offer discounts for annual payments. Additionally, inquire about any available premium assistance programs or subsidies that can help reduce the cost of premiums, especially for low-income individuals or families.

The Importance of Staying Informed

Staying informed about health insurance enrollment deadlines, timelines, and eligibility criteria is crucial to ensuring timely coverage and avoiding penalties. Regularly check reliable sources of information, such as government websites, official health insurance portals, or reputable online resources. Subscribing to newsletters or alerts from trusted health insurance providers can also keep you updated on any changes or important announcements related to enrollment periods.

Furthermore, it's essential to educate yourself about the specific health insurance system in your region. Different countries and even states within a country may have unique regulations and requirements. Understanding the local context will help you navigate the enrollment process more effectively and make informed decisions regarding your health insurance coverage.

Conclusion: A Seamless Enrollment Experience

Navigating the health insurance enrollment process can be complex, but with a thorough understanding of the timelines, eligibility criteria, and key factors to consider, you can make informed choices to secure adequate coverage. By staying informed, assessing your healthcare needs, and comparing plan options, you can find a health insurance plan that aligns with your unique circumstances and provides the financial protection you need. Remember, timely enrollment is crucial to avoid gaps in coverage and potential penalties, so mark your calendar and ensure a seamless enrollment experience.

Can I enroll in health insurance at any time of the year?

+In most cases, enrollment in health insurance is restricted to specific periods known as Open Enrollment Periods (OEP). These periods occur annually, providing individuals with a window to review and select health insurance plans for the upcoming year. However, outside of the OEP, individuals may still have the opportunity to enroll in health insurance if they experience a qualifying life event, which triggers a Special Enrollment Period (SEP). It’s crucial to stay informed about the specific enrollment timelines and eligibility criteria in your region.

What happens if I miss the Open Enrollment Period?

+Missing the Open Enrollment Period can result in limited opportunities to obtain health insurance coverage. Individuals who miss the OEP may need to wait until the next annual enrollment period to enroll in a new plan. However, it’s important to note that qualifying life events can trigger a Special Enrollment Period, allowing individuals to enroll outside of the regular OEP. It’s crucial to understand the specific qualifying events and timelines associated with SEPs to ensure timely coverage.

Are there any exceptions to the enrollment deadlines?

+In certain circumstances, exceptions to the enrollment deadlines may be granted. These exceptions typically apply to individuals who can demonstrate that they were unable to enroll due to extenuating circumstances beyond their control. Examples include natural disasters, severe illness, or technical issues with the enrollment platform. However, it’s important to note that exceptions are evaluated on a case-by-case basis, and individuals should provide sufficient documentation to support their request.

Can I change my health insurance plan during the Open Enrollment Period?

+Yes, during the Open Enrollment Period, individuals have the opportunity to review their existing health insurance plans and make changes. This includes switching to a different plan offered by the same provider or selecting a plan from a different provider. It’s a time to assess your current coverage, compare options, and choose a plan that better aligns with your healthcare needs and financial situation.