How Much Would Homeowners Insurance Cost

Homeowners insurance is an essential aspect of protecting your home and belongings. It provides financial coverage in the event of various mishaps, including damage to your property, theft, or liability claims. The cost of homeowners insurance can vary significantly depending on several factors. In this comprehensive article, we will delve into the factors influencing homeowners insurance rates, provide real-world examples, offer strategies to reduce costs, and present an in-depth analysis of this vital aspect of homeownership.

Understanding the Factors That Affect Homeowners Insurance Costs

Several key elements contribute to the calculation of homeowners insurance premiums. By understanding these factors, you can make informed decisions to potentially lower your insurance costs.

Location and Risk Factors

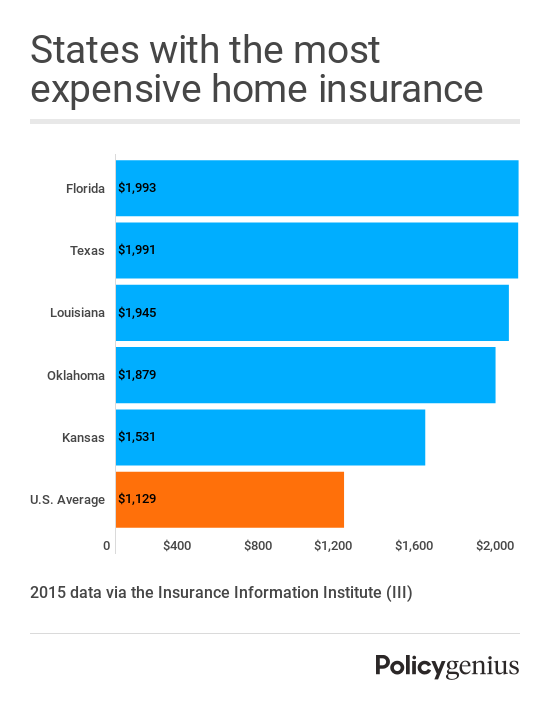

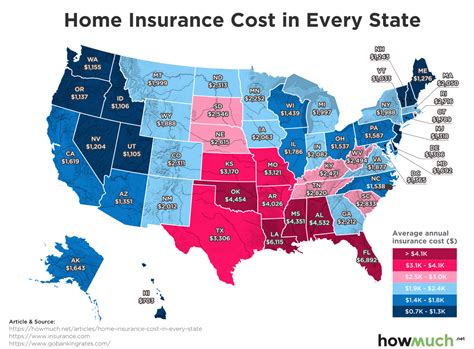

The geographical location of your home plays a significant role in determining insurance rates. Areas prone to natural disasters like hurricanes, tornadoes, or wildfires often carry higher insurance costs. Additionally, crime rates, proximity to fire stations, and the local climate can influence premiums. For instance, homes in flood-prone regions may require separate flood insurance policies, increasing the overall cost.

Consider the example of a homeowner in Miami, Florida. Due to the high risk of hurricanes, their insurance premiums are likely to be higher compared to a similar homeowner in a less vulnerable region like Des Moines, Iowa.

| Location | Average Annual Premium |

|---|---|

| Miami, FL | $2,500 |

| Des Moines, IA | $1,200 |

Home Value and Replacement Cost

The value of your home and its replacement cost are crucial factors. Insurers typically base premiums on the cost to rebuild your home, taking into account construction materials, labor costs, and local building codes. A higher home value generally results in higher insurance costs. For instance, a luxury mansion in an upscale neighborhood may require a more comprehensive policy, impacting the overall premium.

Let's consider a case study of two similar homes in different price ranges. House A, valued at $500,000, may have an annual insurance premium of $2,000, while House B, valued at $250,000, could have a premium of $1,200.

| Home Value | Annual Premium |

|---|---|

| $500,000 | $2,000 |

| $250,000 | $1,200 |

Coverage Options and Deductibles

The type and extent of coverage you choose can significantly impact your insurance costs. Different coverage options, such as liability, personal property, and additional living expenses, can be tailored to your needs. Additionally, selecting a higher deductible (the amount you pay out of pocket before insurance coverage kicks in) can lower your premium. However, it’s essential to strike a balance between affordability and adequate coverage.

For instance, if you opt for a $2,000 deductible instead of a standard $500 deductible, your annual premium may decrease by 15-20%.

Discounts and Bundling

Insurance companies often offer discounts to encourage safe practices and loyalty. These discounts can include multi-policy discounts (bundling home and auto insurance), loyalty discounts for long-term customers, or safety discounts for features like smoke detectors or burglar alarms. Taking advantage of these discounts can help reduce your overall insurance costs.

A homeowner who installs a monitored security system in their home may be eligible for a safety discount of up to 20% on their annual premium.

Credit Score and Claims History

Your credit score can indirectly impact your insurance rates. Insurance companies often use credit-based insurance scores to assess risk. A higher credit score may result in lower premiums, as it indicates financial stability and responsibility. Additionally, a clean claims history can lead to more favorable rates, as it demonstrates a lower risk of future claims.

Strategies to Reduce Homeowners Insurance Costs

While homeowners insurance is essential, there are strategies you can employ to potentially lower your costs without compromising coverage.

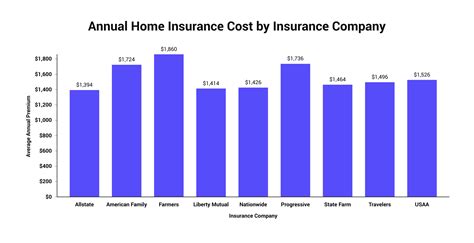

Shop Around and Compare

Insurance rates can vary significantly between providers. By obtaining quotes from multiple insurers, you can compare coverage options and premiums to find the best deal. Online quote comparison tools can be a convenient way to start your search.

Consider using an insurance broker who can provide quotes from multiple carriers, ensuring you receive a comprehensive overview of available options.

Increase Deductibles

As mentioned earlier, increasing your deductible can lead to lower premiums. However, it’s essential to choose a deductible amount that you’re comfortable paying out of pocket in the event of a claim. A higher deductible can save you money on your premium, but it means you’ll have to cover more expenses yourself if a claim occurs.

Improve Home Security

Investing in home security measures can lead to insurance discounts. Features like burglar alarms, smoke detectors, and reinforced doors and windows can reduce the risk of theft and fire, making your home a less attractive target for insurers. Additionally, installing a monitored security system can provide further discounts, as it offers real-time protection and rapid response in emergencies.

A homeowner who installs a comprehensive security system with monitored fire and burglary alarms may be eligible for a 25% discount on their insurance premium.

Maintain a Clean Claims History

Filing frequent claims can lead to increased insurance costs. While insurance is there to provide financial protection, it’s essential to use it wisely. Small claims, especially those close in time, can impact your insurance rates. By maintaining a clean claims history, you demonstrate stability and responsibility, which can lead to more favorable rates over time.

Consider Renovations and Maintenance

Upgrading your home’s safety and structural integrity can potentially lower insurance costs. Regular maintenance, such as fixing leaky roofs or addressing plumbing issues, can reduce the risk of water damage claims. Additionally, installing fire-resistant materials or upgrading to a modern electrical system can enhance safety and lower insurance premiums.

A homeowner who replaces their home's outdated electrical wiring with modern, safe wiring may be eligible for a discount on their insurance policy, as it reduces the risk of electrical fires.

Performance Analysis and Industry Trends

The homeowners insurance industry is constantly evolving, and understanding its performance and trends can provide valuable insights. Here’s an analysis of the industry’s performance and potential future implications.

Industry Performance and Growth

The homeowners insurance market has experienced steady growth in recent years. According to industry reports, the global homeowners insurance market is projected to reach $390 billion by 2025, with a CAGR of 3.2%. This growth is driven by increasing homeownership rates, rising property values, and a growing awareness of the importance of insurance coverage.

Technology and Innovation

Advancements in technology are transforming the homeowners insurance industry. Insurers are leveraging data analytics, artificial intelligence, and machine learning to improve risk assessment and pricing accuracy. Additionally, the rise of telematics and smart home devices allows for real-time monitoring and risk mitigation, potentially leading to more accurate and personalized insurance offerings.

Regulatory Changes and Consumer Protection

Regulatory bodies play a crucial role in overseeing the homeowners insurance industry. Ongoing efforts to enhance consumer protection and ensure fair practices are shaping the industry’s landscape. Recent regulatory changes include stricter guidelines for disclosure of policy terms and conditions, improved dispute resolution processes, and enhanced data privacy measures.

Future Implications and Industry Outlook

The future of homeowners insurance looks promising, with continued growth and innovation expected. As technology advances, insurers will likely leverage data-driven insights to offer more personalized and tailored coverage options. Additionally, the increasing adoption of renewable energy and sustainable building practices may lead to new insurance products and discounts, further incentivizing eco-friendly home upgrades.

Conclusion: Making Informed Decisions

Understanding the factors that influence homeowners insurance costs is crucial for making informed decisions. By evaluating your coverage needs, comparing quotes, and implementing cost-saving strategies, you can find the right balance between affordability and adequate protection. The homeowners insurance industry’s growth and innovation indicate a bright future, with insurers adapting to meet the evolving needs of homeowners.

How often should I review my homeowners insurance policy?

+

It’s recommended to review your policy annually or whenever significant changes occur, such as renovations, additions, or major life events. Regular reviews ensure your coverage remains up-to-date and adequate.

Can I negotiate my homeowners insurance premium?

+

While insurance premiums are generally non-negotiable, you can explore different coverage options and discounts to potentially lower your costs. Shopping around and comparing quotes can also help you find the best deal.

What factors determine my insurance deductible options?

+

Your insurance deductible options are typically determined by your insurance provider and the coverage you select. Different policies may offer varying deductible choices, and you can choose the one that best aligns with your financial comfort and risk tolerance.