Reasonable Health Insurance

In today's world, having access to quality healthcare is crucial, but it can often come at a steep cost. Health insurance serves as a vital tool to mitigate these expenses and ensure that individuals and families can receive the medical care they need without facing financial hardship. However, finding reasonable health insurance that provides comprehensive coverage at an affordable price can be a challenging task. This article aims to guide you through the process of securing affordable health insurance, highlighting key factors to consider and strategies to navigate the complex healthcare system effectively.

Understanding Health Insurance Fundamentals

Health insurance is a contract between an individual and an insurance company, wherein the insurer agrees to cover a portion of the policyholder’s medical expenses in exchange for regular premium payments. These policies typically cover a range of services, including doctor visits, hospital stays, prescription medications, and sometimes even preventive care and wellness programs. Understanding the basic components of health insurance is essential to make informed choices and find a plan that suits your needs.

Premium, Deductible, and Out-of-Pocket Costs

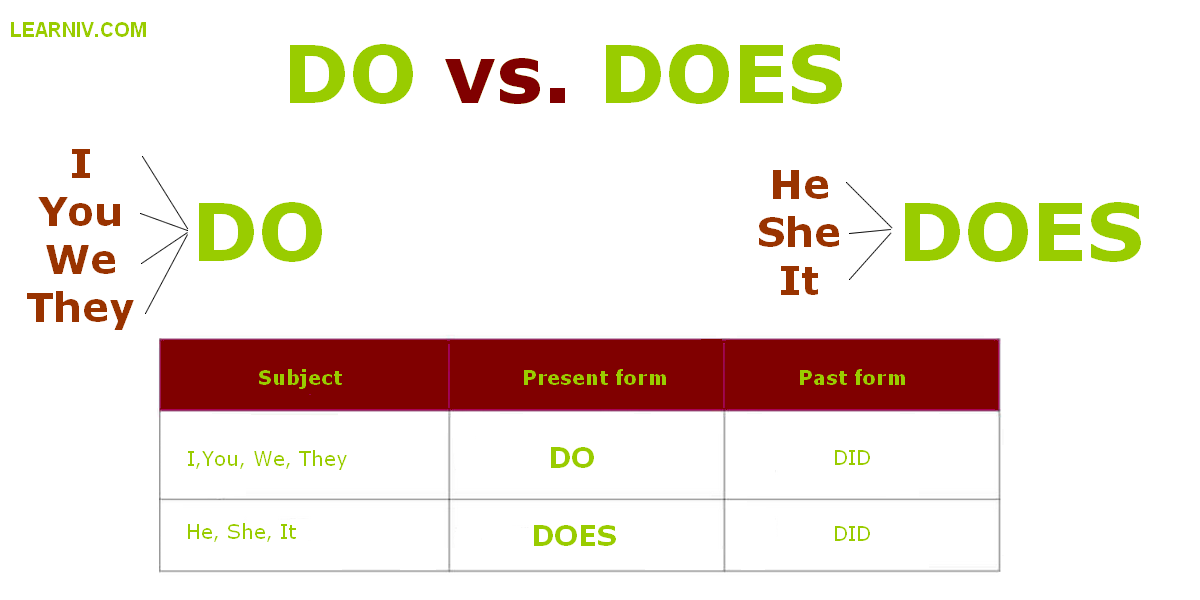

When evaluating health insurance plans, you’ll come across terms like premium, deductible, and out-of-pocket maximum. The premium is the amount you pay monthly to keep your insurance active. Deductibles, on the other hand, are the expenses you must cover before your insurance starts paying for services. Out-of-pocket costs refer to the total amount you pay for healthcare services in a year, including deductibles, copays, and coinsurance. It’s crucial to strike a balance between these costs to ensure you’re not overpaying for insurance or facing unexpected expenses.

| Insurance Term | Definition |

|---|---|

| Premium | Monthly cost to maintain insurance coverage. |

| Deductible | Amount you pay before insurance coverage begins. |

| Out-of-Pocket Maximum | Maximum amount you'll pay for covered services in a year. |

Types of Health Insurance Plans

Health insurance plans come in various types, each with its own set of features and coverage options. The most common types include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). HMOs typically offer lower premiums but require you to choose a primary care physician and obtain referrals for specialist visits. PPOs provide more flexibility in choosing healthcare providers but often come with higher premiums. EPOs are similar to PPOs but don’t cover out-of-network services.

Additionally, there are catastrophic health plans designed for young adults or those who don't qualify for other coverage. These plans have lower premiums but higher deductibles, making them suitable for those who want basic coverage for unexpected medical emergencies.

Researching and Comparing Plans

To find the most reasonable health insurance, thorough research and comparison are key. With the abundance of plans available, it’s essential to consider your specific healthcare needs, budget, and preferences. Here are some steps to guide your research process:

Assessing Your Healthcare Needs

Start by evaluating your current and potential future healthcare needs. Consider factors such as your age, existing health conditions, medications, and the frequency of doctor visits or hospital stays. If you have a family, think about their healthcare requirements as well. This assessment will help you determine the level of coverage you need and the types of services you’ll likely utilize.

Exploring Coverage Options

Health insurance plans vary significantly in the services they cover. Some plans may offer comprehensive coverage, including prescription drugs, mental health services, and dental care, while others might focus primarily on hospital stays and emergency care. Make sure to review the specific details of each plan’s coverage, including any exclusions or limitations, to ensure it aligns with your healthcare needs.

Comparing Costs and Benefits

While cost is a crucial factor, it’s important not to choose a plan solely based on the lowest premium. Consider the overall value the plan provides. Evaluate the deductible, copayments, and coinsurance rates, as these can significantly impact your out-of-pocket expenses. Look for plans that offer a good balance between affordability and comprehensive coverage.

Utilize online tools and resources provided by insurance companies or government websites to compare plans side by side. These platforms often allow you to filter plans based on your specific needs and preferences, making the comparison process more efficient.

Checking Network Providers

Health insurance plans often have networks of preferred healthcare providers, including doctors, hospitals, and specialists. It’s crucial to verify that your preferred healthcare providers are included in the plan’s network to avoid unexpected out-of-network charges. If you have a specific doctor or hospital you prefer, ensure they are covered by the plan you’re considering.

Maximizing Your Health Insurance Benefits

Once you’ve selected a reasonable health insurance plan, it’s essential to make the most of your coverage. Here are some strategies to optimize your health insurance benefits:

Understanding Your Plan’s Details

Familiarize yourself with your insurance plan’s terms and conditions. Know the specifics of your coverage, including any deductibles, copays, and limitations. Understanding these details will help you make informed decisions about your healthcare and avoid unnecessary expenses.

Utilizing Preventive Care

Many health insurance plans offer preventive care services at little to no cost. These services include routine check-ups, vaccinations, and screenings. Taking advantage of these preventive measures can help identify potential health issues early on, potentially saving you from more significant health problems and related costs down the line.

Managing Prescription Costs

Prescription medications can be a significant expense. To manage these costs, consider the following:

- Ask your doctor about generic alternatives to brand-name medications. Generics are often much more affordable while providing the same therapeutic benefits.

- Use mail-order pharmacies or online prescription services, which often offer discounts and convenience.

- Check if your insurance plan has a preferred pharmacy network. Utilizing these pharmacies can result in lower copays and better coverage.

Negotiating Medical Bills

If you receive a medical bill that seems excessive or contains errors, don’t hesitate to negotiate. Many healthcare providers are open to discussions and may offer discounts or payment plans to help you manage the cost. It’s essential to review your bills carefully and contact the provider or your insurance company if you have questions or concerns.

Making Informed Decisions

Finding reasonable health insurance requires a thoughtful approach. By understanding the fundamentals of health insurance, researching and comparing plans, and maximizing your benefits, you can make informed decisions that align with your healthcare needs and budget. Remember, health insurance is a crucial investment in your well-being, so take the time to choose a plan that provides the coverage and peace of mind you deserve.

What is the Affordable Care Act (ACA) and how does it impact health insurance options?

+The Affordable Care Act (ACA), also known as Obamacare, is a federal law that aims to make health insurance more accessible and affordable. It introduced various reforms, including the requirement for individuals to have health insurance (individual mandate), the prohibition of insurance companies from denying coverage based on pre-existing conditions, and the expansion of Medicaid. The ACA also established healthcare marketplaces where individuals and small businesses can shop for and compare health insurance plans.

Can I switch health insurance plans during the year, or are there specific enrollment periods?

+In most cases, you can only switch health insurance plans during specific enrollment periods. The annual Open Enrollment Period, which typically runs from November to December, is the time when you can select or change your health insurance plan for the upcoming year. However, there are also Special Enrollment Periods that may allow you to enroll or make changes outside of the Open Enrollment Period if you’ve experienced certain life events, such as losing job-based coverage, getting married, or having a baby.

How can I reduce my health insurance costs if I’m on a tight budget?

+If you’re on a tight budget, consider the following strategies to reduce your health insurance costs: Look into government-sponsored programs like Medicaid or the Children’s Health Insurance Program (CHIP), which provide low-cost or free health coverage to eligible individuals and families. Explore plans offered through your employer, as many employers offer a range of coverage options and may contribute to your premium costs. Consider catastrophic health plans, which have lower premiums but higher deductibles, making them suitable for those who want basic coverage for unexpected medical emergencies.