Nys Medical Insurance

The New York State medical insurance landscape is an intricate and vital system, offering comprehensive healthcare coverage to its residents. As one of the most populous states in the nation, New York understands the importance of accessible and affordable healthcare. The state's commitment to healthcare reform has led to a range of innovative insurance plans, each designed to meet the diverse needs of its population. From essential health benefits to specialized care, New York's medical insurance options provide a safety net for its residents, ensuring they can access the medical services they require without financial strain.

Understanding the Basics of NYS Medical Insurance

Medical insurance in New York State is a complex but essential system, designed to ensure residents have access to quality healthcare. The state’s healthcare market offers a range of insurance plans, each with its own unique features and benefits. Understanding these plans is crucial for residents to make informed decisions about their healthcare coverage.

Types of Medical Insurance in New York State

New York State offers a variety of medical insurance plans, catering to different demographics and needs. These include:

- Private Health Insurance: This is the most common form of medical insurance, offered by private insurance companies. Private plans offer a wide range of coverage options, from basic health maintenance organization (HMO) plans to more comprehensive preferred provider organization (PPO) plans.

- Medicaid: A government-funded program, Medicaid provides health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. It covers a wide range of healthcare services, including doctor visits, hospital stays, prescription drugs, and more.

- Child Health Plus: This is a low-cost health insurance program specifically for children under the age of 19 whose families earn too much to qualify for Medicaid but cannot afford private insurance. It offers comprehensive coverage, including doctor visits, hospital care, and prescription drugs.

- Essential Plan: The Essential Plan is a low-cost health insurance option for New Yorkers who do not qualify for Medicaid or Child Health Plus but still need affordable coverage. It provides essential health benefits, including doctor visits, hospital care, maternity care, and more.

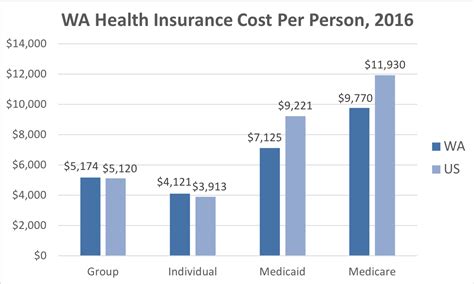

- Medicare: Medicare is a federal health insurance program primarily for people aged 65 or older, although people younger than 65 with certain disabilities can also qualify. It is divided into different parts, each covering different aspects of healthcare, including hospital insurance (Part A), medical insurance (Part B), and prescription drug coverage (Part D)

Key Benefits and Coverage of NYS Medical Insurance

New York State medical insurance plans offer a comprehensive range of benefits and coverage, ensuring residents have access to essential healthcare services. These plans typically cover:

- Doctor visits

- Hospital care

- Prescription drugs

- Preventive care, such as vaccinations and screenings

- Maternity and newborn care

- Mental health and substance abuse treatment

- Rehabilitative and habilitative services and devices

- Laboratory services

- Chronic disease management

- Pediatric services, including oral and vision care

Additionally, New York State has implemented several reforms to ensure its residents receive the best possible healthcare. This includes the Essential Health Benefits, a set of 10 categories of services that must be covered by certain plans, and the guarantee of coverage for pre-existing conditions, ensuring that no one is denied insurance due to their health status.

The Application and Enrollment Process

Applying for medical insurance in New York State is a straightforward process, designed to ensure all residents have equal access to coverage. The state’s official health insurance marketplace, NY State of Health, provides a user-friendly platform for residents to browse and compare plans, and apply for coverage.

Steps to Apply for NYS Medical Insurance

- Visit the NY State of Health website: This is the official marketplace for New York State’s medical insurance plans. Here, you can browse and compare different plans, based on your specific needs and budget.

- Create an account: You’ll need to create an account on the NY State of Health website to access the full range of services and apply for insurance. This is a simple process, requiring basic personal information.

- Choose your plan: Once you’ve created an account, you can start browsing and comparing plans. The website provides detailed information about each plan, including coverage details, costs, and any additional benefits.

- Fill out the application: After choosing your plan, you’ll need to fill out an application. This will require personal and household information, including income details, to determine your eligibility for any subsidies or tax credits.

- Submit your application: Once you’ve completed the application, you’ll need to submit it online. The website will guide you through the process, and you’ll receive a confirmation once your application has been successfully submitted.

It's important to note that the open enrollment period for medical insurance in New York State typically runs from November 1 to December 15 each year. However, if you experience a qualifying life event, such as a job loss, marriage, or birth of a child, you may be eligible for a Special Enrollment Period, allowing you to apply for insurance outside of the open enrollment period.

Qualifying for Subsidies and Tax Credits

New York State offers several financial assistance programs to help make medical insurance more affordable for its residents. These include:

- Premium Tax Credits: If your household income is between 100% and 400% of the federal poverty level, you may be eligible for a premium tax credit to help offset the cost of your insurance premiums.

- Cost-Sharing Reductions: These subsidies are available to individuals with household incomes between 100% and 250% of the federal poverty level. They help reduce out-of-pocket costs, such as deductibles, copayments, and coinsurance.

- Medicaid and Child Health Plus: These government-funded programs provide free or low-cost health insurance to eligible low-income individuals and families. Eligibility is based on income and other factors, such as age, disability status, and pregnancy.

To determine your eligibility for these subsidies and tax credits, you'll need to provide detailed information about your household income and family size during the application process.

Understanding Your Insurance Plan

Once you’ve enrolled in a medical insurance plan in New York State, it’s important to understand how your plan works and what it covers. This knowledge will help you make the most of your insurance and ensure you receive the healthcare services you need.

Understanding Your Coverage and Benefits

Each medical insurance plan in New York State offers a unique set of coverage and benefits. Your specific plan will dictate what services are covered, the level of coverage, and any associated costs. It’s important to review your plan’s details carefully to understand what’s included and what you may need to pay for out of pocket.

Some common benefits and coverage elements include:

- In-Network and Out-of-Network Providers: Your insurance plan will have a network of healthcare providers, including doctors, hospitals, and other medical professionals. Using in-network providers typically results in lower out-of-pocket costs. Out-of-network providers may be more expensive, as your insurance plan may not cover their services as fully.

- Deductibles and Copayments: Deductibles are the amount you pay out of pocket before your insurance coverage begins. Copayments are fixed amounts you pay for covered services, such as a doctor's visit or prescription medication. These costs can vary depending on the type of service and your insurance plan.

- Coinsurance: Coinsurance is the percentage of the total cost of a covered service that you're responsible for paying. For example, if your insurance plan covers 80% of a service and you have a 20% coinsurance, you'll be responsible for paying 20% of the total cost.

- Maximum Out-of-Pocket Costs: This is the maximum amount you'll pay out of pocket for covered services in a given year. Once you reach this limit, your insurance plan will cover 100% of eligible expenses for the rest of the year.

- Preauthorization and Referrals: Some insurance plans require preauthorization for certain services or referrals to see a specialist. Failing to obtain preauthorization or a referral when required can result in your insurance plan denying coverage for the service.

Using Your Insurance Plan Effectively

To make the most of your medical insurance plan, it's important to understand how to use it effectively. This includes knowing how to find in-network providers, understanding your coverage limits, and knowing when to seek preauthorization or referrals.

Here are some tips for using your insurance plan effectively:

- Familiarize yourself with your plan's coverage and benefits. Review your plan's details, including the summary of benefits and coverage, to understand what's covered and what you may need to pay for.

- Know your in-network providers. Use your insurance plan's provider directory to find in-network doctors, hospitals, and other medical professionals. Using in-network providers can result in lower out-of-pocket costs.

- Understand your costs. Know your deductible, copayments, and coinsurance amounts. This will help you budget for healthcare expenses and understand your financial responsibility for different services.

- Seek preauthorization or referrals when required. If your plan requires preauthorization for certain services or referrals to see a specialist, ensure you obtain these before receiving the service. This can prevent coverage denials and additional costs.

- Keep your insurance information handy. Store your insurance card and any other important documents in a safe and accessible place. This will ensure you have your insurance information when you need it, such as when visiting a doctor or filling a prescription.

Making Changes to Your Insurance Plan

Life is full of changes, and sometimes these changes can affect your medical insurance needs. Whether it's a change in your household income, a move to a new area, or a major life event, there may be times when you need to make changes to your insurance plan.

Qualifying for Special Enrollment Periods

In New York State, you can typically only make changes to your medical insurance plan during the open enrollment period, which runs from November 1 to December 15 each year. However, if you experience a qualifying life event, you may be eligible for a Special Enrollment Period (SEP), which allows you to enroll in or change your insurance plan outside of the open enrollment period.

Qualifying life events that can trigger a SEP include:

- Losing your job or other source of health coverage

- Getting married or divorced

- Having a baby, adopting a child, or gaining legal custody of a child

- Moving to a new area that changes your eligibility for certain plans

- Changes in household income that affect your eligibility for subsidies or tax credits

- Gaining status as an American Indian or Alaska Native

When a qualifying life event occurs, you generally have 60 days from the date of the event to apply for or change your insurance plan during the SEP. It's important to act promptly, as waiting too long may result in a lapse in coverage.

Changing Plans During Open Enrollment

If you don’t experience a qualifying life event, you’ll need to wait until the open enrollment period to make changes to your insurance plan. During this time, you can browse and compare different plans, and choose a new plan that better suits your needs or budget.

When considering a change during open enrollment, it's important to:

- Review your current plan's coverage and costs. Understand what your current plan covers and how much it costs, including premiums, deductibles, copayments, and coinsurance.

- Research other plans. Browse the NY State of Health website to compare different plans. Consider factors such as coverage, cost, and provider networks to find a plan that suits your needs.

- Consider your health needs and budget. Choose a plan that provides adequate coverage for your health needs, but also fits within your budget. Remember to consider not just the premium, but also potential out-of-pocket costs.

- Apply for your new plan. Once you've chosen a new plan, you'll need to fill out an application and submit it online. Ensure you provide accurate and up-to-date information to avoid delays or issues with your coverage.

Conclusion: The Importance of NYS Medical Insurance

Medical insurance is a vital component of healthcare in New York State, ensuring residents have access to the medical services they need without financial hardship. With a range of insurance plans available, from private health insurance to government-funded programs like Medicaid and Child Health Plus, New York State offers comprehensive coverage options to meet the diverse needs of its residents.

By understanding the different types of medical insurance, the application and enrollment process, and how to use your insurance plan effectively, you can make informed decisions about your healthcare coverage. Whether you're enrolling for the first time or making changes to your existing plan, the NY State of Health website is a valuable resource, providing clear and concise information to guide you through the process.

Remember, medical insurance is not just about having coverage, it's about having the right coverage for your unique needs. By staying informed and taking an active role in your healthcare, you can ensure you receive the best possible care while managing your financial responsibilities.

What is the NY State of Health marketplace, and how do I use it to find medical insurance plans?

+The NY State of Health marketplace is the official health insurance marketplace for New York State. It’s a user-friendly platform that allows residents to browse, compare, and apply for medical insurance plans. To use it, simply visit the NY State of Health website, create an account, and start browsing plans based on your specific needs and budget. You can filter plans by cost, coverage, and other factors to find the plan that best suits your needs.

What are the Essential Health Benefits, and why are they important?

+The Essential Health Benefits are a set of 10 categories of services that must be covered by certain health insurance plans, as mandated by the Affordable Care Act. These categories include ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services and devices, laboratory services, preventive and wellness services, and chronic disease management. These benefits are important as they ensure that insured individuals have access to a comprehensive range of healthcare services, promoting overall health and well-being.

How can I determine if I’m eligible for subsidies or tax credits to help pay for my medical insurance premiums?

+To determine your eligibility for subsidies or tax credits, you’ll need to provide detailed information about your household income and family size during the insurance application process. If your household income is between 100% and 400% of the federal poverty level, you may be eligible for a premium tax credit to help offset the cost of your insurance premiums. Additionally, if your income is between 100% and 250% of the federal poverty level, you may be eligible for cost-sharing reductions, which help reduce out-of-pocket costs like deductibles, copayments, and coinsurance.